Funding Challenges for Small to Medium-Sized Financial Institutions (SMFIs)

Ronan White

40 years: Capital markets and investor relations

In this video Ronan outlines the evolution of lending institutions in the financial markets and then discusses the importance of funding diversification for lending institutions and introduces various funding solutions available to them.

In this video Ronan outlines the evolution of lending institutions in the financial markets and then discusses the importance of funding diversification for lending institutions and introduces various funding solutions available to them.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Funding Challenges for Small to Medium-Sized Financial Institutions (SMFIs)

10 mins 26 secs

Key learning objectives:

Understand how the banking landscape and funding has developed

Understand why funding diversification is especially important for non-traditional lenders

Outline some of the challenges SMFIs face in achieving funding diversification

Outline some funding diversification solutions for SMFIs

Overview:

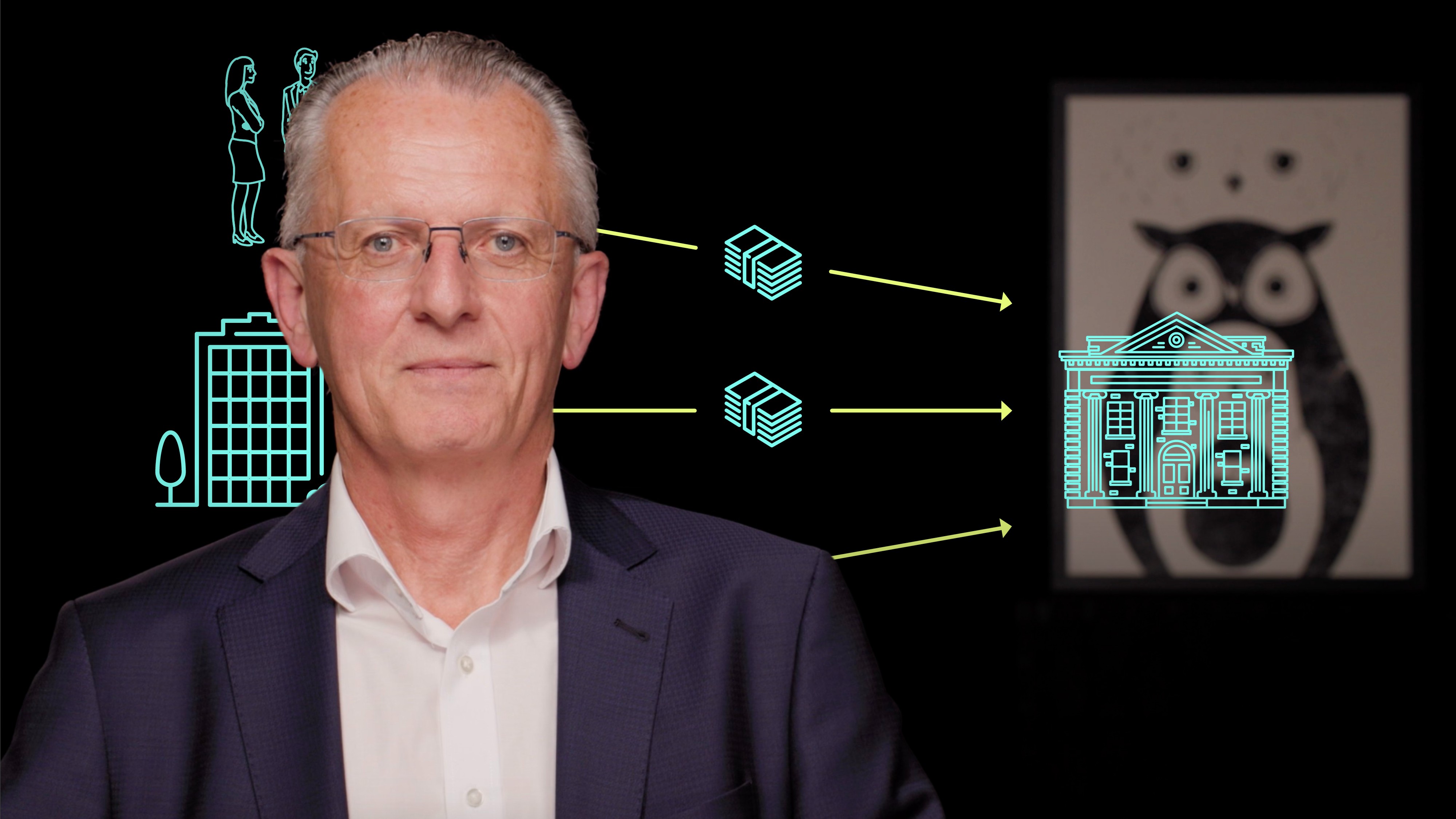

There is a growing diversity of lending institutions now operating across the financial markets. The key objective for these lending institutions is to ensure they achieve diversification with regards to their funding sources.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How has the banking landscape and funding developed?

Many are product specific, they are not full-service providers but focus on a particular element of business, such as mortgages, consumer finance, trade receivable finance or SME lending.

Banks and building societies have been the established providers of debt finance or lenders to personal and business customers. These lenders have traditionally funded themselves through deposit-taking activities supplemented by capital resources or accumulated reserves.

Over time banks and building societies recognised the need to diversify funding and accessed the syndicated loan market where banks lend money to financial institutions or accessed the debt capital markets where banks and institutions invest in bonds issued by established financial institutions.

What are the difficulties for small and medium financial institutions (SMFIs) to achieve funding diversification?

There are now more than 5,000 SMFIs across the European banking landscape. Many of these have little or no access to the capital markets to expand and diversify their funding base. The reasons for this are several and relate to their overall size, lack of credit ratings, absence of published credit research, little or no coverage from investment banks to help with market engagement, and even a lack of treasury and market knowledge and expertise.

This market has increased with the establishment of challenger and digital banks and the emergence of non-bank specialist lending platforms mentioned earlier. Newer banks and non-bank lenders seek to take on more traditional lenders through disintermediation in their markets or specific product areas. This has increased the focus on alternative sources of funding.

Where do smaller and medium-sized financial institutions (SMFIs) source and diversify funding apart from deposit-taking capabilities?

The first real diversification for SMFIs, akin to capital markets engagement, was by way of regulatory intervention following the financial markets crisis in 2008/9. The Bank of England offered financial institutions funding against pledged mortgage and other loan collateral

For many of the smaller to medium-sized institutions, this was their first experience of using their loan portfolios as collateral for funding and being subject to capital markets-type scrutiny and discipline by a third-party funder.

A challenge for some of the smaller to medium-sized financial institutions will be how they prise themselves away from the use of Bank of England funding.

How does an entity achieve funding diversification?

Options exist across the capital markets. Alternative financing routes are now largely built around the use of an institution’s assets to raise funding in amounts appropriate to its size and specific needs.

There is a diversity of investors across institutions such as asset and fund managers, insurers and pension funds, many of whom will be looking for ‘new names’ in perhaps already familiar asset classes (e.g: UK residential mortgage exposure) where they are already regular investors in benchmark-size public transactions ($500m/€500m/£350m) from well-known and larger financial institution names.

Additionally, private banks are looking for opportunities to put surplus liquidity to work and may well lend directly to another financial institution or invest in a bond issued by it.

Universal banks (i.e., banks with private, retail, commercial and investment banking businesses), on the other hand, actively seek to put funds to work with several smaller sized lending entities to allow for the accumulation of loan assets which can then be refinanced through the securitisation markets in benchmark transactions.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Ronan White

There are no available Videos from "Ronan White"