Invoice Finance Jargon Buster

Mark Thompson

15 years: Invoice finance

There is a wide range of terms associated with invoice finance. In this Q&A video, Mark clarifies some of this jargon, such as aged reports, concentration limit, debt purchase agreement and trust account.

There is a wide range of terms associated with invoice finance. In this Q&A video, Mark clarifies some of this jargon, such as aged reports, concentration limit, debt purchase agreement and trust account.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Invoice Finance Jargon Buster

3 mins 51 secs

Key learning objectives:

Define all key terms associated with invoice finance

Overview:

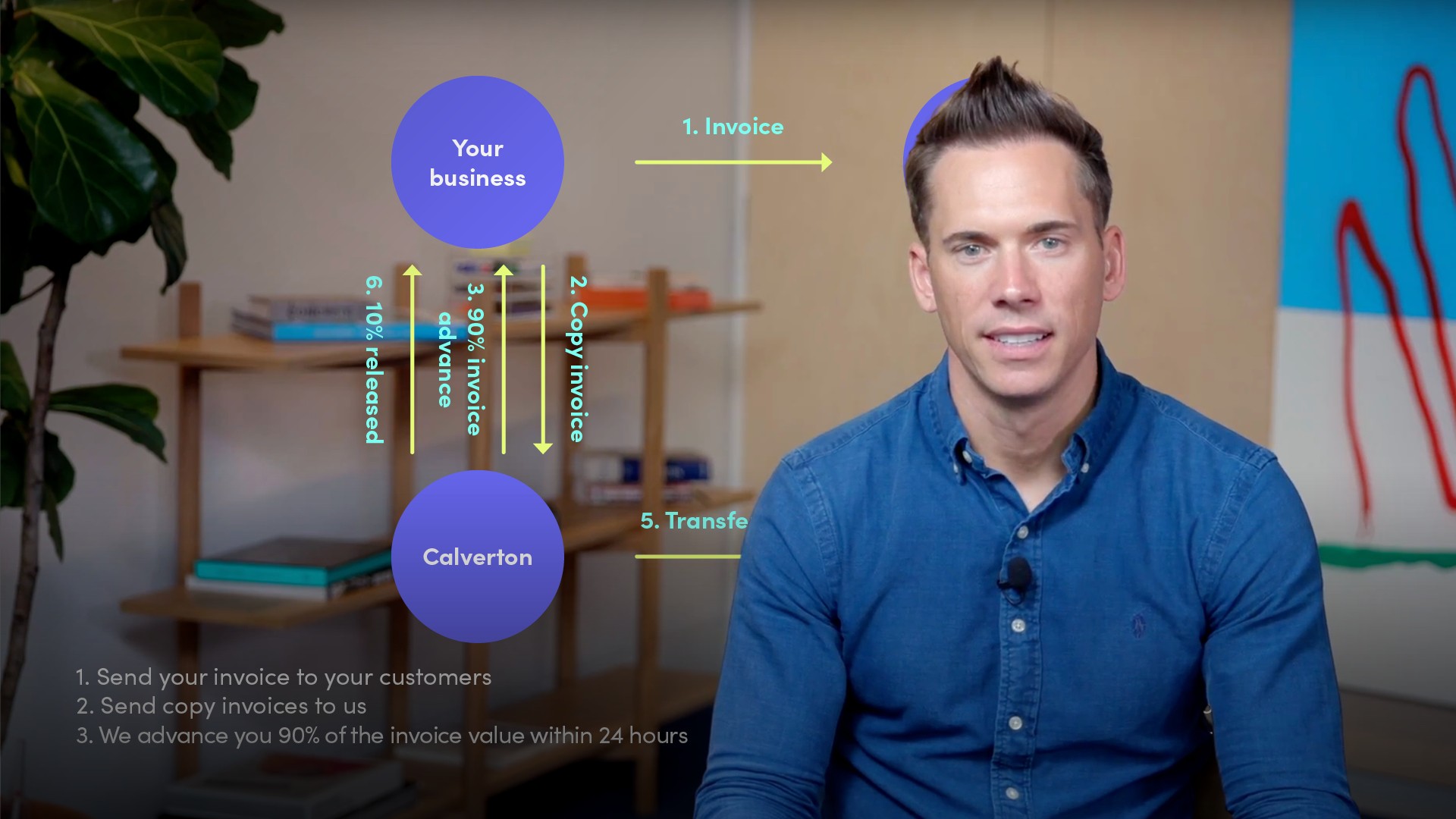

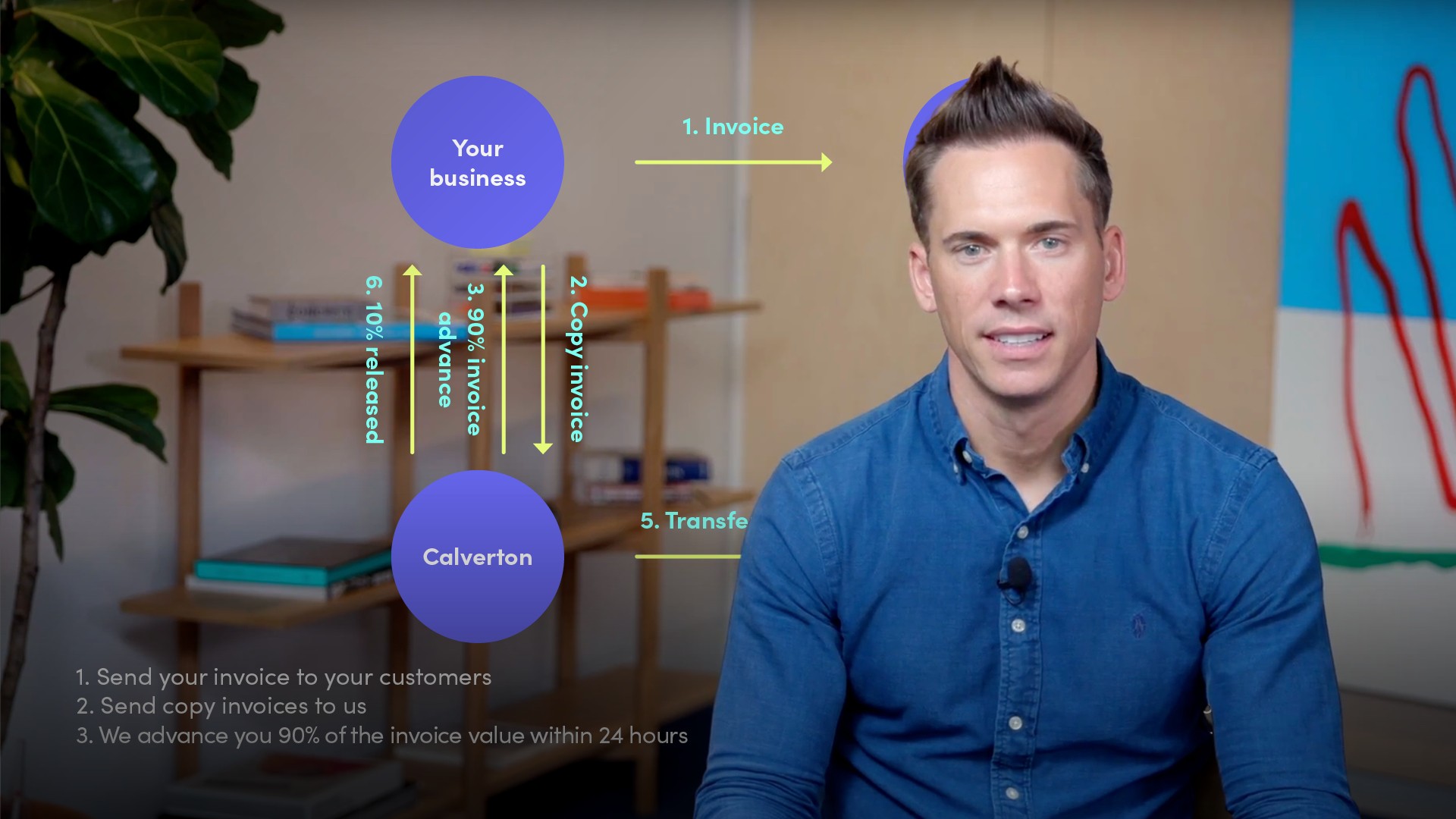

This involves all the key terms and definitions associated with invoice finance. Overall, they provide a good understanding as to how the three parties communicate and inform each other of certain arrangements and funding requirements.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is Acknowledgement?

This is recognition by the debtor that their debt has been assigned to the financier.

What are Aged Reports?

These are an analysis of amounts owed to creditors or debtors by their due date or invoice date.

What is a Debt Purchase Agreement?

This is a legal agreement which gives effect to the sale and purchase of a client’s debts by the financier.

What is a Notice of Assignment?

This is a notice that informs the debtor that the debts or receivables payable have been assigned to the financier and that payment should be made to them, rather than the original provider of the goods.

What is Funding Availability?

This is the amount of cash that is available to the client under a finance arrangement at a single point in time. It is calculated by applying the prepayment % against the value of approved debts.

What is the Concentration Limit?

The maximum amount of funding an invoice financier will provide against debts in a specified category.

What is the Funding Period?

The time over which an invoice financier will provide funding against a debt, normally defined in the debt purchase agreement.

What is a Trust Account?

This is the bank account where account balances are held on trust for the beneficial interest of the financier. The repayment of debts is paid into this trust account.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Mark Thompson

There are no available Videos from "Mark Thompson"