Market Risk Reporting

Paul Newson

20 years: Market Risk

The previous videos in this series covered the nature of market risk, how it affects the trading and the banking book differently and how IRRBB is probably the major market risk for most retail and commercial banks. In this video, Paul explains how market risk is reported both internally and externally.

The previous videos in this series covered the nature of market risk, how it affects the trading and the banking book differently and how IRRBB is probably the major market risk for most retail and commercial banks. In this video, Paul explains how market risk is reported both internally and externally.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Market Risk Reporting

11 mins 45 secs

Key learning objectives:

Outline the process by which market risk in the trading book is reported and the frequency

Outline how reporting market risk in the banking book is different from the trading book

Overview:

Market risk needs to be reported both internally and externally, both from the trading book and banking book. Reporting frequency varies between the trading book and banking book. In a trading book, positions need to be monitored on as near a real time basis as possible and overall risk, usually on a VaR basis, needs to be computed at the end of each day to ensure adherence with whatever limits are in place. Within the banking book banks have to report on both economic value and income sensitivity measures. Economic value sensitivity measures should be reported at least weekly, daily for larger banks. Whereas income sensitivity should be reported on a monthly basis.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How is market risk in the trading book reported?

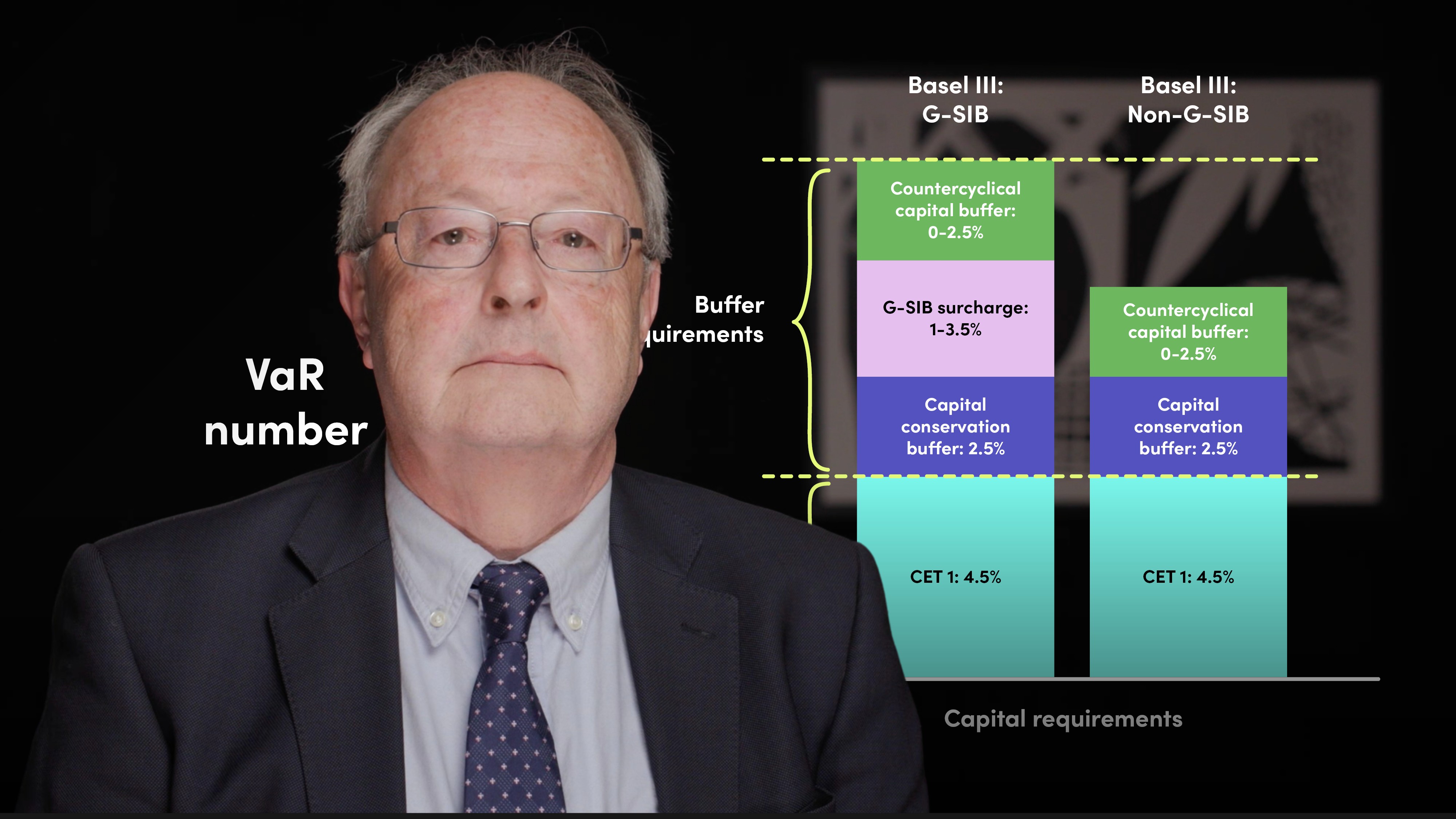

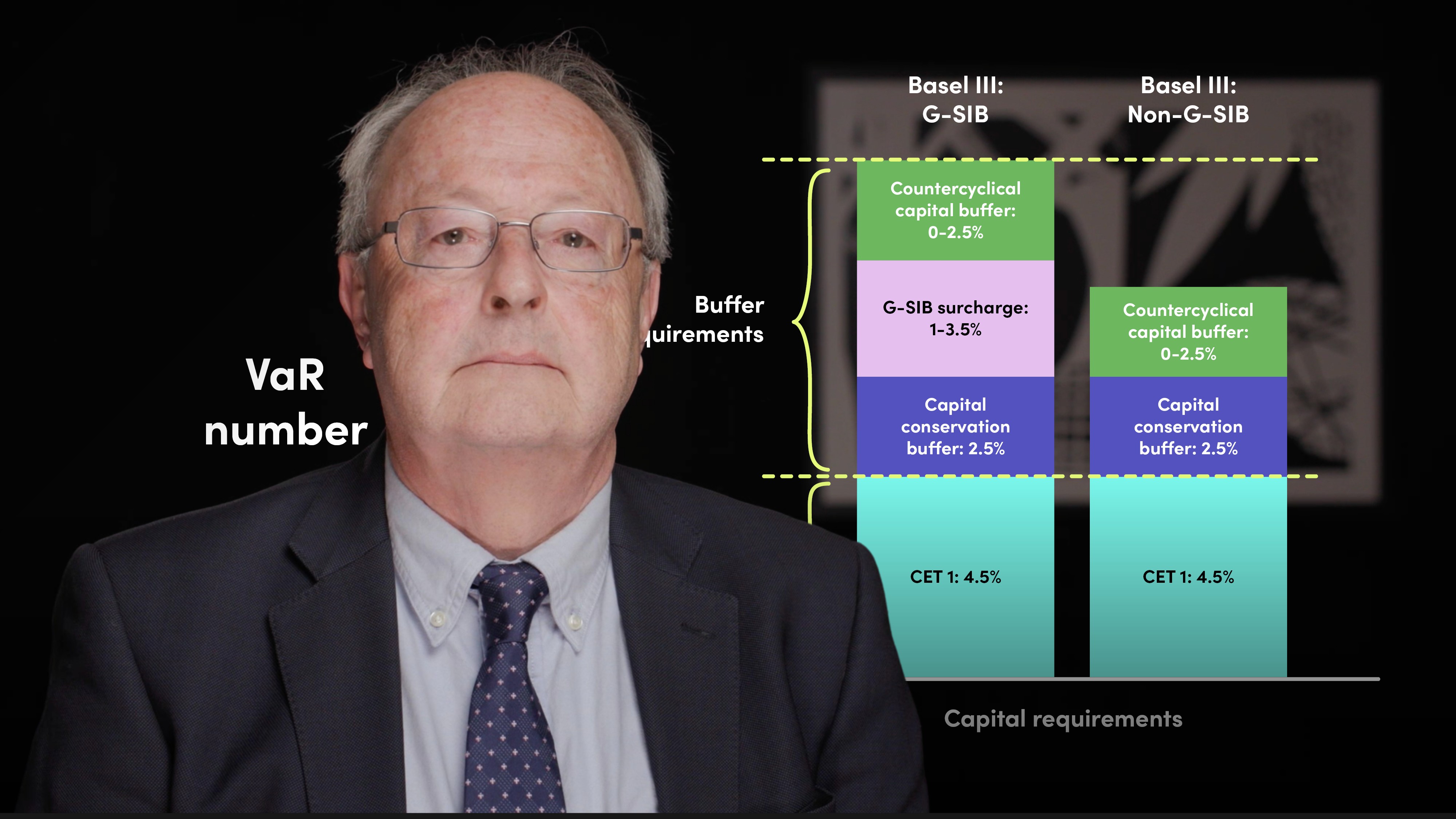

Positions in a trading book need to be monitored on as close to a real time basis as possible and overall risk (in a VaR basis) needs to be computed at the end of each day. This daily reporting accords with the mandatory accounting treatment and each position needs to be revalued each day with any change immediately being passed onto the P&L. The Value at Risk (VaR) number estimates how much the current value might change tomorrow given a certain level of confidence. The bank's VaR number is what the regulators use to determine capital requirements.

How is market risk in the banking book reported?

Risk in the banking book is measured using both economic value and income sensitivity measures and both should be reported. It is a regulatory requirement that banks use both measures to monitor and manage IRRBB.

For internal reporting and regarding economic value, the underlying gap mismatch report should be reported at least weekly, and daily for larger banks. Economic value reporting is primarily a control best suited to quick identification of excessive repricing risk.

Income sensitivity, on the other hand, attempts to capture all those additional behavioural and structural risks whose hedging can, by definition, only be approximate. Over frequent reporting is unlikely to achieve much in respect of addressing the underlying risks, reporting should be on a monthly basis for a discussion at the banks ALCO.

For external reporting of IRRBB new regulatory requirements mean that in most countries banks have to disclose both EVE sensitivity to 6 prescribed interest rate shocks and NII sensitivity to 2 prescribed shocks.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Paul Newson

There are no available Videos from "Paul Newson"