Introduction to Liability Management

Sushanth Papireddy

15 years: Liability Management

In this video, Sushanth explains liability management and the three types of liability management transactions. He also explains why companies use each of the different liability management techniques.

In this video, Sushanth explains liability management and the three types of liability management transactions. He also explains why companies use each of the different liability management techniques.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Introduction to Liability Management

7 mins 46 secs

Key learning objectives:

Understand the purpose of liability management

Understand the main techniques involved in liability management

Outline the reasons companies use liability management

Overview:

Liability Management (LM) refers to a set of techniques used by issuers of debt to manage, modify or retire their debt before maturity. LM techniques include consent solicitations, tender offers, and exchange offers. Consent solicitations are used to amend the terms of existing bonds, tender offers are used to buy back bonds prior to maturity, and exchange offers allow bondholders to exchange their existing bonds for new ones. The LM team is typically part of the Debt Capital Markets business of an Investment Bank and deals with bonds held by institutional and retail investors. Companies use different LM techniques for various reasons such as improving credit metrics, increasing financial flexibility, or accounting considerations. Each technique has its own mechanism and workings, which are explained in subsequent videos.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is liability management and why is it used?

Liability Management (LM) is a set of techniques used by debt issuers in the capital markets to manage, modify, or retire their debt prior to maturity. The most common forms of LM are debt buybacks, debt exchanges, and debt modifications.

LM is used to reduce the pressure on a company's funding desk by taking action on bonds that are nearing maturity. Companies use LM for various reasons such as improving credit metrics, increasing financial flexibility, or accounting considerations. Understanding LM is crucial to executing a successful LM transaction.

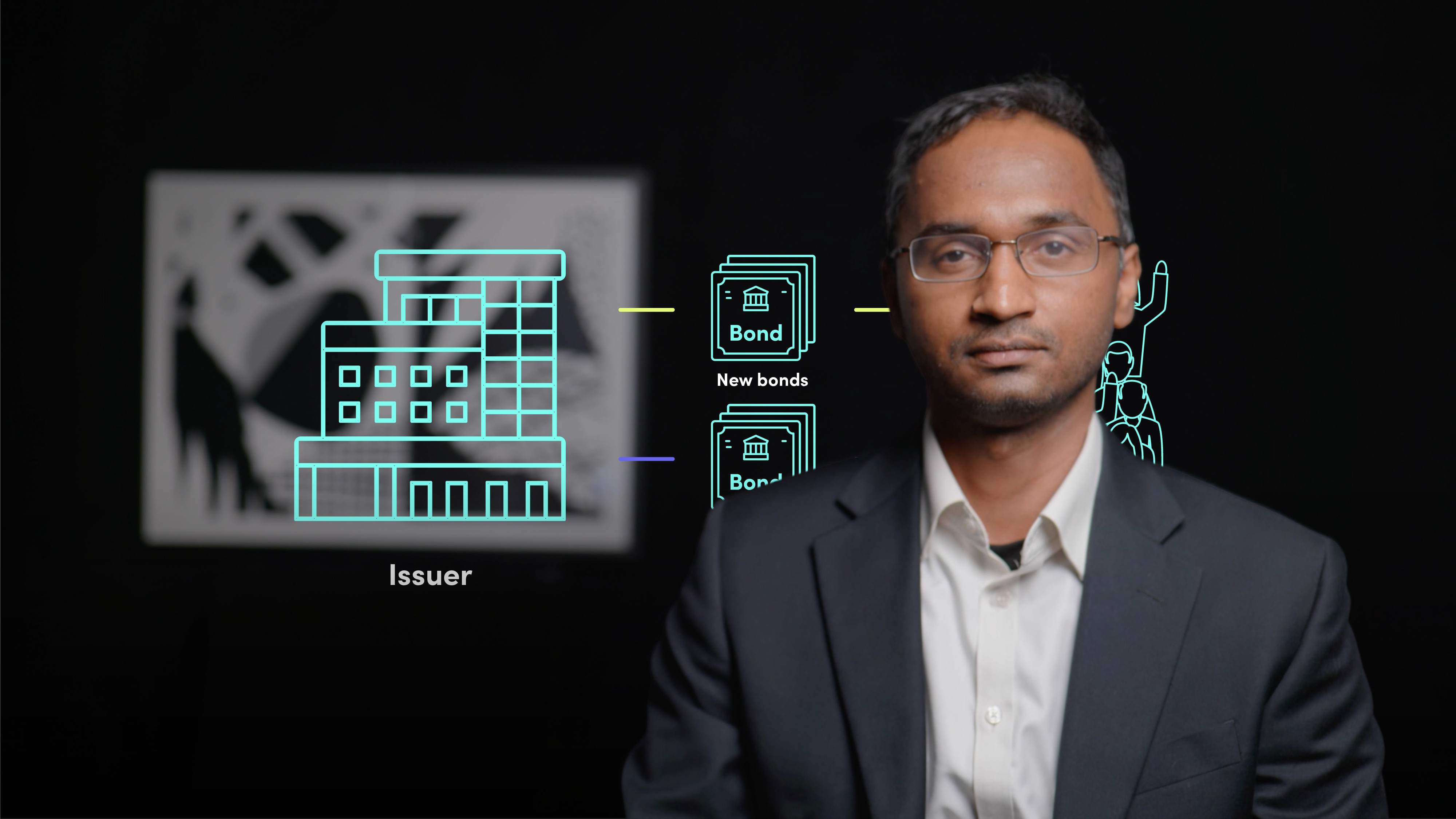

What techniques are involved in liability management?

Liability Management (LM) involves three main techniques: consent solicitations, tender offers, and exchange offers.

Consent solicitations involve seeking the consent of bondholders to make amendments to the terms and conditions of the bonds, which become binding on remaining bondholders whether or not they approved the proposed amendments.

Tender offers allow issuers to buy back their bonds before maturity using cash on the balance sheet or via new bond issuance.

Exchange offers allow bondholders to exchange their existing bonds for new ones. These techniques can be combined to achieve a company's objectives or increase take-up, creating incentives for bondholders to participate in the exercise.

Why do companies use liability management?

Companies use liability management techniques for various reasons depending on the specific technique used.

Consent solicitations are used to amend the terms of existing bonds, such as relaxing certain covenants to increase financial flexibility or changing references to LIBOR.

Tender offers funded by cash help deleverage and improve credit metrics, while buying back bonds with near-term maturities and financing new longer-dated bonds can extend debt maturity profiles.

Exchange offers are used when demand for new bonds is relatively limited, to achieve favorable P&L outcomes, or when technical amendments are required, such as a change of issuer. Understanding the motivations behind each technique is essential for successful LM transactions.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Sushanth Papireddy

There are no available Videos from "Sushanth Papireddy"