Managing Correspondent Banking Networks

Robert Ellison

20 years: Capital markets & banking

In Rob's previous video, "Introduction to Correspondent Banking", he covered what correspondent banking is and the products involved. In this video, Rob explains why banks work together, the benefits of having a large or small network of correspondents and whether circumstances are different for a global bank.

In Rob's previous video, "Introduction to Correspondent Banking", he covered what correspondent banking is and the products involved. In this video, Rob explains why banks work together, the benefits of having a large or small network of correspondents and whether circumstances are different for a global bank.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Managing Correspondent Banking Networks

13 mins 14 secs

Key learning objectives:

Understand the advantage of participating in correspondent banking

Identify the benefits associated with large and small correspondent bank networks

Overview:

Banks must perform the balance act of deciding between whether to maintain a large or small correspondent bank network. There are risks and rewards associated with both options and the details are described below.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Why do banks work with other banks?

Banks are actually many things to each other, including: competitors (when in the same market), they’re also clients, collaborators, creditors and counterparties in financial markets, particularly in countries where they are not present. Because they aggregate their own requirements with the various flows of their clients, they have larger flows/volumes and more lucrative mandates to award.

Who is banking who?

Bank relationship teams might be grouped into geographical coverage teams, i.e. Americas, Asia, Europe or they may be segmented by size of bank, type of bank covered or maybe the segmentation is OECD vs developing markets. One of the key skills in managing this co-operation between banks is understanding, managing and leveraging the extent to which banks are competitors, partners or clients.

Is a bigger network better?

A bank which maintains a very large network of correspondents will recognise some obvious benefits:

- It maximises the bank’s opportunity to support corporate clients by having a large network of banks with whom it can partner to write letters of credit

- A larger network can have benefits of reducing the amount of processing fees underlying customers have to pay for international payments

- It makes sense for global economies to be as connected as possible, especially developing economies

Are there advantages of a smaller network?

Many banks are looking to shrink or “rationalise” their correspondent networks. The answer is all about risk. Firstly, where payment channels are concerned, opening and maintaining bank account balances with a myriad of far-flung banks involves taking an element of credit risk and one of the lessons of the financial crisis is that where possible, banks should avoid taking risk on each-other to minimise global systemic risk.

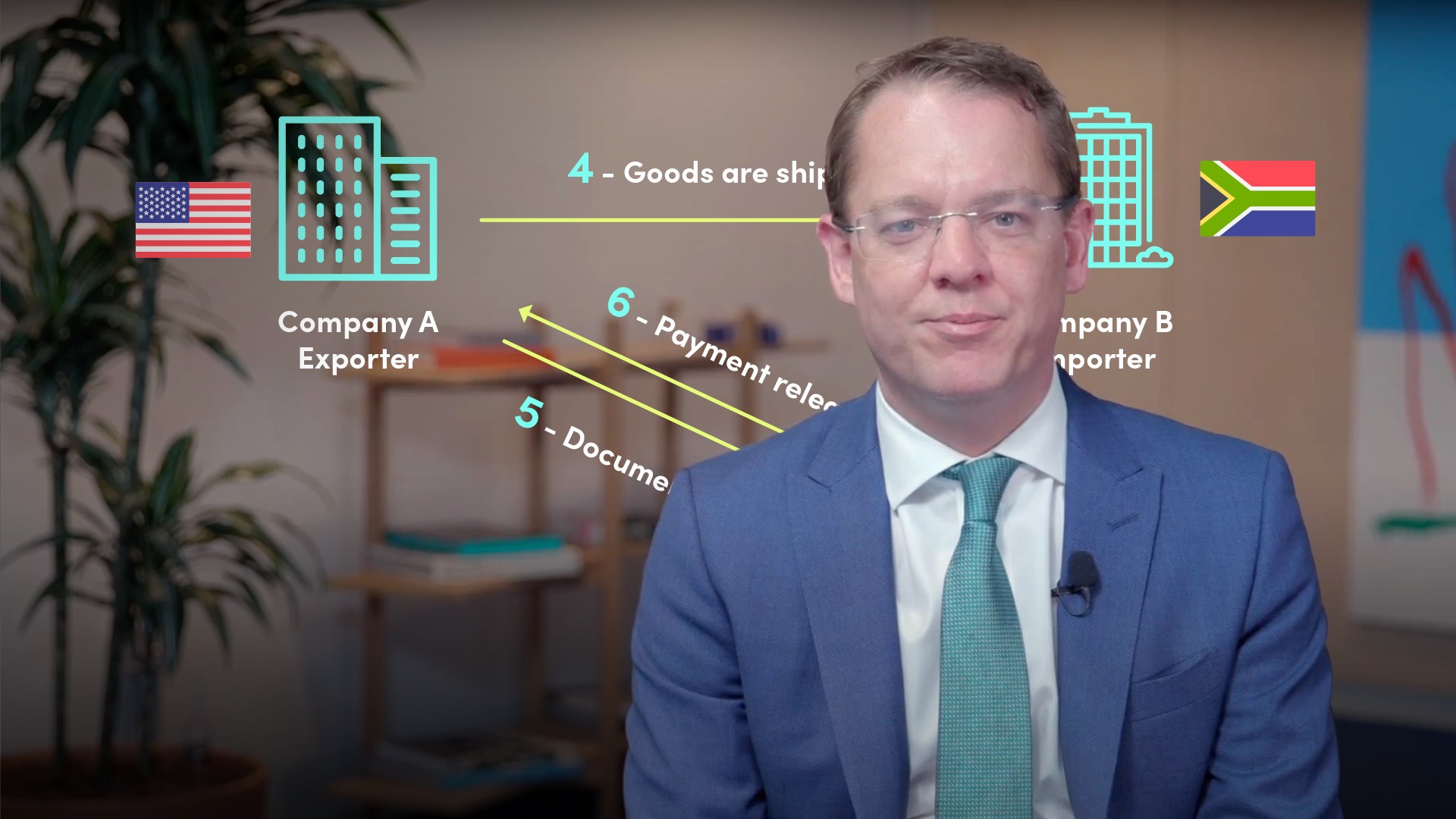

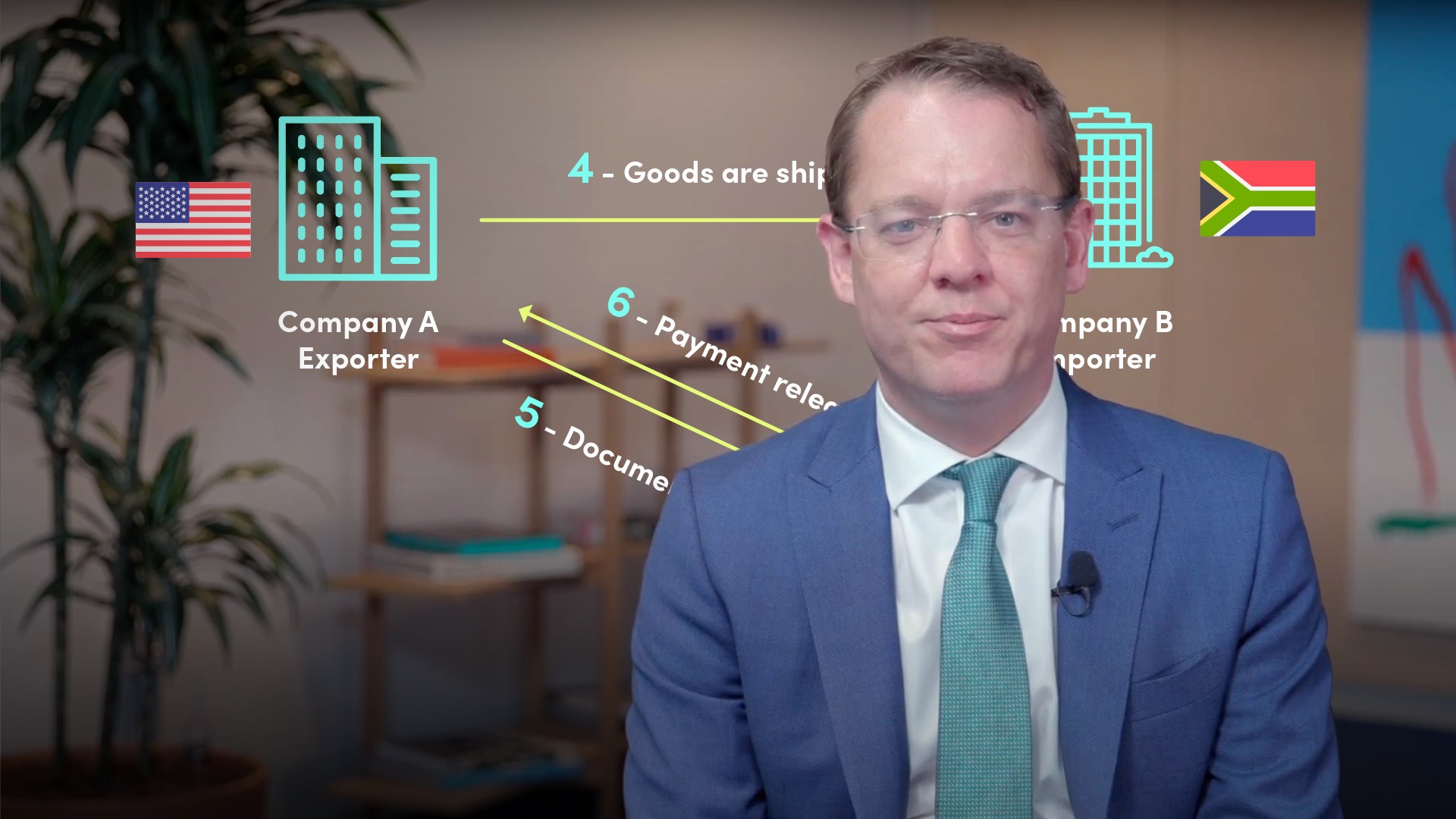

More acutely, when we’re thinking about trade finance, then providing this service to a corporate customer can actually deliver an end result where the bank is taking a credit exposure on another bank, which may be located in a developing economy.

It is possible the bank has a sub-investment grade rating, or it might also be the case that the correspondent bank’s credit is defined more by the sovereign rating and political risk in that offshore jurisdiction, and this is the kind of prospect the bank’s risk department may be less comfortable analysing and managing.

It could be argued, the bigger risk that arises from a bank’s correspondent network is operational. The more connections you make with other banks, the more scope there is for those connections to go wrong. And when something goes wrong in a bank, then they can go wrong in a big way.

What underpins correspondent banks?

These networks are facilitating global trade worth trillions of dollars, and billions of individual payments. It may seem quite chaotic.

Where payments are concerned, then we have SWIFT, or to give them their full name, the Society for Worldwide Interbank Financial Telecommunication. SWIFT is responsible for providing the global messaging infrastructure through which correspondent banks speak to each-other. When correspondent banks send each-other instructions to credit this account or debit that account then that message is sent via SWIFT, and can only be acted upon if it has been sent through that channel.

Similarly, the good news where Trade Finance is concerned, is that most of these transactions are documented under globally standardised rules, co-ordinated and adjudicated by the International Chamber of Commerce. We also have the activities of The Financial Action Task Force (FATF) on Money Laundering, and the Wolfsberg Group who are working hard to promote global standards.

What are the safeguards for banks with a global presence?

Many large banks have a very significant international footprint which might reduce their need to use other banks, but very few banks are truly global and those that come closest do not always use their own bank branches and subsidiaries in the countries they need to operate in. They may lack scale, competitive advantage or risk appetite in a particular country or market, or they may for instance, be a retail bank in a country where they also require a corporate service.

Here, it makes sense for even the biggest global banks to partner with locally significant firms.

The economic theory of ‘comparative advantage’ plays a role here. In the same way that countries and companies build capability where they have a natural advantage, banks where they are present in a local market, may choose to source certain products from a bank which has a larger local presence or greater capability, lower cost or a comparative advantage locally.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Robert Ellison

There are no available Videos from "Robert Ellison"