Operational Risks to Manage at a Wealth Management Firm I

Faisal Sheikh

25 years: Wealth and risk management specialist

In the next video, Faisal dives deeper into the specific operational risks that are particularly relevant to wealth management firms and their clients.

In the next video, Faisal dives deeper into the specific operational risks that are particularly relevant to wealth management firms and their clients.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Operational Risks to Manage at a Wealth Management Firm I

7 mins 44 secs

Key learning objectives:

Outline how fraud, business continuity and conduct risk impact wealth management firms

Understand the impact of not monitoring and preventing these risks effectively

Overview:

Operational risk is by far the biggest risk that wealth management firms and their clients face, purely due to all of the different methods it can impact the business. Risks that are included within operational risk include the likes of fraud, business continuity and conduct risk to name a few. Fraud can be internal or external, typically with the aim of misappropriating client funds. If your place of work becomes uninhabitable, business continuity is essential. And given the general unsophisticated nature of wealth management clients, ensuring your staff follow conduct rules is essential if you want to avoid the possibility of large fines.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What impact can fraud have on wealth managers and their clients?

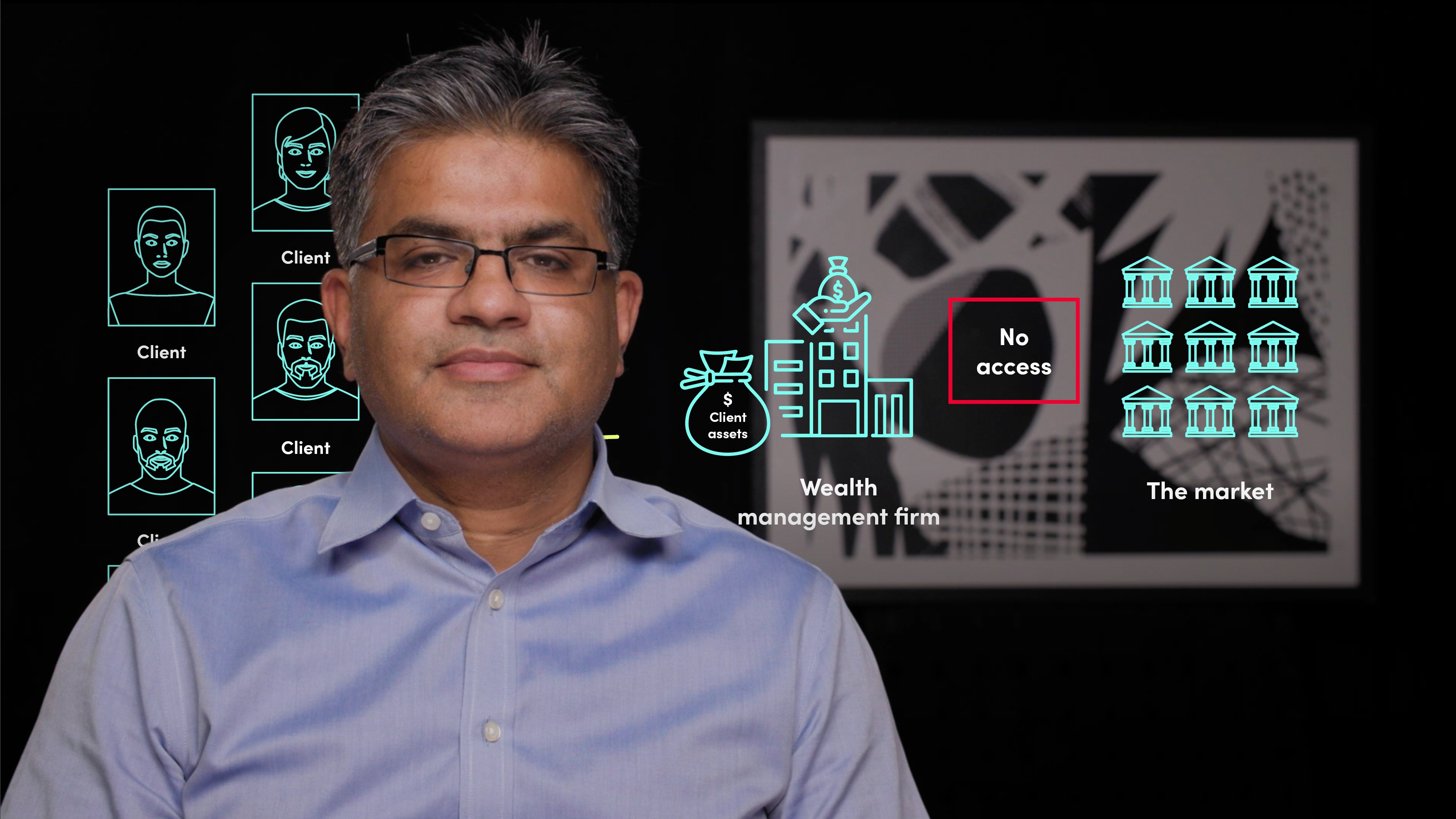

Fraud can be internal or external. Internal fraud is that which is committed within the firm itself whereas external fraud is the theft of firm or client assets from sources outside the firm.

Fraud usually entails attempting to misappropriate client assets, through identity theft or hacking emails.

Wealth management firms devote significant resources to their anti-fraud frameworks, as well as educating their clients as to the risks. They may for example require two-factor authentication, or use facial or voice recognition.

Human knowledge is one of the most powerful tools in preventing fraud. Wealth managers and relationship bankers need to know what their clients have asked for and need to check in frequently with them.

Why is business continuity so important for wealth managers and their clients?

The ability to continue undertaking client business is essential for Wealth Management firms, whether that includes taking and executing payments and trades or providing investment advice and managing a discretionary portfolio on behalf of clients. If the firm is unable to continue operations it will pose a significant financial and reputation risk to the wealth managers.

Detailed business continuity plans need to be developed to cope for various circumstances such as power outages, systems failures or staff unavailability.

The COVID-19 pandemic highlighted how important business continuity planning is. Given most wealth managers had planned and tested for scenarios involving extended loss of access to business premises, meant they could continue servicing their clients remotely.

Why is it important to be aware of conduct risk in wealth management?

Given the increase in focus around conduct by the world's regulators, it's no surprise that it has also gained prominence in wealth management.

Wealth management firms use their employees to safeguard the assets of millions of private clients. Client mistreatment or the failure to fulfil duties for customers is of great importance.

Examples of misconduct could include the improper distribution of product or marketing material which may represent the product or service in question (intentional or not), or the improper design of a product or service that does not perform as marketed.

Firms can receive significant fines for misconduct as highlighted following the financial crisis.

Since the crisis, most first have established new code of conduct requirements, employee misbehaviour guidelines and training. Employees found to have committed misconduct are likely to be subject to disciplinary procedures, dismissal as well as potentially being banned from working in the industry.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Faisal Sheikh

There are no available Videos from "Faisal Sheikh"