How is a Hedge Fund Set Up?

Trevor Pugh

20 years: Trading & hedge funds

To conclude this series, Trevor explains the setup of a Hedge Fund. This includes the Master & Feeder funds, Prime Brokers, along with all the other associated parties. Such as the administrators and regulators, all with important roles.

To conclude this series, Trevor explains the setup of a Hedge Fund. This includes the Master & Feeder funds, Prime Brokers, along with all the other associated parties. Such as the administrators and regulators, all with important roles.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How is a Hedge Fund Set Up?

4 mins 41 secs

Key learning objectives:

Describe a master fund and feeder fund structure

Identify the main services used by a hedge fund

Understand how hedge funds are regulated

Overview:

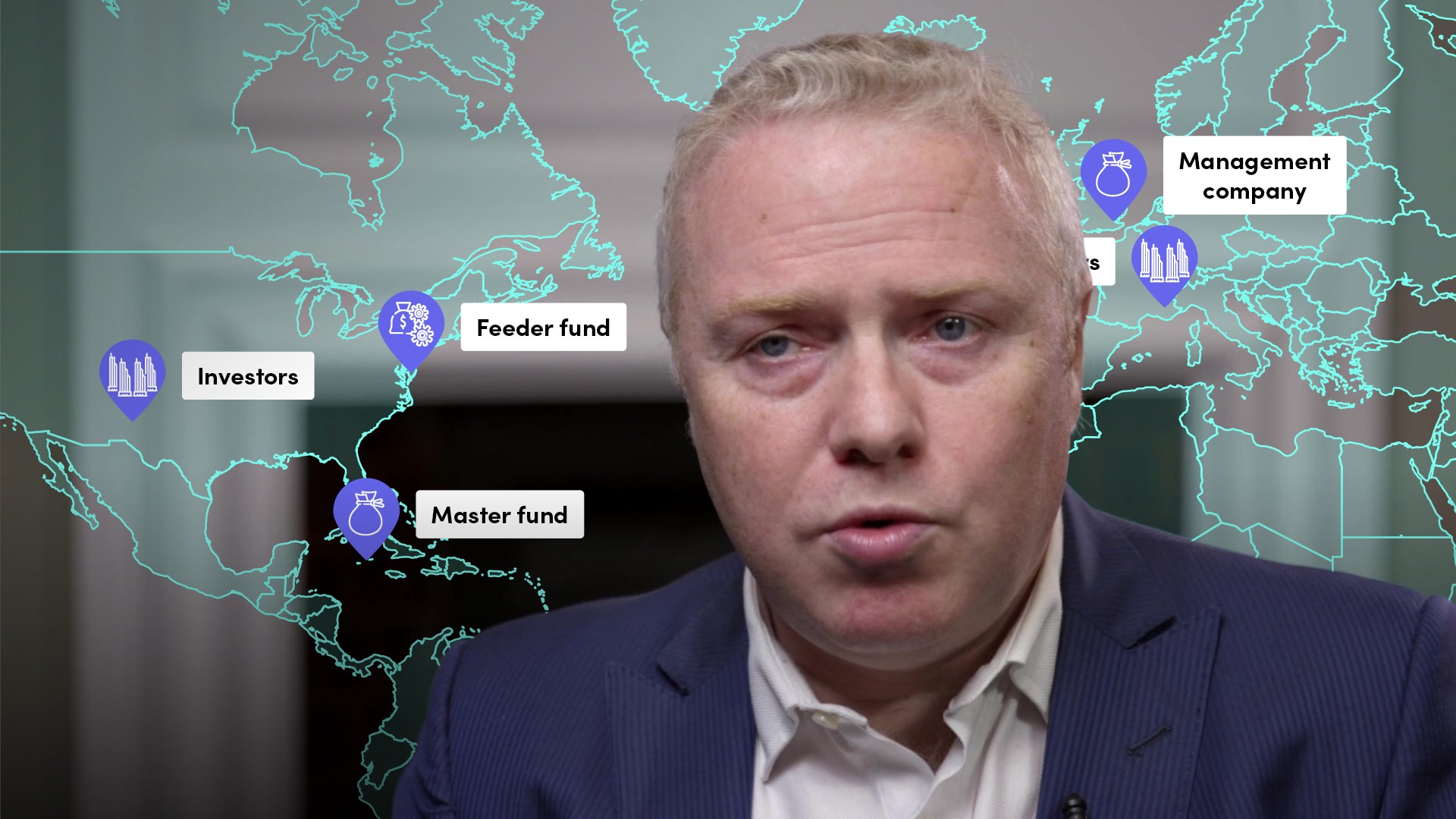

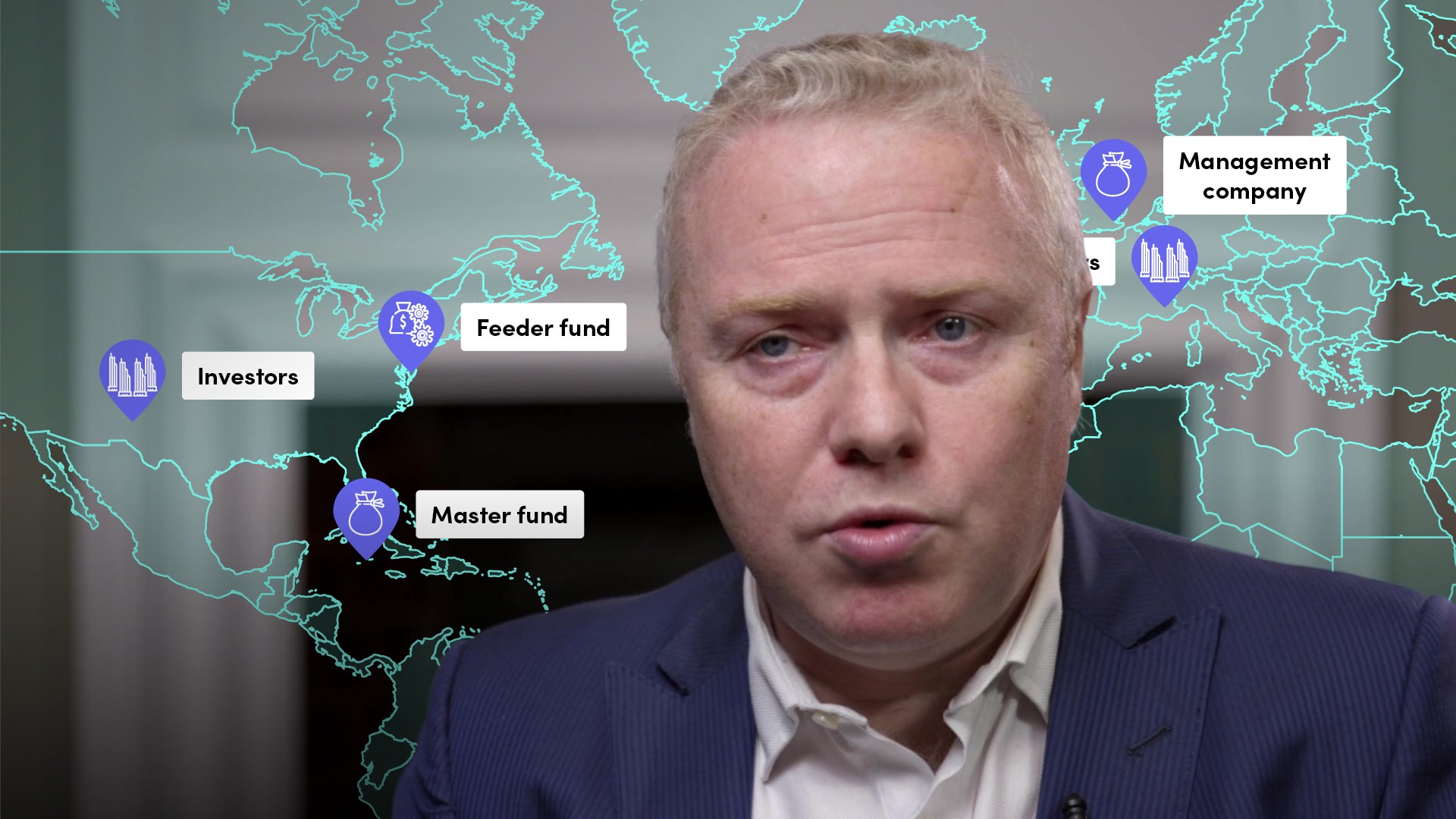

Hedge funds tend to consist of a management company or partnership that directs the investment of the fund and a separate legal entity, frequently in a jurisdiction such as the Cayman Islands which holds the actual assets. There may also be Feeder Funds which are more tax efficient for investors when placing their assets before these assets are moved to the Master Fund. In order to run such a fund, hedge funds tend to be large users of other services from Prime Brokers, Administrators, accountants and others. Legal counsel and compliance are especially important given the potential for hedge funds to be regulated in multiple jurisdictions.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a master fund and feeder fund structure?

Although the term hedge fund is used quite loosely, in reality most hedge funds actually consist of two or more legal entities. There is the fund itself, and there is the management company. The fund (or Master Fund) is likely to be based in a jurisdiction such as the Cayman Islands which is tax neutral; in other words, it does not impose corporation tax. This Master Fund is where the assets are actually held. The management of the fund will usually be done by a separate entity, either a company or a Limited Liability Partnership (LLP), based in perhaps London or New York. In addition to the Master Fund where the hedge fund assets sit, Feeder Funds are frequently set up to assist investors find the right tax structure. For example, it is not unusual for a hedge fund to have a Cayman Islands Master Fund as well as feeder funds. These feeder funds might be, for example, in Delaware for US investors who want an onshore investment or there may be a feeder fund in the Cayman Islands for investors in the US who want an offshore investment.

What are the main services used by a hedge fund?

The Prime Broker relationship is a key one for hedge funds, and these are usually, but not always, divisions of investment banks, providing securities financing, derivatives clearing, custody of securities and collateral management. The other major hedge fund relationship is with the Administrator. The Administrator provides two vital functions for the fund itself. These are the fund accounting role and the investor relation role. In essence, this provides comfort for investors that the funds are being handled properly. A fund will also need specialised accountants for the management company, legal counsel, trade processing and settling functions (otherwise known as middle and back office), as well as risk management and trade booking and execution services (also known as front office).

How are hedge funds regulated?

There are multiple regulators that impact the business of a regular London hedge fund for example. The FCA in the UK will require the registration of the London entity. The Cayman Islands Monetary Authority requires a Fund Annual Return. The EU’s Alternative Investment Fund Management Directive will apply, which includes onerous Annex Four reporting for transparency. On the US side, the Foreign Account Tax Compliance Act or FATCA will apply. And further regulation may come from other entities depending on what products are traded, such as EMIR for derivatives (which stands for European Market Infrastructure Regulation) or the National Futures Association rules in the US.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Trevor Pugh

There are no available Videos from "Trevor Pugh"