Integrity Council’s Core Carbon Principles

Sam Hope

5 years: Carbon Markets

The Integrity Council for the Voluntary Carbon Market (ICVCM) has published its Core Carbon Principles (CCPs). Join Sam Hope as he talks us through each principle.

The Integrity Council for the Voluntary Carbon Market (ICVCM) has published its Core Carbon Principles (CCPs). Join Sam Hope as he talks us through each principle.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Integrity Council’s Core Carbon Principles

7 mins 40 secs

Key learning objectives:

Understand the Core Carbon Principles (CCPs)

Outline how the CCPs make a high-integrity carbon credit

Overview:

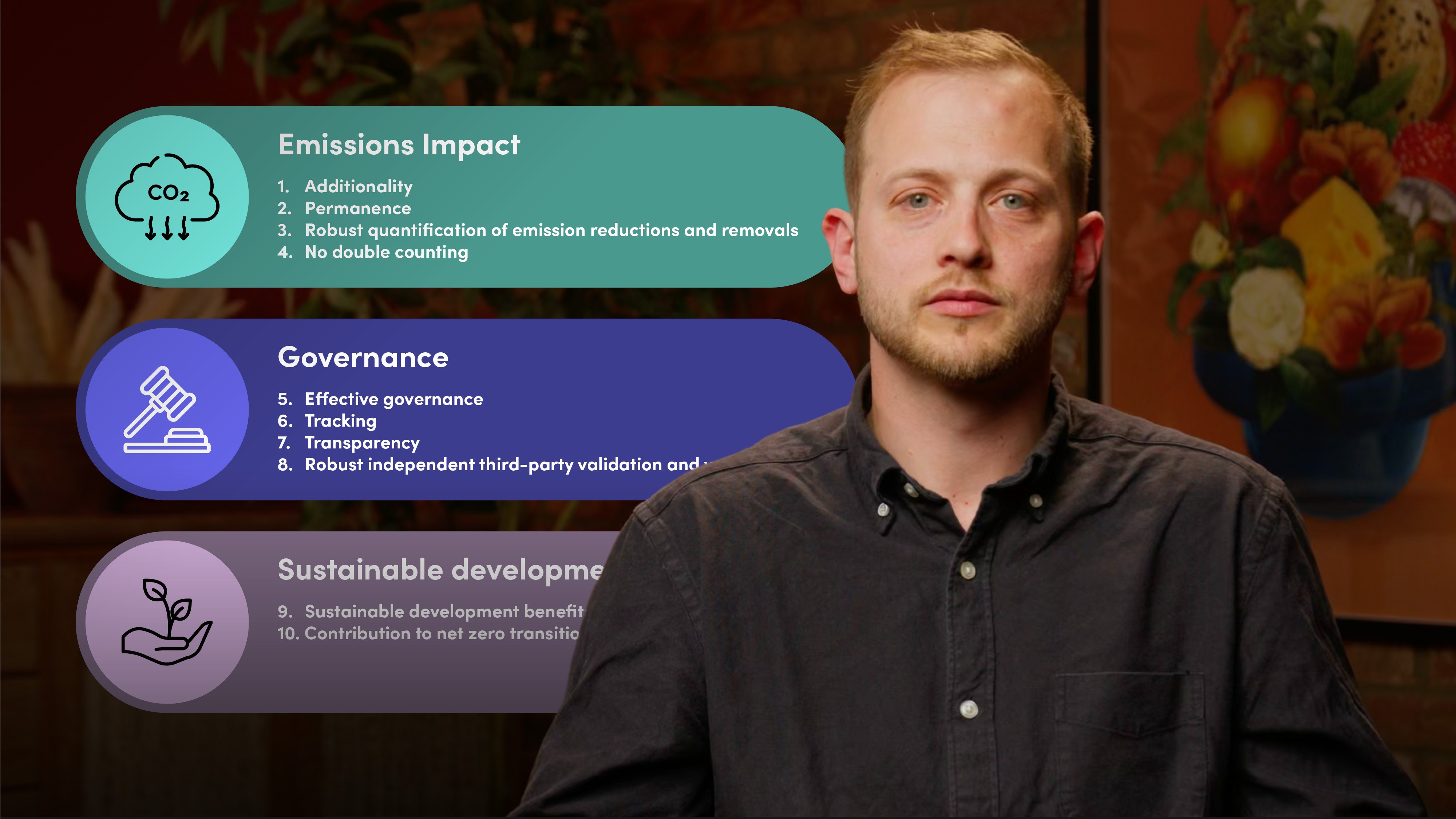

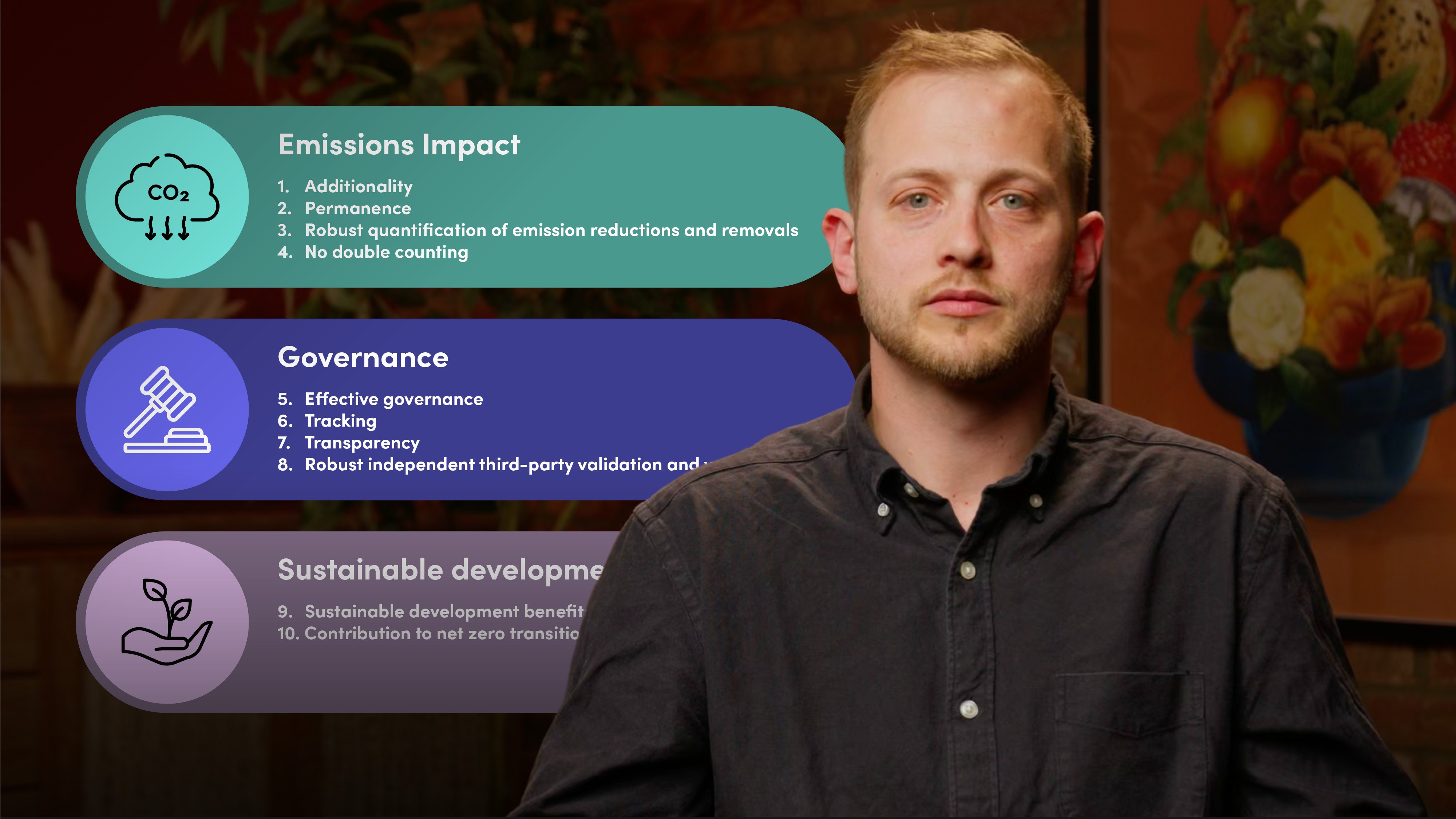

The Integrity Council for the Voluntary Carbon Market (ICVCM) has published its Core Carbon Principles (CCPs). The CCPs are a global benchmark for high-integrity carbon credits that meet rigorous thresholds on disclosure and sustainable development. They provide a credible means of identifying carbon credits that create real, measurable climate impacts. The 10 CCPs are categorised under three key areas: governance, emission impact and sustainable development.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Sam Hope

There are no available Videos from "Sam Hope"