Portfolio Manager Skills Assessment I

Ali Chabaane

25 years: Investment management

In this video, Ali highlights the importance of examining the key metrics that impact a portfolio manager's performance - from how they make decisions for long-term positive performance, to assessing explicit or implicit behavioural patterns that can indicate biases.

In this video, Ali highlights the importance of examining the key metrics that impact a portfolio manager's performance - from how they make decisions for long-term positive performance, to assessing explicit or implicit behavioural patterns that can indicate biases.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Portfolio Manager Skills Assessment I

13 mins 11 secs

Key learning objectives:

What metrics can be used to assess the research and investment decisions of the portfolio manager?

What are some biases that lead to a suboptimal sell discipline?

How can we analyse a portfolio manager's skill level?

Overview:

When examining the portfolio managers' decisions, two key metrics play an important role - The Hit Ratio, and The Win/Loss Ratio. Similarly Ali outlines assessing explicit or implicit behavioural patterns that can indicate biases which we need to be aware of.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What information is used when making investment decisions?

- The date of the decision

- The instruments used

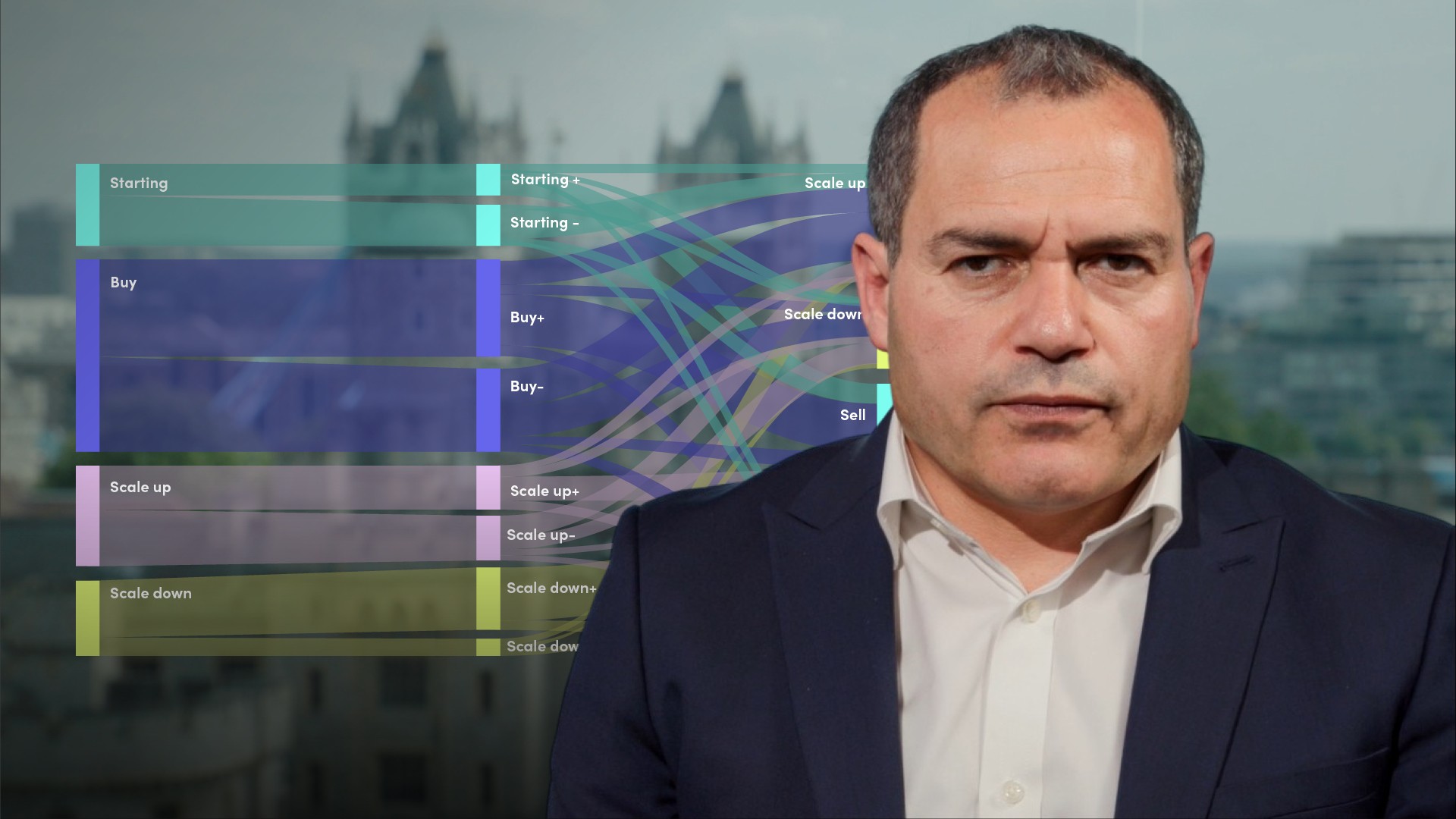

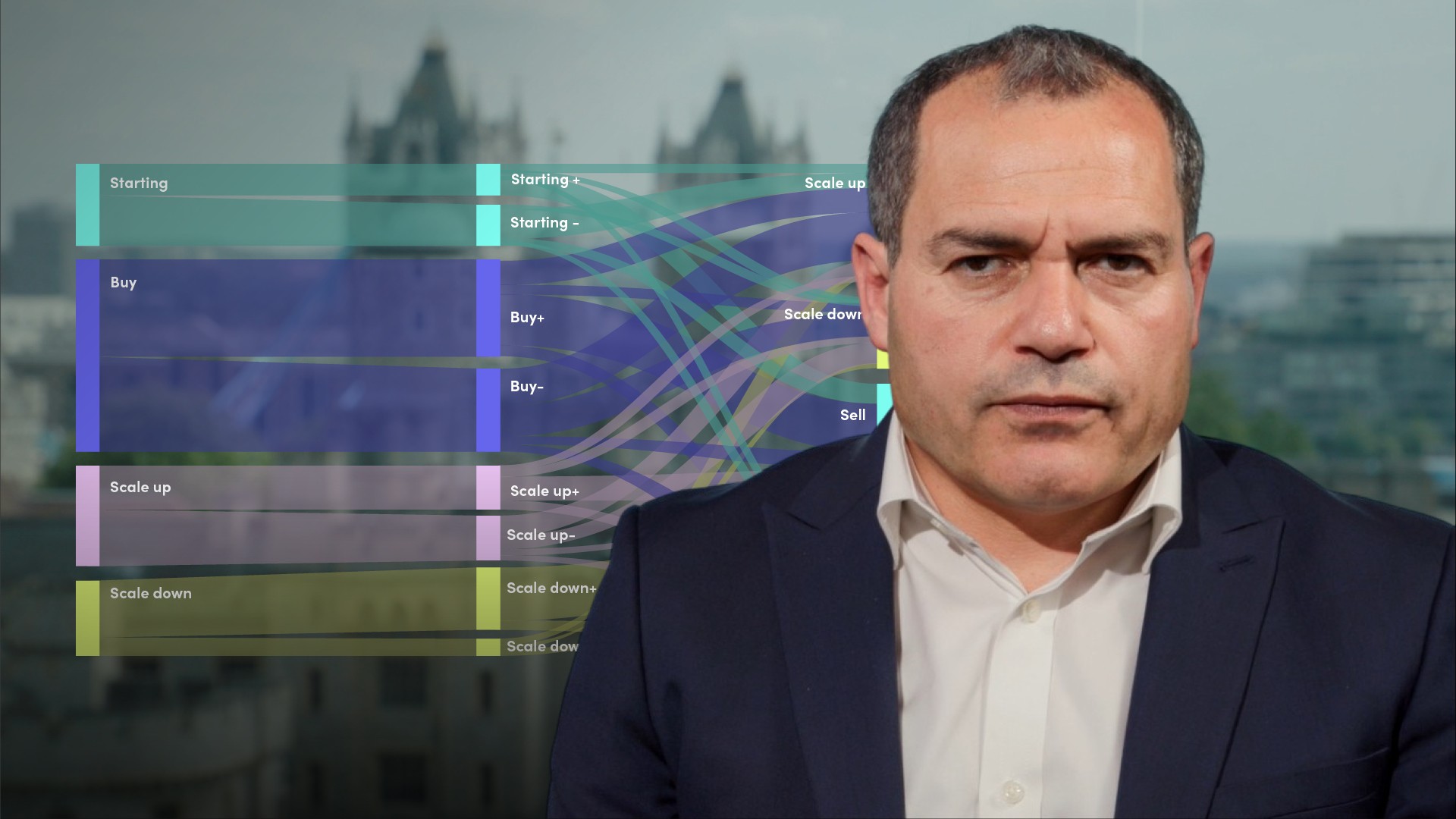

- The type of decision implemented

- The Investment context in which the decision was made

- The final outcome of the decision and the full path of the strategy from initial decision to closure

- Other metrics that can be useful to describe the decision

How can we analyse a portfolio manager's skill level?

- We need to understand how good the Portfolio manager is at researching their market or investment universe, and at finding appropriate and successful investment strategies

- What type of behaviour and decision-making processes that can allow a portfolio manager to not only generate positive performance, but also maintain it

- Identify any specific patterns in the sequence of events that the portfolio manager is implicitly or explicitly following

What metrics can be used to assess the research and investment decisions of the portfolio manager?

- The Hit Ratio which indicates a portfolio manager’s degree of foresight. It’s calculated by dividing the number of positive decisions by the total number of decisions made and then multiplying the resulting number by 100

- The win-loss ratio which indicates a portfolio manager’s degree of loss control. The Win Loss Ratio is defined by the average return of positive decisions divided by the average return of negative decisions.

What do the metrics tell us?

When the Hit Ratio is below 50% it means that we have more negative investment ideas than positive ones. When this number is above 50% we have a more favourable situation with more positive outcomes and of course the higher the Hit Ratio is, the more effective and successful the portfolio manager’s decisions will have been.

If the Win Loss ratio is above 1 or 100%, we can say that when we make a positive gain it’s on average much bigger that negative one. In this case, even if we have the same number of winners and losers i.e. a Hit Ratio of 50%, the portfolio will have total positive performance as winners will outsize losers. When this number is below 1 or 100%, it means that on average, a loss is much bigger than a gain.

Why might portfolio managers not be able to maintain strategies that deliver good performances?

- Some portfolio managers fall in love with their own investment or they simply forget about the importance of adjusting their position and may tend to procrastinate when it comes to making the right decision.

- Some investment teams put a lot of time and effort researching ideas. To avoid losing the human capital invested they may be reluctant to sell out

What are some biases that lead to a suboptimal sell discipline?

- Endowment bias

- Loss aversion

- Overconfidence

- Disposition effect

What are two further biases to be investigated when analysing the sequencing of decisions?

- Escalation of commitment: when the portfolio manager is faced with a negative outcome will always increase his commitment regardless of their future potential.

- Disposition effect: where we tend to sell winners too early and keep losing positions in the portfolios

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Ali Chabaane

There are no available Videos from "Ali Chabaane"