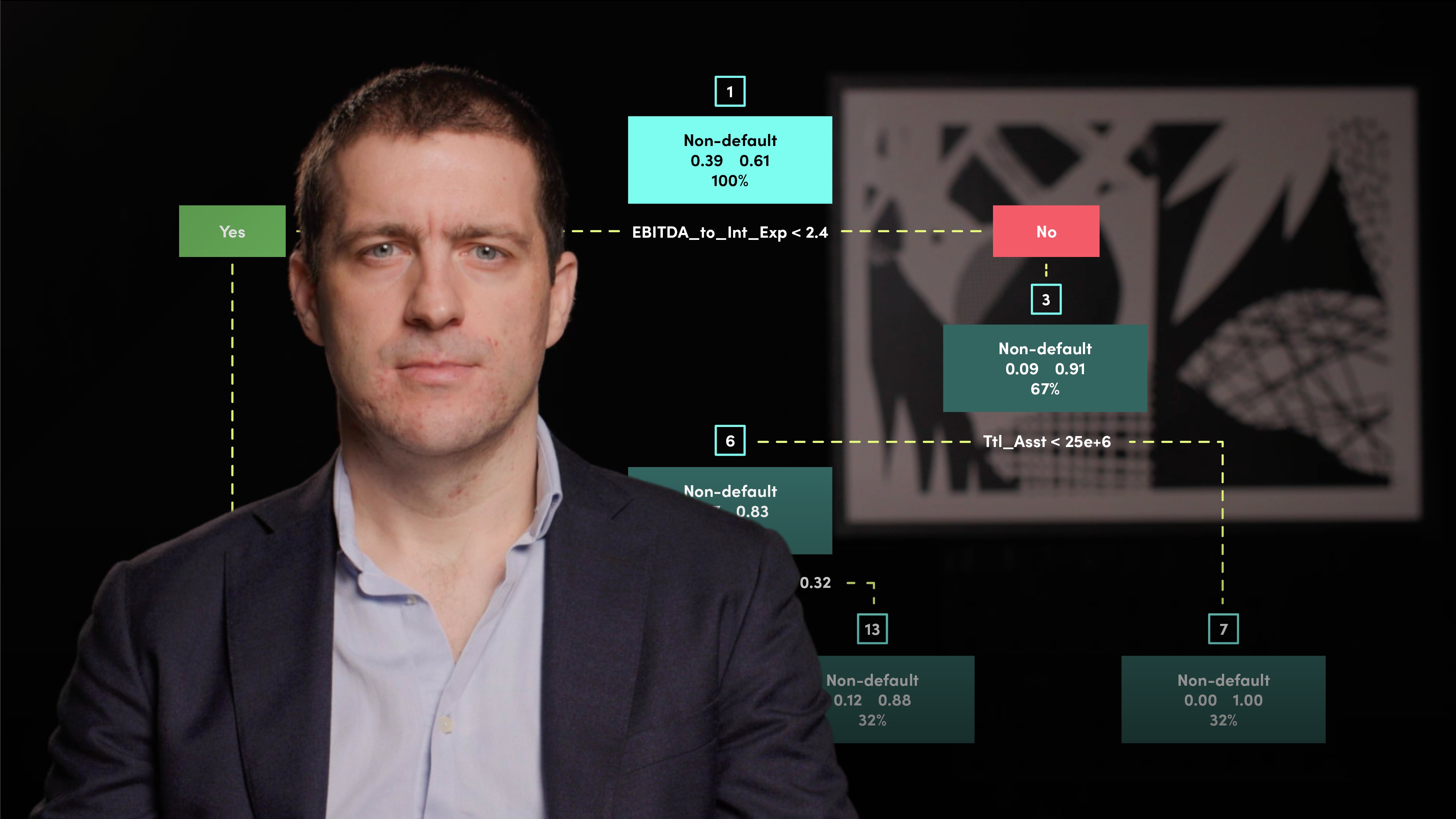

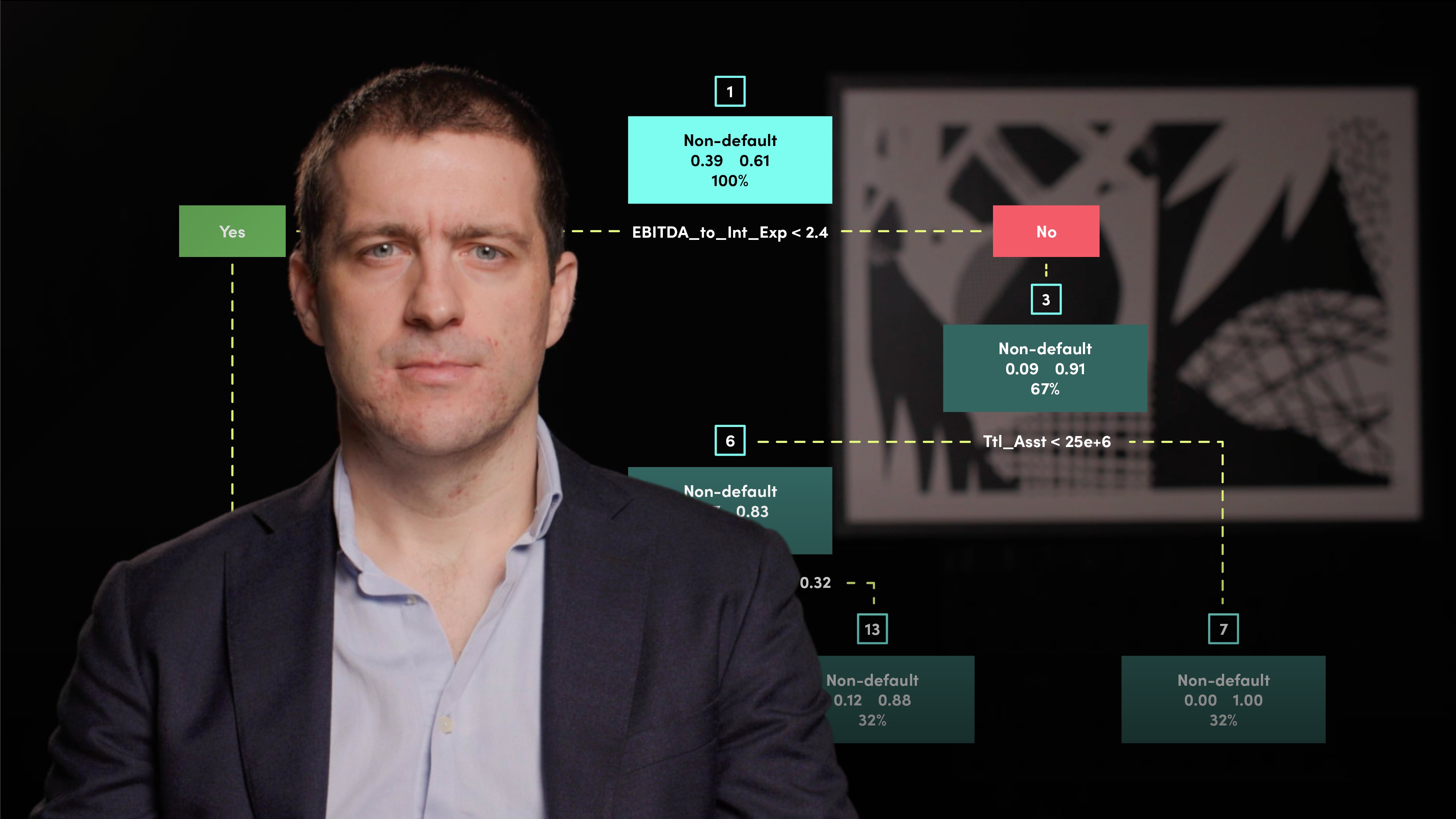

Moody's Machine Learning Case Study

Carlos Salas

Portfolio Manager and Data Scientist

Let’s see how a credit rating agency used machine learning model training. Join Carlos Salas as he explores how data science and machine learning can be used in finance to improve credit scoring tools.

Let’s see how a credit rating agency used machine learning model training. Join Carlos Salas as he explores how data science and machine learning can be used in finance to improve credit scoring tools.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Moody's Machine Learning Case Study

5 mins 12 secs

Key learning objectives:

Understand how Moody’s use machine learning

Overview:

Moody’s is a credit rating agency who compared their internal parametric model against several machine learning models to assess the credit risk of small and medium-sized corporate borrowers. This assessment yielded surprising results, with the machine learning models outperforming Moody’s model.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How has Moody’s used data science?

Moody’s is a credit rating agency who compared their internal parametric model against several machine learning models to assess the credit risk of small and medium-sized corporate borrowers. Moody’s proprietary model uses a traditional parametric general additive framework (GAM). The alternative machine learning models used were random forest, boosting, and neural networks. Two different datasets were used for the comparison study. The first dataset utilises only firm information and financial ratios, while the second dataset adds additional data to the first such as behavioural information including credit line usage, loan payment behaviour, and other alternative data.

Generalisation results were impressive with machine learning models outperforming Moody’s proprietary model from 2 to 3% using both datasets. There is also an 8-10% jump in accuracy when adding loan behavioural information.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Carlos Salas

There are no available Videos from "Carlos Salas"