Introduction to Performance Attribution Models

Ali Chabaane

25 years: Investment management

In this video, Ali covers some basic ideas within the area of performance attribution, including who within the investment management industry might make use of this tool and what specific information they might glean from it.

In this video, Ali covers some basic ideas within the area of performance attribution, including who within the investment management industry might make use of this tool and what specific information they might glean from it.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Introduction to Performance Attribution Models

9 mins 38 secs

Key learning objectives:

Understand why it is important to analyse performance and who conducts the analysis

Outline who uses the information provided by performance attribution

Understand how to interpret the outcomes and how they can be used

Overview:

Investment professionals need to understand how they have generated performance, where it has come from and what they can do better in the future, this is the purpose of using performance attribution tools. This can be conducted in different ways, each of which allows us to dissect the performance of different types of decisions. Various market participants use the insights provided by performance attribution including portfolio managers, marketing and sales teams, regulatory teams and investors.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Why is it important to analyse performance and who performs the analysis?

Lots of investment decisions need to be made in order to achieve top-level performance. They therefore need to be able to understand how each of these decisions contributed to the portfolio performance.

Performance attribution is the process of using a set of mathematical models and numerical procedures to dissect the portfolio performance, in order to identify the sources of return and to relate them to decisions made by the portfolio manager.

The analysis is performed by Performance Analysts who are highly specialised experts in financial mathematics, portfolio and complex data management. Performance Analysts need to be able to provide the portfolio manager with unbiased feedback on what decisions worked and how to go about adjusting the portfolio using the information.

Who uses the information provided by performance attribution?

- Portfolio managers - To understand sources of generated performance and relate their decisions to achieved outcomes

- Marketing and sales teams - To build the confidence of an existing or prospective investor

- Teams with fiduciary responsibilities - Ensure regulatory oversight is carried out by monitoring sources of generated performance are inline with the stated mandate.

- Investors - Helps to identify sources of performance and assess how good the portfolio manager is.

How are the outcomes of attribution interpreted?

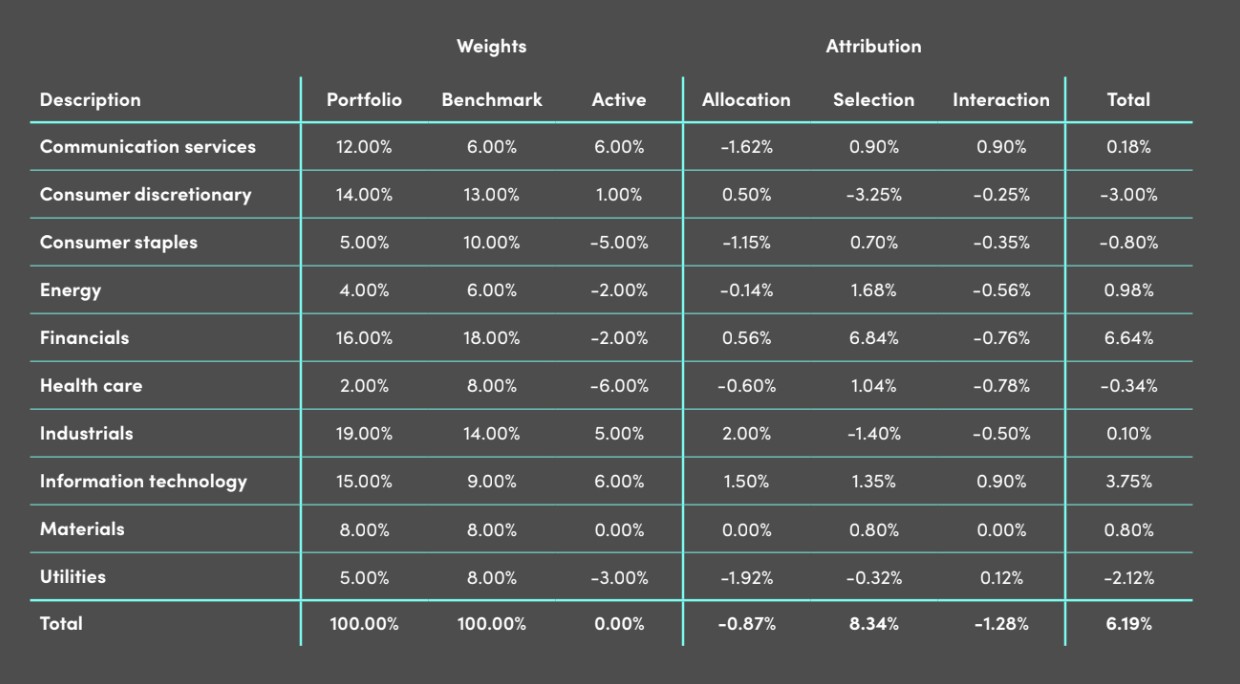

The chart shows the performance attribution of an equity portfolio across sectors decomposed into allocation and stock selection decisions. The first three columns show how the weights of the portfolio deviate from those of the benchmark. The next four columns’ attribution section of the table provides a decomposition of the realised return within each sector into three components: allocation, stock selection and interaction. The portfolio manager’s performance was mainly due to stock selection. The allocation decisions have not added value.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Ali Chabaane

There are no available Videos from "Ali Chabaane"