Introduction to Fixed-Term Funds

Nigel Owen

20 years: Debt capital markets

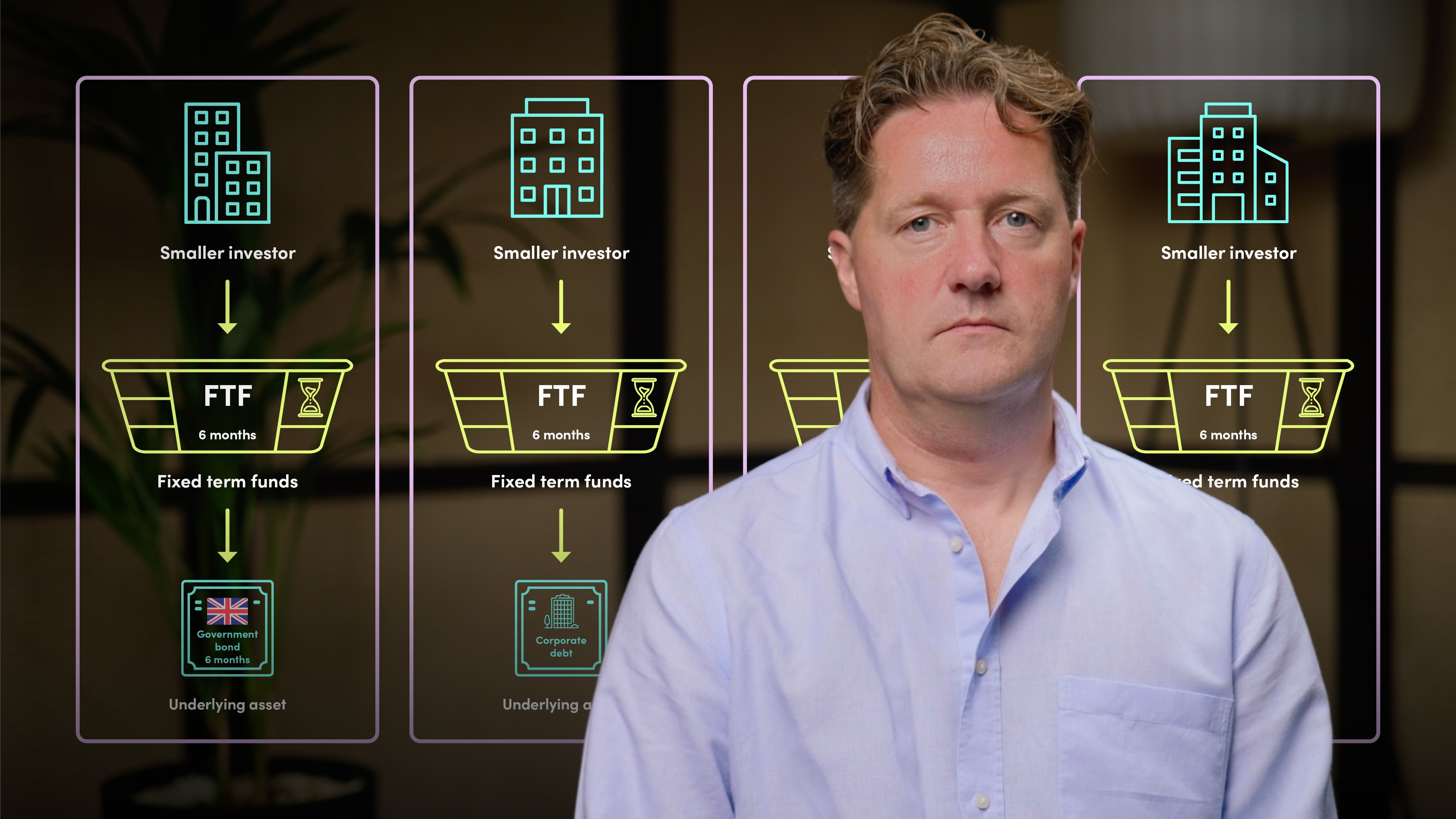

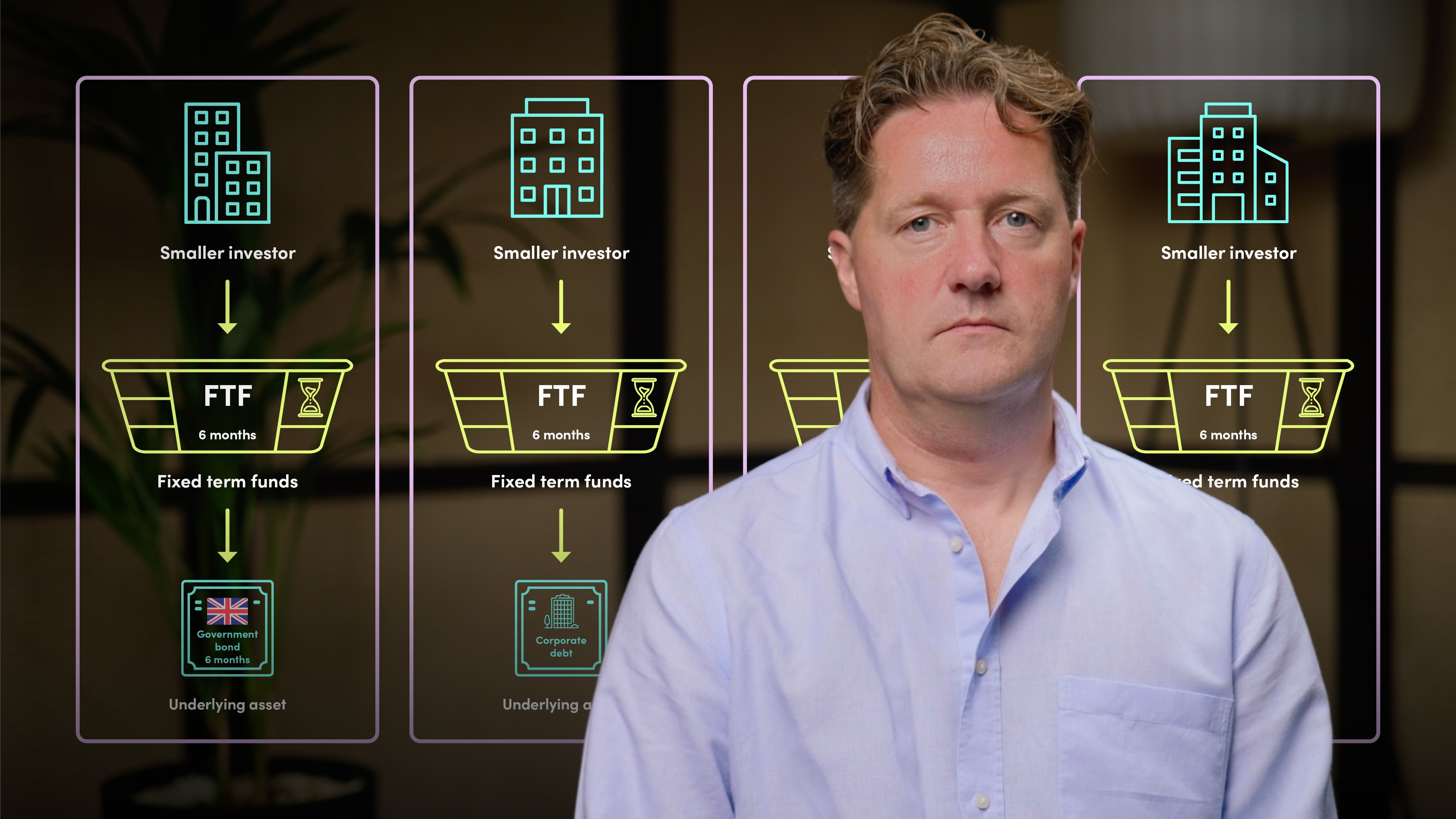

In this video, Nigel explores Fixed-Term Funds (FTFs), a game-changer in accessing short-dated fixed-income investments. He covers why FTFs emerged, how they work, and their benefits for investors and issuers.

In this video, Nigel explores Fixed-Term Funds (FTFs), a game-changer in accessing short-dated fixed-income investments. He covers why FTFs emerged, how they work, and their benefits for investors and issuers.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Introduction to Fixed-Term Funds

9 mins 37 secs

Key learning objectives:

Understand why Fixed Term Funds (FTFs) have emerged

Understand what Fixed Term Funds are (FTFs) and how they work

Understand the benefits of Fixed Term Funds (FTFs) for issuers and investors

Overview:

Historically, only large investors could access short-dated fixed-income investments, leaving others with low-yield bank accounts. The 1970s introduced money market funds, and in 2018, TreasurySpring launched the Fixed-Term Fund (FTF), a regulated platform offering assets like UK Government debt to a broader audience. By September 2023, the FTF market had grown to over $50 billion across more than 1,000 products. FTFs provide unique, individualised exposure to specific assets, reducing correlation risk. Today, a range of investors, from global corporations to startups, use FTFs for better returns, while issuers benefit from increased liquidity.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Nigel Owen

There are no available Videos from "Nigel Owen"