FX Options and the Greeks

Kees van den Aarssen

35 years: FX & financial markets

In this video, Kees van den Aarssen describes each of the option greeks and how they are calculated.

In this video, Kees van den Aarssen describes each of the option greeks and how they are calculated.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

FX Options and the Greeks

16 mins 12 secs

Key learning objectives:

Understand and define delta, theta, rho, phi and vega

Overview:

The option greeks are essential to understanding options as a whole. They are the mathematical terms that define or explain the changes in price, interest rates or risk for an option contract.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are Option Greeks?

The main greeks are Delta, which measures the price impact for a change in the underlying (spot price). Theta, which measures the price impact for a change in time (usually 1 day). We use Rho and Phi for a change in domestic and foreign rate (usually 1 bps), and finally Vega is used for a change in volatility (usually 1 pct).

These are not constant but increase and decrease as a function of time, spot and volatility. Therefore, these Greeks all have a second order greek to measure how the greek itself can change.

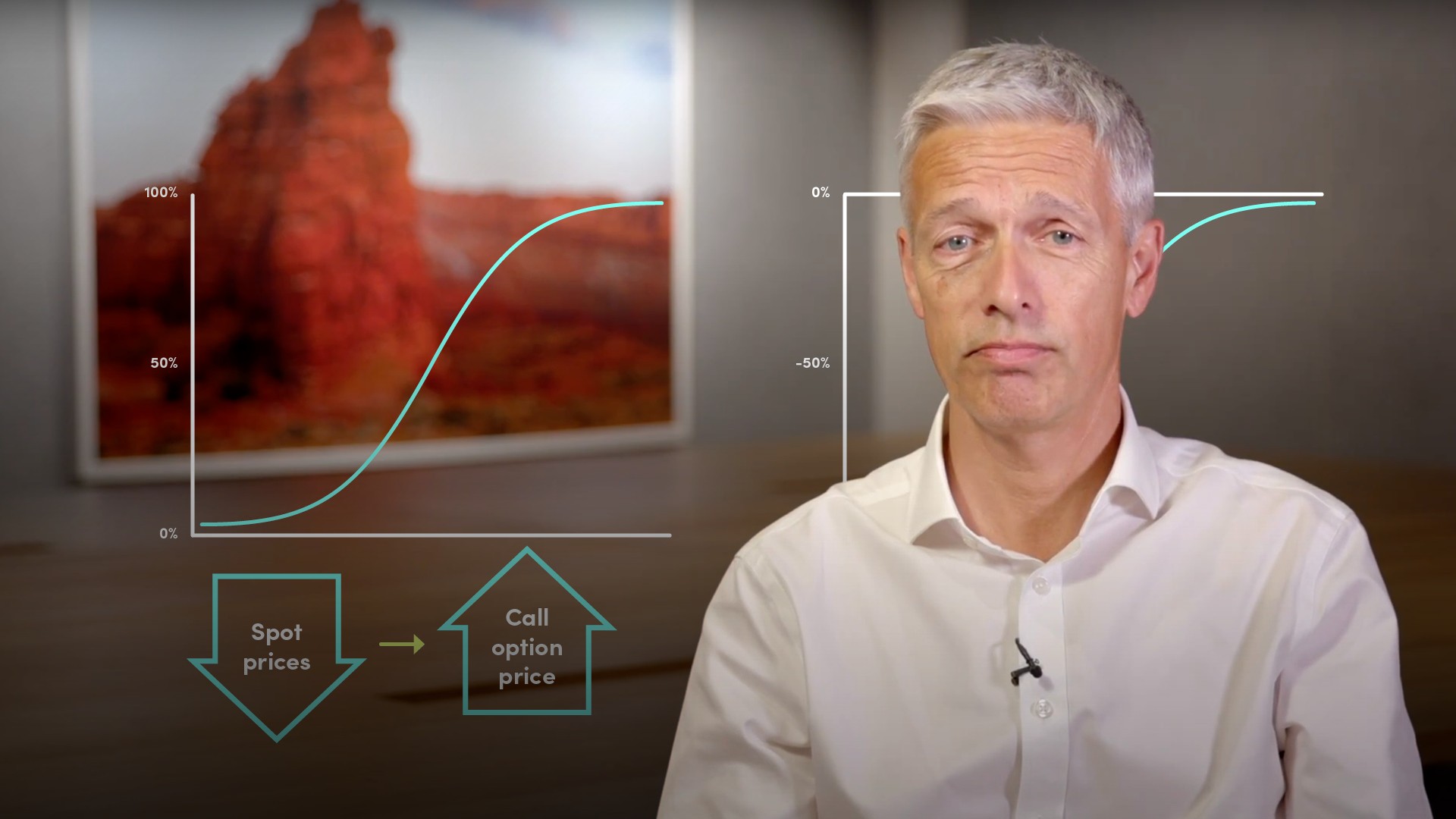

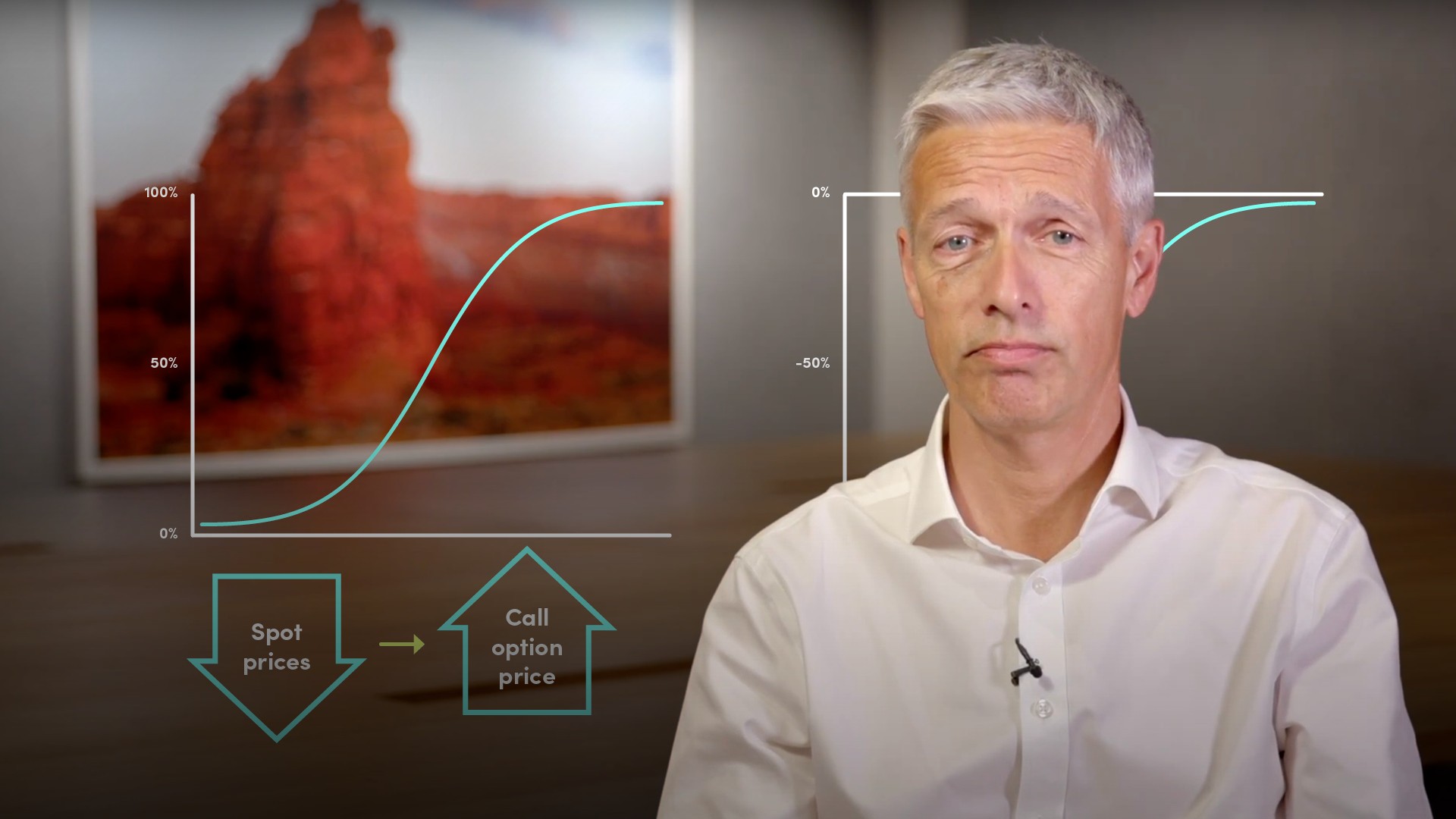

What is Delta?

Delta is usually expressed as a percentage. If the underlying (the spot price) changes, delta measures how much of that change is passed on to the price of the option. For a call option the delta can be anything between 0% to 100%. A put option has a delta between 0% and minus 100%. This means when spot goes up, the price of a call option will also go up whilst the price of the put will be lower. At 0% the option price is not at all affected by a spot move - we would say the option is ‘far out of the money’. when the delta is 100%, the value of the option behaves the same as the spot and every move in spot will result in the same P and L. If spot goes 100 pips higher, the option price will be 100 pips higher as well. We would say the option is ‘deep in the money’. These are the boundaries and most of the time the delta will have a value in between. Right in the middle we have 50% delta (in FX jargon we simply say 50 delta btw) and 50 delta options we call ‘at the money’.

We have seen three typical deltas, but as mentioned, the value can be anything between the boundaries 0 and 100%. This is true when you are long a call option. The sign can reverse if you are short or when you are long a put option. Sometimes the delta is referred to as ‘the chance the option will get exercised’. Exercising an option means that the owner of the option decides at expiry that he will buy one currency against another at the strike. The chance this will happen is nihil for a far out of the money option and a certainty for a deep in the money option. The at the money option has in fact the biggest uncertainty with respect to this point. There is a 50/50 chance that the option gets exercised or expires, which is the alternative. One or the other will happen - there are no alternatives.

What is Gamma?

The greek used to measure the change in delta for a change in spot is called gamma. Gamma is the largest for at the money options right at expiry. We will discuss delta hedging later but the size of the gamma will tell you how stable this hedge is, and thus, how often you need to re-hedge.

What is Theta?

Theta measures the change in value of the option over time keeping all other market conditions the same. Theta is also known as ‘decay’. Theta measures the speed at which decay occurs: how much value is lost from one day to the next. The value of an option can be decomposed into time value and intrinsic value. The intrinsic value is purely the difference between strike and underlying whereas the time value is the possibility that this changes. The time value is the true optionality if you like, and only the time value decays. It seems reasonable that as time disappears, the time value also disappears.

What are Rho and Phi?

These greeks measure the change in option value as a result of any change in interest rates. It is quite straightforward and easy to see that as the interest rate for either currency changes this will have an impact on the forward of the underlying, and as we have seen, this affects the moneyness of the option and hence the price.

If the rate of Currency 1 will go up and/or the rate of Currency 2 will go down the forward price will move lower and the value of Call options will go lower as well. The price of a Put option will go up obviously. The reverse is obviously also true. Rho and Phi will be the value change in the option for a move in rates of 1 bps.

What is Vega?

It measures the impact of a 1% change in the volatility of the underlying asset on the value of the option. We have seen that the value can be split in two components: the intrinsic value and the time value. The intrinsic value will not be affected by volatility and hence a change in volatility has subsequently also no impact. Volatility can only affect time value. As time value is largest for at the money options this is also where volatility has its biggest impact on the value of the option. So Vega is largest when the option is ‘at the money’. A higher volatility is as if the option will extend its time to maturity and will increase the price. The more time to expiry, the more time value, the more impact volatility has: the longer dated the option the larger the vega. The exposure to volatility is quite exclusively reserved for option type products and vega is therefore probably the most important risk parameter. As option portfolios are constantly exposed to market changes, traders can hedge all these risks by trades in the underlying.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Kees van den Aarssen

There are no available Videos from "Kees van den Aarssen"