Traditional Credit Analysis Vs Trade Finance

Aidan Applegarth

30 years: Commodity & trade finance

Aidan outlines the significance of credit support in trade finance. He critiques traditional credit analysis, explains the components that makeup credit analysis and outlines the value of focusing on these components.

Aidan outlines the significance of credit support in trade finance. He critiques traditional credit analysis, explains the components that makeup credit analysis and outlines the value of focusing on these components.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Traditional Credit Analysis Vs Trade Finance

10 mins

Key learning objectives:

Identify the traditional credit risk analysis used by credit managers

Discuss the flaws associated with traditional credit analysis

Explain the focus of trade finances’ credit analysis, and its benefits

Overview:

In this video, Aidan outlines the traditional credit risk review of balance sheet analysis and identifies the flaws associated with this, and then introduces the trade financing solutions, how they differ to general corporate lending and the reason for their relatively low loss-default rate.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Why is there a lack of credit support?

Traditional credit analysis falls back on the quality of a borrower’s balance sheet. This may work well for the larger, more established investment-grade corporates which can demonstrate net worth, net current assets and profitability, however, for sub-investment grade corporates and SMEs who are typically light on fixed and net current assets, balance sheet lending rarely justifies the sort of funding needs these firms require to deliver on their day to day activities.

It means that SMEs in particular have to resort to alternative financing options - options which are less ‘backward looking’ into last year’s audited results and more ‘forward looking’ into the operationalisation of the individual transactions requiring finance.

Why is it often difficult to sway credit risk managers from their traditional analysis?

- Looking at and analysing historical financials is backward looking, however, it presents tangible criteria, something definite that you can point to

- Whereas assessing what might happen in the future is forward looking but often based on intangibles, assumptions rather than definite facts. Hence, credit managers prefer to make judgements on tangible data, so having to adapt to the forward looking view of intangibles may take them out of their comfort zone, where they may then stall taking any decision or impose such conditions as makes a deal untenable

What is then required of credit managers that might benefit smaller-mid sized companies?

Credit managers must be trained to show that a reliance on backward dated numbers has its limitations, whilst a focus on the forward looking operationalisation of a trade finance transaction offers a more relevant and practical approach, which not only leads to finding sensible mitigants, but can also lead to further lending opportunities.

What are the flaws with traditional credit analysis?

- Assumes that historical performance is a suitable gauge for a company’s capacity to service debt in the future, and thus its future performance. For example in 2008-09, banks continued to apply this methodology of looking at prior year balance sheets. This meant that a financially good looking balance sheet at the end of 2008 was justification for continued lending through the first half of 2009, even though the value of those components were beginning to collapse.

- Tells us nothing about the context in which those financials arose. The consequence was a much higher default rate through 2009-09 than previous years. Speculative grade default rates shot up from 0.91% in 2007 to a staggering 9.88% in 2009.

Why are trade loan default rates comparatively lower than general corporate loan rates?

Where the corporate credit office looks to the balance sheet for creditworthiness, the trade finance credit office also looks to the balance sheet for vulnerability, and to the pros and cons of the transaction being financed for creditworthiness.

This is a necessary mindshift because the risk of the trade transaction to be financed is in the operationalisation of the transaction being considered, and in most cases, repayment doesn’t come from the borrower of the record, but from the receivable due from the buyer at the end of the transaction chain - self liquidating transactions. For this reason trade loan default rates are comparatively lower.

What is trade finances’ credit risk focus?

- Performance Risk

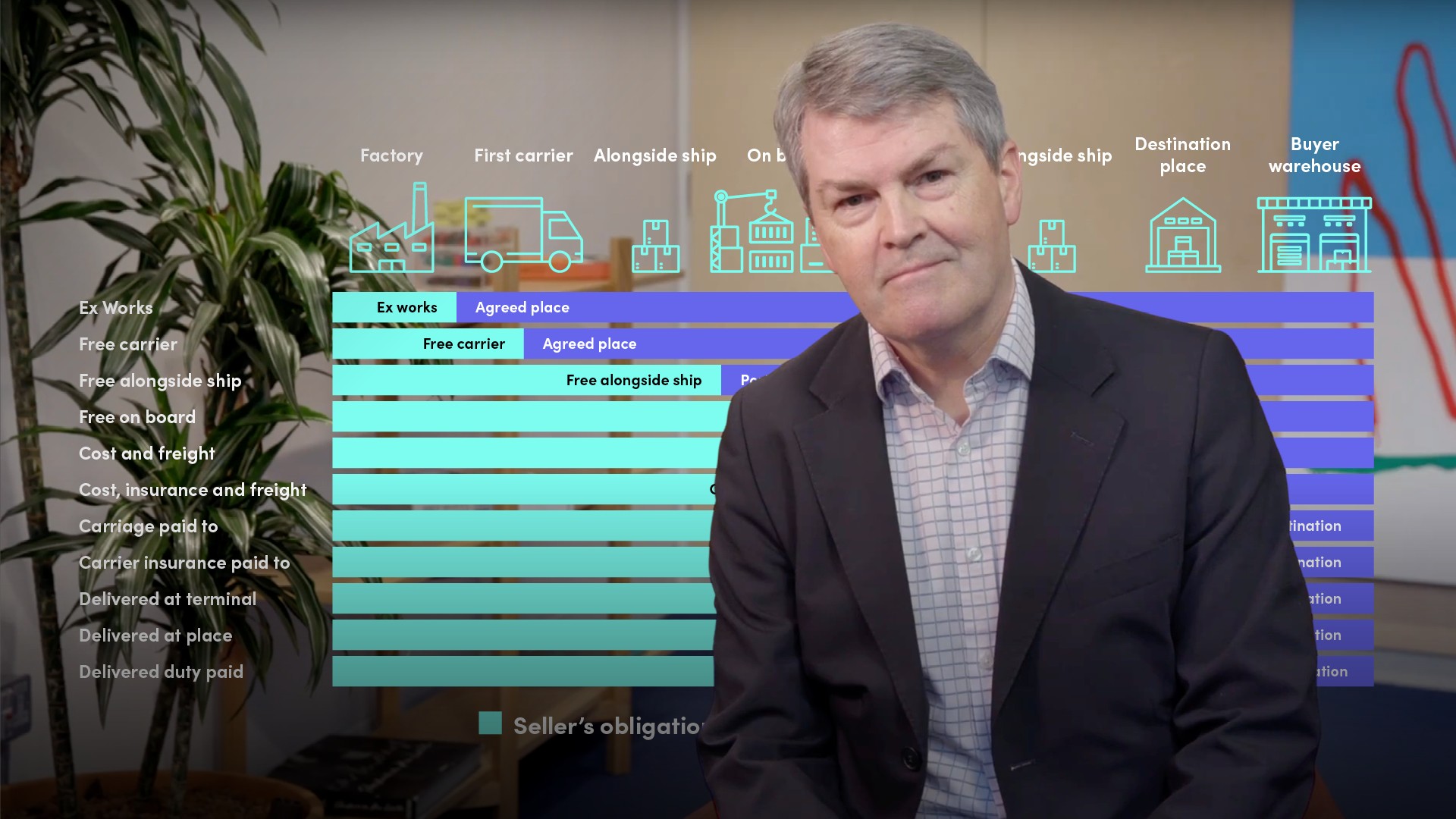

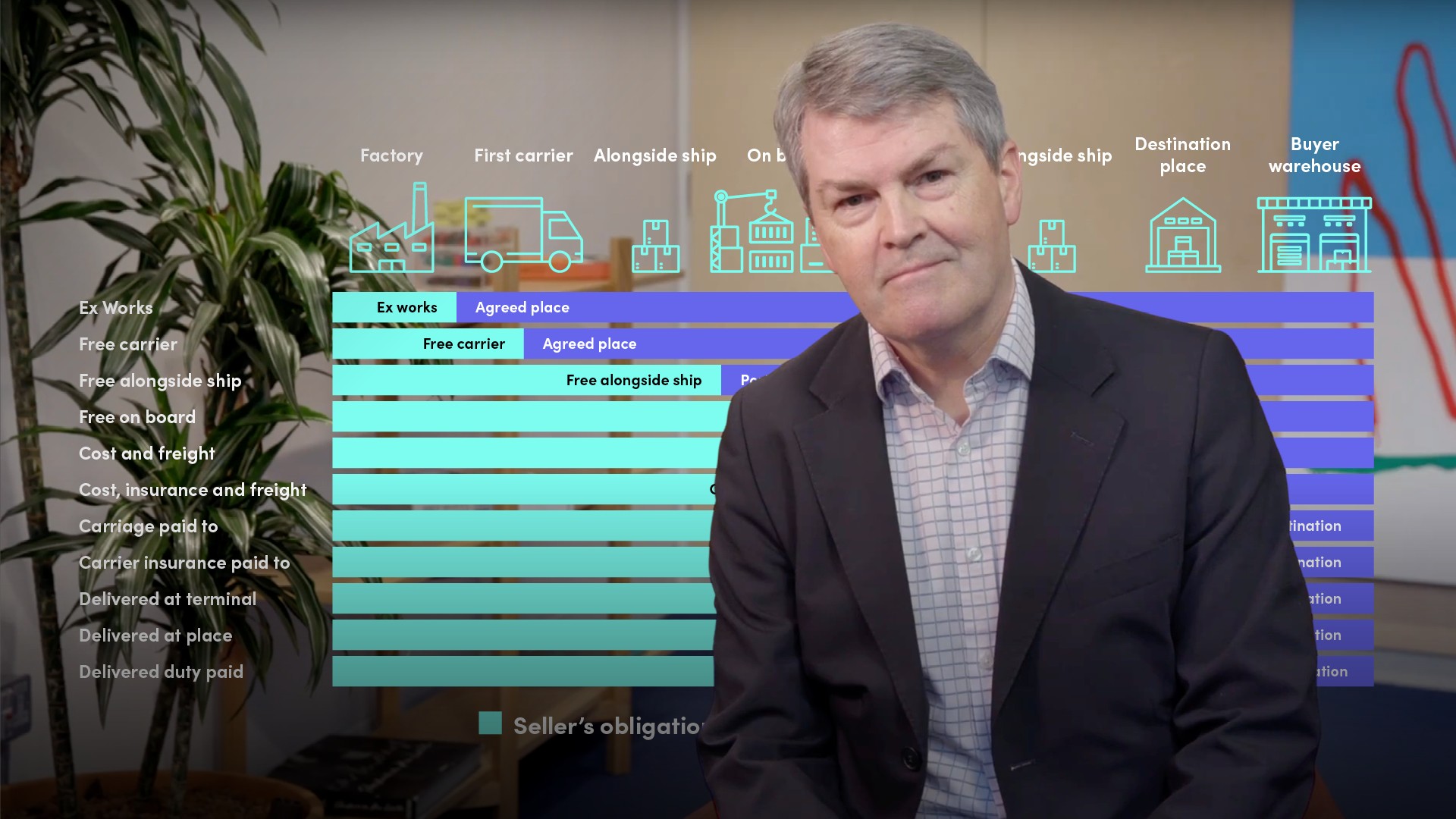

- Logistics Risk

- Settlement Risk

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Aidan Applegarth

There are no available Videos from "Aidan Applegarth"