Insurance Hybrid Debt Case Studies

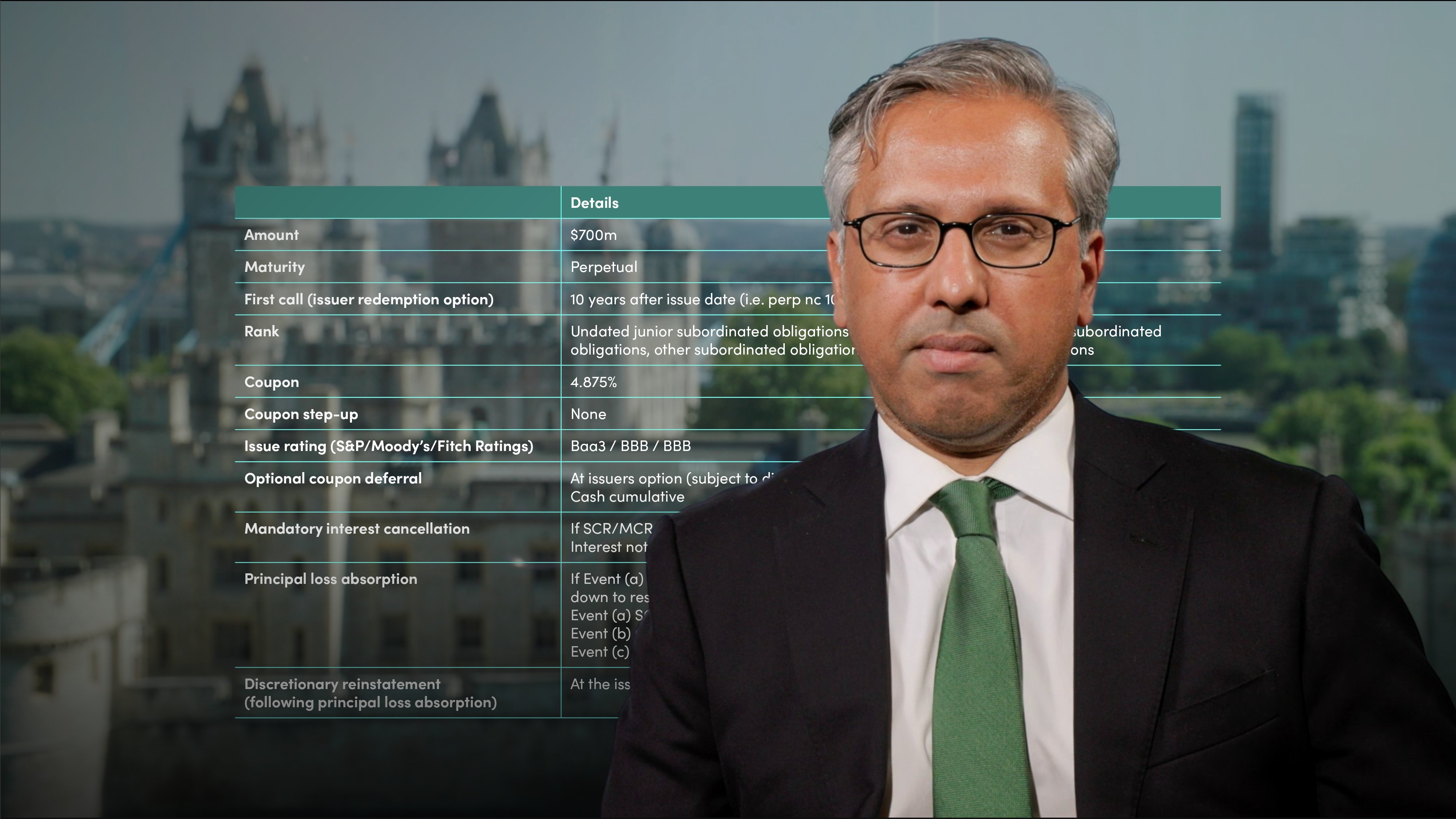

Gurdip Dhami

25 years: Treasury & ratings

Now we know how rating agencies assess insurance hybrid debt and where they differ, Gurdip Dhami is here to walk us through four case studies and explore how each was evaluated by Moody’s, Fitch Ratings and S&P.

Now we know how rating agencies assess insurance hybrid debt and where they differ, Gurdip Dhami is here to walk us through four case studies and explore how each was evaluated by Moody’s, Fitch Ratings and S&P.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Insurance Hybrid Debt Case Studies

9 mins 57 secs

Key learning objectives:

Understand how the ratings agencies evaluated them

Identify examples of hybrid debt issuance

Overview:

Recent examples of insurance hybrid debt include: Groupama issuing a Tier 3 bond (July 2021), MACIF issuing a Tier 1, Tier 2 and Tier 3 bond (June 2021), CNP issuing a restricted Tier 1 bond (April 2021) and lastly Storebrand issuing a Tier 2 bond (March 2021). Each rating agency provided published comments on these bond issues which set out their analysis on the capital and leverage impact.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are recent examples of hybrid debt issuance from insurance companies and how did the ratings agencies review these?

MACIF case study (June 2021)

The French Insurance company MACIF issued Restricted Tier 1, Tier 2 and Tier 3 at the same time in order to fund the acquisition of Aviva France. This is an interesting transaction because it is not usual to see an insurer issue all three Tiers of capital at once. Additionally, the hybrid debt had a novel term relating to Acquisition Financing.

Moody’s published a comment on the capital raising.

On Tier 3: “The notes are intended to qualify as Tier 3 capital under Solvency II but, given their maturity of less than 30 years, they will not result in any equity credit under Moody's debt equity continuum.”

On Tier 2: “The notes are intended to qualify as Tier 2 capital under Solvency II and their hybrid features will result in some equity credit based on the notes' above 30-year maturity.”

On Tier 1: “The notes are intended to qualify as restricted Tier 1 capital under Solvency II and will receive equity credit.”

Groupama case study (July 2021)

The French insurance company issued a Tier 3 bond. The terms of the hybrid make it eligible as Tier 3 – that is the bonds are subordinated, have a maturity greater than 5 years and have a mandatory interest deferral requirement.

The hybrid debt is rated by Fitch who published the following comment: “The notes are intended to qualify as Tier 3 capital under Solvency II (S2) and are treated as 100% equity in Fitch's Prism Factor-Based Model (FBM) due to the application of Fitch's regulatory override. However, given that these notes are a dated instrument, they are treated as 100% debt in Fitch's financial debt leverage calculation.”

Storebrand case study (March 2021)

The insurance subsidiary of the Norwegian group, Storebrand issued a Tier 2 bond.

This transaction was structured as a Green bond using the issuers Green bond framework.

The terms of the Tier 2 are in line with both Solvency II requirements and S&P requirements.

S&P provided a comment on the Tier 2 bonds classifying the bonds as having intermediate equity credit which means they get 100% credit up to 25% of S&P’s measure of capital, the TAC.

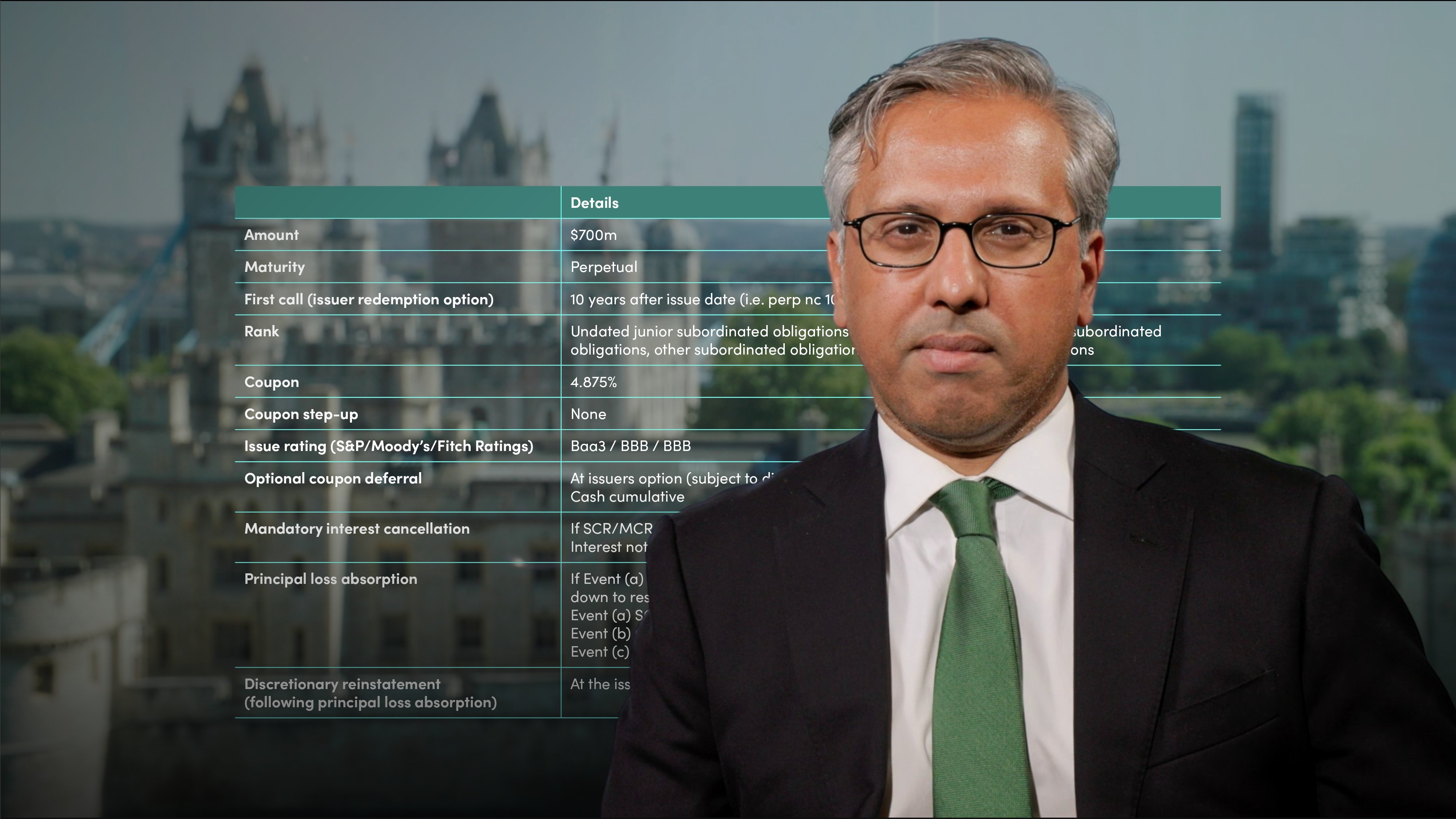

CNP case study (March 2021)

CNP Assurances is a French based insurer and in March 2021 issued a Restricted Tier 1 bond.

Moody’s, S&P and Fitch commented on this bond issue and all stated that the bond was eligible for equity credit for capital. Only Fitch and Moody’s gave equity credit for the leverage calculations in line with their criteria.

S&P stated: “The deeply subordinated notes will be eligible as RT1 capital under the EU's Solvency II regulations. We expect to classify the notes as having intermediate equity content, subject to our receipt and review of the final terms and conditions. Hybrid capital instruments with intermediate equity content can comprise up to 25% of total adjusted capital (TAC), which is the basis of our consolidated risk-based capital analysis of insurance companies. The inclusion of TAC is also subject to the issuance being considered eligible for regulatory solvency regarding both the amount, and terms and conditions.”

Moody’s stated: “The notes are intended to qualify as restricted Tier 1 capital under Solvency II and will receive equity credit, as other restricted Tier 1 securities.”

Fitch stated: “Given that RT1 notes are a non-cumulative perpetual instrument with no step-ups on call dates, they will be treated as 100% equity both in Fitch's Prism Factor-Based Model and financial leverage ratio (FLR) calculation…”

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Gurdip Dhami

There are no available Videos from "Gurdip Dhami"