What are Medium-Term Notes? I

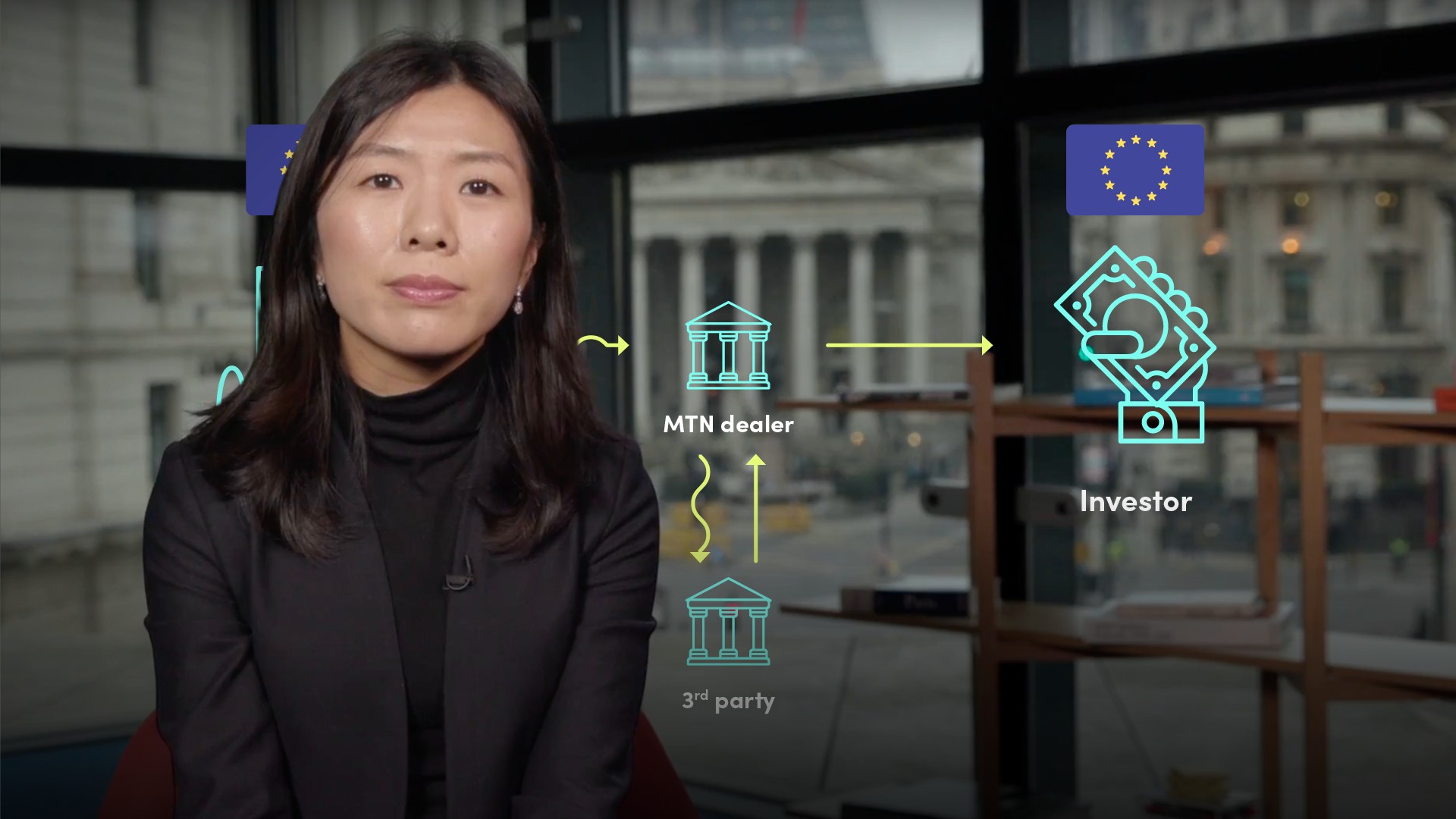

Aya Suzuki

15 years: Capital markets

A Medium-Term Note, or MTN, is a form of privately placed debt in a bond format. In this video, Aya answers the questions: what is a MTN, what is a private placement and what are the differences between MTNs and Public Benchmark Transactions?

A Medium-Term Note, or MTN, is a form of privately placed debt in a bond format. In this video, Aya answers the questions: what is a MTN, what is a private placement and what are the differences between MTNs and Public Benchmark Transactions?

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are Medium-Term Notes? I

10 mins 17 secs

Key learning objectives:

Define MTNs, MTN programmes and Private Placement

Explain the differences between MTNs and Benchmark transactions

Overview:

A Medium-Term Note refers to any fixed-income security with a maturity longer than 1 year. They are typically issued by financial institutions, corporations, and public finance borrowers.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are MTNs and Private Placements?

- A Medium-Term Note - A form of privately placed debt in a bond format

- Private Placement - Privately placed debt or equity

What is an MTN Programme, and what are its benefits?

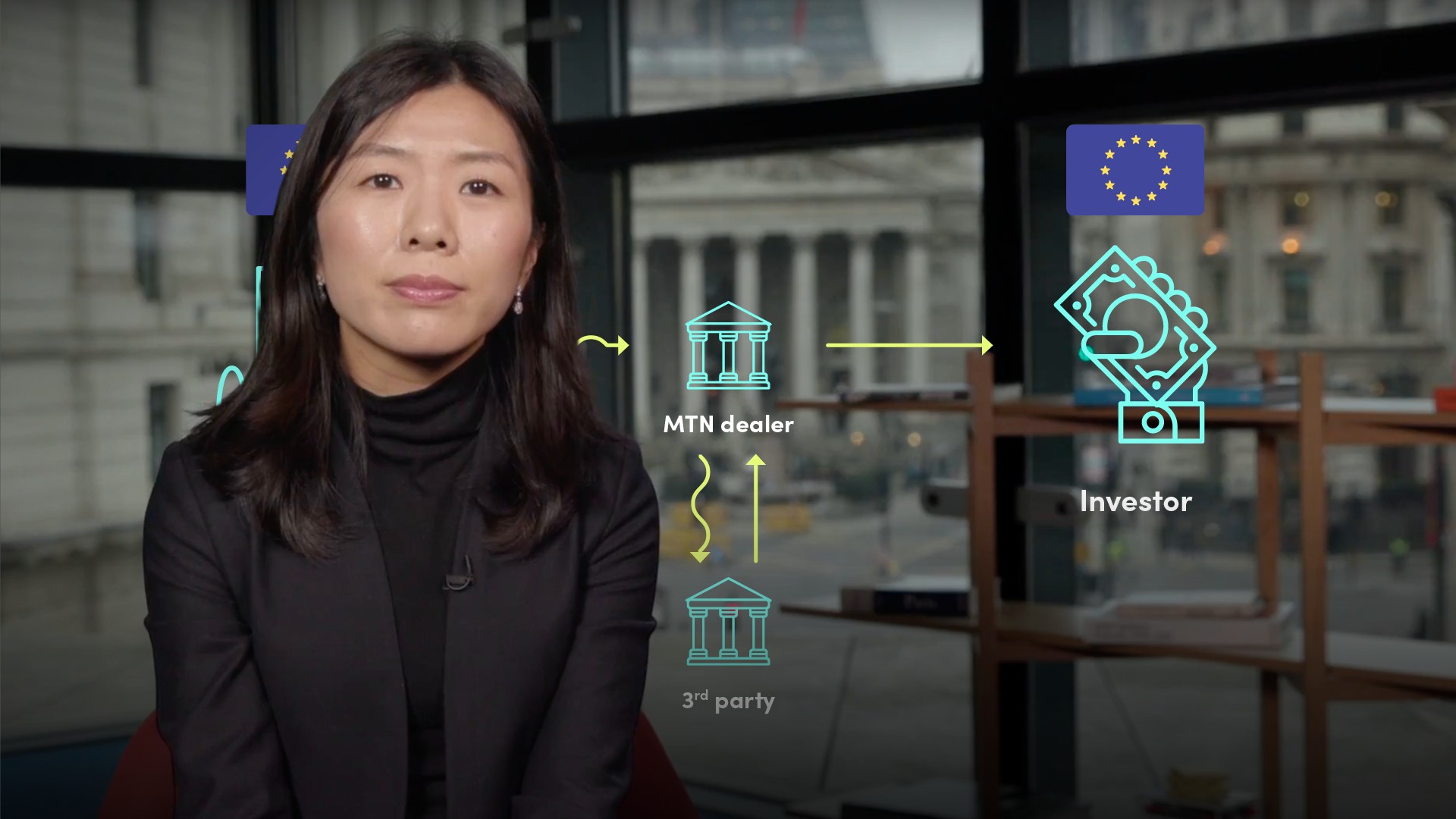

MTN Programme - This is an issuance programme that allows issuers, via a panel of MTN dealers, to continuously offer securities under different structures, sizes and maturities. They are typically listed on regulated stock exchanges, and are rated in line with borrowers credit ratings.

Benefit - If an MTN programme is set up and kept up to date, the borrower can issue debt very quickly with little additional cost, which means they can go ahead and raise capital quickly when the market conditions are favourable. Thus, if a borrower needs to access capital markets on a regular basis, it’s cost-efficient to set up an MTN programme.

In what ways do MTNs and Public Benchmark Transactions differ?

- Publicity and Number of Investors:

- Benchmark transactions are publicly announced, so the entire market is given access to the information. They help issuers access the widest possible audience for an optimal outcome. Bookbuilding starts right after the announcement

- MTNs can be kept “off the radar” as long as both the issuer and investor agree to do so. There is no public bookbuilding

- Size:

- MTNs are generally sold in 10-100 million US dollars equivalent per trade, based on a single investor's demands. They are typically arranged by a single dealer

- Benchmark transactions are typically syndicated by multiple dealers and are minimum 500 million in size in USD and Euros. A benchmark transaction may have single or multiple tranches in order to achieve desired size and duration

- Maturity:

- MTNs are flexible, ranging from 1 year to 30 years or longer, as terms are agreed between the issuer and investor

- Benchmark bond transactions are driven by the relevant market demand. In Euros, most transactions are in the 5-15 year maturity bucket

- Currency:

- MTNs can be issued in any traded currency

- Benchmark transactions can too, although they are driven by market demand and by the borrower's requirement for size, most come in major currencies such as USD, Euro and GBP

- Timing of Transactions:

- MTNs can be issued any day and time, provided that the issuer is not restricted from doing so. MTNs can be issued very quickly, such as, within 15 minutes from the confirmation of an investors order to execution

- Market demand dictates the timing of benchmark transactions. They generally require a minimum of half a day between announcement and launching and pricing, given the need for bookbuilding

- Frequency of Issuance:

- MTNs can be issued on a daily basis

- The frequency of benchmark issuance is driven by the capacity and availability of each relevant market

- Structures:

- MTNs - A number of large frequent issuers are flexible to issue both plain vanilla, i.e. standard bonds, as well as structured MTNs (those using derivatives structures that dictate payouts to investors)

- Benchmark transactions tend to be plain vanilla due to general market demand

- Allocations:

- A buyer of an MTN is able to purchase the size they wish, as agreed with the issuer, as MTNs are transactions based on bilateral negotiations

- Benchmark transactions are sized to suit market demand at the time

- Liquidity in the secondary market:

- Most MTNs do not have a liquid secondary market, given the limited number of participants in each transaction

- Benchmark transactions tend to have more liquid secondary markets, given the number of investors involved

- Pricing:

- MTN pricing tends to be tighter, resulting in a lower yield. The rationale is that few issuers wish to pay the same price for raising 10 million Euro and 1 billion Euro

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Aya Suzuki

There are no available Videos from "Aya Suzuki"