Introduction to Fiscal Policy

Tim Hall

30 years: Debt capital markets

Fiscal policy is one of three pillars of macroeconomic policy that can be used to influence the trajectory and growth rate of an economy. In this video, Tim provides an overview of macroeconomic theory that will provide the foundation for a more detailed discussion on fiscal policy.

Fiscal policy is one of three pillars of macroeconomic policy that can be used to influence the trajectory and growth rate of an economy. In this video, Tim provides an overview of macroeconomic theory that will provide the foundation for a more detailed discussion on fiscal policy.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Introduction to Fiscal Policy

18 mins 13 secs

Key learning objectives:

Explain the macroeconomic theory that is the basis for economic growth and the foundation of fiscal policy

Explain why an economy has economic cycles, often requiring government intervention in the form of fiscal policy

Overview:

Fiscal policy refers to the use of government spending and tax policy to influence economic growth in order to smooth variations in the business cycle, achieve full employment and reduce poverty. Fiscal policy is often used by governments on a discretionary basis to influence business cycles. The basis for understanding fiscal policy is macroeconomic theory, meaning understanding the relationship between prices and economic output (i.e. GDP). Most economists trace the roots of active fiscal policy to well-known British economist John Maynard Keynes. Keynes was especially influential throughout the first half of the 20th century, including during the Great Depression of the 1930s in the United States. His research and findings remain highly relevant today, and his extensive work at the time is why proactive fiscal policy is still often referred to today as “Keynesian Economics”.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the determinants that influence the trajectory of growth in an economy?

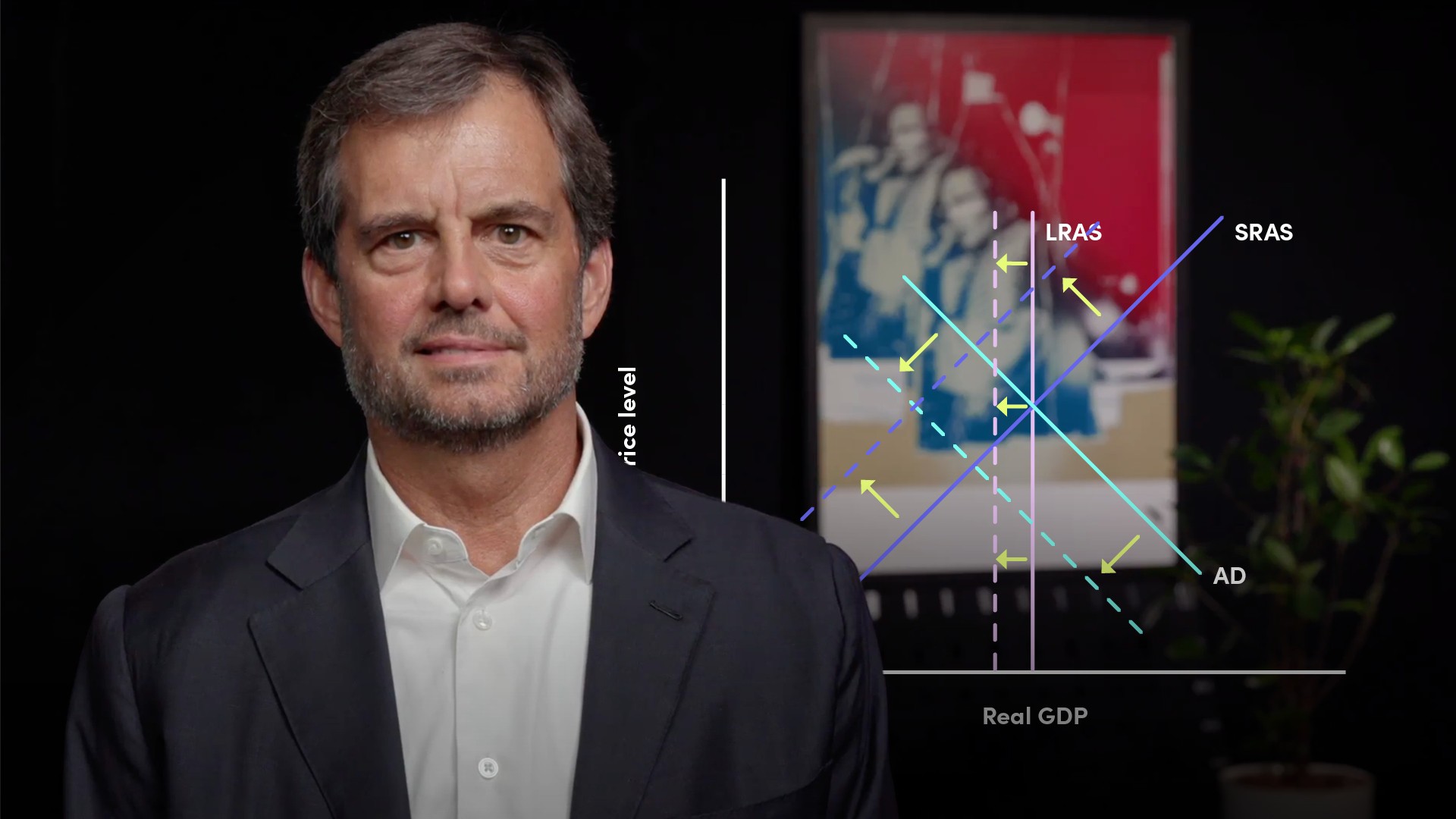

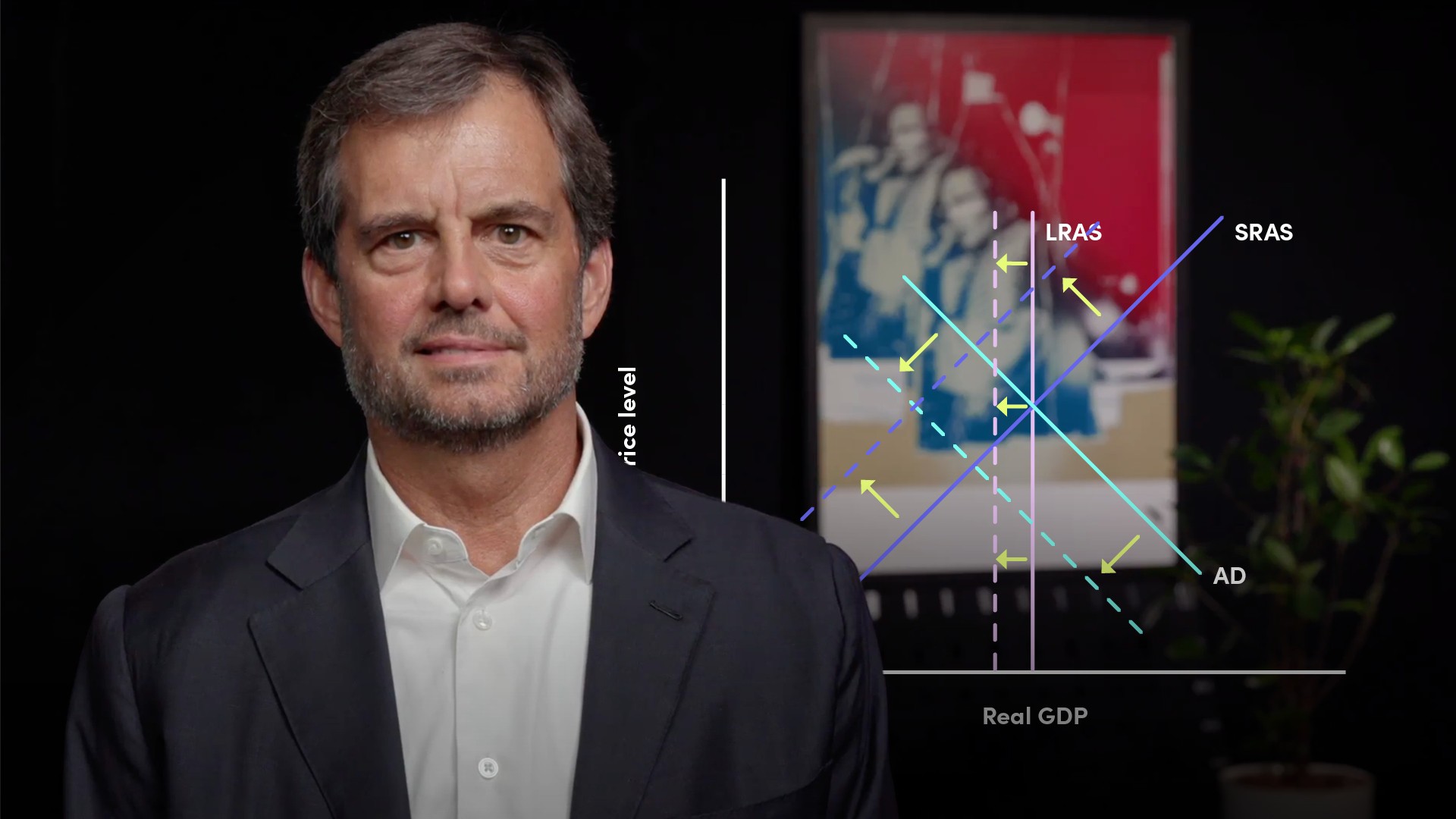

The key determinants that drive economic growth are prices and output. Graphically, these two parameters – prices on the vertical axis and output on the horizontal axis – are used in drawing the aggregate demand curve (AD), the short-term aggregate supply curve (SRS), and long-term aggregate supply curve (LRS). The AD curve slopes down and to the right, because the lower the prices, the more goods and services will be in demand. The SRS curve slopes up and to the left because the lower the prices, the less amount of good & services will be provided. The LRS curve is vertical meaning that supply of goods and services are limited by factors of production.

Graphically, the intersection of the aggregate demand curve and short-term aggregate supply curve on the long-term aggregate supply curve represents economic equilibrium, reflecting an economy operating at its natural rate of employment with stable prices.

What can cause an economy to move away from this utopia of perfect equilibrium?

Things that can derail an economy from equilibrium, usually meaning shifting one or both of the aggregate demand or short-term supply curves, this include things like:

- Unanticipated inflation or deflation;

- Changes in economic outlook and especially an increase in recession expectations;

- Demographic changes in a country’s population;

- Unexpected movement in foreign exchange rates;

- Higher or lower interest rates;

- Adverse trade policies;

- Changes in productivity (e.g. technological advances);

- Changes in government subsidies;

- Unanticipated supply shocks (like the current pandemic or an unexpected increase in the price of oil).

What can governments do to address macroeconomic imbalances?

The major fiscal policy tools that a government has at its disposal are taxes and government expenditures. Lowering taxes and / or raising government expenditures can provide stimulus to an economy in recession that is suffering from high unemployment and slack production capacity. Raising taxes and / or decreasing government expenditures can apply the brakes to an overheated economy that is suffering from inflation.

Why do economic cycles occur over time, and how is discretionary fiscal policy used to address economic cycles?

Economies tend to move in and out of equilibrium over time, experiencing periods of boom – or high growth – and periods of bust – or low to negative growth. Governments tend to use discretionary fiscal policy to lessen the amplitude and shorten the length of cyclical swings, with the objective being to manage economic growth as closely as possible to a targeted long-term growth target, typically around 2% / annum in developed economies, that represents equilibrium.

How has the COVID-19 pandemic affected economies, and what sort of fiscal policy response from governments has it provoked?

In most countries around the world, the pandemic led to a “manufactured” recession that drastically cut demand, and then interrupted supply chains. The pandemic caused a demand side shock initially as large portions of economies were temporarily shuttered , followed by a supply side shock as supply chains were interrupted. As capacity utilisation abruptly declined and unemployment increased dramatically, most governments embarked on aggressive fiscal stimulus programmes to aid unemployed and nurture businesses through periods when demand slumped or businesses were forced to close down completely. Concurrently, most central banks unleashed unprecedented amounts of monetary stimulus to also assist their economies weather the downturn.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Tim Hall

There are no available Videos from "Tim Hall"