What is Maturity Transformation?

Moorad Choudhry

34 years: Banking and Capital Markets

In this video, Moorad introduces the concept of maturity transformation before moving onto how to understand, use and analyse the yield curve.

In this video, Moorad introduces the concept of maturity transformation before moving onto how to understand, use and analyse the yield curve.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is Maturity Transformation?

25 mins 9 secs

Key learning objectives:

Understand maturity transformation and the yield curve

Identify the different interpretations of the yield curve

Learn how investors and bankers use the yield curve

Overview:

Maturity transformation is the act of banks accepting traditionally short-term deposits and using these deposits to make loans that will not be repaid for years. This creates an operating risk for the bank, which must be managed in perpetuity. This risk is affected by the yield curve: a snapshot of the current level of market interest rates. The yield curve indicates current market trading and future expectations. There are multiple different ways to interpret a yield curve such as: the conventional, upward-sloping, downward-sloping, and humped shapes. Both bankers and investors utilise the yield curve to decide when to loan money or determine market sentiment.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is Maturity Transformation?

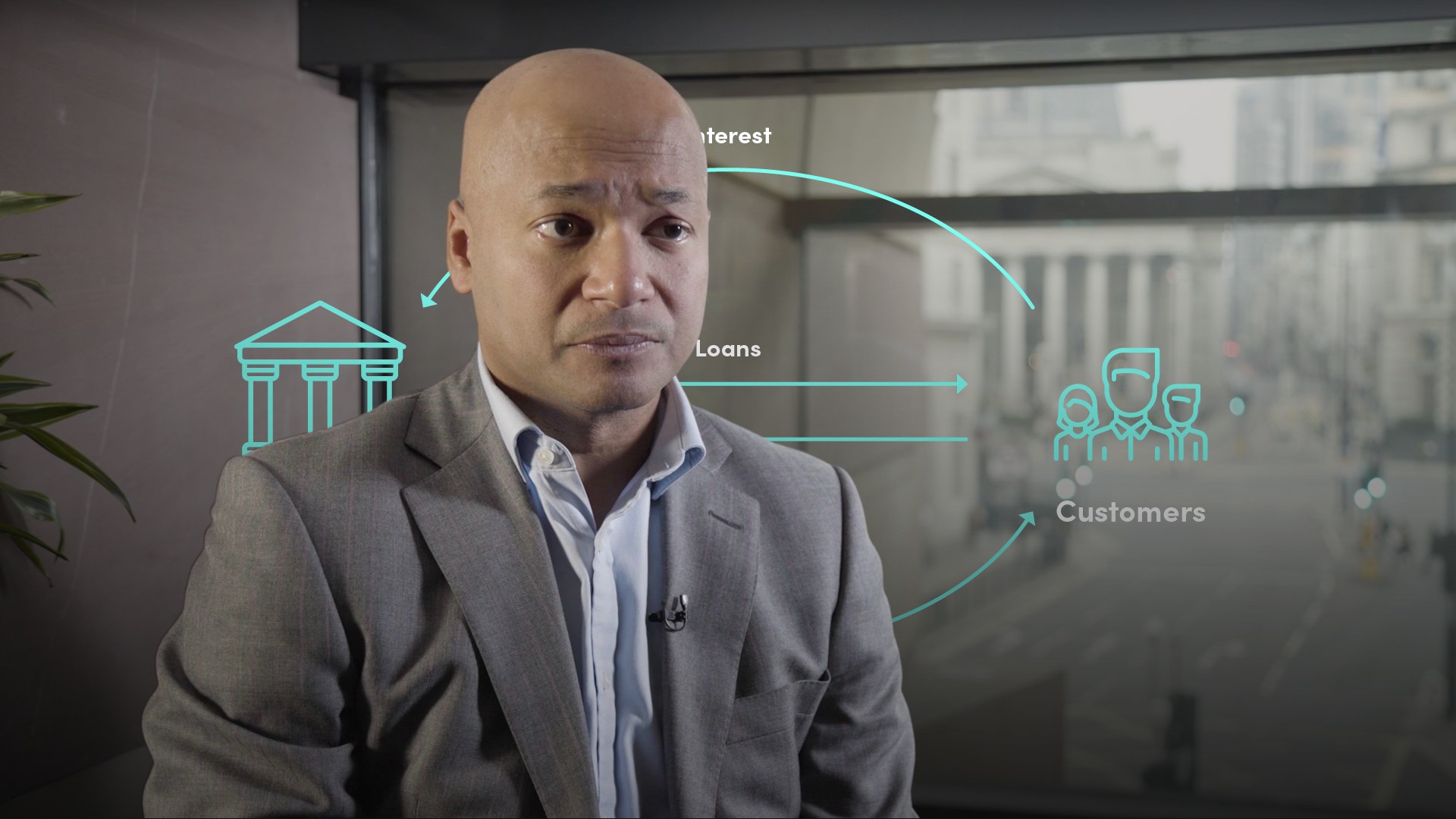

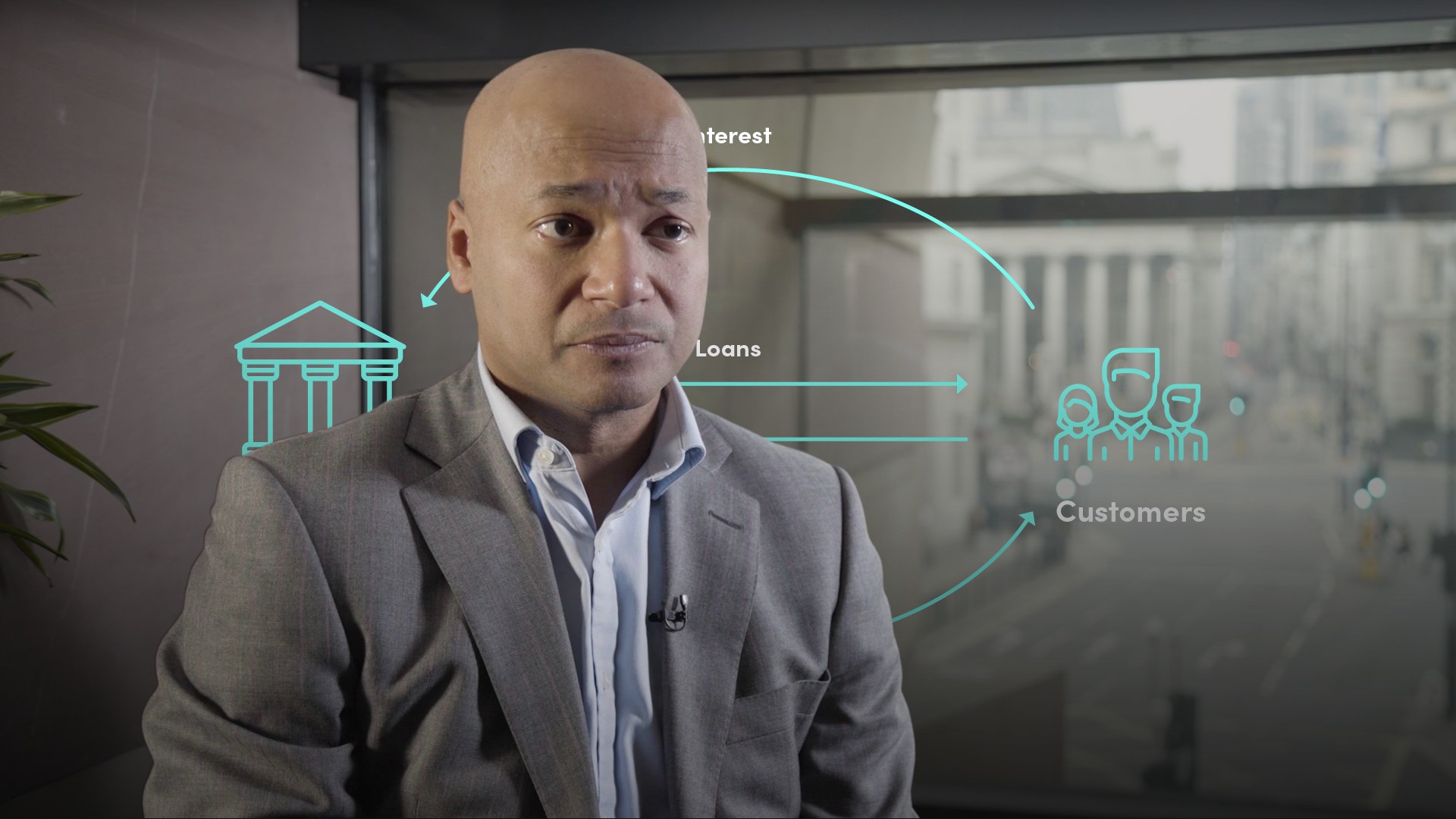

The primary function of a bank is to act as a safe store of deposit for customers’ money, and then also to use these funds to enable it to make loans to customers. When a customer makes a deposit at a bank, the bank has to ensure that the customer’s funds are available to it at instant notice. When a customer takes out a loan from a bank there will be a specified date on which the customer will repay the loan in full. This act of accepting deposits that may be required back by the customer at an instant’s notice, but may also be left with the bank for many years while using these same funds to make loans that will not be repaid back for many years, is maturity transformation.

How is the Yield Curve Derived?

Deposit customers placing their funds with a bank will expect to receive a rate of interest on that money for every day that the deposit is in place. Loan customers borrowing money from a bank will expect to pay interest on that money for the period of the loan. If we plot the interest rates applicable for deposits and loans for call money out to long dated-loans, we will have a yield curve for that market. The yield curve is a graph that plots the interest rate, or yield, of deposits or loans against their term-to-maturity. In other words, it is a snapshot of the current level of interest rates in the market. It is not a historical graph, that is, it does not show the level of yields over time. We expect that yields would increase the longer the maturity due to inflation and future economic risk.

What does the Yield Curve tell us, and who uses it?

The yield curve tells us where the financial market is trading now. It also implies the level of trading for the future, or at least what the market thinks will be happening in the future. In other words, it is a good indicator of the future level of the market. It is also a much more reliable indicator than any other used by private investors, and we can prove this empirically. Bond market participants analyse the present shape of the yield curve in an effort to determine the implications regarding the direction of market interest rates. This is perhaps one of the most important functions of the yield curve. Interpreting it is a mixture of art and science. The yield curve is scrutinised for its information content not just by bond traders and fund managers but also by corporate financiers as part of their project appraisal. Central banks and government treasury departments also analyse the yield curve for its information content, not just regarding forward interest rates but also inflation levels. They then use this information when setting interest rates for the whole country!

What are the Different Shapes of a Yield Curve?

There are four basic shapes of a yield curve. Normal or conventional: in which yields are at “average” levels and the curve slopes gently upwards as maturity increases. Upward sloping or positive or rising: in which yields are at historically low levels, with long rates substantially greater than short rates. Downward sloping or inverted or negative: in which yield levels are very high by historical standards, but long-term yields are significantly lower than short rates. Humped: where yields are high with the curve rising to a peak in the medium-term maturity area, and then sloping downwards at longer maturities.

What are some Theories of the Yield Curve?

The expectations hypothesis suggests that bondholders’ expectations determine the course of future interest rates. A related theory is the pure or unbiased expectations hypothesis, which states that current implied forward rates are unbiased estimators of future spot interest rates. It assumes that investors act in a way that eliminates any advantage of holding instruments of a particular maturity. The liquidity preference theory explains why we might feel that longer-maturity investments are riskier than shorter ones. An investor lending money for a five-year term will usually demand a higher rate of interest than if she were to lend the same customer money for a five-week term. The difference between a yield curve explained by unbiased expectations and an actual observed yield curve is sometimes referred to as the liquidity premium. This refers to the fact that in some cases short-dated bonds are easier to transact in the market than long-term bonds. It is difficult to quantify the effect of the liquidity premium which is not static and fluctuates over time. The liquidity premium is so-called because the yields on such securities must be higher than those available on short-dated securities, which are more liquid and may be converted into cash more easily.

Why should Investors use the Yield Curve?

There are a number of reasons why all investors should follow the yield curve. Forecasting is quick and simple if we use the yield curve, and does not require sophisticated analysis. The simplicity of the yield curve, coupled with its reliability, means that it can be used to confirm conclusions that we have obtained from other indicators. The yield curve serves as a good indicator of market sentiment. The shape of the yield curve also reflects the following anticipated changes by the central bank, the extent of the risk premium and when the curve is inverted, it can explain the extent of the impending recession.

When would a Yield Curve be beneficial to a bank?

When the yield curve is positively sloped, the conventional approach is to fund the book at the short end of the curve and lend at the long end. The bank would fund short. In the case of an inverted yield curve, a bank will lend at the short end of the curve and borrow at the longer end. This is known as funding long.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Moorad Choudhry

There are no available Videos from "Moorad Choudhry"