IFRS 16 Discount Rates

Saket Modi

20 years: Chartered accountant & educator

In this video, Saket covers IFRS 16 discount rates, specifically the rate implicit in the lease and the incremental borrowing rate.

In this video, Saket covers IFRS 16 discount rates, specifically the rate implicit in the lease and the incremental borrowing rate.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

IFRS 16 Discount Rates

1 min 4 secs

Key learning objectives:

Learn about the rate implicit in the lease

Describe the incremental borrowing rate

Overview:

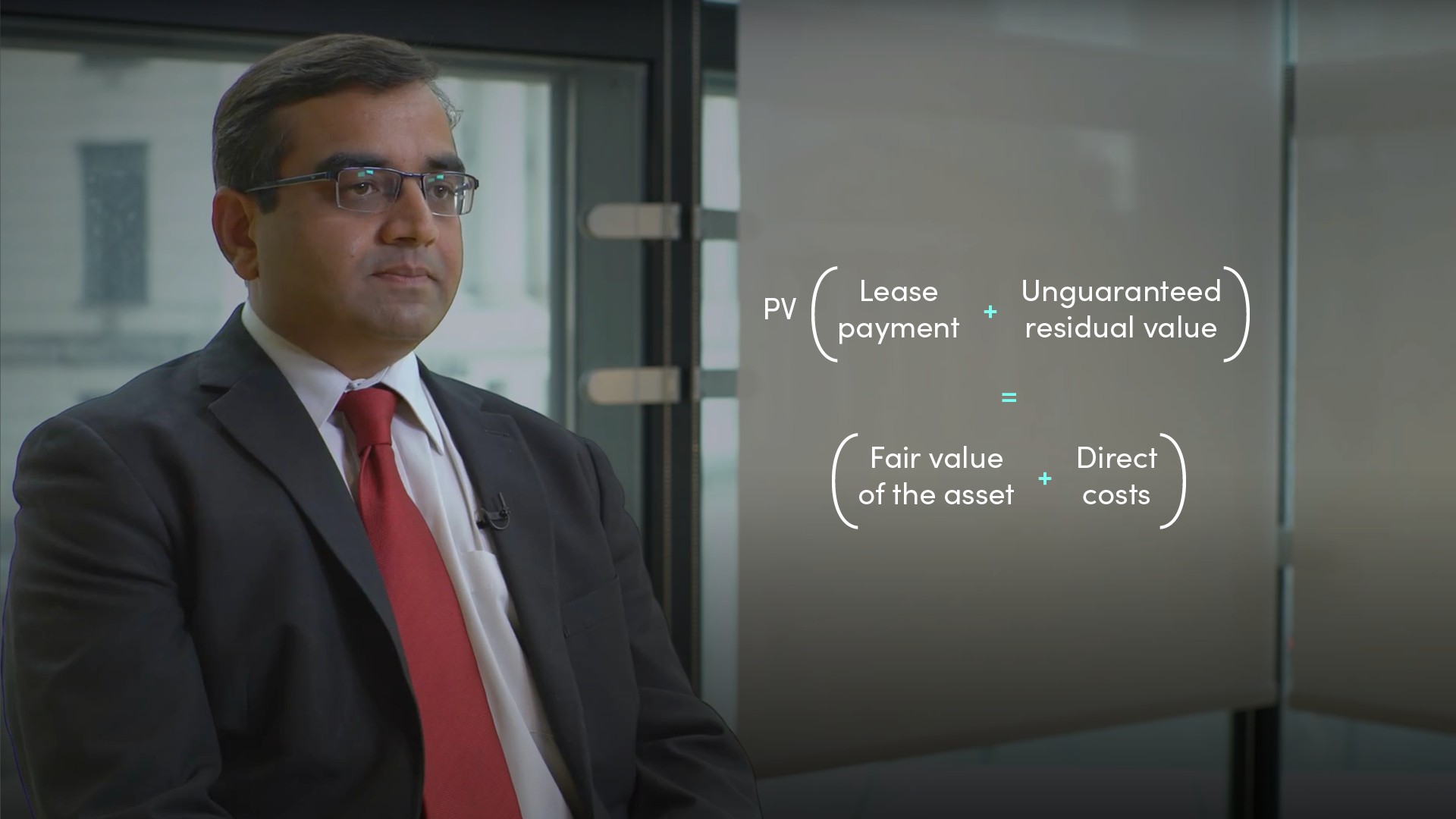

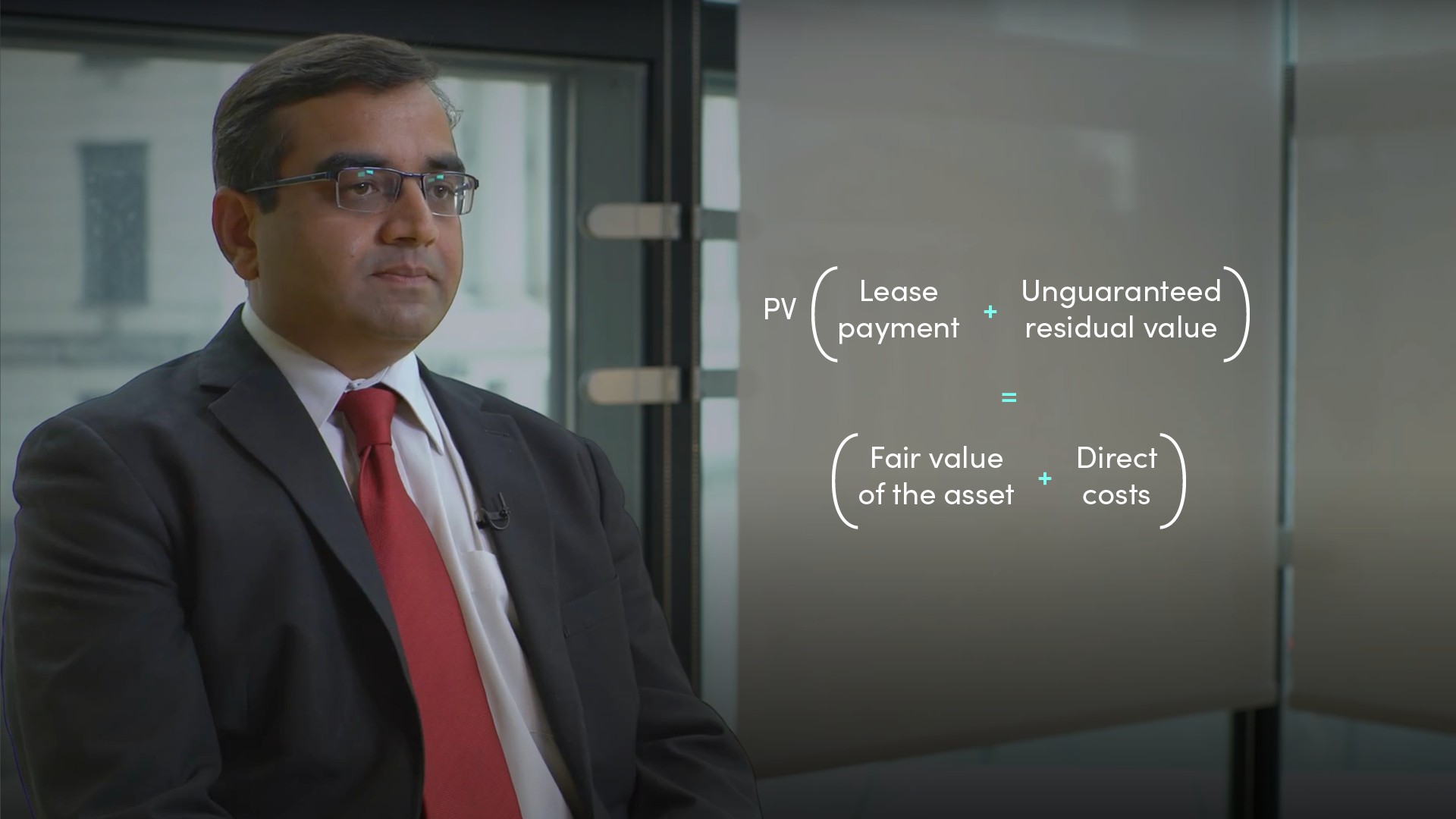

The rate implicit in the lease is the rate that causes the present value of the lease payments and unguaranteed residual value to be equal to the sum of the fair value of the underlying asset and any initial direct costs of the lessor.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the rate implicit in the lease?

PV(Lease payment + Unguaranteed residual value ) = (Fair value of the asset + Direct costs)

What is the incremental borrowing rate?

The incremental borrowing rate is the rate of interest that a lessee would have to pay to borrow over a similar term, and with a similar security the funds necessary to obtain an asset of a similar value to the right-of-use asset in a similar economic environment. This rate is therefore specific to the lessee and the underlying asset.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Saket Modi

There are no available Videos from "Saket Modi"