High Integrity Carbon Offsets

Sam Hope

5 years: Carbon Markets

How can we identify if a carbon credit is worth its weight in salt (or emissions)? Join Sam Hope as he explores high-integrity carbon offsets.

How can we identify if a carbon credit is worth its weight in salt (or emissions)? Join Sam Hope as he explores high-integrity carbon offsets.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

High Integrity Carbon Offsets

11 mins 36 secs

Key learning objectives:

Outline how to assess carbon offset quality

Understand who governs VCM integrity

Identify best practice questions to screen projects

Overview:

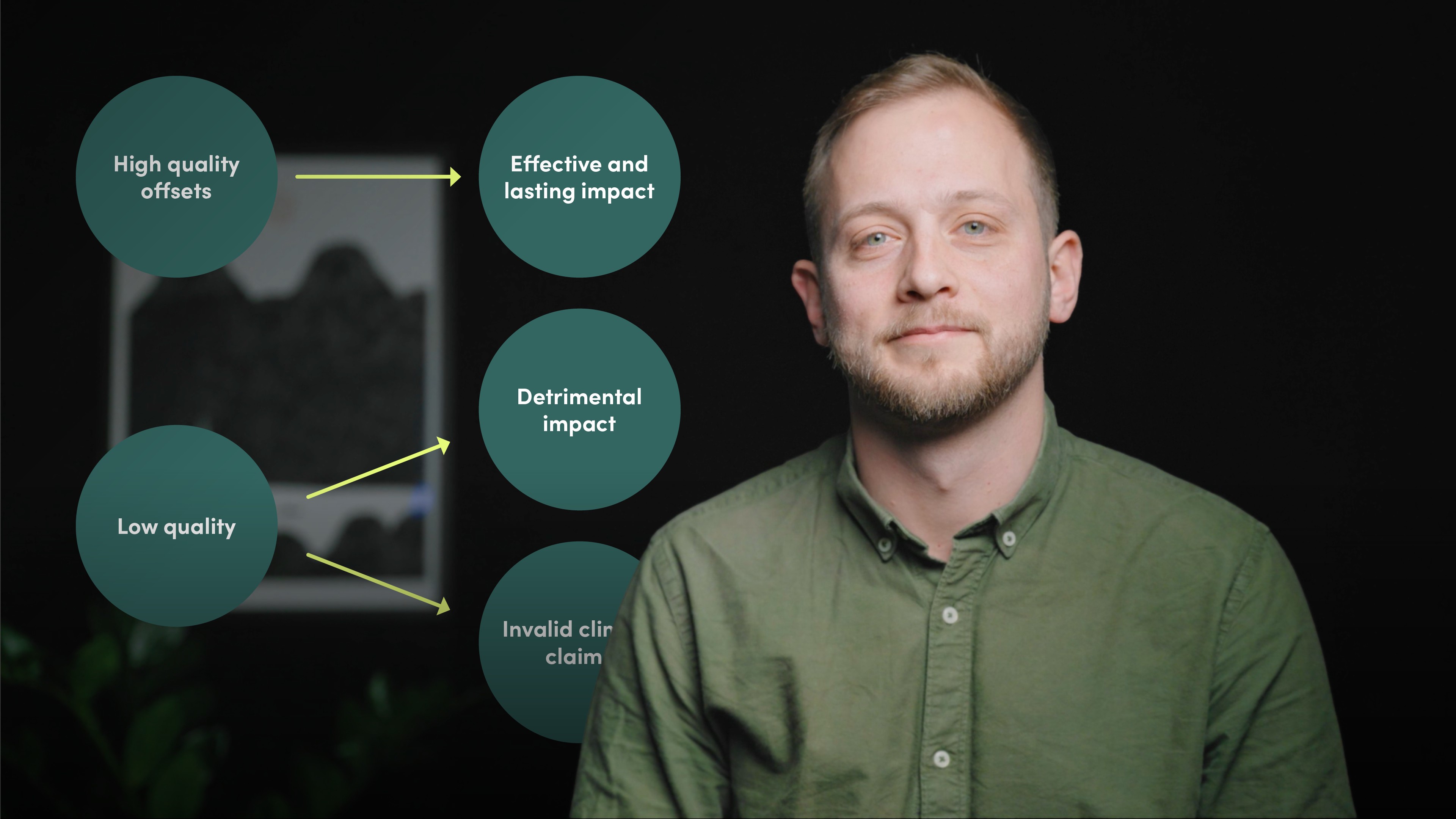

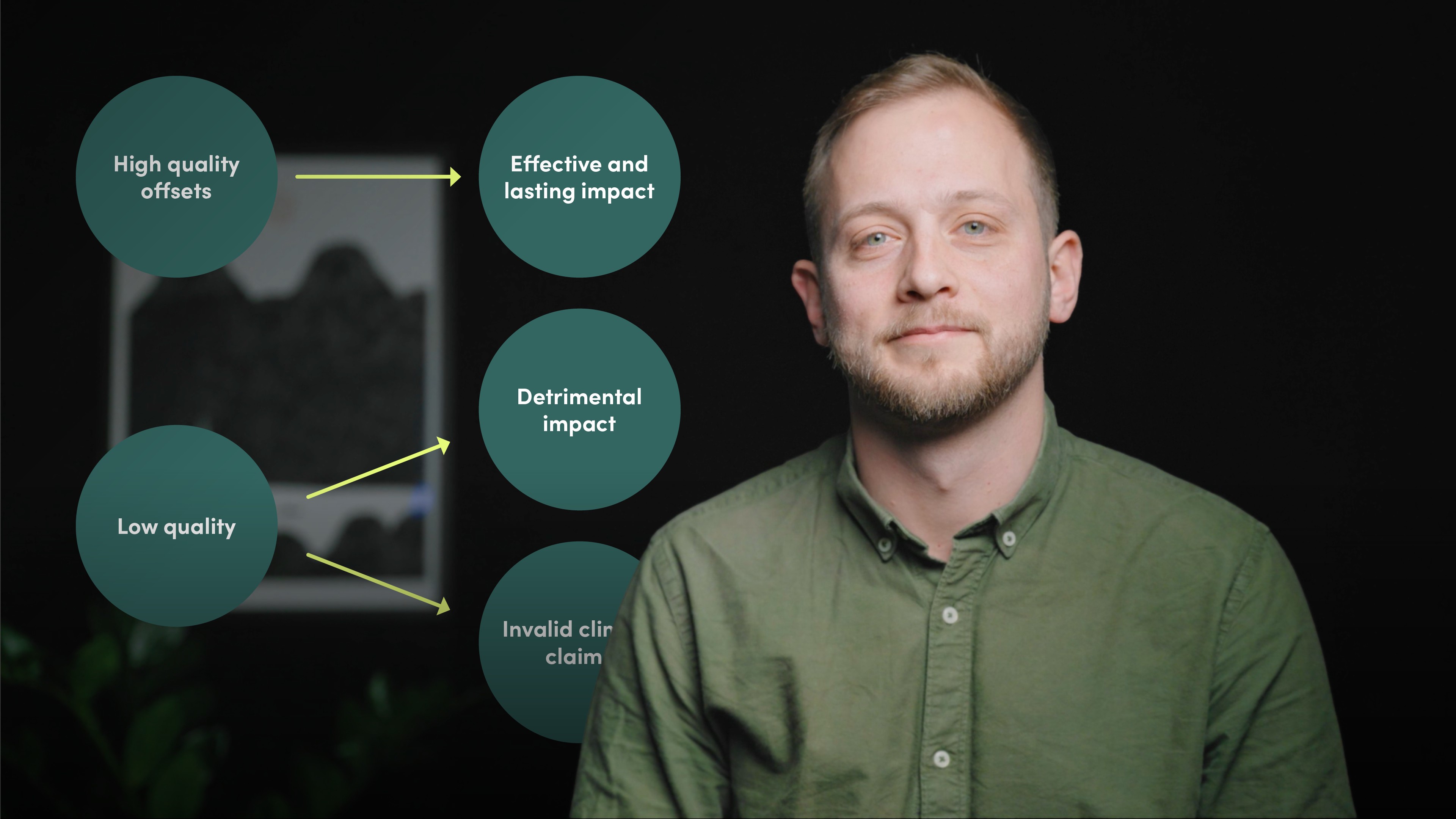

There are four metrics we use to measure carbon offset quality: baseline (reference by which we calculate GHG removal), additionality (did they occur because of the carbon credit scheme), leakage (did it cause unintended increase in GHG elsewhere) and permanence (are the reduction or removals permanent or can they be reversed). The integrity and quality of these offsets are governed by a few organisations in the VCM, namely the Integrity Council for the Voluntary Carbon Market, the Stockholm Environment Institute and the Oxford Principles.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Sam Hope

There are no available Videos from "Sam Hope"