Funding Alternatives for SMFIs

Ronan White

40 years: Capital markets and investor relations

In the previous video, Ronan introduces the need for lending institutions to embrace funding diversification. In this video, he outlines some of the options available to SMFIs, apart from traditional capital markets solutions. He then also explains the difficulty in raising capital and implications of IFRS 9 standard on SMFIs.

In the previous video, Ronan introduces the need for lending institutions to embrace funding diversification. In this video, he outlines some of the options available to SMFIs, apart from traditional capital markets solutions. He then also explains the difficulty in raising capital and implications of IFRS 9 standard on SMFIs.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Funding Alternatives for SMFIs

14 mins 59 secs

Key learning objectives:

Understand traditional capital markets funding sources such as covered bonds and securitisation

Outline the alternative funding options available to SMFIs

Understand the challenges in raising capital for SMFIs

Understand the implications of IFRS 9 on SMFIs with regards to expected credit loss

Overview:

There are now different alternative funding solutions available for smaller and medium-sized financial institutions (SMFIs). Traditional sources of alternate funding involved capital markets solutions, using their loan assets as collateral, to borrow in smaller amounts appropriate to their needs, using a repeatable ‘shelf or cell structure’ or by using special purpose entities for a specific funding project.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are traditional sources of alternative finance?

Covered Bonds: Issued by a financial institution where there is recourse by the investor(s) to a specific pool of loan assets that secures the bond. In the event of default by the Issuer (the financial institution) the investors have recourse to both the pool of assets and the Issuer itself. Covered bonds are suited to institutions that have their own investment grade ratings from a credit ratings agency (eg: Moody’s or S&P).

Securitisation: Loans are sold by their originator (lender) to a special purpose vehicle (SPV). This is known as a “true sale” securitisation. The SPV will issue debt securities to investors and use the sale proceeds from the issuance to fund its purchase of the loans. The principal and interest payments on the debt securities are funded by (and limited to the extent of) the cash flows (both capital and revenue) generated by the loans. The SPV’s obligations under the debt securities are typically secured by the loans and their cash flows.

What alternative funding tools are available to smaller and medium sized lenders?

- Structured covered bonds

- Conditional pass-through covered bonds (CPT)

- Retained securitisation and Term repurchase agreement (Repo)

- Bank to bank loan financings

- Forward flow agreements

What are the issues SMFIs face when raising capital?

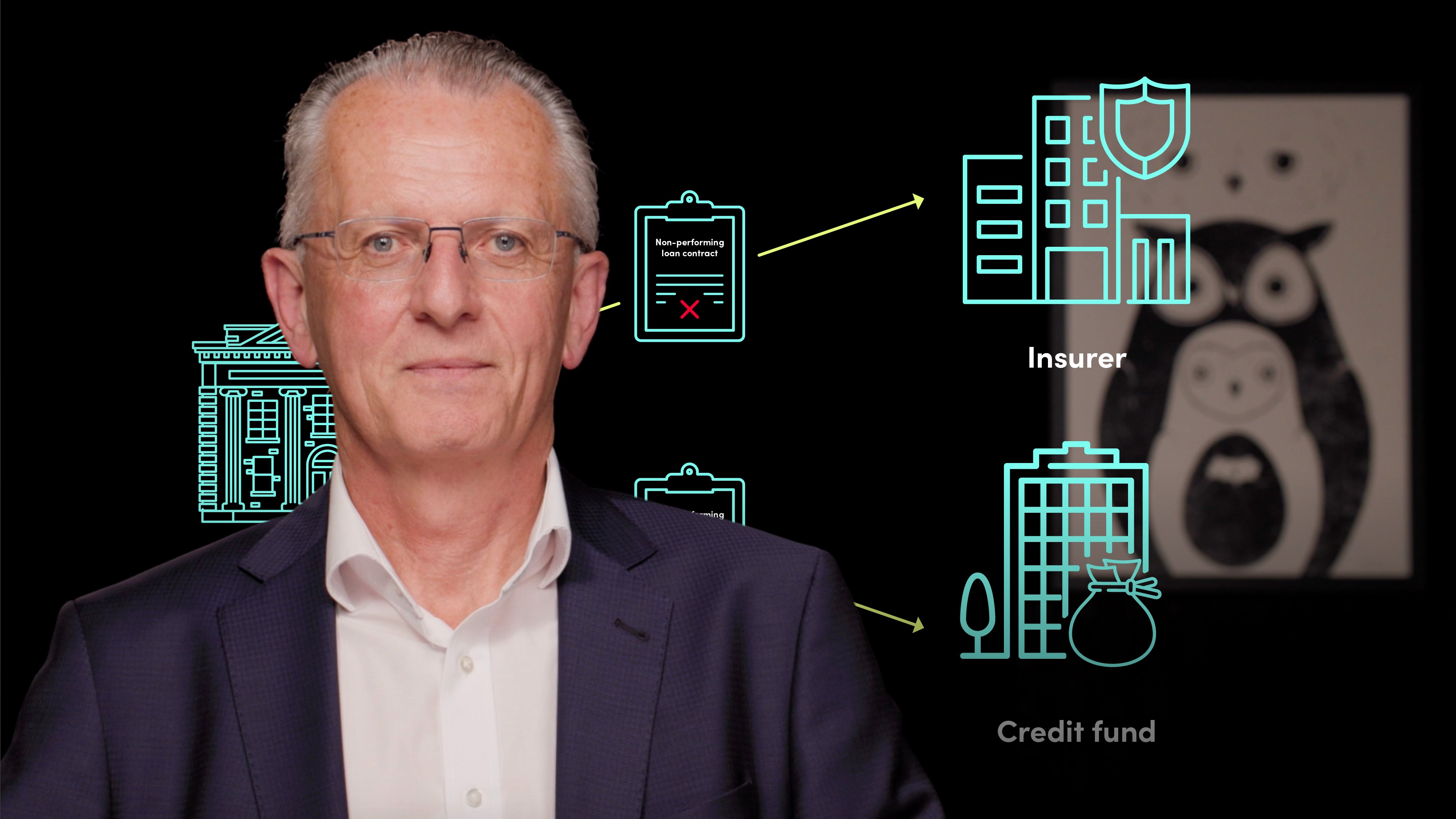

SMFIs have limited ability to raise core equity capital directly or to issue hybrid capital instruments such as Additional Tier 1 or even Tier 2. Larger banks apart from an ability to raise equity or hybrid capital through benchmark sized transactions have also been able to avail of the option for releasing regulatory capital using ‘credit risk transfer’ techniques.

Under this an entity reduces its risk assets for capital measurement purposes by transferring an element of the risk associated with a portfolio of loans to a third party. It is only a matter of time before a risk transfer solution is brought in a workable format to smaller and medium sized financial institutions too.

What is the impact of IFRS 9 standard on SMFIs?

Another area potentially impacting financial institutions’ capital is the accounting standard, International Financial Reporting Standard 9. This introduces, amongst others, the concept of expected credit losses, requiring banks to predict the future loss of all assets requiring higher charges against capital

Larger financial institutions can avail of tailored solutions devised to protect against the potential adverse capital consequences of IFRS 9 allowing them to transfer or sell assets to a third party. Will smaller and medium sized financial institutions be able to avail of such solutions too?

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Ronan White

There are no available Videos from "Ronan White"