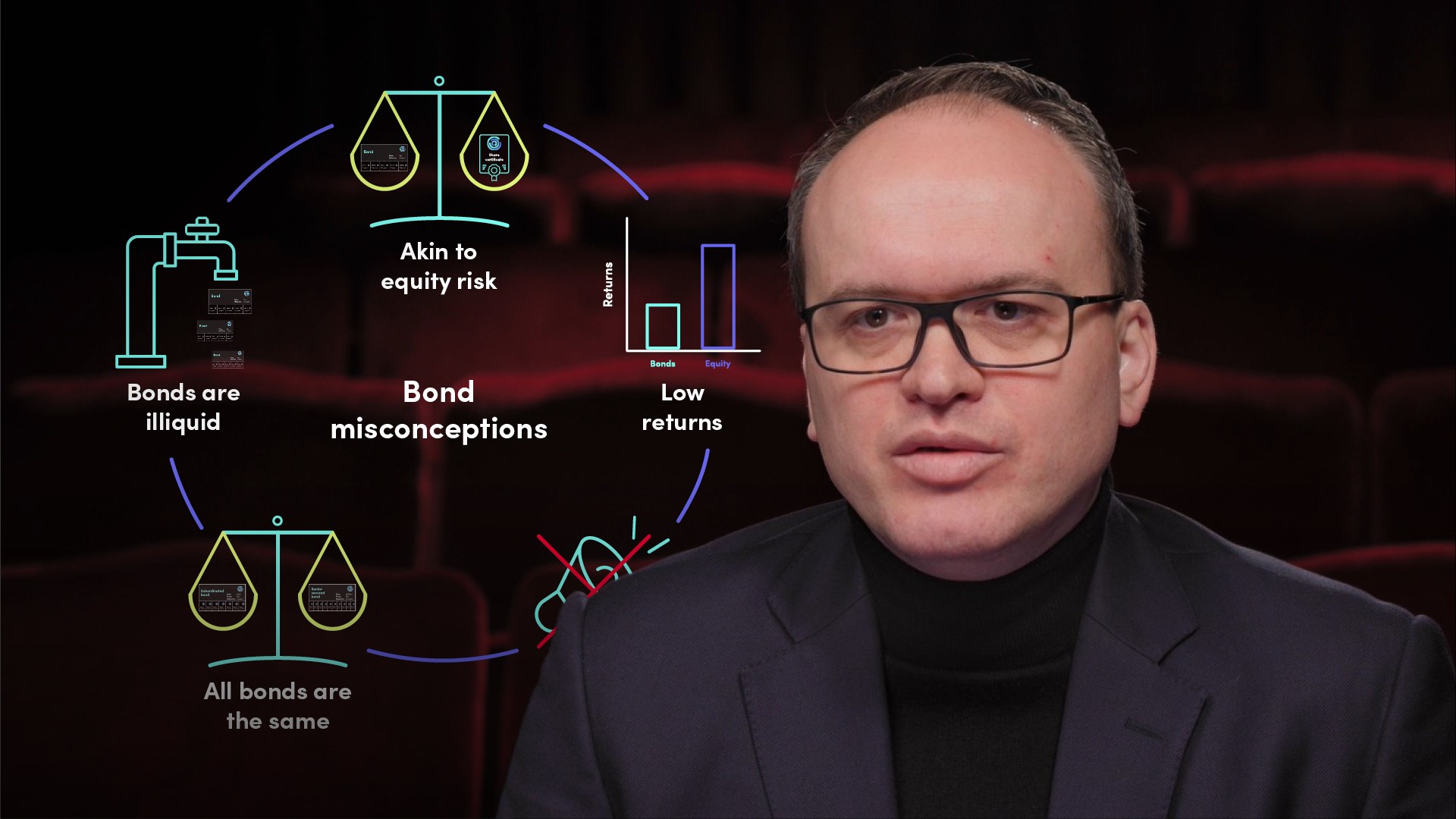

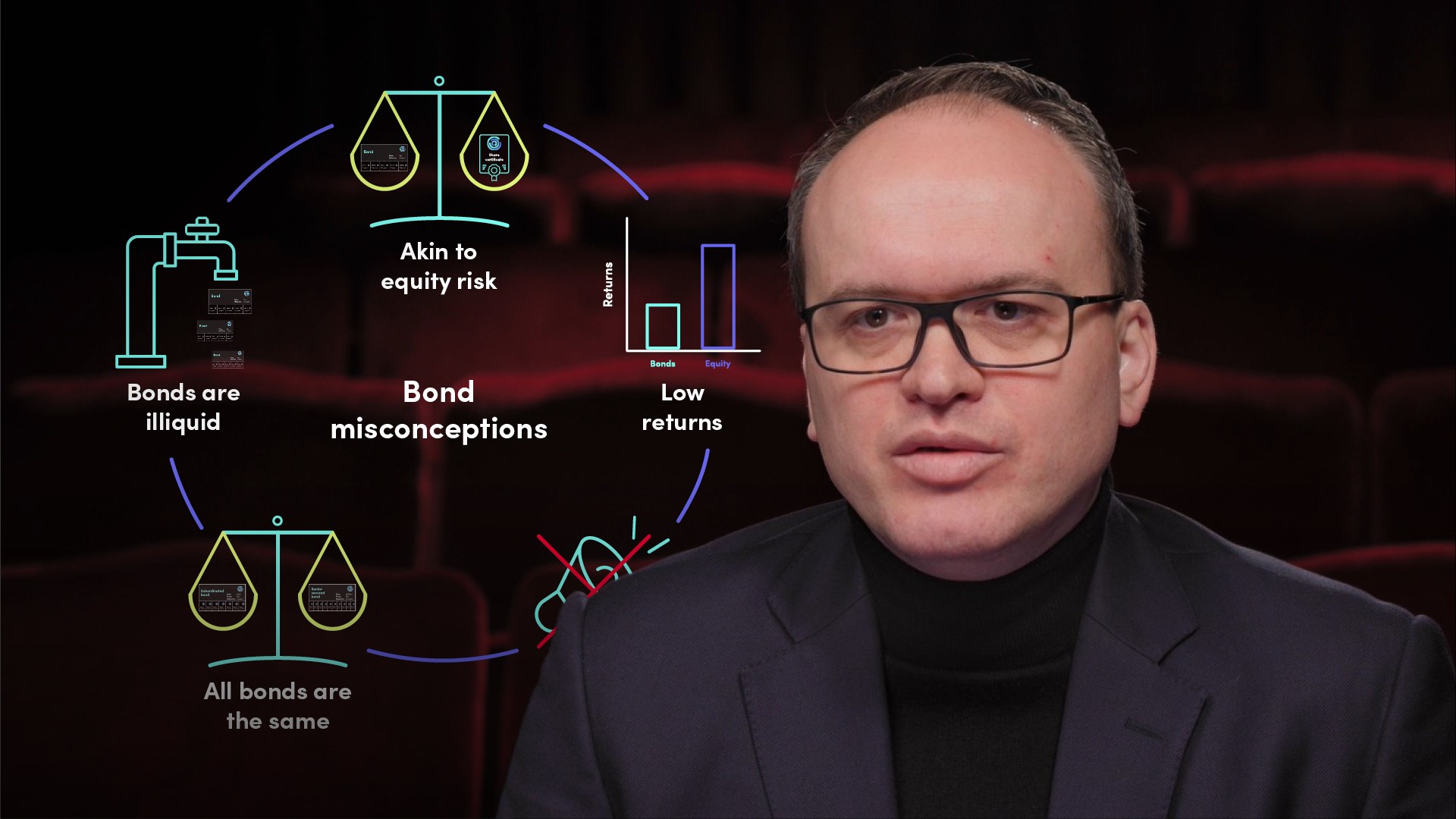

5 Misconceptions About Bonds

Alex Struc

20 years: Asset management

This video is for everyone, and particularly for those who view the world of finance exclusively through the prism of company ownership. In this video, Alex explains bonds at a high level, the key misconceptions associated with it, and how understanding these can enhance our decision-making and better our investment choices.

This video is for everyone, and particularly for those who view the world of finance exclusively through the prism of company ownership. In this video, Alex explains bonds at a high level, the key misconceptions associated with it, and how understanding these can enhance our decision-making and better our investment choices.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

5 Misconceptions About Bonds

11 mins 17 secs

Key learning objectives:

Outline the structural differences between bonds and equities

Explain the key misconceptions about bonds and equities

Identify which parties may find this information useful

Overview:

In this introductory video Alex examines bonds at a high level, the key misconceptions about bonds, and how understanding these can enhance our decision-making and better one’s investment choices.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Which parties may find this content particularly useful?

- This video is for everyone, and particularly those who view the world of finance exclusively through the prism of company ownership.

- Shareholders will find this content particularly useful because borrowing is an additional and cheaper cost of funding that can enable growth – critically, without diluting ownership rights

- This video is also important to bond investors because you need to know when and why what you are saying about bonds is not understood

Bonds and equity carry the same risk when things go wrong. Is this true or false?

False. A bond is a contractual obligation. It is a promise that a company makes to its investors, to borrow money and to pay it back over time at a pre-agreed rate of interest. Unlike shareholders, bond holders will not benefit from the full upside related to the growth of the business, but they will always be reimbursed first, ahead of equity. This will make bonds much less volatile to economic conditions and market swings.

Bond returns are always low. Is this true or false?

False. Bond prices are linked to interest rates. The coupon is a combination of the yield on a government bond of the same maturity plus a premium, which reflects incremental risk related to the credit quality of the borrower, the specificities of the financing and the tenor of the transaction. A common misconception is that a bond yielding 2% cannot generate higher returns than that. Yet, the move in rates from 2% to 1% on an obligation with a 7-year duration can generate a circa 7% return on an investment, depending on the original purchase price.

Bonds investors don’t speak with the management. Is this true or false?

False. Giving up ownership is an expensive task. This is one reason treasurers and CFOs of large companies with frequent borrowing needs look to the bond market for financing. It is also the main reason a company would pursue bond financing much more frequently than ask shareholders for additional capital. As bonds are frequently issued, bondholders meet management often to discuss the business, specific uses of proceeds as well as the issues of governance – basically, to make sure that the business case is still solid, and operational agility is not impaired.

All bonds from the same issuer carry equal risk. Is this true or false?

False. Bonds from the same issuer can significantly vary in return profile, credit rating and valuation. The probability of default is similar for all bonds because failure to pay to interest on one bond affects all others too. But the loss severity in case of default can vary greatly because each obligation, or promise, is structured differently.

Bonds are illiquid or never trade. Is this true or false?

This is a historical fact, that is simply no longer true. Liquidity is the ability to change your mind. Price transparency, the depth of the market, and a detailed list of owners are all public knowledge in stocks. The picture is different for fixed income, mainly due to the bond market’s historically private nature, but those who can interpret individual structures and investor needs will have a structural advantage.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Alex Struc

There are no available Videos from "Alex Struc"