Key Participants in the Securities Lending Markets

Richard Comotto

30 years: Money markets

In this video, Richard explains "who" borrows and "who" lends. He also explains how borrowers and lenders interact, which gives us a view of the main flows across the securities lending market.

In this video, Richard explains "who" borrows and "who" lends. He also explains how borrowers and lenders interact, which gives us a view of the main flows across the securities lending market.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Key Participants in the Securities Lending Markets

13 mins 2 secs

Key learning objectives:

Outline who the end-suppliers and end-demand for securities are

Understand the intermediaries that facilitate transactions between lenders and borrowers

Overview:

To understand the structure of the securities lending market, it is helpful to look at the two ends of the market, end-supply and end-demand. Beneficial owners, such as institutional investors like pension funds and asset managers, provide most of the securities supply, while hedge funds and active investors make up the demand side. Intermediaries, including prime brokers and custodial agents, facilitate transactions between lenders and borrowers.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Who is providing the end supply in securities lending? I.e. Who is the lender?

The end-supply comes from so-called ‘beneficial owners’. The beneficial owners of securities, including government entities, pension funds, ETFs, mutual funds, insurance companies, broker-dealers, endowments, foundations, corporates, and some large hedge funds, lend securities in securities lending transactions. These entities are naturally risk-averse and try to limit their risk by only lending to a narrow list of borrowers. They often employ intermediaries as they lack the scale to manage their own securities lending, and they may also insist on indemnification against the risk of securities not being returned.

Who borrows securities?

Hedge funds and other active investors, as well as traders like broker-dealers and market-makers, borrow securities. Hedge funds use the intermediary services of prime brokers.

Some borrowers are also investors who mainly run long investment positions, such as funds that are allowed to both leverage or go short within limits. Long/short funds and liability-driven investors tend to borrow through their custodial agents.

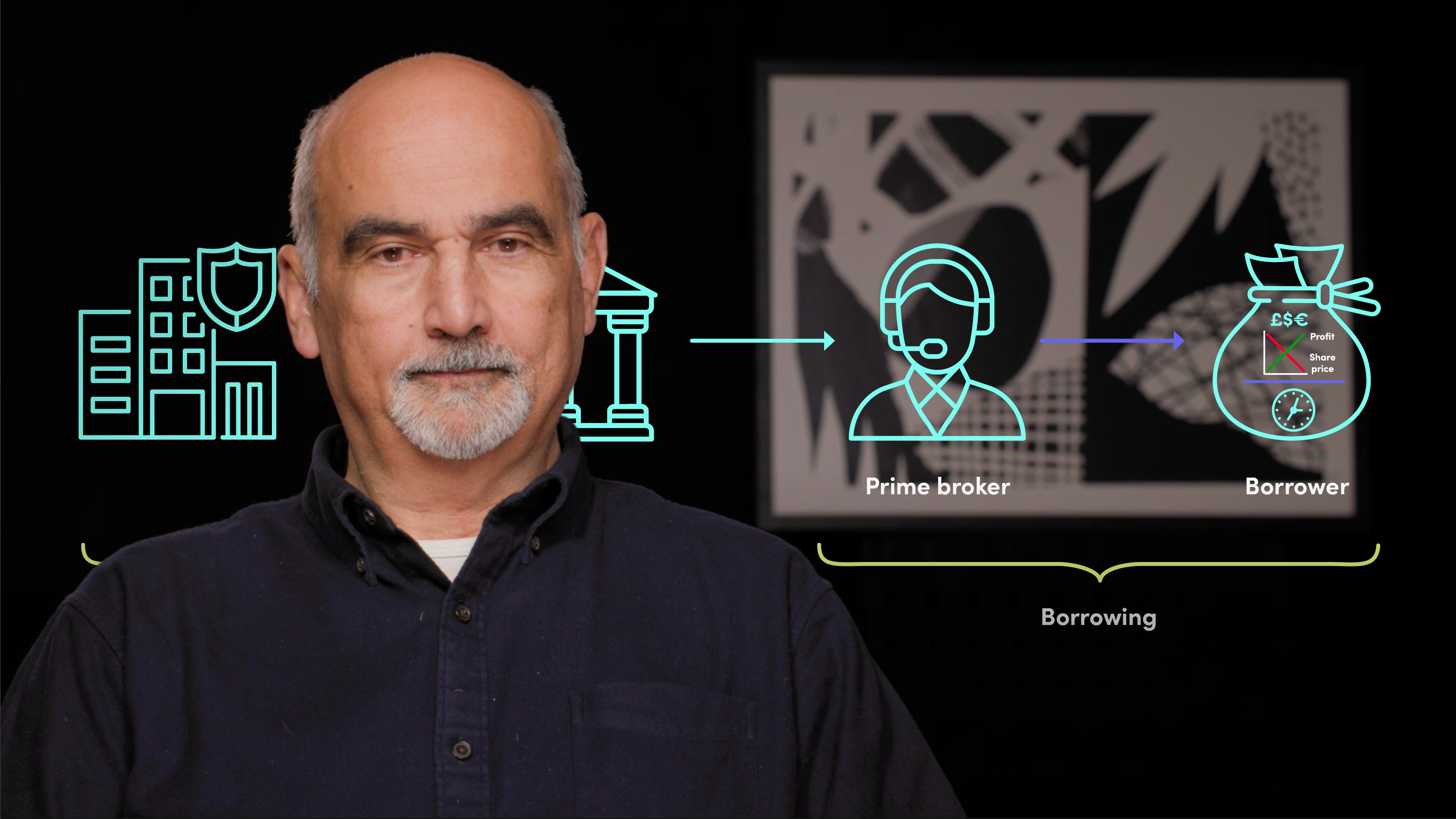

Who are the intermediaries involved to facilitate transactions between lenders and borrowers?

In the securities lending market, there are three intermediaries involved in facilitating transactions between lenders and borrowers, namely prime brokers, principal lenders and agency lenders.

Prime brokers are brokers used by hedge funds to clear and settle trades, and offer additional services like collateral management and setting up a hedge fund. Hedge funds use prime brokers as they are usually unable to borrow directly from beneficial owners.

While some beneficial owners choose to lend directly, direct lending is rare and limited to large investors. Some beneficial owners lend to "principal lenders" who take credit risk on borrowers and commercial risk on securities demand. Beneficial owners in this case have guaranteed fixed revenue, low overheads, and little credit risk.

The most common intermediaries in the securities lending market are agents, and they come in different forms, but the majority of securities lending agents are the custodian banks of the beneficial owners. It is also fairly common for asset managers to act as securities lending agents for the funds which they manage. Agents will manage securities lending (pre and post trade) and, where collateral takes the form of cash, they may also be responsible for cash collateral reinvestment.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Richard Comotto

There are no available Videos from "Richard Comotto"