Introduction to FVA

Steven Marshall

25 years: Derivatives trading

In the next video of this pathway on XVA, Steven Marshall discusses Funding Valuation Adjustment, or FVA. FVA looks at the cost of financing related to derivative transactions. Steven discusses the need for FVA and then the various developments that have taken place since the financial crisis.

In the next video of this pathway on XVA, Steven Marshall discusses Funding Valuation Adjustment, or FVA. FVA looks at the cost of financing related to derivative transactions. Steven discusses the need for FVA and then the various developments that have taken place since the financial crisis.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Introduction to FVA

13 mins 8 secs

Key learning objectives:

Understand how FVA has developed

Outline the purpose of FVA

Outline other funding adjustments, CollVA and IMVA

Overview:

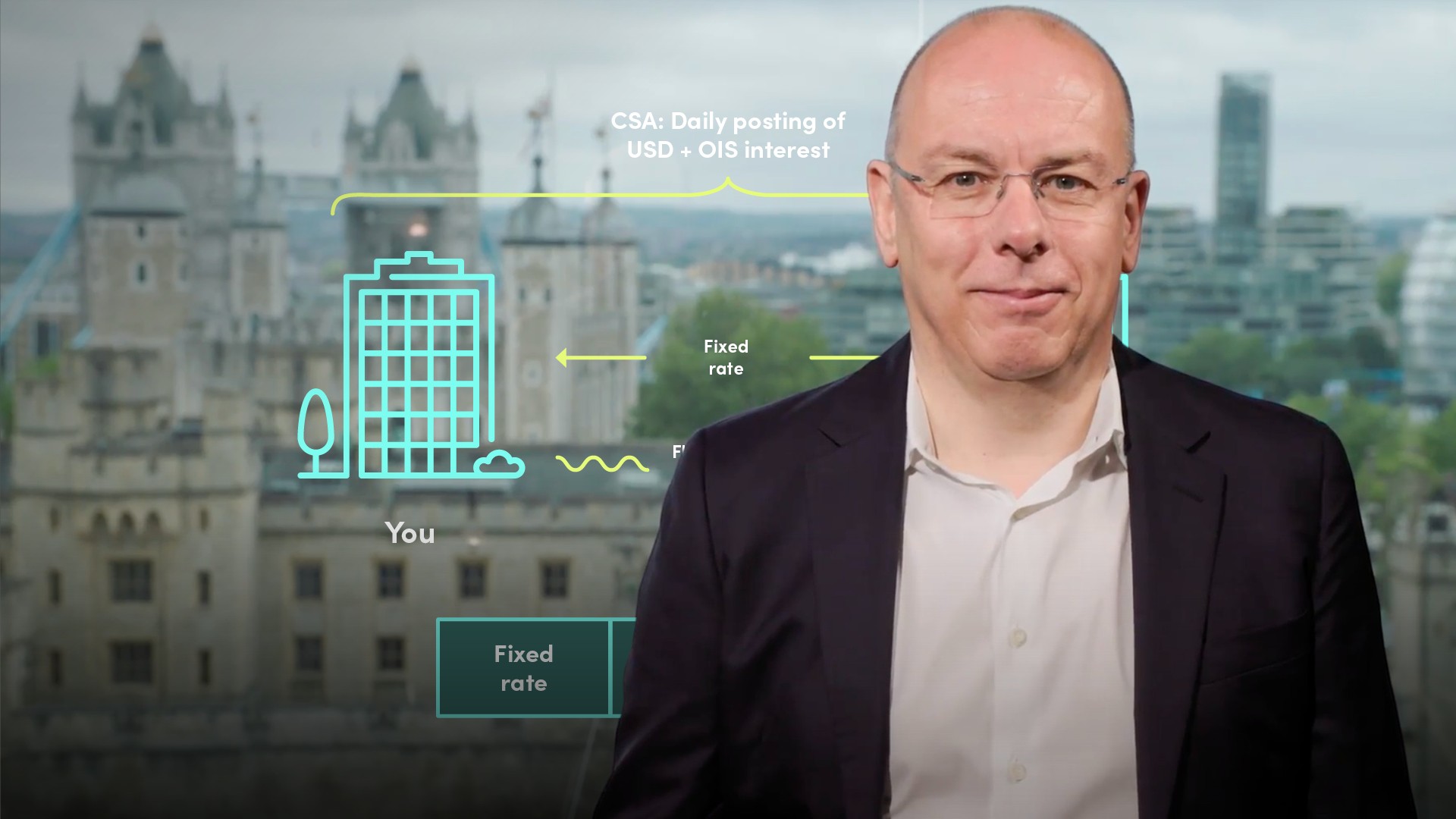

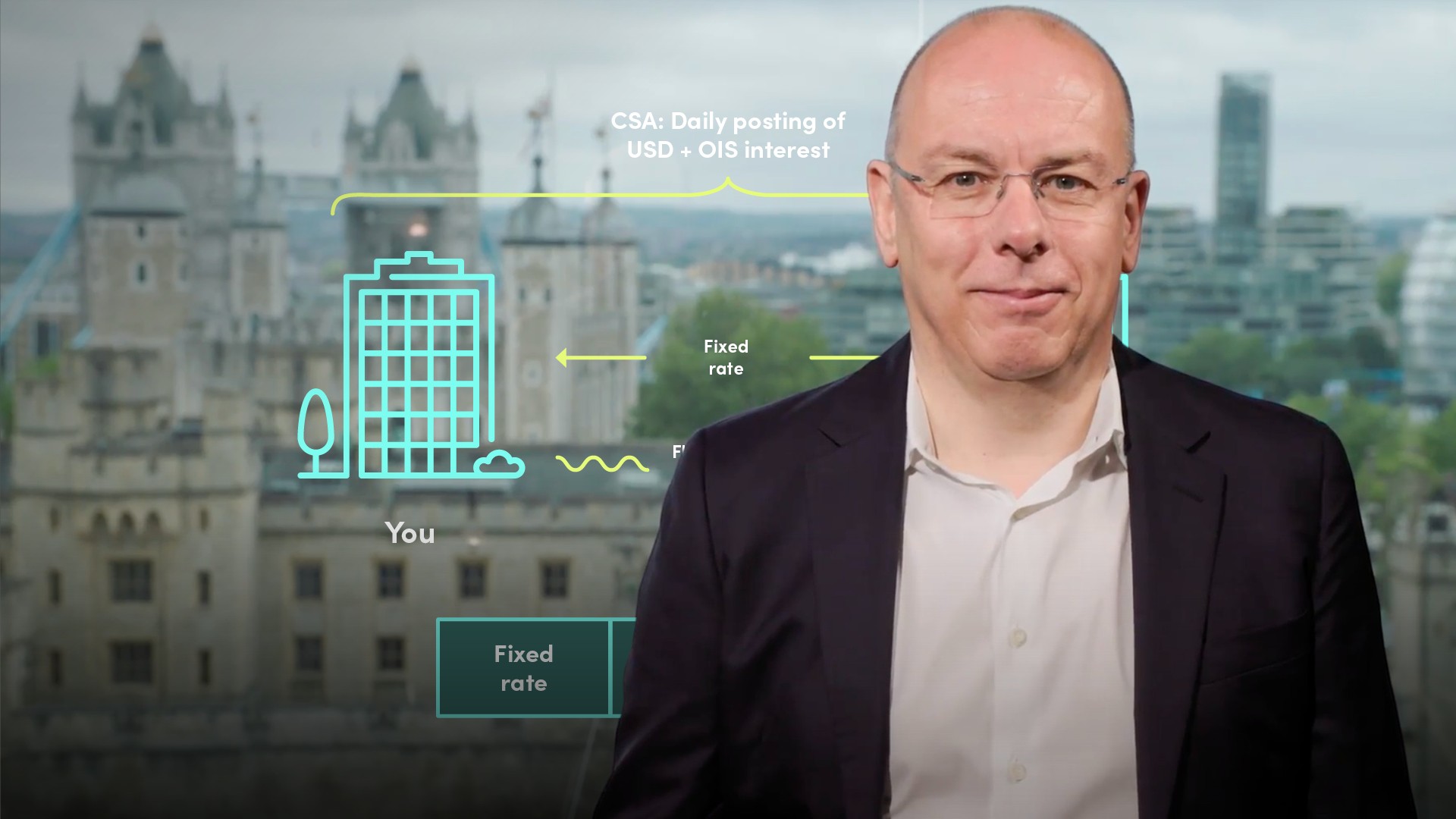

Funding Valuation Adjustment (FVA) looks at the cost of financing related to derivative transactions. The cost related to the trade depends on the derivative, whether it is uncollateralised or collateralised.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Where would we find financing costs in a derivative transaction?

- In uncollateralised trades, when payments are made or received it will give rise to a cash balance, either a credit or a debit. This will need to be financed as and when it occurs.

- In collateralised trades the margin payments, which usually occur daily, will also need to be financed.

Why is there a need for FVA?

In the case of a collateralised derivative where a margin has to be paid, a daily interest rate is paid to the counterparty on this margin. The margin has to be borrowed at the bank's unsecured borrowing rate, typically LIBOR. The increased cost of the margin versus the cost of the interest received on it adds an additional cost to the transaction, this is what gives rise to Funding Valuation Adjustment.

Before the crisis, this wasn’t much of an issue as OIS and LIBOR tracked very closely and it was assumed they’d net each other off to zero (or very close to zero). However following the crisis the spread between LIBOR and OIS widened significantly, significantly impacting portfolios which had a large mark-to-market.

What developments have taken place since the crisis to help with derivative pricing?

- Changes in contract definitions: E.g. a move to forward cash settlement on swaptions rather than payment today.

- Simplification of collateral terms in CSAs

- Push towards clearing

- Introduction of the standardised initial margin model (SIMM)

Most of the market has now agreed on standard CSA (Credit Support Annex) agreements with zero thresholds and US Dollar cash collateral - so for bilateral trading things have been simplified such that most of the discounting is now done on US Dollar OIS curves. Anything else is regarded as bespoke pricing.

If firms cannot move to US dollar collateral, payments must be funded directly off-balance sheet, discounted using their term funding rate.

If cash is not held, firms may wish to post their bond holdings as collateral. In this case, a firm may hold a collateral valuation adjustment (CollVA) for various pools of collateral they may have to finance.

The SIMM requires both counterparties to a transaction to post a segregated initial margin to minimise credit risk between them in addition to the variation margin. This will increase the cost over the life of the trade. As more counterparts fall within SIMM regulations, it is likely that market participants will look at the cost of this in the form of an initial margin valuation adjustment (IMVA).

FVA considers what interest rate is paid for collateral. CollVA looks at the cost of financing bond (or other assets) collateral. And IMVA will consider the cost of financing a SIMM portfolio.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Steven Marshall

There are no available Videos from "Steven Marshall"