Option Pricing without Black-Scholes Illustration

Abdulla Javeri

30 years: Financial markets trader

In the first video on this topic, Abdulla discussed option pricing without using the Black-Scholes model but left a few unanswered questions. In this video, Abdulla will cover those remaining questions relating to the appropriate probability distribution to use, the volatility of the asset, how far away the spot is in relation to the strike, the forward price and the time to expiry.

In the first video on this topic, Abdulla discussed option pricing without using the Black-Scholes model but left a few unanswered questions. In this video, Abdulla will cover those remaining questions relating to the appropriate probability distribution to use, the volatility of the asset, how far away the spot is in relation to the strike, the forward price and the time to expiry.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Option Pricing without Black-Scholes Illustration

5 mins 12 secs

Key learning objectives:

Understand the future probability distribution

Describe the volatility of the underlying asset

Outline how far away the spot is in relation to the strike, the forward price, and the time to expiry

Overview:

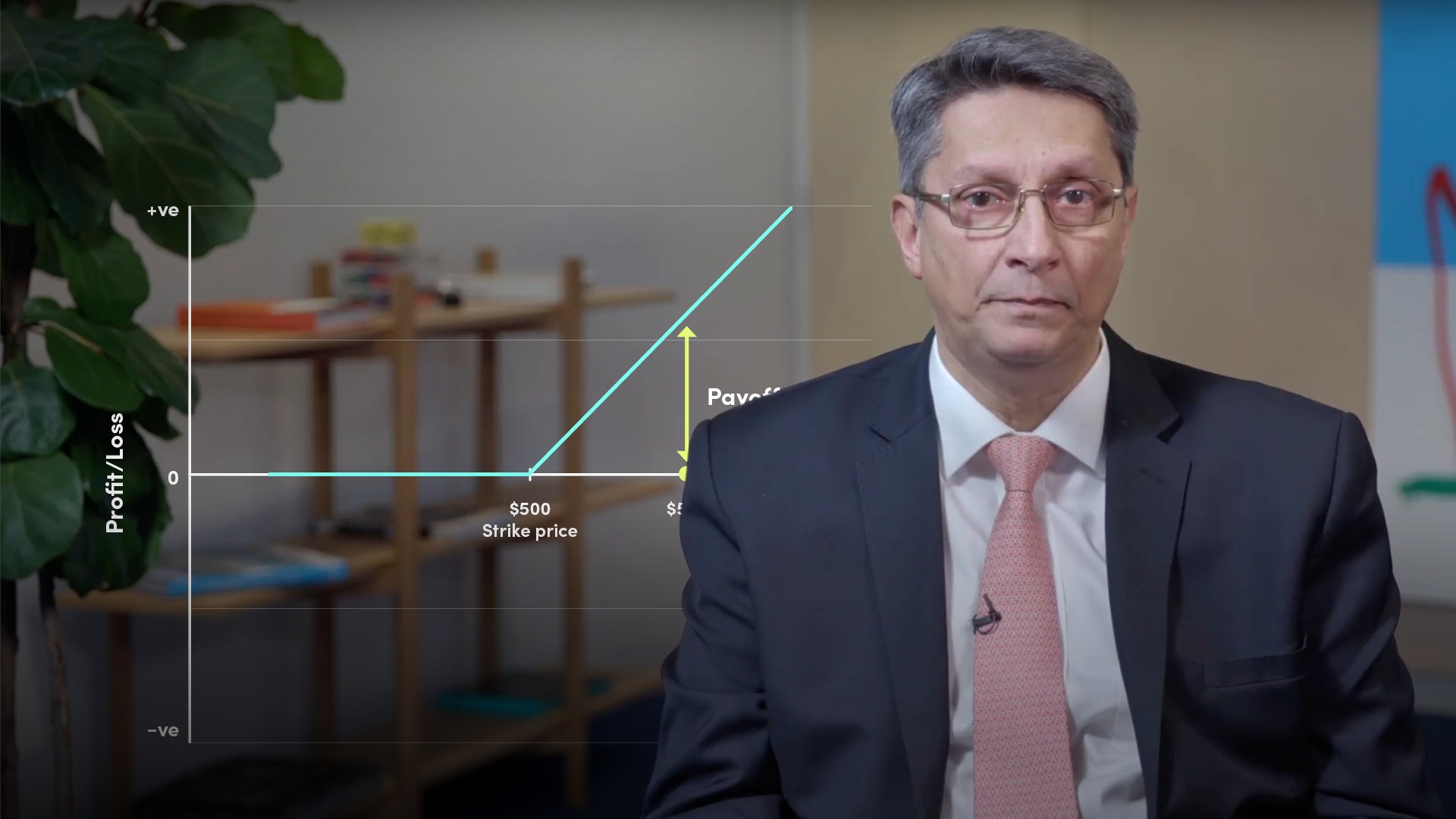

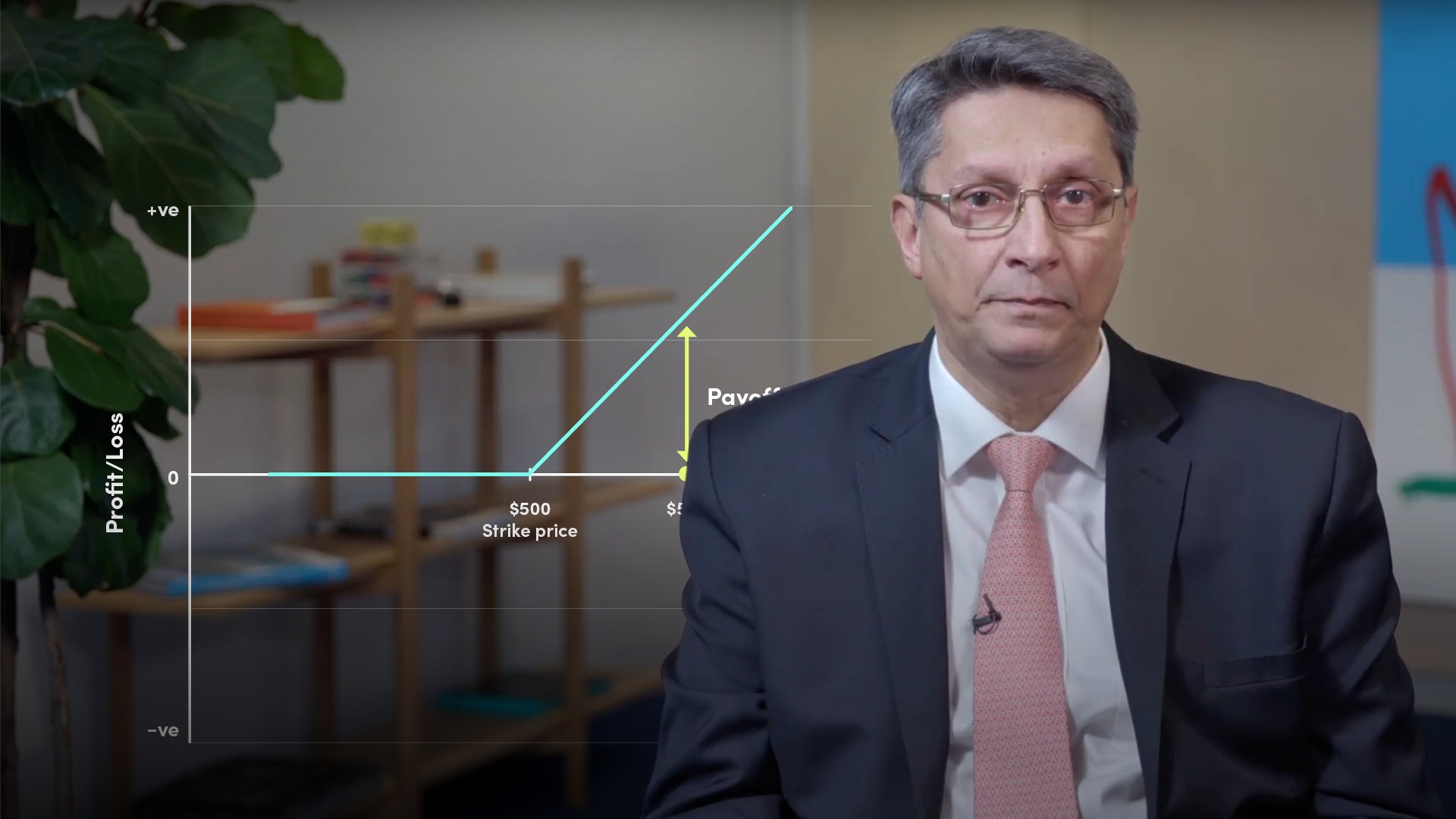

The price of an option is the present value of the total probability weighted payoff. However, there are some discrepancies in the calculations when compared with the Black-Scholes method. These are outlined below for changes in spot/strike prices, interest rates, time to expiry and the volatility.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Using the inputs outlined below, what is the call and put prices both with black-scholes and without black-scholes?

- The spot and strike price is 100

- 15% volatility

- Zero interest rate

- A year to expiry

| No Black Scholes | Black Scholes | |

| Call Price | 6.599 | 5.979 |

| Put Price | 5.459 | 5.979 |

Why are there discrepancies in the pricing above?

This is down to some technical factors. For example we’ve used a discrete distribution, not a continuous one. Also, we haven’t taken the price range up to infinity. Along with this, we haven’t applied what’s referred to as the drift.What are Option Greeks?

These are delta, sigma or vega, theta etc. and they quantify the sensitivity of the option price to incremental changes in the model inputs, other factors remaining the same.What happens if we raise/reduce the spot price in relation to the strike?

Raise spot to 120, all other inputs remaining the same as above - this is going to increase the probability of the call being exercised, and reduce it for the put. Hence calls are more valuable and the puts less so.| No Black Scholes | Black Scholes | |

| Call Price | 22.047 | 20.891 |

| Put Price | 0.765 | 0.891 |

| No Black Scholes | Black Scholes | |

| Call Price | 1.140 | 0.979 |

| Put Price | 15.168 | 15.979 |

What happens if we change the volatility?

Increasing the volatility changes the probabilities associated with the outcomes. Those further away from the current price, have a higher probability of occurring, therefore higher potential payoffs. Hence, both calls and puts are more vulnerable. Assuming the following:- The spot and strike price is 100

- 25% volatility

- Zero interest rate

- A year to expiry

| No Black Scholes | Black Scholes | |

| Call Price | 11.288 | 9.948 |

| Put Price | 8.592 | 9.948 |

| No Black Scholes | Black Scholes | |

| Call Price | 2.064 | 1.995 |

| Put Price | 1.929 | 1.995 |

What happens to the forward price if we change the interest rate?

Changing the interest rate changes the forward price. Raising it, raises the forward price and has the same effect as raising the spot price in relation to the strike. Calls become more valuable and puts become less so. The opposite occurs if the interest rate is cut. The Greek that relates to this is rho.What is the effect of a change in the time to expiry?

Once the option has been established, time only moves in one direction. The passage of time reduces the value of both calls and puts. The effective range of potential returns over a longer period is higher than for a shorter period. Reducing the time to expiry reduces the probabilities of the more extreme outcomes. The Greek that relates to this is theta.Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"