Global Master Securities Lending Agreement

Richard Comotto

30 years: Money markets

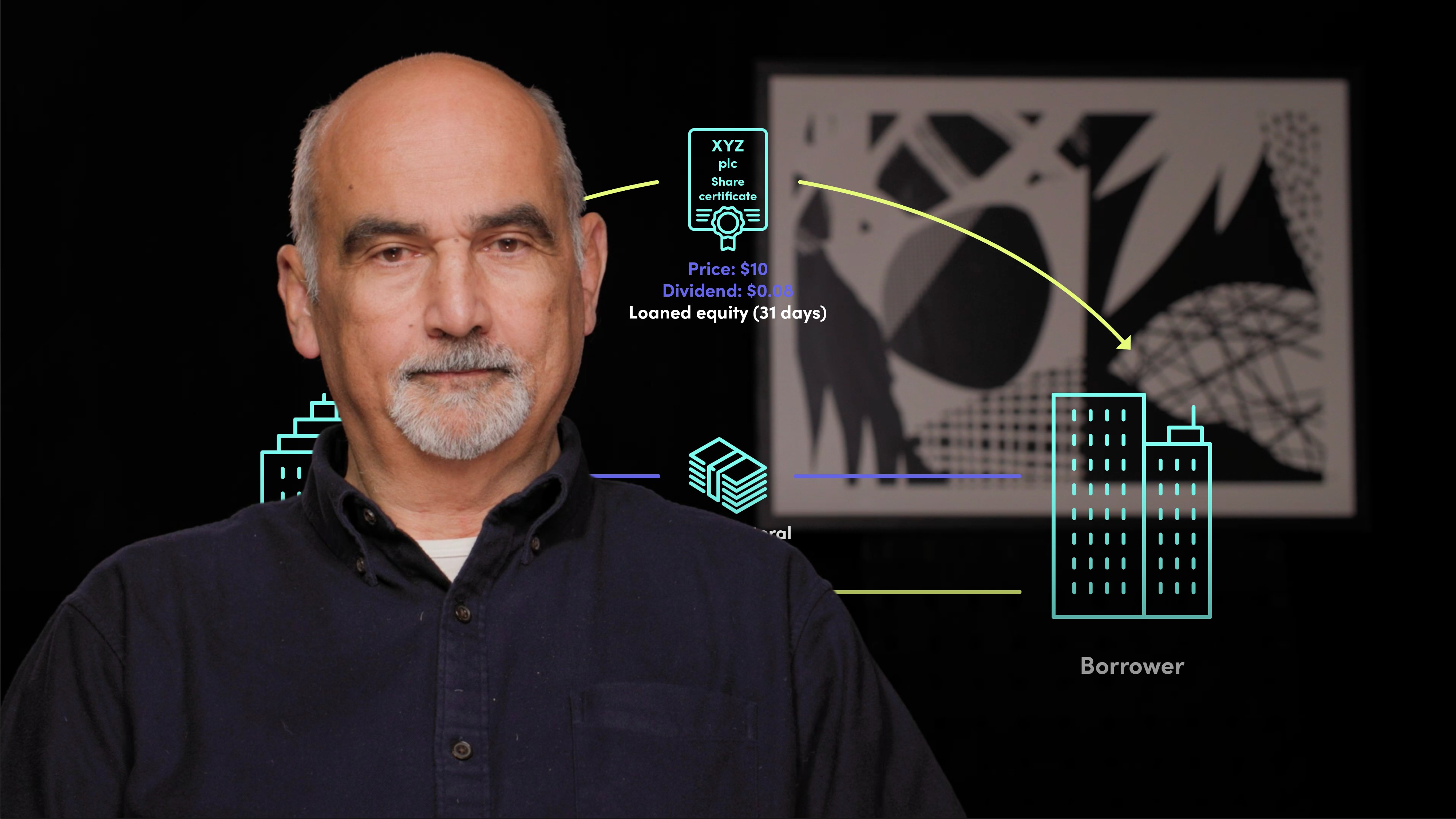

The Global Master Securities Lending Agreement (GMSLA) is the most commonly used contract in the international securities lending market. It provides a standard agreement to replace the range of agreements used in the market, with many provisions shared with the Global Master Repurchase Agreement (GMRA). The GMSLA has three levels: the Master Agreement, the Schedule attachment, and the confirmation or its automated equivalent. The Schedule defines the general relationship between counterparties, and amendments are standardised in annexes. The most commonly used version is the GMSLA 2010, which transfers collateral from borrower to lender by title transfer. A new version published in 2018 transfers collateral by means of a pledge.

The Global Master Securities Lending Agreement (GMSLA) is the most commonly used contract in the international securities lending market. It provides a standard agreement to replace the range of agreements used in the market, with many provisions shared with the Global Master Repurchase Agreement (GMRA). The GMSLA has three levels: the Master Agreement, the Schedule attachment, and the confirmation or its automated equivalent. The Schedule defines the general relationship between counterparties, and amendments are standardised in annexes. The most commonly used version is the GMSLA 2010, which transfers collateral from borrower to lender by title transfer. A new version published in 2018 transfers collateral by means of a pledge.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Global Master Securities Lending Agreement

26 mins 43 secs

Key learning objectives:

Understand the purpose of the GMSLA

Outline the key paragraphs of the GMSLA

Overview:

The Global Master Securities Lending Agreement (GMSLA) is the most commonly used contract in the international securities lending market. It provides a standard agreement to replace the range of agreements used in the market, with many provisions shared with the Global Master Repurchase Agreement (GMRA). The GMSLA has three levels: the Master Agreement, the Schedule attachment, and the confirmation or its automated equivalent. The Schedule defines the general relationship between counterparties, and amendments are standardised in annexes. The most commonly used version is the GMSLA 2010, which transfers collateral from borrower to lender by title transfer. A new version published in 2018 transfers collateral by means of a pledge.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the purpose of the GMSLA?

The purpose of the Global Master Securities Lending Agreement (GMSLA) is to provide a standard agreement to replace the range of agreements used in the international securities lending market, governing the most commonly-used or generic types of securities loan. The GMSLA has three levels: the standard Master Agreement, the pivotal Schedule attachment, and the confirmation or its automated equivalent. The Schedule links all the component parts of the GMSLA together and lists the basic decisions that need to be made in order for the GMSLA to function. It is a "framework agreement" that contains as many pre-agreed terms as possible to economise on the negotiation of individual loans.

What are the key paragraphs of the GMSLA and what do they outline?

Paragraph 1 provides a basic definition of securities lending and establishes that the GMSLA applies to all loans between the contracting parties. It also requires parties to specify the Designated Offices where loans can be booked, excluding jurisdictions where the GMSLA may not be enforced in a default or where there may be tax issues.

Paragraph 2 sets out key definitions, such as “Alternative Collateral,” “buy-in,” “Income,” and “Margin,” and clarifies that the headings in the agreement have no legal significance.

Paragraph 4 deals with delivery obligations and requires the lender to deliver loaned securities at the start of the loan and accept delivery of “equivalent” securities at the end. The reciprocal delivery obligations of the GMSLA are subject to “condition precedent,” allowing a party to withhold delivery or payment until the other party has provided assurance.

Paragraph 5 outlines the borrower’s obligation to deliver collateral at the same time as the loaned security or by the end of the day, as well as the mechanics of variation margining.

Paragraph 6 covers Distributions and Corporate Actions, including income on loaned securities or collateral, the manufactured payment in the case of a Distribution on a loaned security or collateral, and the prohibition on borrowing solely to acquire voting rights.

Paragraph 8 establishes the right of the lender to recall loaned securities and the borrower to return them, thereby terminating the loan.

Paragraph 9 covers the failure to deliver securities and collateral, with the lender not delivering loaned securities being non-default, but the borrower failing to deliver collateral being a default event.

Paragraph 10 lists events of default, including acts of insolvency, which may trigger automatic early termination. The non-defaulting party must serve a default notice to place a party into default, which accelerates the performance of outstanding obligations to the termination date.

Paragraph 11 offers three methods for calculating the default market value of loaned securities and non-cash collateral.

Paragraph 12 covers tax provisions. The provision requires that coupons and dividends, except on non-cash collateral, be paid without withholding tax unless legally required, with the payor responsible for any required tax deduction to protect the lender from unexpected taxes.

Paragraph 20 sets out the methods of communication between borrowers and lenders. These paragraphs provide essential guidance for parties to securities lending transactions, and it is crucial that they be understood to ensure smooth and efficient transactions.

Paragraph 23 specifies English law and courts as the governing law and exclusive jurisdiction for disputes.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Richard Comotto

There are no available Videos from "Richard Comotto"