Key Risks in Trade Finance

Aidan Applegarth

30 years: Commodity & trade finance

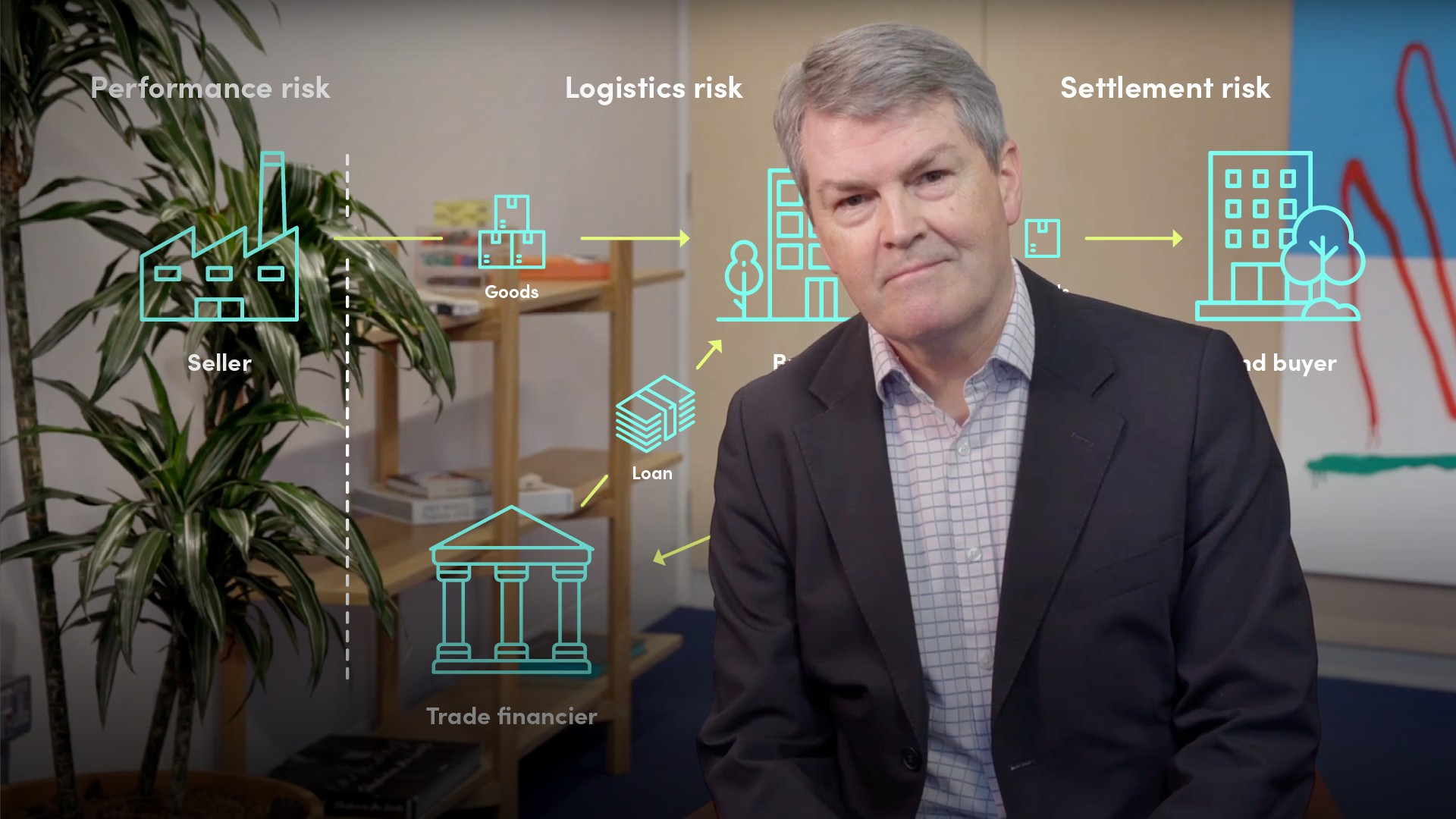

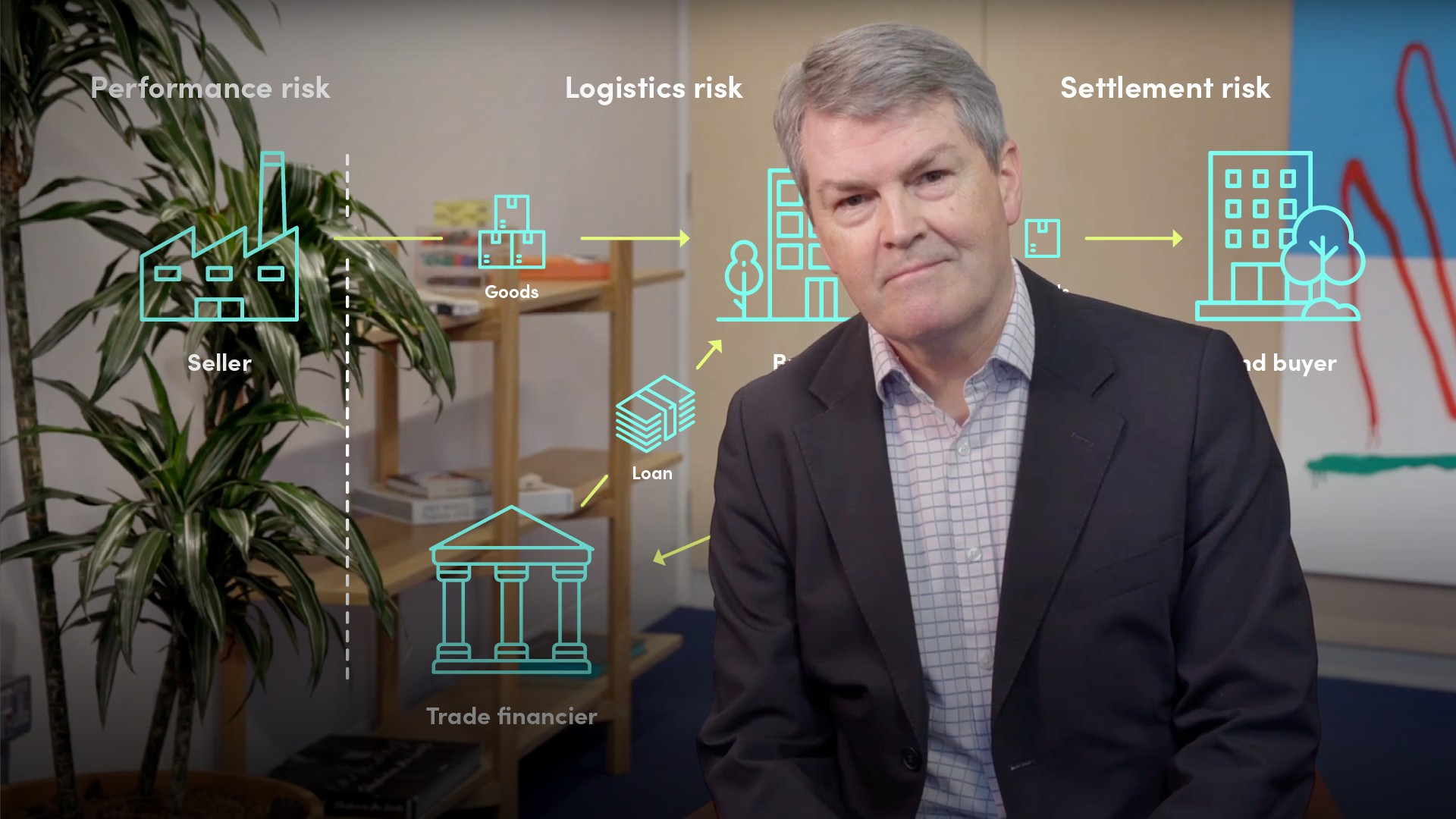

In this video, Aidan breaks down the credit risk focus of trade finance, and the importance of their management. This includes settlement risk, performance risk, and logistics risk.

In this video, Aidan breaks down the credit risk focus of trade finance, and the importance of their management. This includes settlement risk, performance risk, and logistics risk.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Key Risks in Trade Finance

9 mins 28 secs

Key learning objectives:

Define and identify how performance, settlement and logistics risk should be managed

Understand what constitutes a ‘delivery’

Identify what prevents the seller from performing

Overview:

This provides a constructive framework for Credit Managers to use in assessing transactional trade and commodity trade finance deals that facilitates transparency, a more informed risk assessment, and ensures that what really matters is considered.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is trade finances’ credit risk focus?

- Performance Risk - The risk that the seller can do all that is required to meet the terms of his sales contract - in other words, he can perform and meet his obligations

- Logistics Risk - The risk that the seller can transport the goods safely and securely to the point at which the buyer takes up and pays for them

- Settlement Risk - The risk that the sales proceeds required to settle the loan will be received on time and in sufficient amounts to service the debt.

Why is performance risk especially important?

It’s a primary consideration since, if the seller has limited or no experience in doing what is required, the probability of success is much lower than it would be if he had a positive track record. If there is doubt on the seller's ability to perform, the transaction is likely to be refused, or to have collateral required beyond the goods and their receivables.

What constitutes a ‘delivery’?

- Ex Works - The seller will have performed when he makes the specified goods available at this or his agent’s site for collection

- Free on Board (FOB) - The seller must deliver goods over the ship’s rail

- Cost of Insurance and Freight (CIF) - Obliges the seller to cover the cost of insurance and freight, duty unpaid, to the port of destination

What might prevent the seller from performing?

- Not control of all the documents he has to provide

- May need a particular commodity or resource to complete delivery on time which may not be readily available

- Might not have sufficient free working capital available to pay their suppliers

How should logistics risk be managed?

- Are title documents available?

- How and when can they be transferred?

- Storage and shipment should be managed by third-parties

- Any requirements for bills of lading should distinguish between the ships owners bill of lading and a charter-party bill of lading

- Each party involved in the transaction should be screened against sanctions lists, anti-money laundering lists and financial crime lists. These parties include: seller, buyer freight forwarders, shippers, inspectors, insurers, warehouse keepers and any other party that receives payment

To analyse settlement risk, what should we be aware of?

- Who pays - is it the buyer directly or via a bank or third-party?

- How and when do they pay - is there a bank instrument, e.g. a letter of credit, and is the settlement date defined or readily determinable?

- Is payment conditional? - e.g. against presentation of specified documents under a letter of credit, or subject to a third-party or the buyer’s inspection

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Aidan Applegarth

There are no available Videos from "Aidan Applegarth"