Introduction to Stewardship

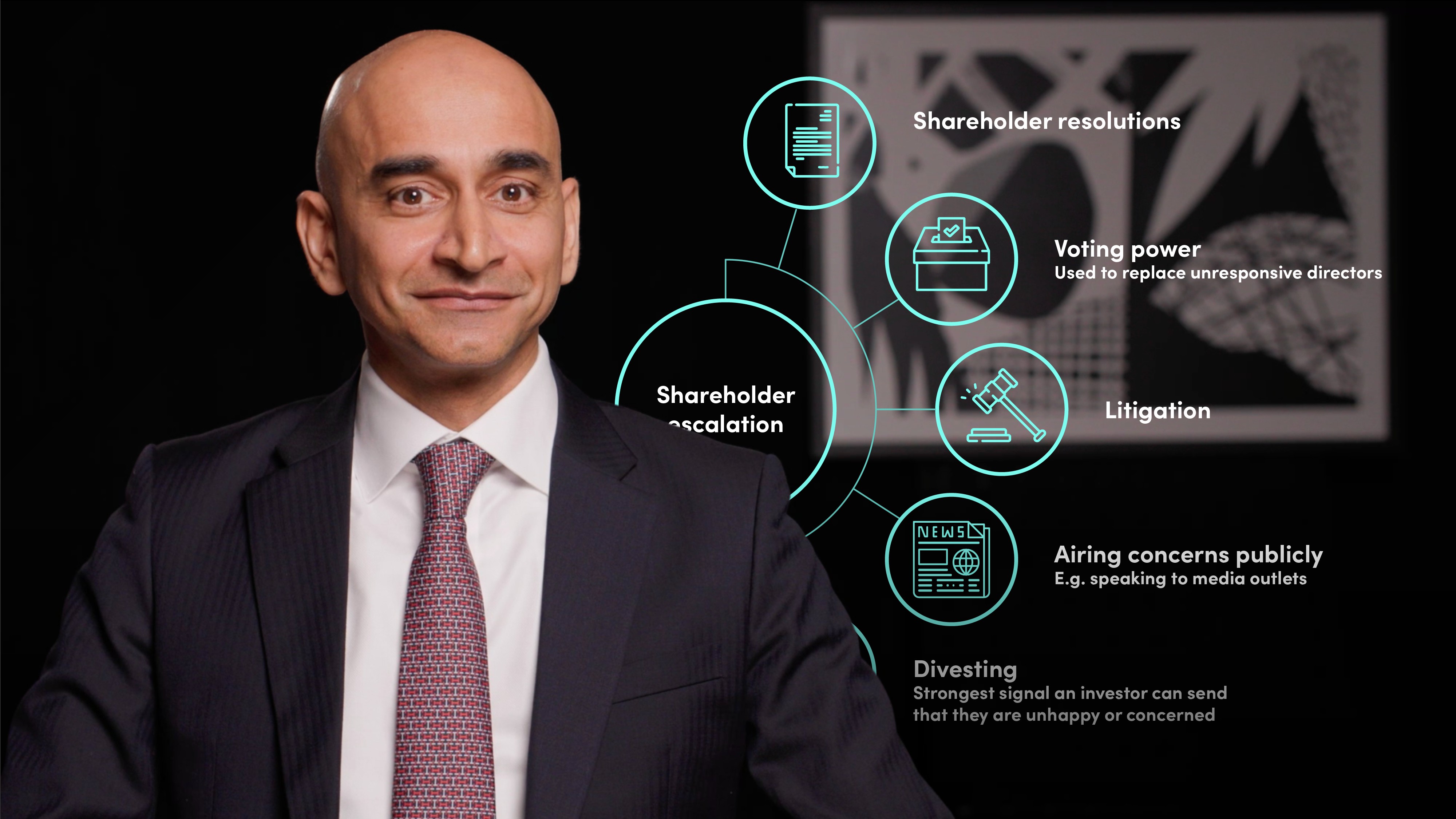

Arun Kelshiker

20 years: Asset management and stewardship

In the first video of this two-part video series, Arun defines what stewardship is and then looks at the different approaches to stewardship, such as stewardship through engagement, stewardship through voting, and stewardship through escalation.

In the first video of this two-part video series, Arun defines what stewardship is and then looks at the different approaches to stewardship, such as stewardship through engagement, stewardship through voting, and stewardship through escalation.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Introduction to Stewardship

11 mins 4 secs

Key learning objectives:

Understand investment stewardship

Identify the different methods of actioning stewardship

Assess why investment stewardship is so important in for tackling societal and environmental issues

Overview:

In 2018, Larry Fink, chairman of Blackrock wrote a letter to all the CEOs of companies Blackrock invests in stating that “society is demanding that companies, both public and private, serve a social purpose. To prosper over time, every company must not only deliver financial performance but also show how it makes a positive contribution to society.” This is where stewardship comes in. Given the magnitude of the societal challenges that we are facing, together with the scale of investment needed to action solutions, stakeholders have raised the bar on how all aspects of our outcomes and behaviours need to change. Investors are exercising their influence, actioning stewardship and championing their expectations with respect to corporate behaviours.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is stewardship?

Stewardship, also known as active ownership, is the use of influence by institutional investors to maximise overall long-term value including the value of common economic, social and environmental assets, on which returns and clients’ beneficiaries interest depend. It is a key aspect of responsible investing.

How can investors action stewardship?

Ways through which investors can influence their target companies include; engagement, voting at shareholder meetings, filing shareholder resolutions, fulfilling direct roles on boards and litigation.

Through engagement, investors can actively dialogue with current or potential investees or issuers on specific areas of concern. Engagement can take the form of meetings, calls, emails or letters between the investor and the company which has been targeted for engagement. Investors discuss their concerns and communicate their expectations of company boards and management teams.

Voting is a key tool for listed equity investors to signal their views to a company and often takes the form of approving director appointments and board pay.

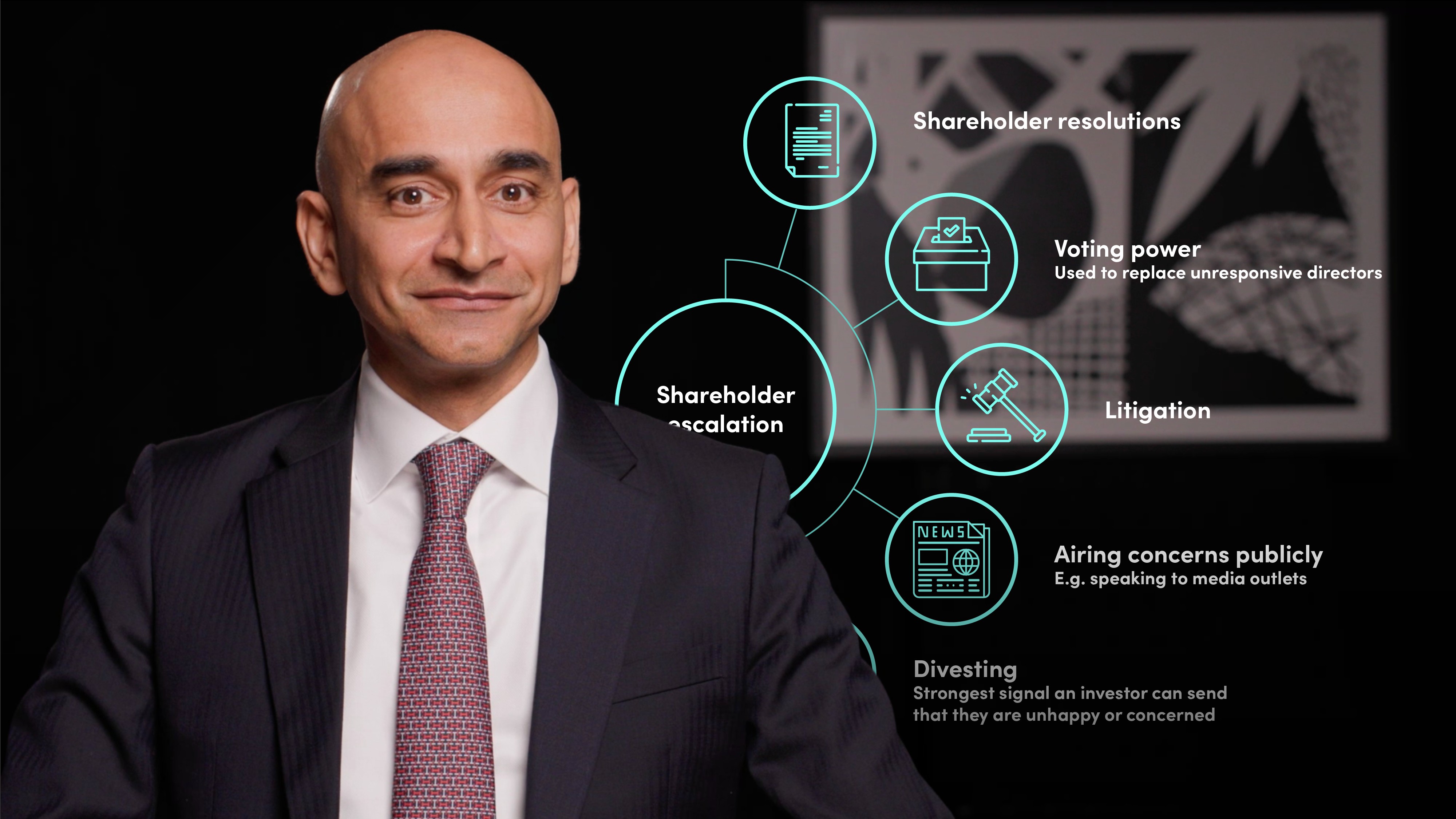

When investors believe that engagement strategies and dialogues have been ineffective or haven’t achieved intended outcomes, investors will often consider escalation strategies. These can take a number of forms including:

a. Filing shareholder resolutions.

b. Using voting power to replace unresponsive directors.

c. Pursuing litigation.

d. Speaking out publicly in the media to air specific concerns.

e. Divesting from a company

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Arun Kelshiker

There are no available Videos from "Arun Kelshiker"