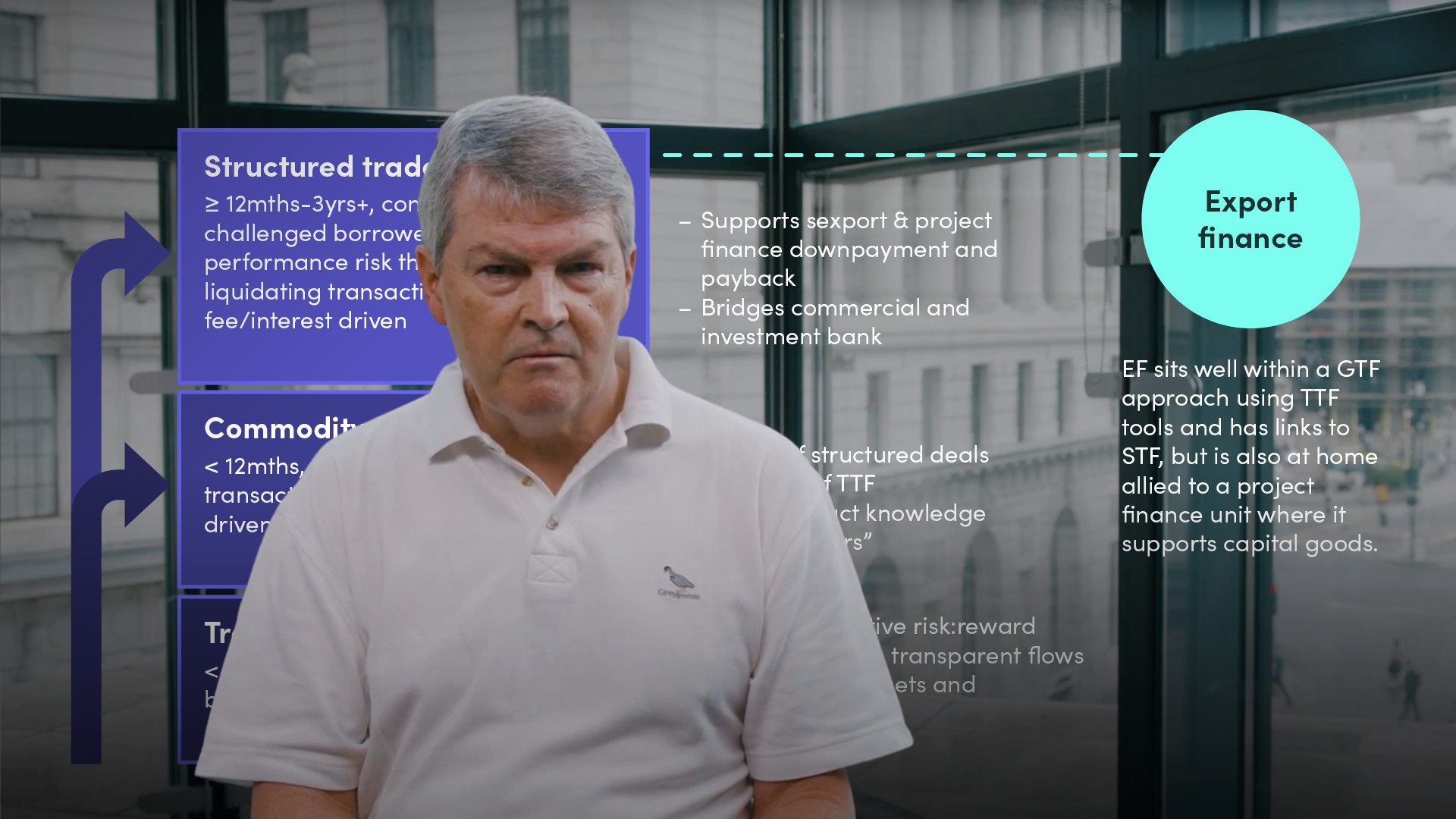

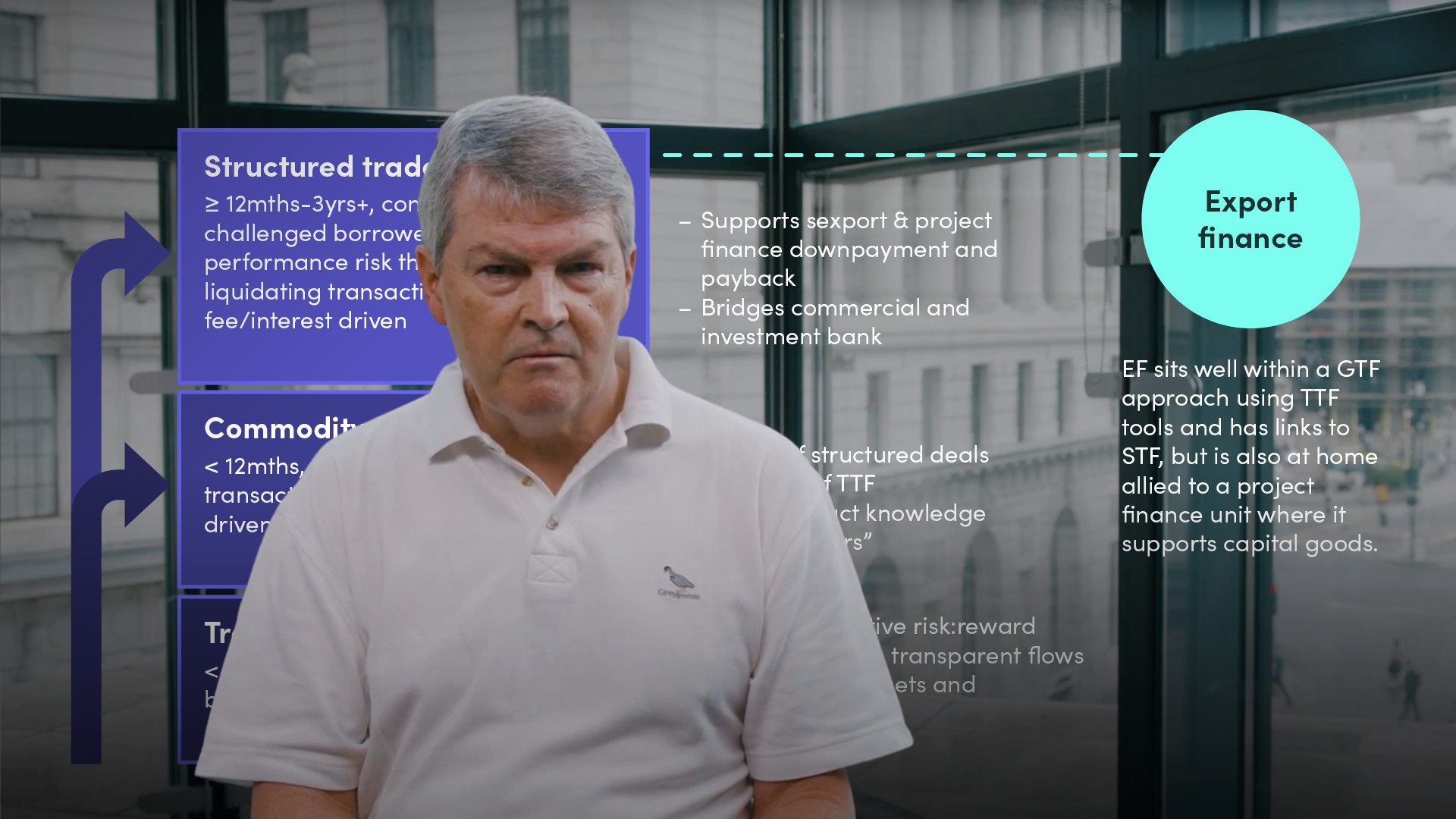

Contextualising the Role of Trade Finance

Aidan Applegarth

30 years: Commodity & trade finance

Trade is taking centre stage in world affairs, and with good reason! In this video, Aidan provides an explanation of what will be covered in this series on Trade Finance.

Trade is taking centre stage in world affairs, and with good reason! In this video, Aidan provides an explanation of what will be covered in this series on Trade Finance.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Contextualising the Role of Trade Finance

5 mins 7 secs

Key learning objectives:

Identify the credit assessment required for trade finance deals

Understand the importance of legal support

Outline the benefits of establishing distribution channels

Overview:

Credit support for trade finance deals is especially important, because the risks relate more towards the underlying goods/receivables. The assessment breaks transactional risk down into three key components where the lender is able to assess risk based on where it actually lies, not on the balance sheet.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What credit assessment is required for trade finance deals?

- Performance Risk

- For the seller, can they do what is required to meet the terms of their sales contract?

- Logistics Risk

- For the trader/distributor, will the goods arrive safely, intact and on time to the point of delivery?

- Settlement Risk

- For the buyer, will the goods be paid for in full and on time?

What is the importance of legal support?

- Many of the risks faced will involve cross-border transactions with goods moving between different jurisdictions whose laws may be different to the laws governing the underlying commercial contract

- The ability to understand the legal implications and mitigate as appropriate is a necessity. It can be achieved in-house, or by having access to established law firms with a proven specialty in the product or geography concerned

What are the benefits of establishing distribution channels?

- Provides the lender with an outlet for selling assets

- Is a tool for buying assets in the marketplace

- Tool for networking amongst trade practitioners for market information and price trends

- For deals originated by the lender but beyond their risk appetite, it provides the means to bring in participants

- For trade, a dedicated distribution team is recommended for buying into and selling of risk participations in individual LCs, or bid/performance bonds and for arranging any club deals

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Aidan Applegarth

There are no available Videos from "Aidan Applegarth"