Bonds and Bond Yields

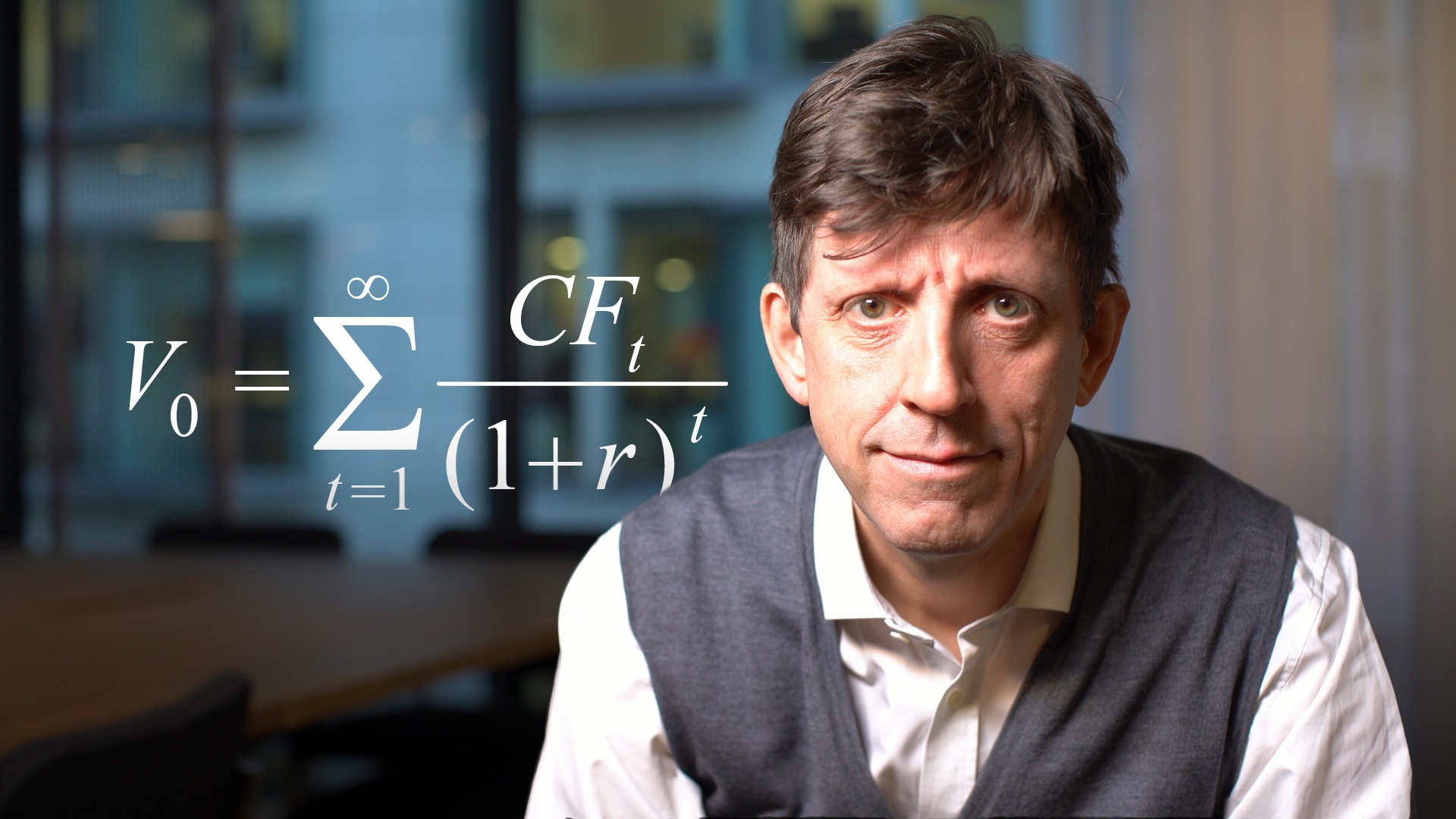

Lindsey Matthews

30 years: Risk management & derivatives trading

Lindsey begins his series by explaining what a bond is, why people invest in them and the factors you should consider when investing.

Lindsey begins his series by explaining what a bond is, why people invest in them and the factors you should consider when investing.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Bonds and Bond Yields

13 mins 34 secs

Key learning objectives:

Describe a Bond

Learn the importance of investing in Bonds

Learn about bond prices, cashflows and values

Explain yields, yield-to-maturity and the yield curve

Overview:

Rather than borrowing from a bank, large companies, banks and sovereign governments borrow money in the capital markets by issuing bonds. A bond is a security representing debt of an issuer. Bond buyers are the lenders; bond issuers owe lenders money and pay periodic interest to them. Interest payments a.k.a. coupons, are expressed as a percentage of the money borrowed. Key determinants of bond value are coupon, price and yield.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a bond?

Rather than borrowing from a bank, large companies, banks and sovereign governments borrow money in the capital markets by issuing bonds. A bond is a security representing debt of an issuer. Bond buyers are the lenders; bond issuers owe the lenders money and pay periodic interest to them. Interest payments are called coupons; coupons are expressed as a percentage of the money borrowed. Why invest in Bonds? Investors generally buy bonds because they want to invest capital to generate a return. Most bond investing by volume is undertaken by investors that have to meet of future liabilities – such as defined benefit pension schemes or life insurance companies that make promises to pay money out in the future to retirees until death or on the death of insured lives. Bond investors typically look for a specific set of characteristics from their investments:- Relatively low-risk investments

- Stability and certainty of future cashflows

- Income

Bond yields, yield-to-maturity and the yield curve

An investor buying a zero coupon bond at a price of 90 that returns 100 in a year will earn a return of $10 on $90, or over 11%. If the price of the bond rises from 90 to 95, the return falls to $5 on $95 or about 5.3%. As the bond price rises, the bond yield falls. Paying more for the same set of fixed future cashflows will result in a lower return. Bond yields allow investors to compare bonds with different cash flows. Knowing which of two five-year bonds is better to invest in from the same borrower with otherwise identical provisions – one priced at 95 and one at 105 – will depend on the size of the coupon. Bond 1 paying 1% over five years at 95 is a better investment than Bond 2 paying 2% at 105. Buying Bond 2 involves paying 10 extra points upfront (105-95) for only one extra point per year over five years. If the bonds have coupons of 1% and 3.25%, yield-to-maturity (YTM) comes in handy. The YTM of Bond 1 is 2.06% whereas the YTM of Bond 2 is 2.18%, making Bond 2 the favoured Investment. The yield to maturity is the single interest rate that can be used to discount future cash flows to get the bond price. But it is a forward-looking measure, not a guarantee of a return. The total return earned on a bond held to maturity is driven by the amount of money the investor ends up with at the end. If investors leave coupon payments in cash, the return will be lower than the yield. But if they reinvest them, the return could be higher than the yield. In normal times, yields on short-dated bonds are lower than on longer-dated bonds. This is referred to a normal or upward-sloping yield curve. The argument is that investors should get more for tying their money up for longer. Occasionally, yields on longer-term bonds fall below those on shorter-dated bonds. This is unusual and is referred to as an inverted yield curve.Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Lindsey Matthews

There are no available Videos from "Lindsey Matthews"