ECB Monetary Policy Response to the GFC

Trevor Pugh

20 years: Trading & hedge funds

The European monetary union was created without the required fiscal union to back it up. Trevor discusses the consequences of this reality in terms of monetary policy implementation in response to the 2008 Financial Crisis.

The European monetary union was created without the required fiscal union to back it up. Trevor discusses the consequences of this reality in terms of monetary policy implementation in response to the 2008 Financial Crisis.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

ECB Monetary Policy Response to the GFC

14 mins 14 secs

Key learning objectives:

Identify the effects of the Crisis on the Eurozone area

Identify whether the monetary policy responses were effective to combat the crisis

Overview:

The impact of the crisis was severe on peripheral European countries. In an attempt to combat this, the European Central Bank (ECB) were slow and ineffective in their responses, given its singular focus on inflation.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What were the crucial aspects of the European Monetary Union?

- The Union suited larger countries such as Germany, and left smaller countries such as Greece and Ireland in severe difficulties.

- Nature of the ECB - The ECB was to be completely independent. The rationale for this was the desire to avoid any adverse political influence from individual member states. However, the ECBs level of accountability was comparatively low, accountable to the European Parliament, but not directly to member state governments.

- Inflation mandate - The ECB focused singularly on inflation. Whereas the Federal Reserve in the US has a dual mandate of price stability and maximum sustainable employment, the ECB would act purely to control inflation.

What was the impact of the crisis on the Eurozone?

Peripheral European countries suffered greatly in the Eurozone sovereign crisis of 2010 onwards:

- In January 2010, the Athens stock market fell by 25%.

- By April the yield on a Greek 2 year bond was 25%, a sign of a huge lack of confidence on the part of investors.

- Borrowing in many of these economies built up to unsustainable levels, property-related borrowing in Ireland and Spain for example, government borrowing in Greece. These loans found their way onto the public sector balance sheet, such as when the government decided to guarantee its banks’ liabilities. And ultimately, these countries had to take bailouts to rescue them.

What were the ECB responses to the crisis?

They were slow to act in the face of the crisis:

- In Oct 2008, the ECB was still hiking rates to 3.25%, and they had to reverse this hike in November 2008.

- The inability of the Eurozone area to react fiscally to issues across its borders inevitably led Europe to its own crisis

- The ECB tightened policy by raising rates in both April and July 2011. However, the Bank was forced to ease policy with rates coming down in November 2011. Continued easing of rates was not enough to stimulate an economy that had to see several members receive bailouts from the IMF and others.

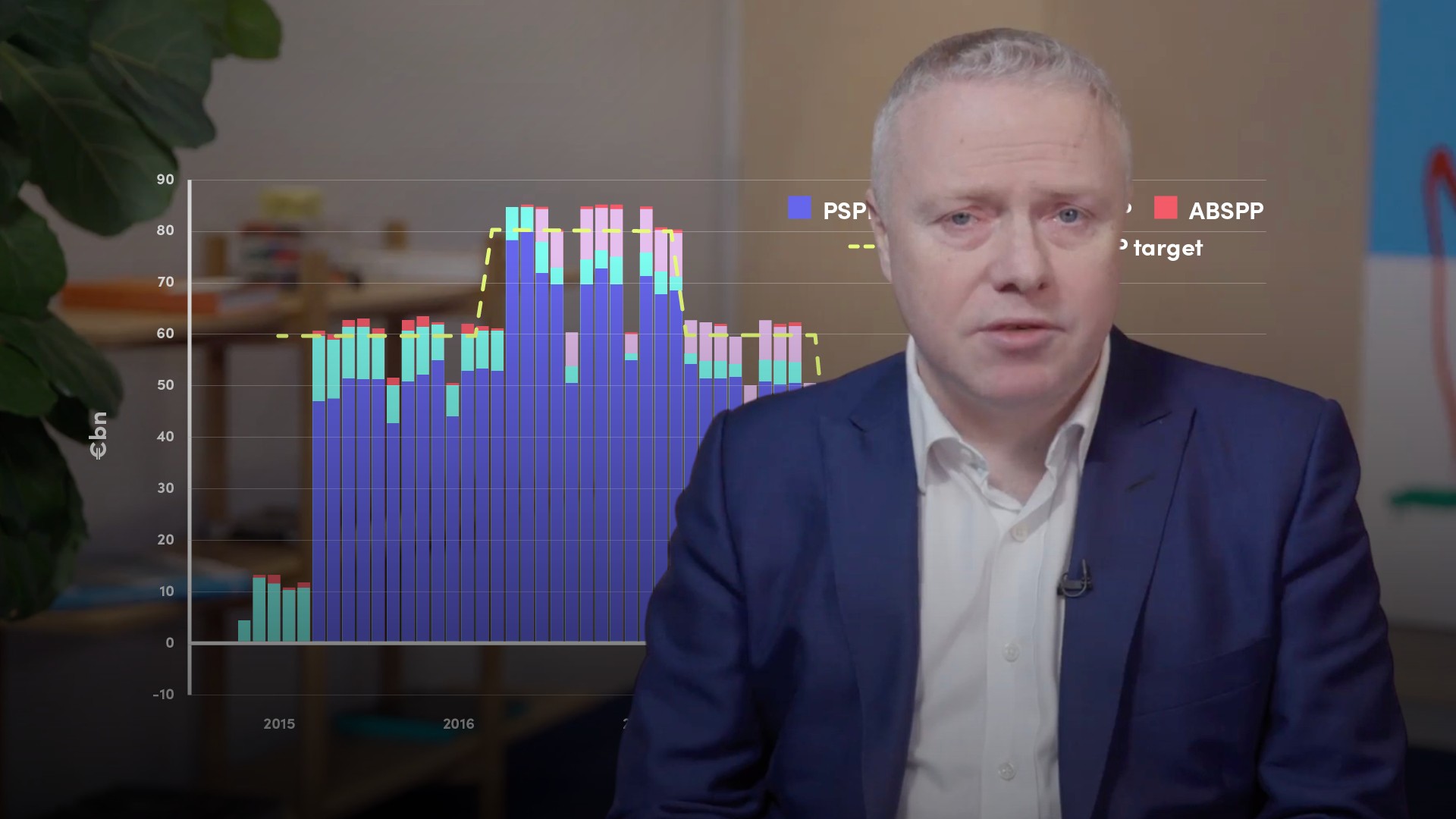

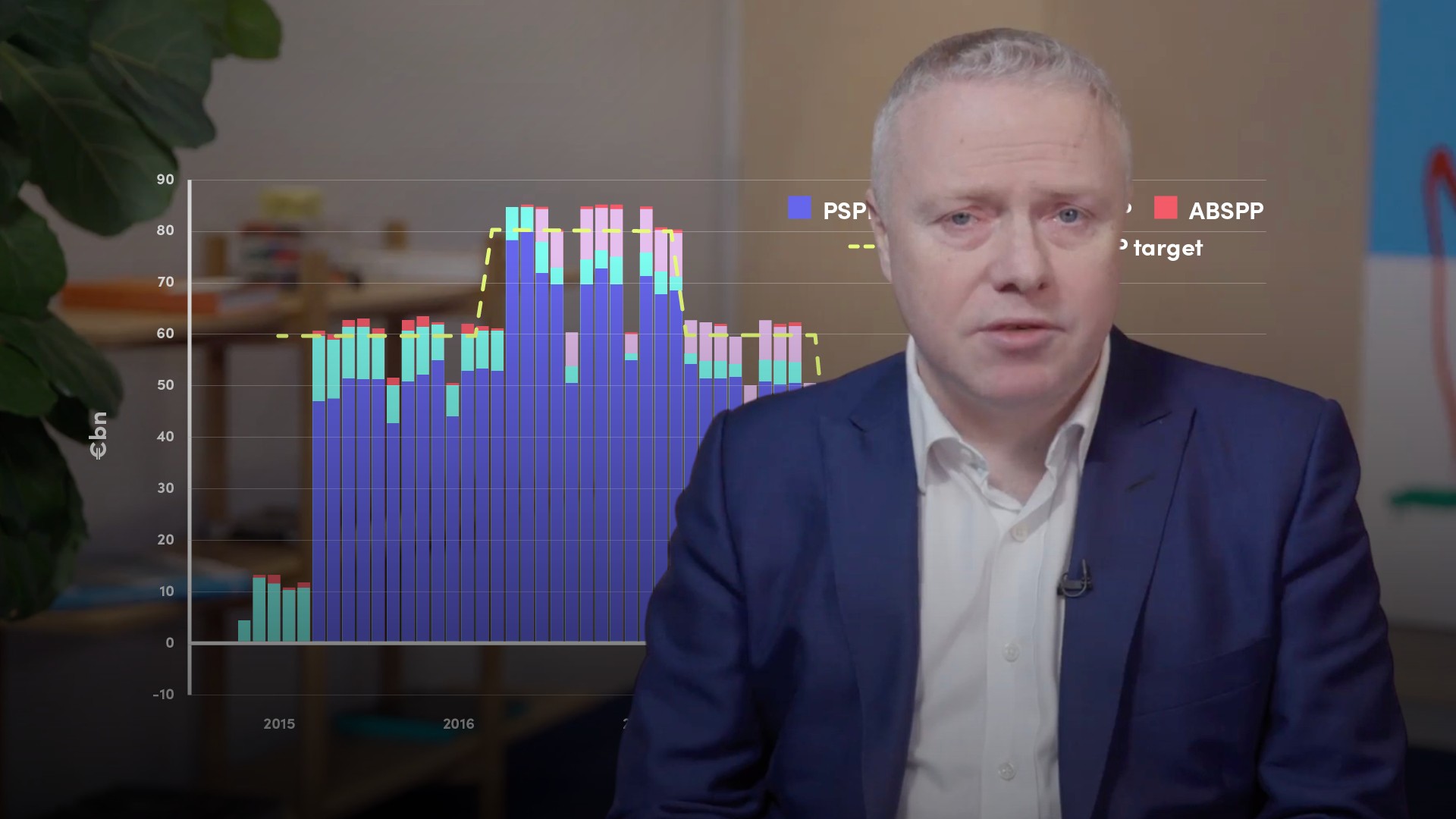

- In the second half of 2014, the ECB was forced to start its own Quantitative Easing (QE) programme - buying up to 90bn Euros per month of bonds, the ECB had by January 2020 accumulated almost 2.6trn Euros of government securities.

What are Negative Rates?

Negative interest rates was part of the reaction to struggling to push inflation towards the 2% target. The ECBs deposit rate moved into negative territory in 2014. The psychological barrier of cash returning less than the amount invested was a tough one to break.

- Nominal Rate of Interest - The rate of return before inflation is taken into account. So if a bank account was to pay 5% interest, that would be the nominal rate.

- Real Rate of Interest - The rate after inflation is taken into account. In the example of a bank account paying 5%, if inflation was running at 2%, the real rate of interest would be 3% (5%-2%).

Negative real rates of return are extremely common. For example, the UK base rate at the start of 2020 was 0.75% with inflation running at around 1.25%. This suggests that real interest rates in the UK are negative by half a percent.

What are the issues with Negative Interest Rates?

- It leaves banks with a negative yield on an asset, namely central bank reserves, without the corresponding ability to reduce the rate on a liability, customer deposits to a negative level. In effect, the negative rate operates as a tax that cannot be avoided. It is a tax that has been estimated at around 7.5bn Euros a year in the Eurozone.

- There is a danger that banks will simply increase the desired yield on other assets to compensate for the poor or negative return on their central bank reserves. For example, they could push up mortgage rates.

- Negative interest rates could also be accused of distorting financial markets. In early 2019, about 40% of Eurozone government bonds had negative yields. These extreme rates could lead to bubbles in the price of assets such as bonds, equities and housing.

- Reductions in interest rates around these low levels don’t boost consumption as economic theory might suggest. They boost the desire or need to save given that returns are so low. Households find themselves needing to save more in order to pay for future consumption, because of the low returns available.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Trevor Pugh

There are no available Videos from "Trevor Pugh"