Equity Options Case Study

Lindsey Matthews

30 years: Risk management & derivatives trading

In this video, Lindsey explains some equity option strategies that include the protected put, the covered call, and the collar.

In this video, Lindsey explains some equity option strategies that include the protected put, the covered call, and the collar.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Equity Options Case Study

6 mins 43 secs

Key learning objectives:

Outline how to assemble a protected put and when it would be used

Outline how to assemble a covered call and when it would be used

Outline how to assemble a collar and when it would be used

Overview:

Equity options offer investors more flexibility in expressing their views on an investment. By altering the range of potential outcomes, these financial instruments allow investors to tailor their exposure to market risks and potential rewards. Some common equity option strategies include the protected put, the covered call, and the collar.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a protected put and when would it be used?

A protected put is a strategy that involves purchasing both a put option and the underlying stock.

Assume an investor is holding IBM stock at $123.43. If the investor is concerned that IBM will underperform relative to the rest of the index, they can buy a put to limit the downside risk. Assume the investor buys the 110 put on IBM for $2.64. In the combined option payoff the investor is long IBM at $126.07, but the value of their position cannot fall below -$16.07, which will be their loss on the position over the 3 months if the IBM share price falls to $110 or below as you can see on the diagram.

What is a covered call and when would it be used?

A covered call is a strategy in which the owner of a stock writes (sells) an out-of-the-money call option on the stock, in order to generate additional income from the option premium. This strategy is often used when an investor expects the stock's price to remain relatively flat or to decline slightly over a short period of time. By writing the call option, the investor is agreeing to sell the stock at the option's strike price if the option is exercised. The purpose of this strategy is to add additional return to the position through the sale of the call option, and it will only underperform if the stock rallies significantly and the call option is exercised.

For example, if an investor who holds IBM stock at $123.43 sells a $135 strike call option for $2.52, their position will outperform a long-only position for all values of the stock below $137.52, as shown by the diagram. This is because the investor will receive the option premium of $2.52 upfront, which will increase their overall return on the position. The position will only underperform if IBM's stock price rises above $137.52, at which point the call option will be exercised and the investor will have to sell their stock at the strike price of $135.

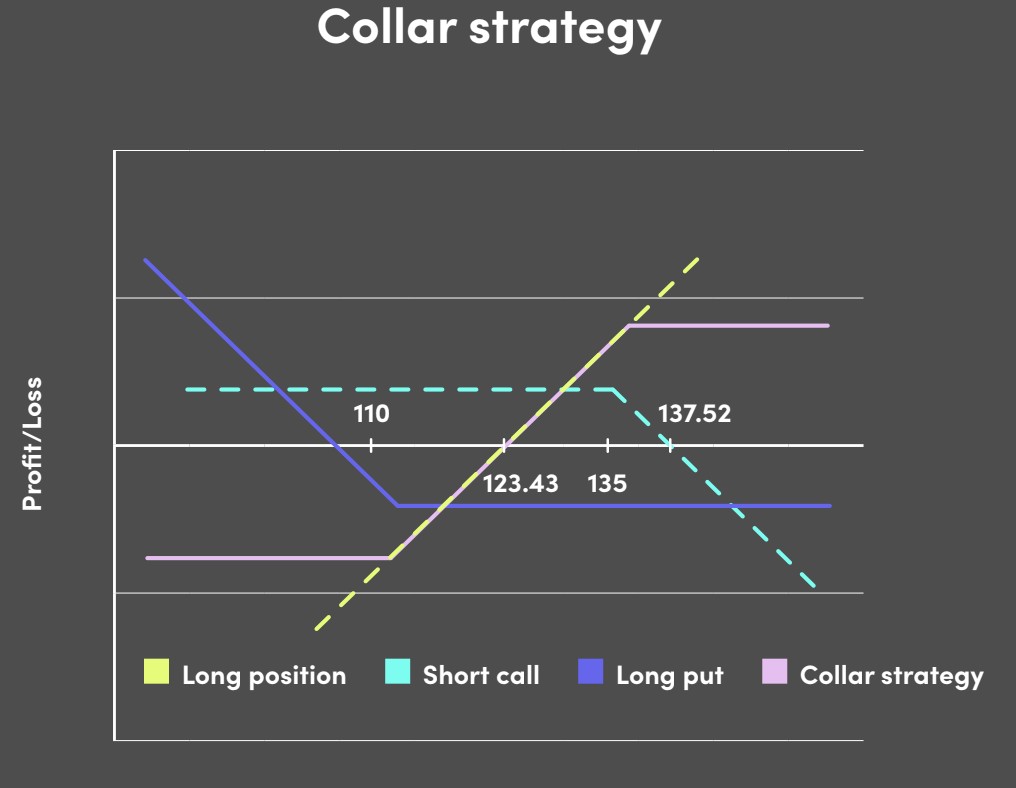

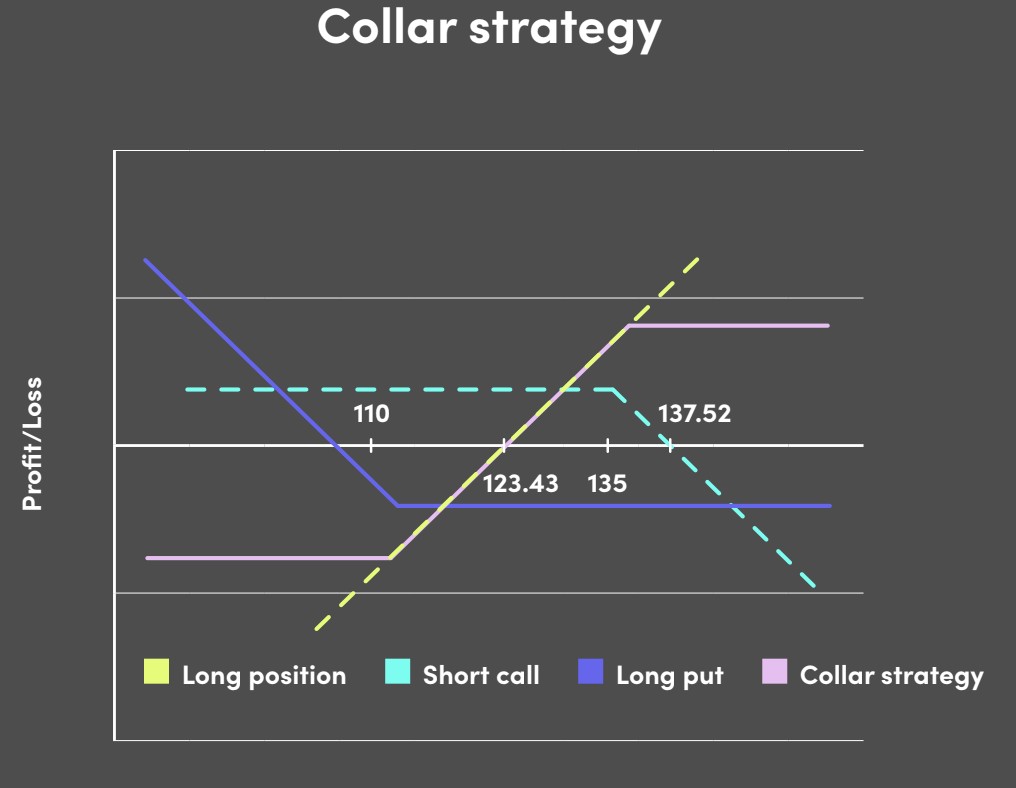

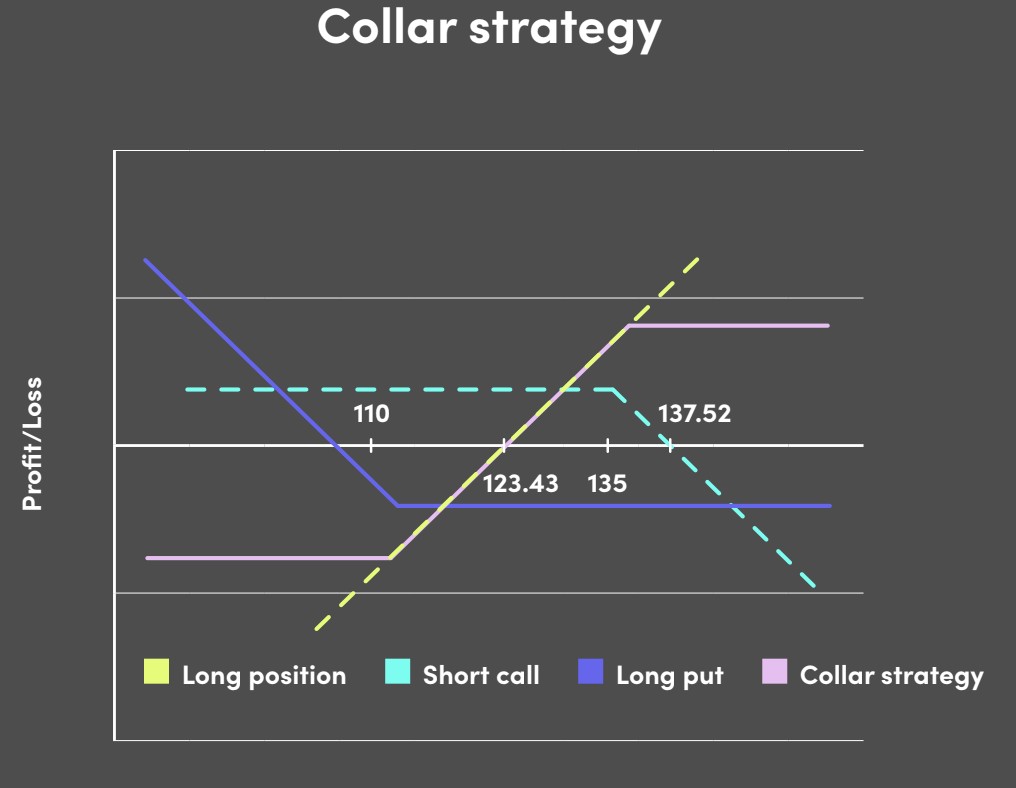

What is a collar strategy and when would it be used?

A collar strategy is a risk management technique that involves purchasing a put option on a stock and simultaneously writing a call option on the same stock. This strategy is often used by investors who are bullish on a stock and want to protect themselves against potential losses, but who also want to participate in any potential upside from the stock.

For example, an investor who holds IBM stock at $123.43 could sell a $135 strike call option for $2.52 and buy a $110 strike put option for $2.64, resulting in a net payout of $0.12. The breakeven point for this position would be at $123.55, and the range of possible outcomes for the investor would be greatly narrowed by the options, as the returns would be "capped" and "floored" by the put and call options, respectively. This means that the investor's potential gains and losses would be limited by the strike prices of the options, effectively "collaring" the potential outcomes for the position.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Lindsey Matthews

There are no available Videos from "Lindsey Matthews"