Pricing US Dollar Bonds

Nigel Owen

20 years: Debt capital markets

Buyers and sellers of new bonds need to agree on a price at which to transact. In this series of videos, Nigel describes the new issue process that brings together all the components of pricing a bond, and surrounding conventions which are applied in the various different bond markets. In this first video of the series, Nigel outlines the various components considered when pricing a bond before specifically detailing how to price US Dollar bond.

Buyers and sellers of new bonds need to agree on a price at which to transact. In this series of videos, Nigel describes the new issue process that brings together all the components of pricing a bond, and surrounding conventions which are applied in the various different bond markets. In this first video of the series, Nigel outlines the various components considered when pricing a bond before specifically detailing how to price US Dollar bond.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Pricing US Dollar Bonds

12 mins 1 sec

Key learning objectives:

Understand how a bond yield is reflected in the bond price

Identify the convention used in the US dollar bond market for coupon payments

Understand how a bond’s yield to maturity is calculated in the US

Describe a coupon rounding convention

Understand the day-count convention for US dollars and what this is used for

Overview:

A bond represents a series of cash-flows. Investors buying bonds acquire rights to receive those cash-flows at a series of dates – the interest payments during the life of the bond (the coupons) and return of the money at maturity (redemption). For new bonds, buyers and sellers need to agree a price and a yield (discount rate) to arrive at a present value, or price, at which they can transact. The yield is a component of the risk-free rate plus a risk premium (a credit spread). The choice of benchmark hinges on the currency of issue and the conventions that apply to bonds issued in that currency.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What convention is used in the US dollar bond market for coupon payments?

XYZ Corp has opted to issue a 10-year bond in US dollars. The company needs to decide the interest payments – or coupons – to which the bond’s eventual owners will be entitled. US dollar bonds are conventionally issued with semi-annual coupons i.e. the holder of a bond with, say, a 2.5% coupon would receive 1.25% every six months.How is a bond’s yield to maturity calculated in the US?

The bond’s cash flows then need to be discounted to calculate the yield of the bond. Calculating the yield on the bond has two components:

- The risk free rate. In the US, the benchmark used to price fixed-rate bonds is the US Treasury market. The US market prefers to use new bonds (issued with maturities of 2, 3, 5, 7, 10 and 30 years), known as on-the-run maturities. Maturities in between these are off-the-run and are less liquid. XYZ’s market-makers price the bond against the on-the-run 10 year Treasury yield (which in this example has a 1.546% yield).

- The credit spread is the additional compensation investors demand to take on the extra risk of lending to a corporate issuer. This risk premium is quoted in basis points (i.e. 1/100s of a percentage point). The credit spread agreed with XYZ’s investors is 100 basis points or 1%. Adding that to the benchmark bond yield gives a yield to maturity of 2.546% (1.546% + 1%).

What is the coupon rounding convention?

With a yield to maturity of 2.546% and a redemption value of $100, assigning an issue price could be a really simple exercise: assigning a coupon of 2.546% and an issue price of 100 (or to use the jargon, par). The present value of a bond paying 2.546% coupon discounted at a rate of 2.546% is par. Convention dictates that bond coupons are rounded down to the nearest 1/8th of 1%. This means a coupon of 2.5% for XYZ.How is a bond yield reflected in bond price?

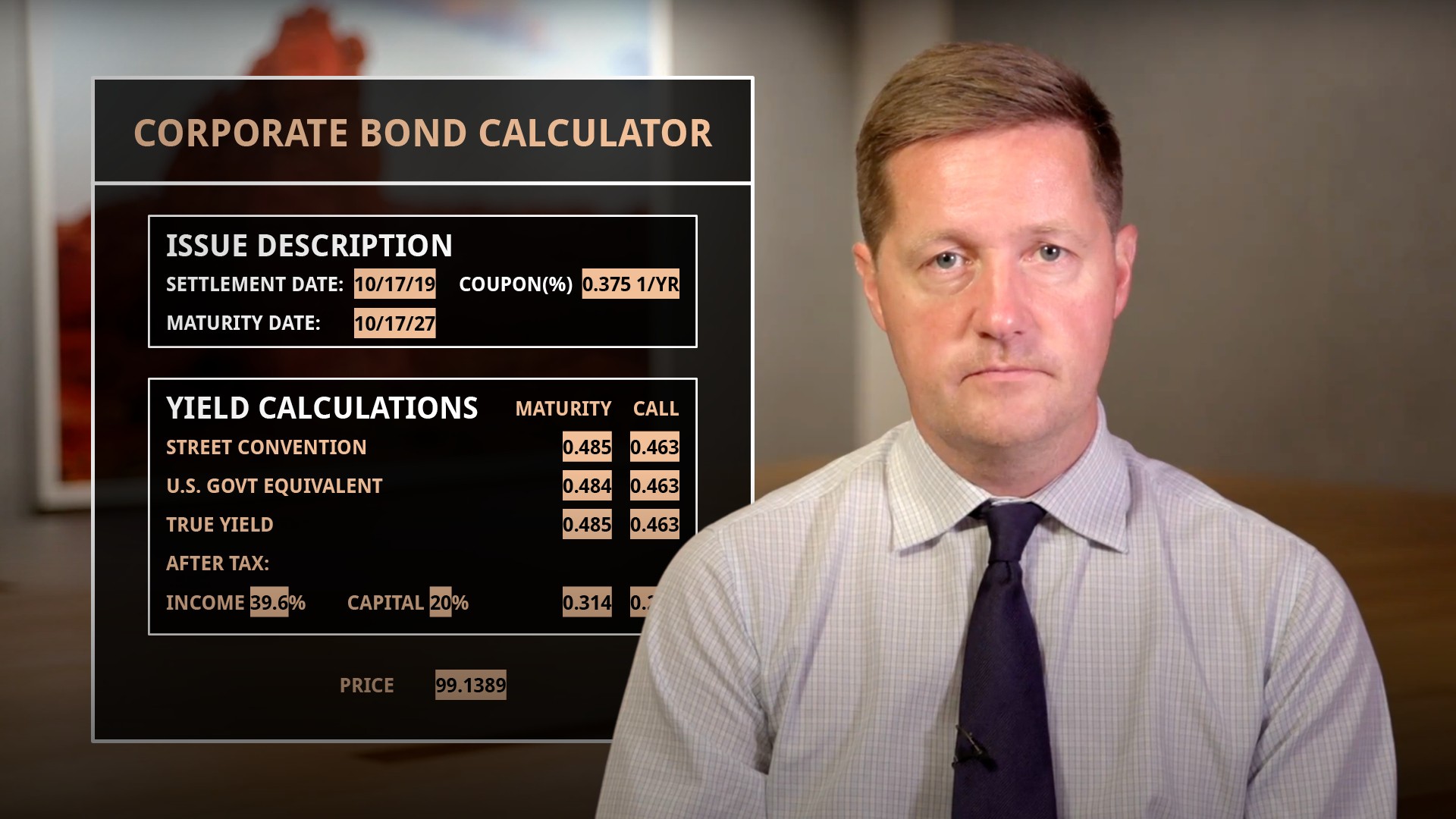

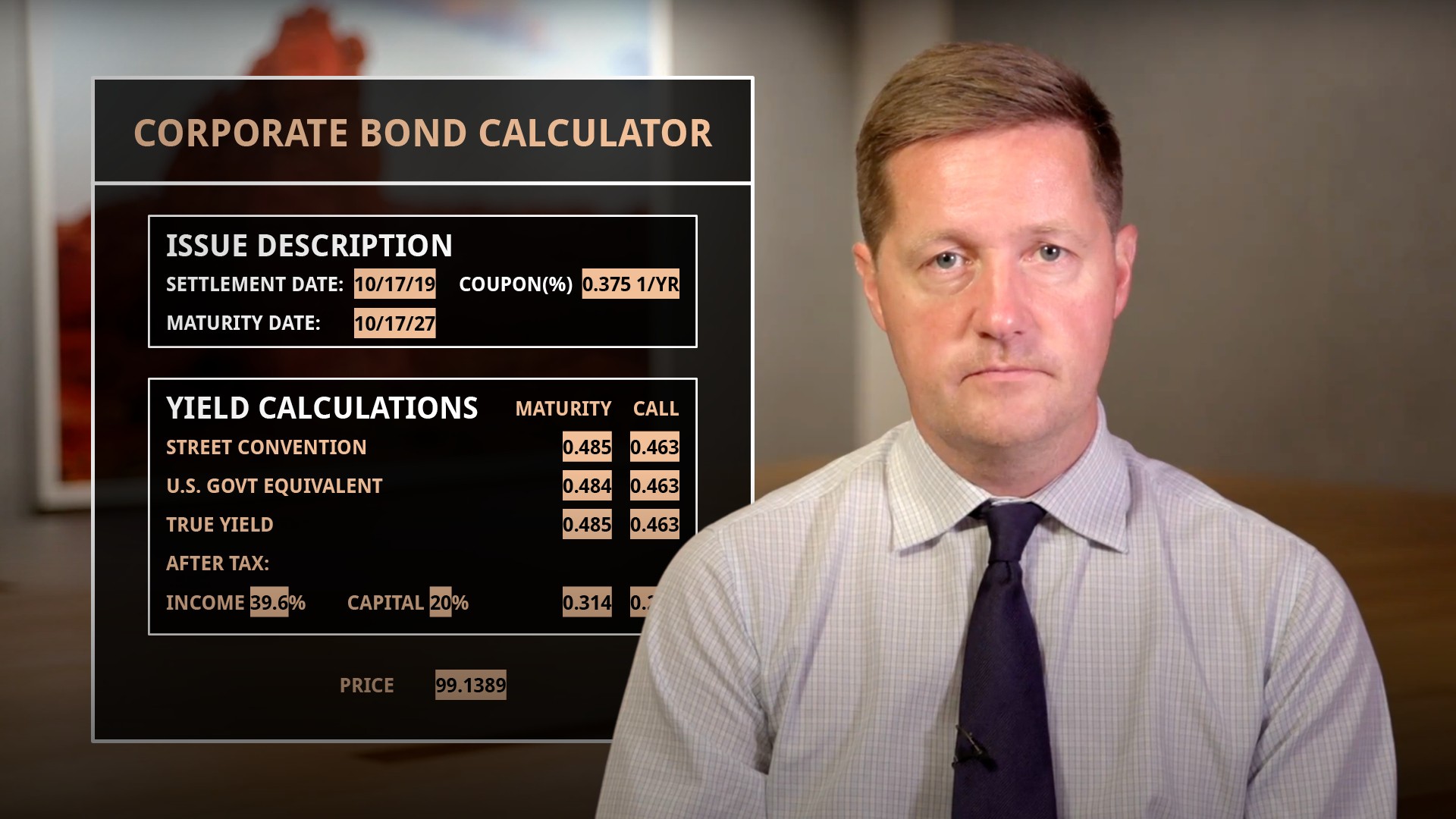

To reflect the 2.546% yield on a bond paying a 2.5% coupon, the issue price needs to be discounted. This discount can be calculated for every single cash-flow to derive a series of net present values, which can be added up to equal the appropriate issue price for the bond. For simplicity, a bond calculator can be used. Either way will tell you that to give investors a yield to maturity of 2.546%, XYZ’s 2.5% bond should have an issue price of 99.596.What is the day-count convention for US dollars and what is this used for?

To help future investors value and trade the bond during its life, day-count and business day conventions need to be borne in mind. As soon as XYZ’s bond is issued, it is free to trade, which means investors are free to buy and sell the bonds. The issuer’s obligation to pay coupons and redeem the bonds at maturity is limited to who owns the bonds at the time the obligations become due. Since coupons are usually only paid twice a year, it is typical in the US dollar market for each investor who sells bonds to have the buyer compensate them for interest accrued during the time they held the bond.

Day-count conventions set the framework for investors to calculate interest accrued when a bond has not been held for the full period of a coupon. In the US dollar market, the convention is for accrued interest to be calculated on a 30/360 basis i.e. each whole month comprises 30 days hence for the purposes of the accrued interest calculation, there are only 360 days in a year.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Nigel Owen

There are no available Videos from "Nigel Owen"