What is a Market Bubble?

Peter Eisenhardt

30 years: Capital markets & investment banking

In this first part of the series on market bubbles, Peter explains what market bubbles are and how they form by referencing Hyman Minsky's five stages of a market bubble.

In this first part of the series on market bubbles, Peter explains what market bubbles are and how they form by referencing Hyman Minsky's five stages of a market bubble.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a Market Bubble?

3 mins 34 secs

Key learning objectives:

Define a market bubble

Understand the five stages of a bubble

Overview:

Market bubbles are caused when optimism around an asset drives the price well above a rational valuation. Bubbles often start with excitement and end with panic.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a market bubble?

Market bubbles are when prices of assets rise well above and beyond all accepted analytical means of valuation. Bubbles are caused by many factors, including greed, group-think and herd mentality, and are the subject of in-depth study by behavioural economists.

Markets are made up of human beings, and human beings can be irrational. Emotion drives people to follow and exacerbate trends, and “jump on the bandwagon”. Rising prices attract greater investment. There is a fear of missing out and being left behind.

It can be said that it is human nature to be a pro-cyclical - or momentum - investor, rather than a value investor. Bubbles burst when reality sets in, and prices come crashing down to earth. As an overpriced market is fragile, any number of outside factors - such as an economic downturn or change in monetary policy - can pop a bubble. Bubbles lead to widespread economic hardship. Trust in the economy and financial institutions take considerable time to rebuild.

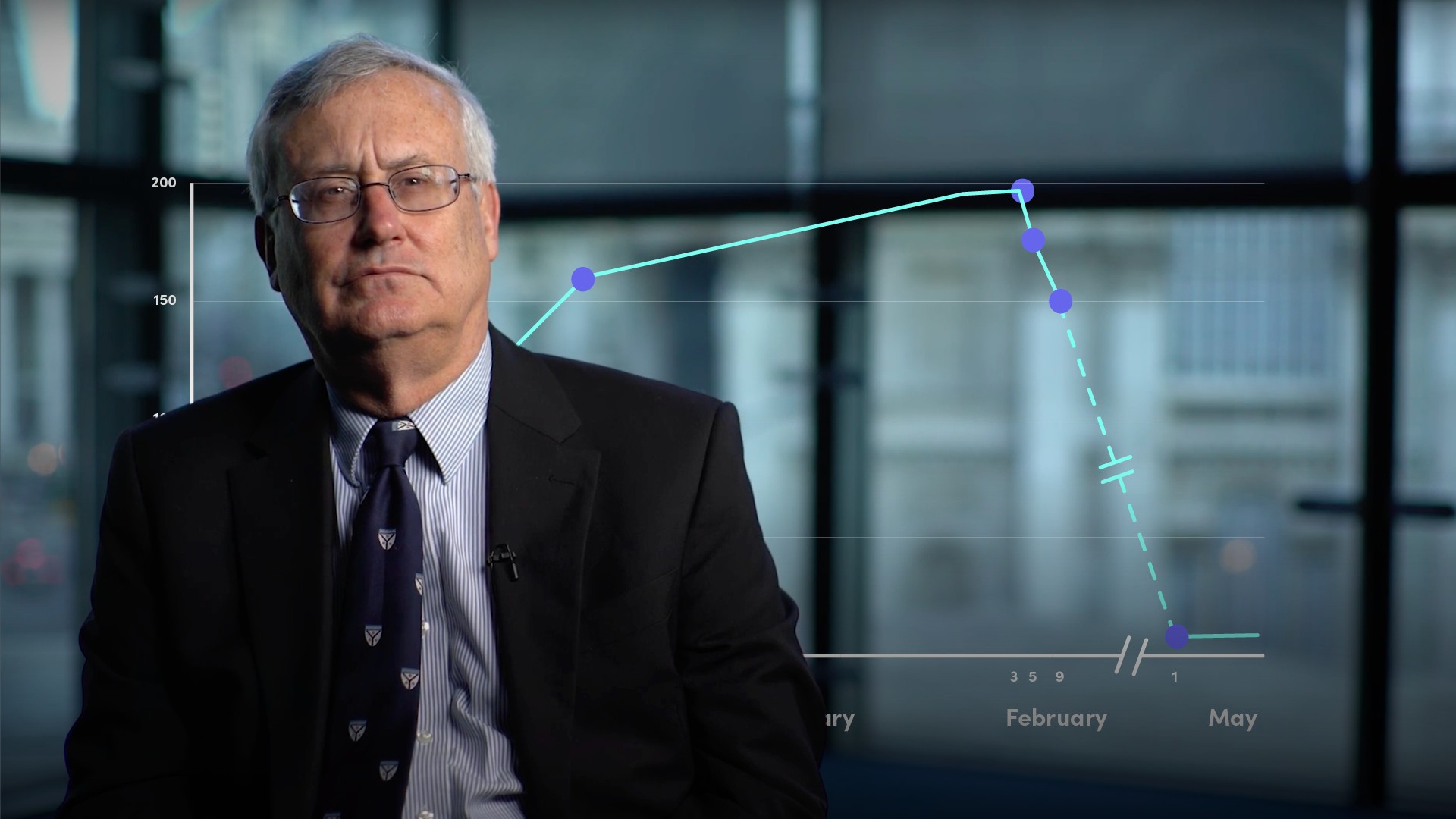

What are the stages of a market bubble?

- Displacement

- Investors become enamoured with a new paradigm. This could be an exciting new opportunity, innovation, or technology.

- Market Boom

- Prices rise slowly at first, but gain momentum as more and more participants enter the market. The asset attracts increasing attention. Credit is made available for purchase of the asset.

- Euphoria

- Caution is thrown to the wind, and prices skyrocket. Valuations reach extreme levels. New valuation measures and metrics emerge to justify ever higher prices.

- Bursting of the Bubble

- A single or several events signal that the asset isn’t equal to its lofty valuation. Some have called this the “Minsky Moment”. Those with first-hand understanding of the asset and smart money, cash out, taking profits. The bubble is now pricked and the rapid inflation phase is over. Prices may remain relatively high for a while, but warning signs are flashing.

- Panic

- Asset prices plunge as the investment does not generate returns. Investors and speculators are faced with margin calls and forced to liquidate. This selling leads to further drops in price, triggering still more sales. Many investors are willing to get out at any price.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Peter Eisenhardt

There are no available Videos from "Peter Eisenhardt"