History of Insurance

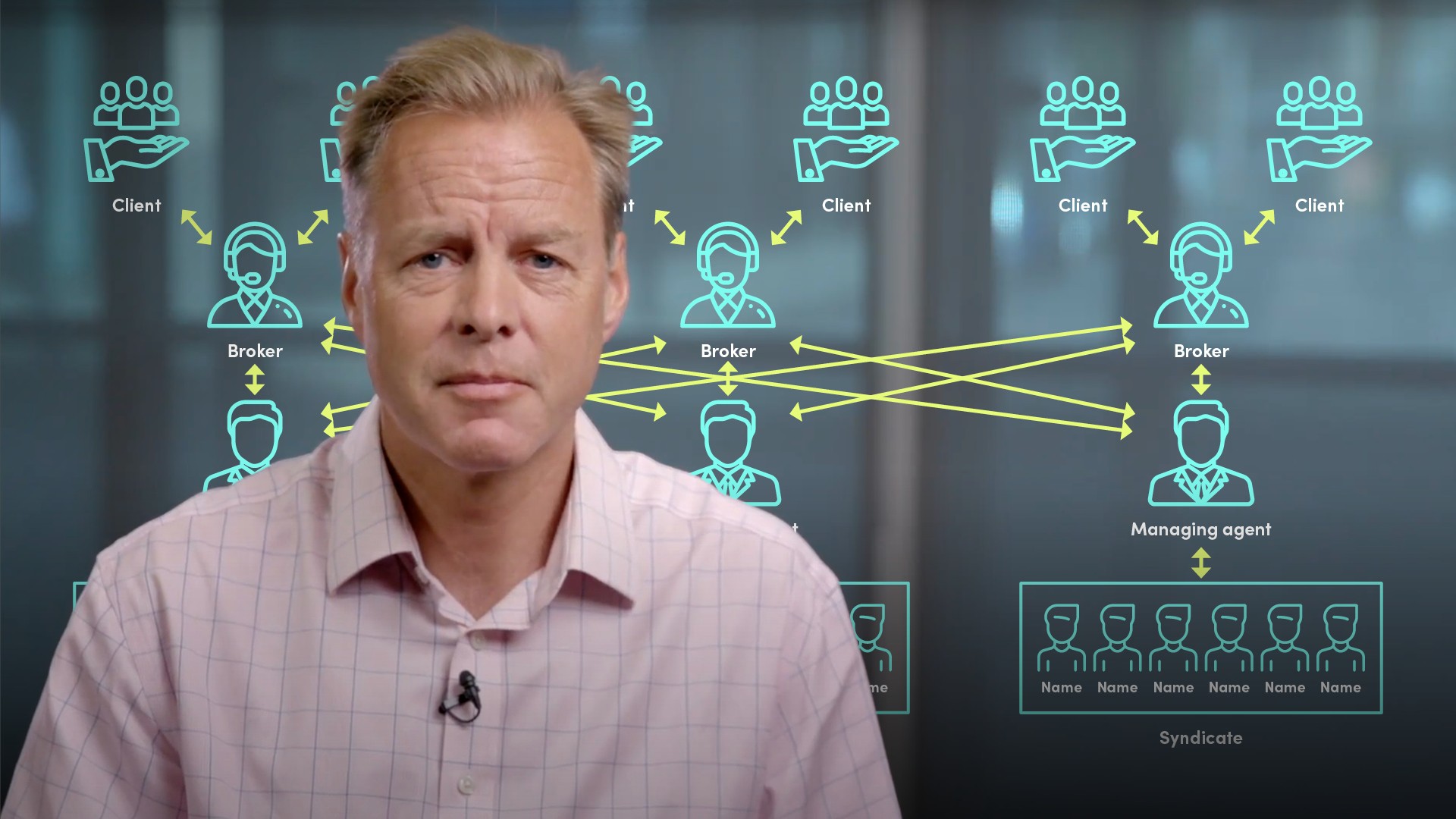

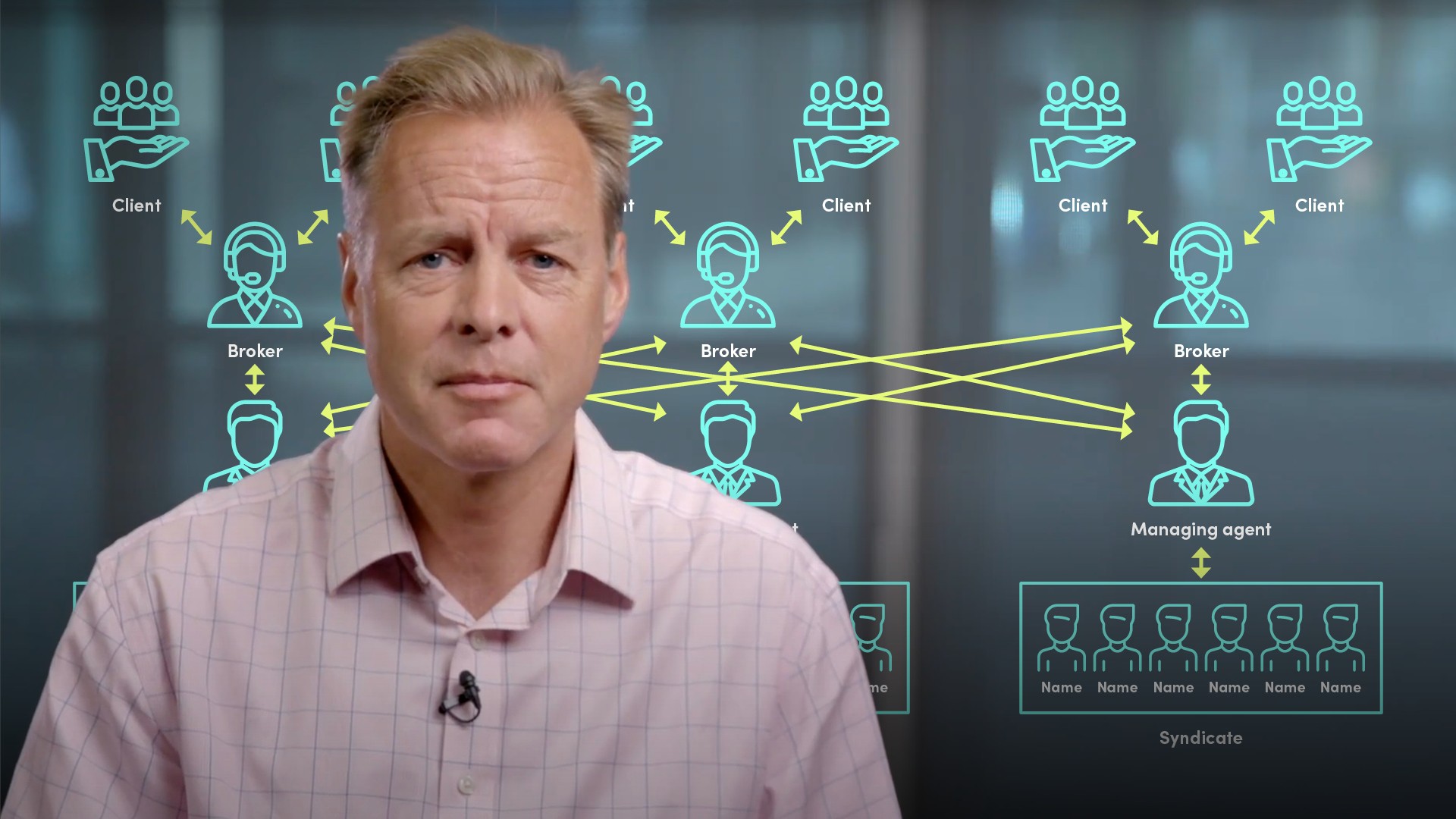

Ted Wainman

20 years: CA & educator

The history of insurance can be traced, in some form or other, back to prehistory and to the world of barter and trade. In this video, Ted covers the history of the various types of insurance, some of which include, property insurance, life insurance, and national insurance.

The history of insurance can be traced, in some form or other, back to prehistory and to the world of barter and trade. In this video, Ted covers the history of the various types of insurance, some of which include, property insurance, life insurance, and national insurance.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

History of Insurance

9 mins 51 secs

Key learning objectives:

Describe the earliest forms of insurance

Understand the difference between insurance and assurance

Understand when life insurance was conceived

Overview:

The world of insurance has a long and illustrious history. In this video Ted traces the business of insurance back to its roots and outlines out how this multi-trillion dollar business started.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the earliest forms of insurance?

Insurance has existed in some form since homo sapiens lived in communities. Lloyd’s of London – probably the most famous insurance market – was born out of the ashes of the Great Fire of London and is older than the Bank of England.

What is the difference between insurance and assurance?

Insurance refers to an event that might happen (such as the sinking of a boat or destruction of property) during a specific period. Assurance is concerned with an event that will definitely happen – in this case the death of an individual. Both insurance and assurance products are purchased by individuals and companies to address specific risks that they face and to mitigate these risks.

When was Life Insurance conceived?

Life Expectancy tables date back to 1693. However, these in themselves were not sufficient to allow insurance companies to accurately price life insurance cover. It took another 50 years before the statistical techniques were sufficiently developed to allow accurate pricing.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Ted Wainman

There are no available Videos from "Ted Wainman"