IBOR Transition and Fallback Provisions II (Dec 20)

James Eves

30 years: Equity capital markets

In the previous video, James began by covering derivative fallbacks and in this video he will cover loan fallbacks, bond fallbacks, governing law and currency.

In the previous video, James began by covering derivative fallbacks and in this video he will cover loan fallbacks, bond fallbacks, governing law and currency.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

IBOR Transition and Fallback Provisions II (Dec 20)

14 mins 45 secs

Key learning objectives:

Define loan fallbacks

Define bond fallbacks

Understand the role governing law plays in the transition from LIBOR to the new ARR

Overview:

In the previous video James began by covering derivative fallbacks and in this video he will cover loan fallbacks, bond fallbacks, governing law and currency.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are Loan fallbacks?

For syndicated loans, where you have a group of banks providing a loan, if the Agent determines that LIBOR cannot be ascertained then the loan converts to an Alternate Base rate loan. This base rate varies by region, so for example it is typically the higher of Prime or Federal Funds in the US or the banks’ Cost of Funds in Europe.

Bilateral loans often reference a screen page, if no longer provided, then the rate will be determined in good faith from a source comparable to the Screen page (or its successor).

While these loan fallbacks in theory have ‘clarity’, in reality, they are quite challenging. In the US, the prime rate is typically well above LIBOR, while in Europe, banks are very reluctant to provide information on their ‘cost of funds’ for this purpose.

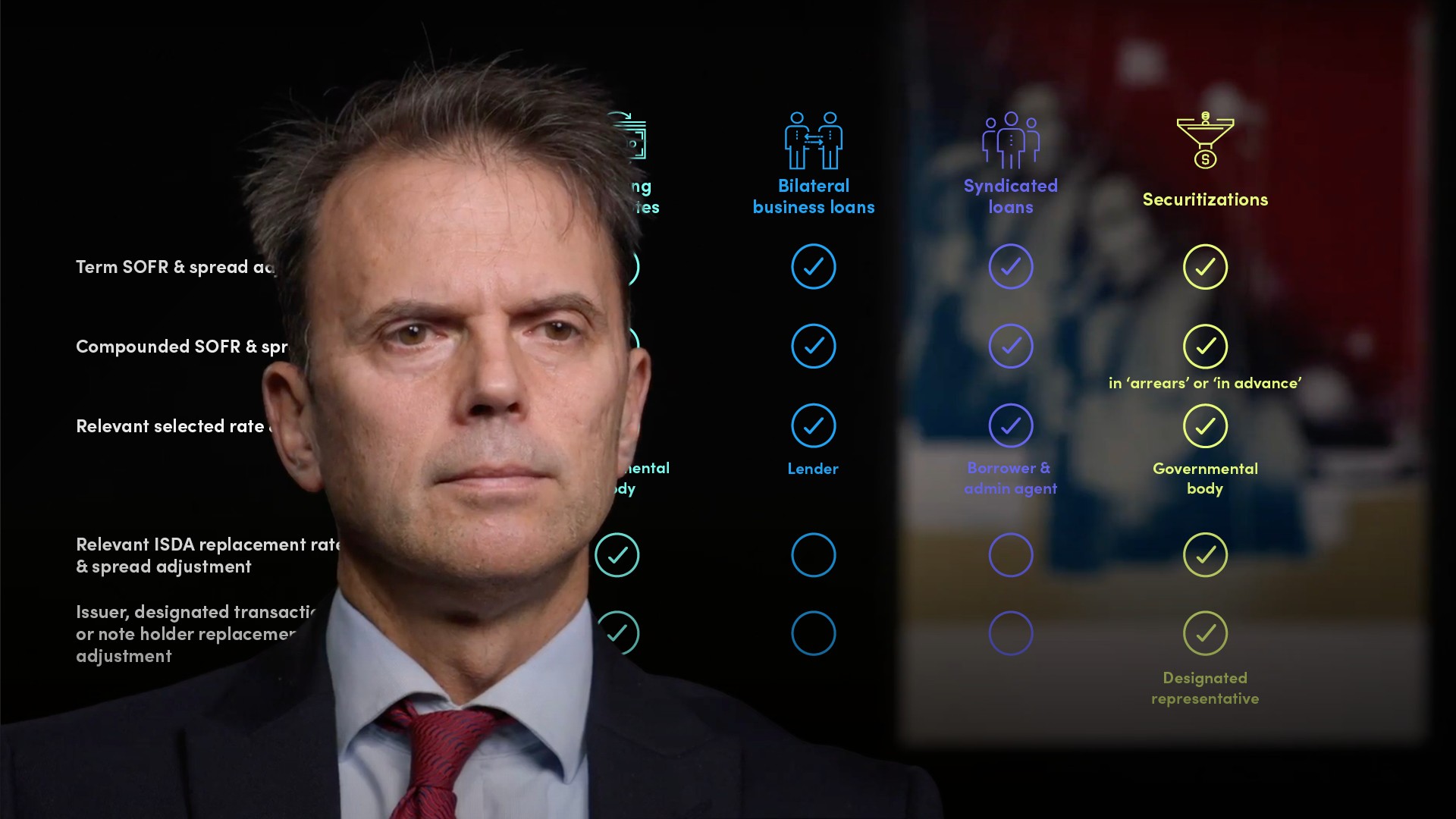

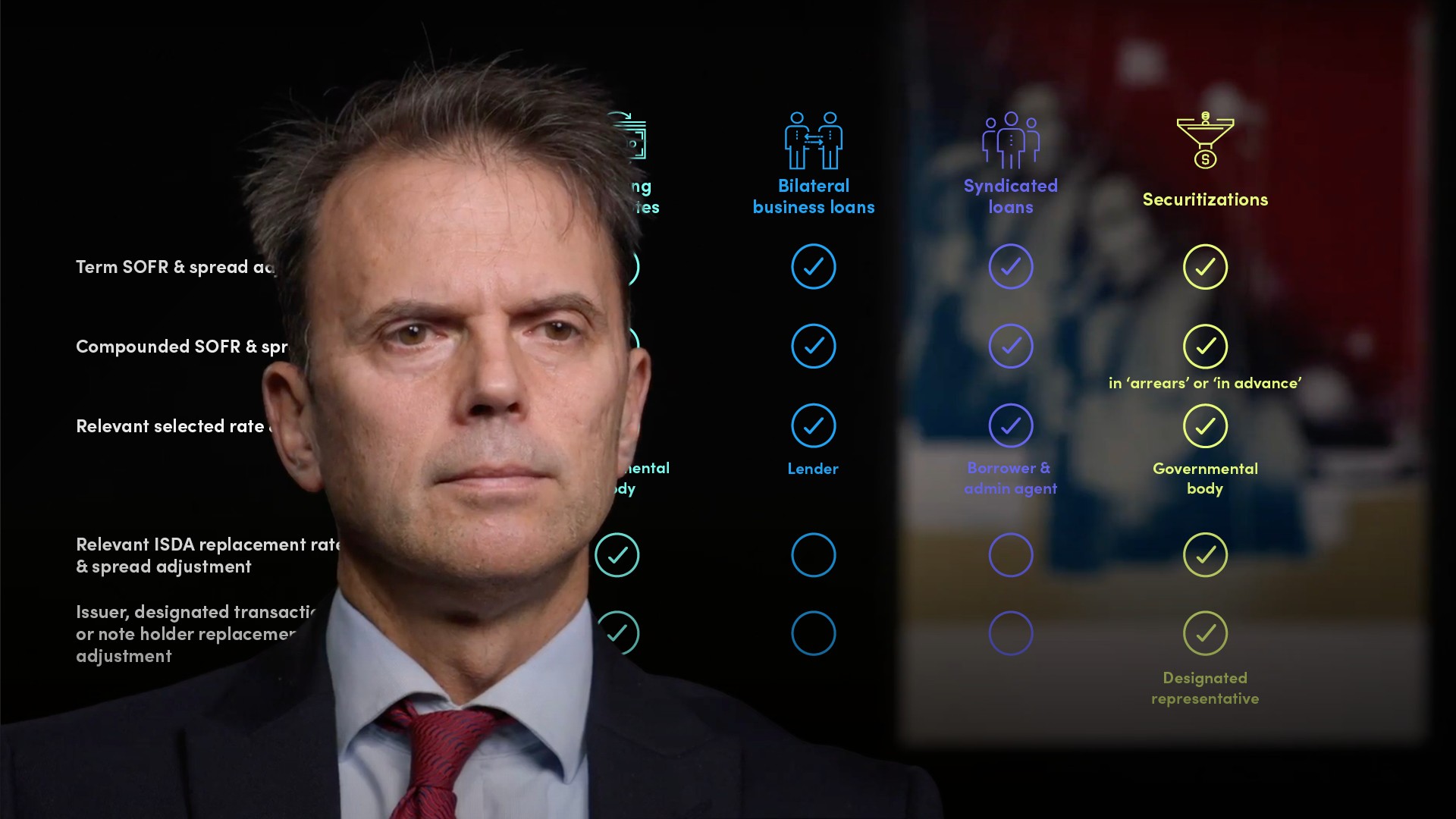

To address this, the loan market's trade associations, in consultation with their members, developed a new fallback language for new loans that meets a ‘waterfall' selection procedure, as well as a simpler consent process. They mean by waterfall that you have an order to pick the replacement rate so that it is completely transparent to the individual in charge of deciding the new prices.

What are Bond fallbacks?

Let’s start with pre-2018 floating-rate notes and their typical fallbacks. Bonds have always been tradeable; and the terms have had fallback provisions that on the surface look fairly detailed with several layers. The initial LIBOR source is typically a particular Screen Page (for example Bloomberg or Refinitiv). If this is not available, the Calculation Agent requests LIBOR quotes from several major banks. If not enough banks provide LIBOR quotes, then the Calculation Agent asks them at what rate they would borrow money from other major banks for the same period, and failing this, at what rate they would lend money.

But if LIBOR does not exist then banks will not give you a quote for it. This is what LIBOR effectively was and is partly being replaced because banks lend or borrow in the interbank market very rarely these days.

Generally, if a bond has been issued from 2018 onwards there is a good chance that it will have updated fall-backs, to reflect the demise of the relevant LIBOR. While these are designed to make sure there is a relatively smooth transition at cessation, there are differences.

What is the role of Governing Law?

The governing law, in particular for bonds, has become an important consideration in how the transition from LIBOR to the new ARR may occur. The most challenging are instruments issued under New York law (which covers 90% of US cash products) – and the interaction with the Trust Indenture act of 1939.

Making a substantive adjustment to the terms of a bond requires 100% approval of holders – not just 100% at a meeting, but ALL holders – under this act.

The ARRC has suggested a 'legislative' solution for instruments that use USD LIBOR as a fallback (which typically does not include loans as they fall back to Prime based rates). According to the proposed legislation, if a bond references LIBOR, it is simply considered to be replaced by the SOFR rate, the ARRC-recommended rating, plus a credit spread adjustment.

Of course this is not straightforward, but it is progressing through the legislative process, with the extension providing valuable time for the full procedure.

What is Consent Solicitation?

A consent solicitation is the name of the process whereby bond issuers seek approval from bondholders to change the terms of a bond.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

James Eves

There are no available Videos from "James Eves"