Liability Management Case Studies

Sushanth Papireddy

15 years: Liability Management

In this video, Sushanth takes us through some practical real world examples of liability management transactions to conceptualise the topics learned so far in the previous two videos.

In this video, Sushanth takes us through some practical real world examples of liability management transactions to conceptualise the topics learned so far in the previous two videos.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Liability Management Case Studies

4 mins 43 secs

Key learning objectives:

Outline the different liability management techniques in practice

Understand the different reasons the companies undertook the transactions

Overview:

Liability management transactions take place every single day, outlining a few however; VIGIE sought to solicit consent from noteholders to approve its merger with Veolia in August 2022, while also requesting certain technical amendments to its hybrid bonds. K+S AG launched a tender offer for one of its bonds in November 2022 to use surplus cash, reduce debt and future interest expense. In September 2022, KTZ made a successful tender offer with exit consent for its bonds, optimising its cost of debt, and Stada announced an exchange offer to extend the maturity profile of its debt in October 2022. The transactions were all successful, with high participation rates from bondholders.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Why did VIGIE undertake a consent solicitation and what was the outcome?

VIGIE undertook a consent solicitation in August 2022 to obtain consent from noteholders to approve a merger with Veolia, following which the issuer of the bonds would be substituted with Veolia. The consent solicitation also sought certain technical amendments to the hybrid bonds. The outcome was that 12 out of 14 series of bonds accepted the proposals in the first meeting, and the remaining 2 bonds successfully implemented the proposals in a second meeting.

Why did K+S AG undertake a tender offer?

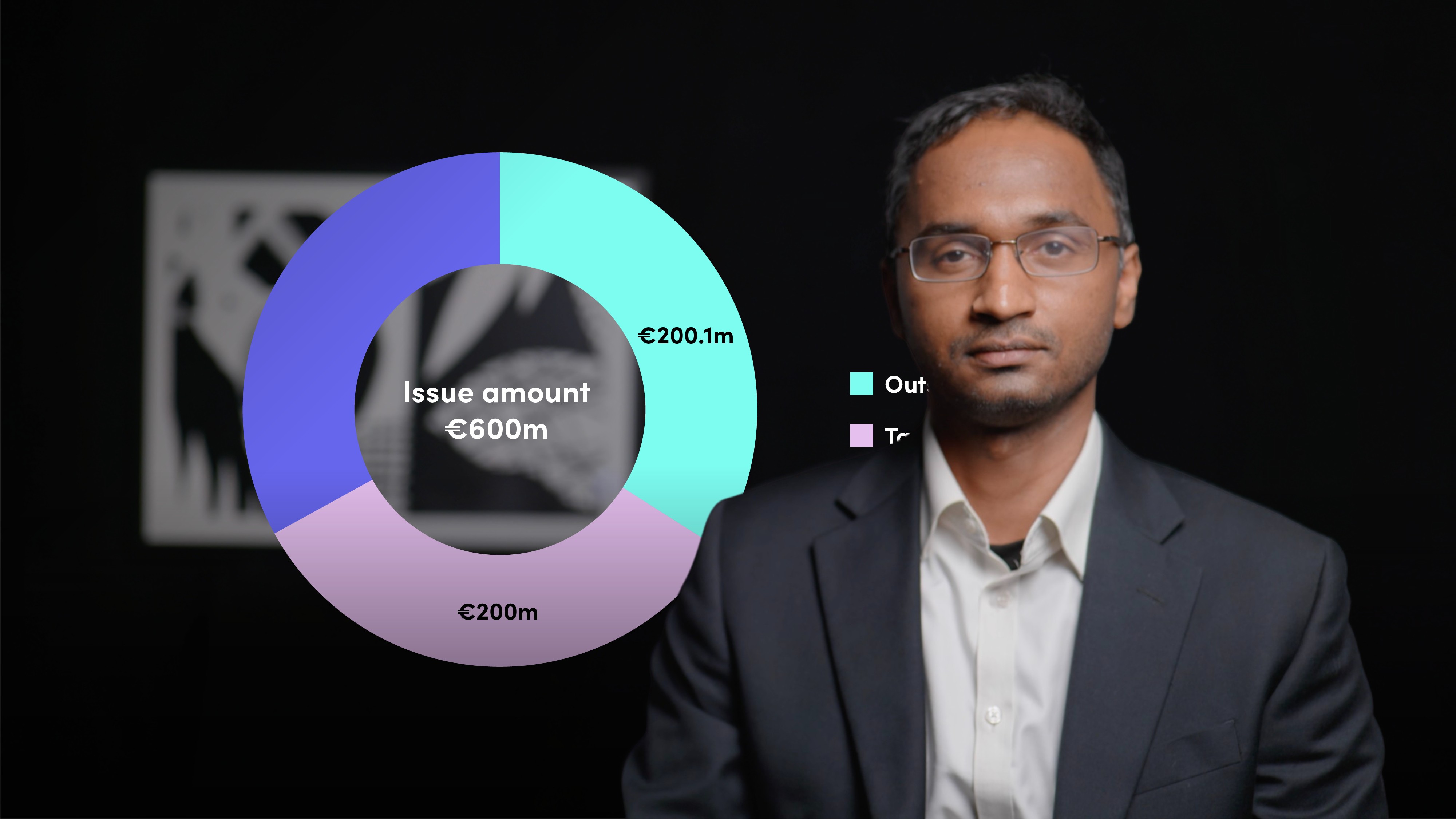

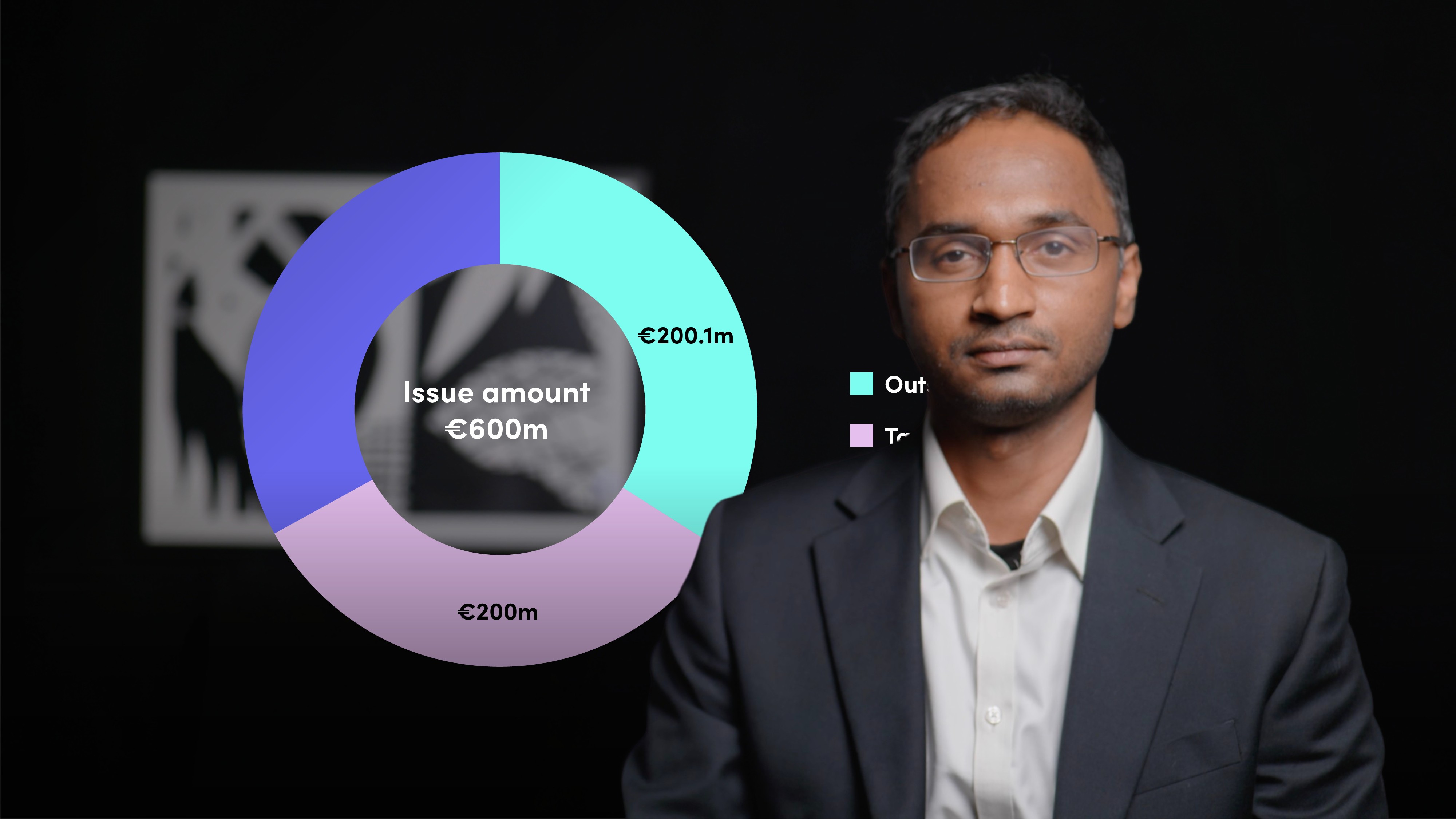

K+S AG undertook a tender offer in November 2022 to proactively use surplus cash, reduce debt, and future interest expense. The offer targeted one of its bonds maturing in 2024, with €400.1m outstanding, and sought to purchase €200m of the bonds, representing 50% of the amount outstanding, at a premium to the market price. If the company received more bonds than the target amount, it would pro-rate the bonds tendered.

Why did KTZ undertake a tender offer with an exit consent?

KTZ undertook a tender offer with an exit consent in September 2022 to optimise its cost of debt by buying back all of its bonds maturing in 2042 at a premium of about 15 points above the market price. The offer required bondholders who tendered to also consent to insert a mandatory issuer call option at par into the bonds. If two-thirds of the notional participated, the redemption option would have been activated, allowing the company to redeem the remaining amount. The transaction was successful.

Why did Stada undertake an exchange offer?

Stada undertook an exchange offer in October 2022 to extend the maturity profile of its debt. The exchange offer was targeted at 2 series of its senior secured notes (SSNs) maturing in 2024, with a total amount outstanding of just under €1.9bn. Holders of 2024 SSNs were offered new SSNs maturing in 2026 on a 1-for-1 basis and received €80 for each €1,000 of 2024 SSNs. The exchange offer was contingent on at least EUR 500m of the 2024 SSNs participating, resulting in at least €500m of new SSNs to be issued.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Sushanth Papireddy

There are no available Videos from "Sushanth Papireddy"