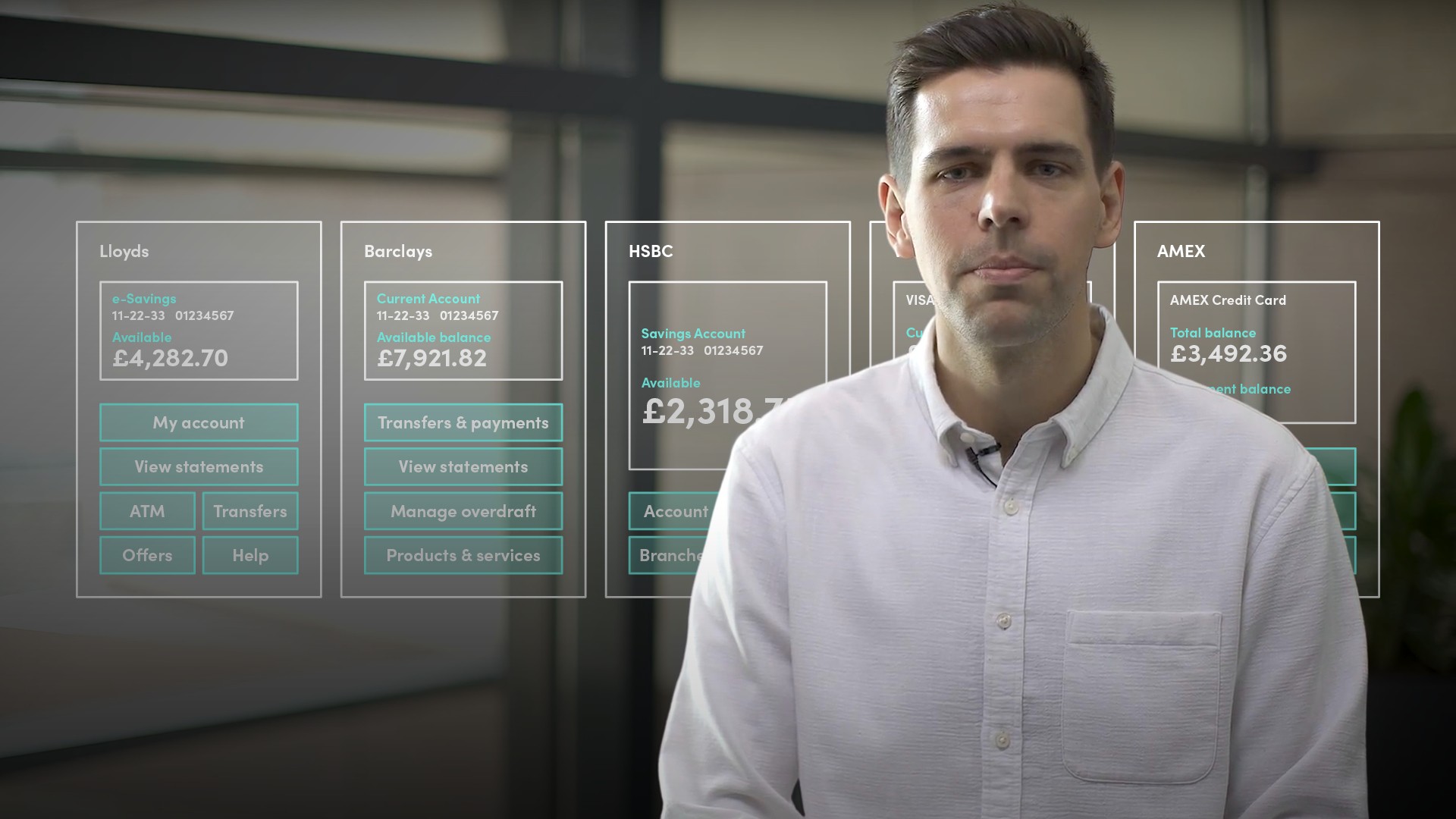

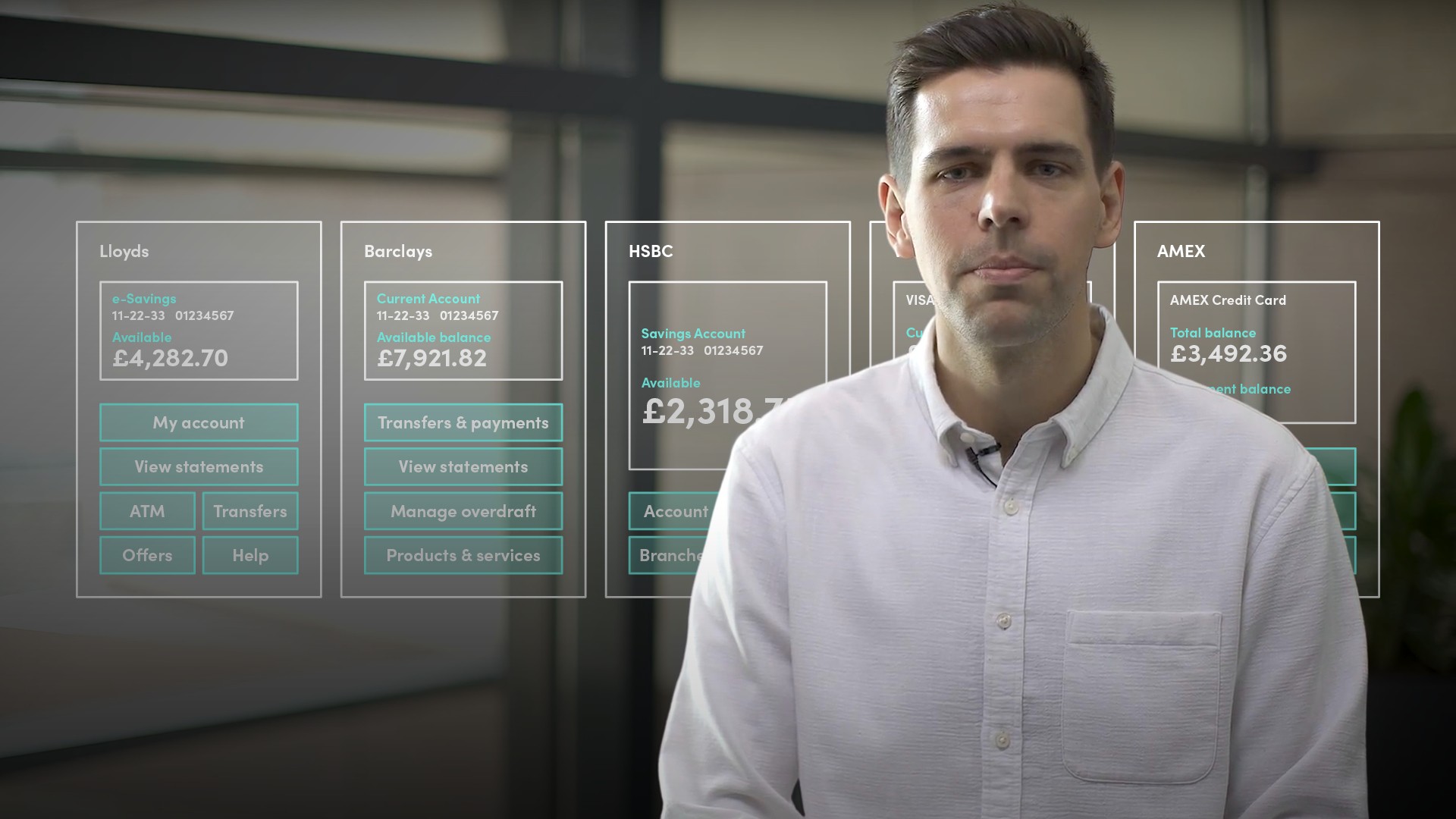

What is the Open Banking Initiative?

Jonny Hawkins

Financial technology & SMEs financing

The Open Banking initiative was launched to help level the advantage that established banks have over challenger banks in terms of the amount of customer data they hold. Jonny explains how Open Banking intends to solve this problem by providing examples with a focus on small and medium-sized enterprises.

The Open Banking initiative was launched to help level the advantage that established banks have over challenger banks in terms of the amount of customer data they hold. Jonny explains how Open Banking intends to solve this problem by providing examples with a focus on small and medium-sized enterprises.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the Open Banking Initiative?

7 mins 48 secs

Key learning objectives:

Explain the initial problem with established banks and the Open Banking Initiative to combat it

Discuss how Credit and Price decisions are made

The key metrics Underwriters use when reviewing customer data.

Explain the measures that are in place to ensure equity in markets.

Overview:

Open banking challenges the monopolistic behaviour of banks by ensuring more information and data is given to customers. It allows them to gain access to finance with ease due to the higher concentration in the market, overall providing a better experience than traditional banking.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the Open Banking initiative?

Typically, larger banks have a huge advantage over competitors in that they hold more data on customers. This makes it difficult for SMEs to grow as they’re unable to compete. Customers suffer as they overpay for existing services and don’t benefit from the competing alternatives that could be developed by new entrants.

Open Banking was introduced to tackle this problem by giving customers and SME’s ownership of their data. This enables customers to mandate their banks to share data they hold with other banks and third-party businesses. The benefit is:

- For customers, they can compare prices for existing products before choosing what's best for them.

- For new businesses, they grow and develop alternative product options to offer based on the availability of new data.

In practice, if an individual or SME was declined finance by their bank, they can request their data and information is shared with an alternative provider. They may confirm this applicant fits within their risk appetite for finance provision.

How is a Credit and Price Decision made?

Credit:

- Banking data must be collected from customers. E.g. through pdf statements

- Data reviewed by underwriters

Price:

- Future credit card sales are estimated

- This is done by collecting their historical sales and forecasting – Sharing statements from the credit card payment processor

What key metrics do Underwriters look for when reviewing data?

- Average balances

- The Proportion of days spent below nil balance

- Any recurring transactions

- Key categories such as tax or rent

The most important metrics will vary from business to business, depending on what they would most need to understand about potential customers.

What is the Consensual process when sharing Bank data?

This is an example of Openwrks’ process:

- Customers follow a hyperlink

- Customers are given information about the service provider & regulation by the FCA

- They then explicitly give consent for Openwrks to give their data

- The customer selects their bank from a list of options

- They are then transferred to their online banking portal

- URL is recognisable to the customer as their secure online banking

- Login details entered.

- The customer will give their bank permission to share data with specified third parties

- Customer data is given to Openwrks.

What regulation is in place to protect consumers?

The Competition and Markets Authority:

- They work to promote competition for the benefit of consumers.

- The overarching aim is to make markets work well for consumers, businesses and the economy.

In 2016 they published a report concluding that older and larger banks do not have to compete hard enough for their customers’ business. Similarly, smaller and newer banks find it difficult to grow. Hence, consumers are overpaying for existing services and not benefitting from new services.

Payment Services Directive 2:

- aims to better protect consumers when they pay online.

- Promotes the development and use of innovative online and mobile payments such as through open banking.

- Makes cross-border European payment services safer.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Jonny Hawkins

There are no available Videos from "Jonny Hawkins"