Hybrid Debt for Insurance Companies

Gurdip Dhami

25 years: Treasury & ratings

Why do insurance companies issue hybrid debt? And where does regulatory capital come into it? Join Gurdip Dhami as he explores these questions, as well as the three tiers of Solvency II capital.

Why do insurance companies issue hybrid debt? And where does regulatory capital come into it? Join Gurdip Dhami as he explores these questions, as well as the three tiers of Solvency II capital.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Hybrid Debt for Insurance Companies

16 mins 28 secs

Key learning objectives:

Define hybrid debt

Understand why insurance companies issue hybrid debt

Outline how regulatory capital requirements affect hybrid debt issuance

Overview:

Hybrid debt (also referred to as hybrid capital), is so called because it has characteristics of both debt and equity. If structured correctly, hybrid debt can qualify as regulatory capital as well as rating agency capital. Therefore, if an insurance company needs capital to grow or fund an acquisition it can issue hybrid debt. Before structuring and issuing hybrid debt an insurance company needs to balance the demands of its various stakeholders including policyholders, shareholders, investors, regulators and rating agencies.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is hybrid debt?

Hybrid debt (also referred to as hybrid capital), is so called because it has characteristics of both debt and equity.

Why do insurance companies issue hybrid debt?

Whether rated or not, insurance companies need to have a minimum level of regulatory capital. If structured correctly, hybrid debt can qualify as regulatory capital as well as rating agency capital. Therefore if an insurance company needs capital to grow or fund an acquisition it can issue hybrid debt. Hybrid debt, depending on its form, can also be more beneficial in the calculation of rating agency leverage. This is because in part or whole hybrid debt may be classified as equity instead of debt in the leverage calculation which takes the form debt as percentage of debt and equity.

How do regulatory capital requirements affect hybrid debt issuance?

Regulatory capital is the starting point when insurance companies consider issuing hybrid debt - there is no point issuing hybrid debt if it does not qualify as regulatory capital. The capital requirements of an insurance company are set by its local regulator (e.g. the Prudential Regulation Authority or the Australian Prudential Regulation Authority).

What factors should be considered when structuring hybrid debt?

Before structuring and issuing hybrid debt an insurance company needs to balance the demands of its various stakeholders including policyholders, shareholders, investors, regulators and rating agencies. Additionally there are eligibility criteria and limits on the amount of hybrid debt issued by insurance companies set by regulators and the rating agencies.

Given regulatory and rating agency limits on hybrid debt, insurance companies usually manage their level and mix of hybrid debt very carefully. This is because issuing hybrid debt which doesn’t receive regulatory or rating agency capital treatment is costly – the company may as well have issued senior debt which is much cheaper.

What is Solvency II capital and what are the three tiers of capital?

In Europe, there are a set of regulations called Solvency II which detail the regulatory requirements for insurance companies operating in Europe or headquartered there. The regulations cover capital requirements as well as governance, risk, reporting and disclosure.

Under Solvency II, insurers have to have enough capital to cover their risk based capital requirement.

The level of the capital requirements of an insurance company will depend on its risk profile and size. Solvency II details the basis for the calculations of capital and the capital requirements of an insurance company in Europe.

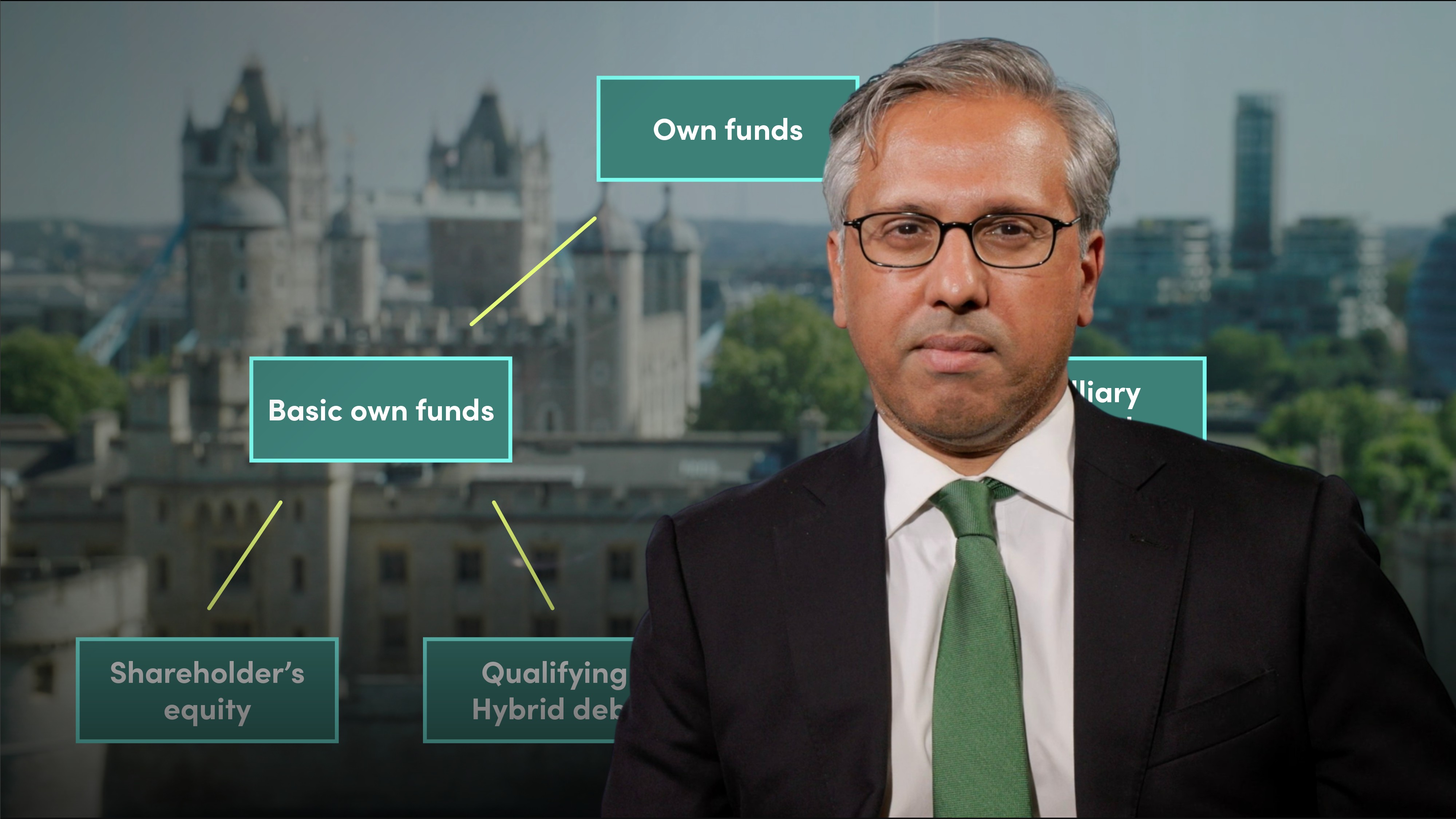

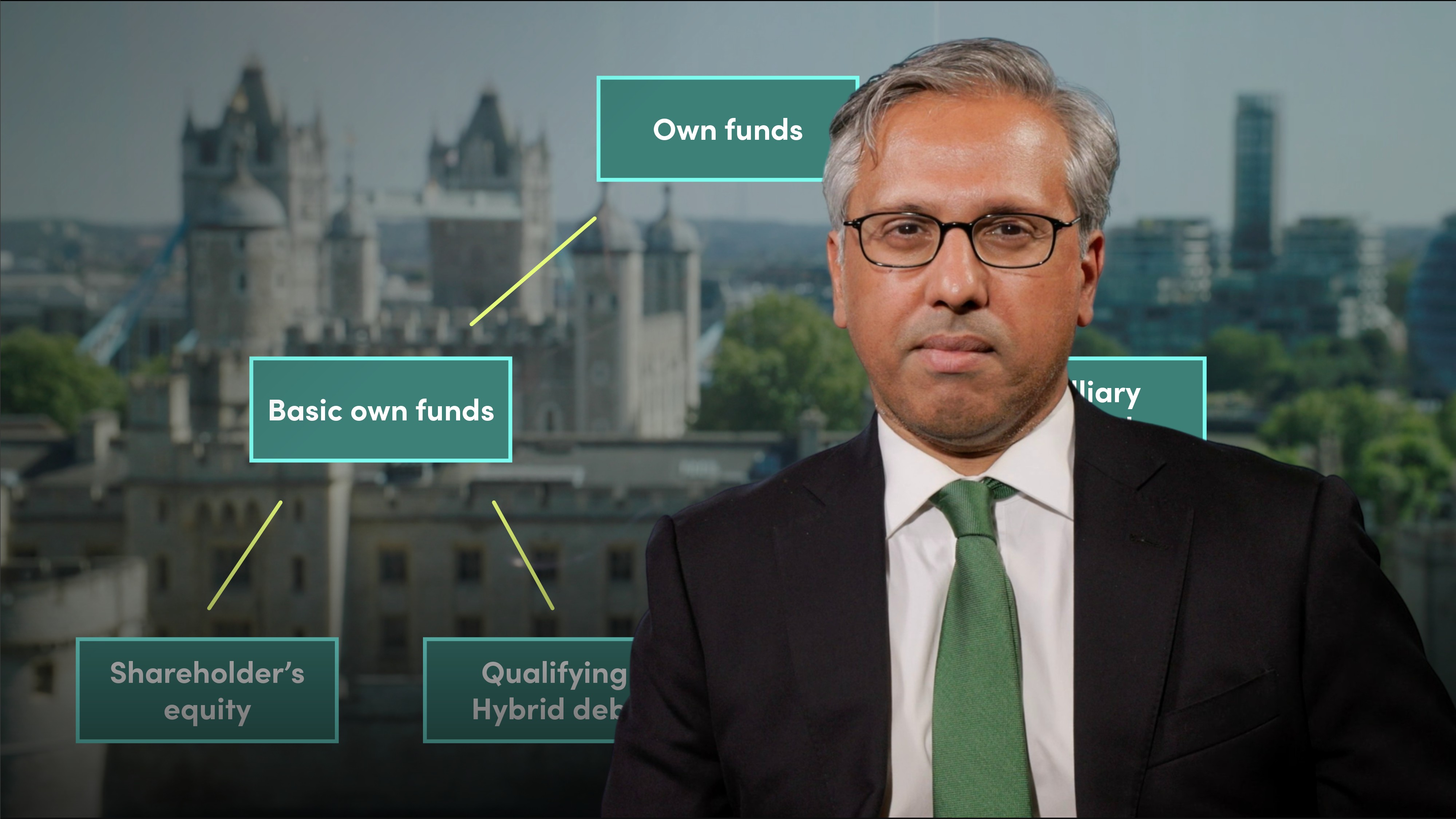

Under Solvency II, the capital of an insurer is called its ‘own funds’ and own funds are divided into 3 Tiers - Tier 1, Tier 2 and Tier 3 – which reflect their permanency and loss absorption capability. Tier 1 features are more equity-like than Tier 2 and 3 - Tier 1 is more subordinated, perpetual and has non-cumulative interest deferral – that is any interest payments that have to be skipped are cancelled and not payable in future. The features of Tier 1 provide more permanency and loss absorption capability than Tier 2, while Tier 2 has more permanency and loss absorbance than Tier 3. In the regulatory capital of an insurance company, regulators allow a greater proportion of Tier 1 than Tier 2, and a greater proportion of Tier 2 than Tier 3.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Gurdip Dhami

There are no available Videos from "Gurdip Dhami"