Managing Credit Ratings During an M&A I

Gurdip Dhami

25 years: Treasury & ratings

Managing a company’s credit rating effectively during an acquisition process is vital to ensuring surprising changes to the credit rating level post-acquisition are minimised. In part I, Gurdip sets out the seven steps to managing a company’s credit rating during an acquisition process, starting with project set-up and ending with the rating agency's decision.

Managing a company’s credit rating effectively during an acquisition process is vital to ensuring surprising changes to the credit rating level post-acquisition are minimised. In part I, Gurdip sets out the seven steps to managing a company’s credit rating during an acquisition process, starting with project set-up and ending with the rating agency's decision.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Managing Credit Ratings During an M&A I

12 mins 18 secs

Key learning objectives:

Outline the key areas of focus of the agency analysts

Outline the main reasons for having a rating strategy at the start of an acquisition process

Identify steps 1-3 in the credit rating acquisition process

Overview:

This video outlines the first three steps to managing a company’s credit rating during an acquisition process. The initial being the project set up, which includes the production of a project plan. Secondly, to obtain a rating estimate using in-house modelling, and lastly, the initial contact with the rating agency where management should acquire certain information as described below.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Why is it vital to manage a company’s credit rating effectively and efficiently?

- Surprises with respect to credit rating level post-acquisition are minimised

- The maximum information can be gathered from the agencies prior to announcement

- Workflow is optimised

What is Step 1?

Project Set Up:

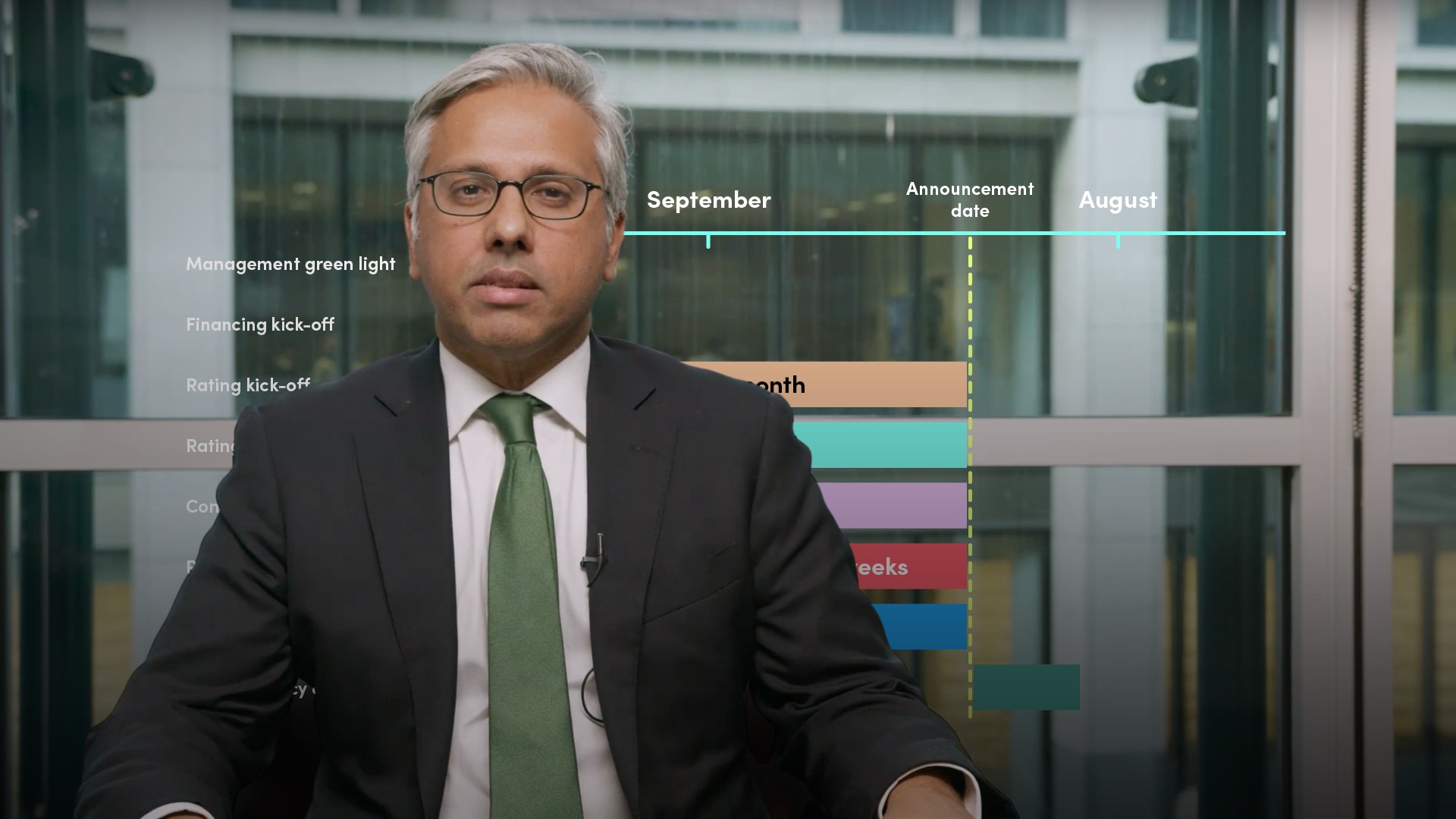

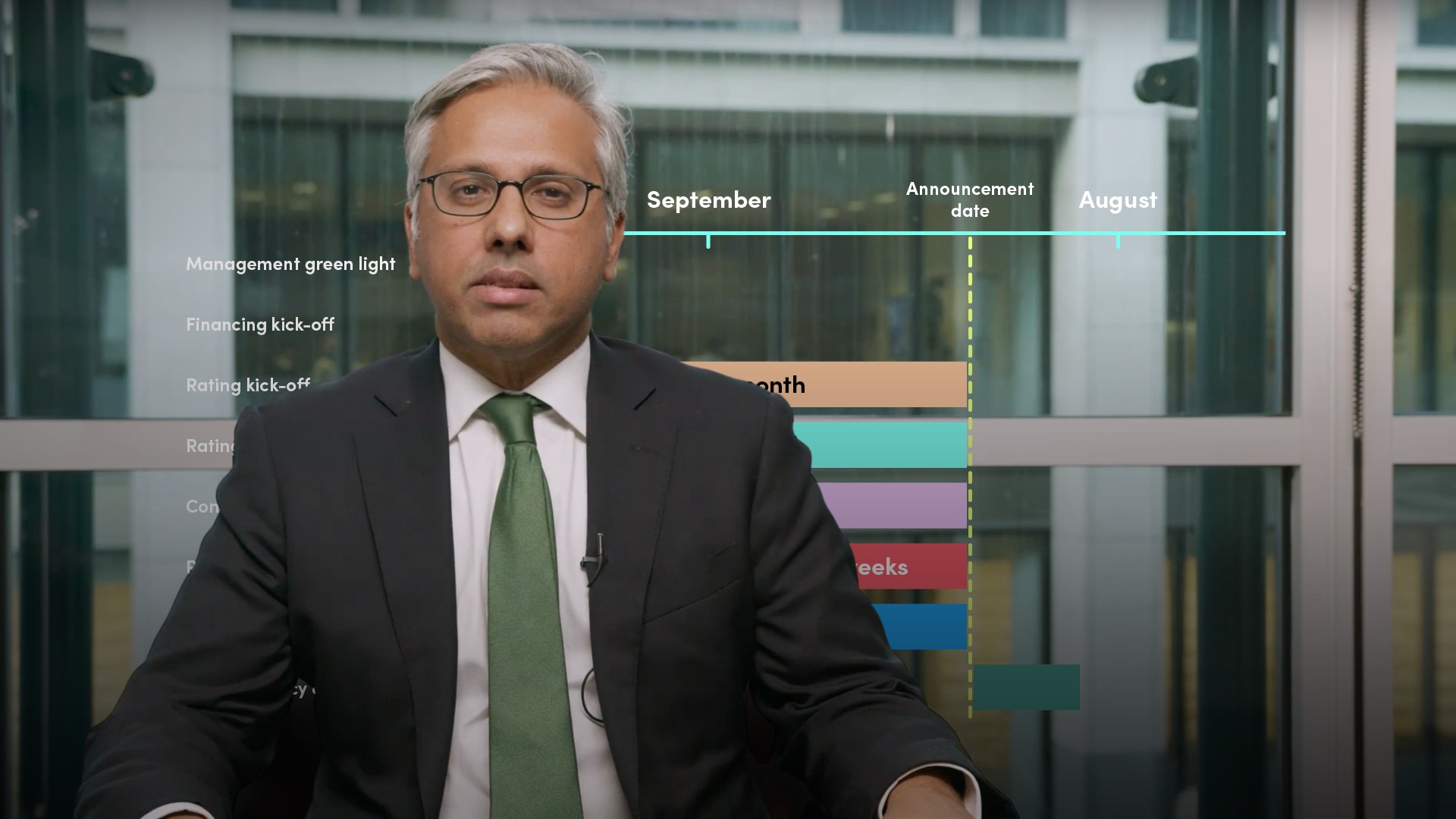

- The project plan for managing the credit rating should be produced and incorporated into the main M&A plan

- The plan as a minimum should cover, ownership and resources, the information requirements and the timetable including key milestones. For example, initial ratings estimate, initial rating agency contact, finalisation of the ratings pack, rating agency decision etc.

What is the ratings objective?

How important is it to maintain the credit rating or to have a certain credit rating level, compared with the other acquisition objectives such as minimising the purchase cost, minimising the cost of funding or the need to complete the acquisition for strategic reasons? It is important that the management agree upon this at the beginning.

What should the team member responsible for the ratings workstream be accountable for?

- Rating estimate

- Production of the ratings information for the rating agencies

- Communication with the rating agencies

What is Step 2?

Rating Estimate:

The objective of step 2 is to estimate the credit rating post-acquisition using desktop analysis. This should be started when the acquisition is first contemplated by management, months before the company decides to go ahead with the acquisition.

How has the risk profile changed after the acquisition?

- Has the risk changed in the business profile?

- Has the risk changed in the financial profile of the company?

- Are there material execution or integration risks?

What are the five sources management can use to help with its rating analysis?

- The latest agency reports on the company and the target company can be used. In particular, the current perceived weaknesses and rating trigger points should be examined

- The current rating criteria used by the rating agency should be reviewed. The criteria sets out the key qualitative and quantitative factors the agency uses to produce a rating. For example, certain financial ratios

- Sector reports are useful because they set out the current concerns and areas of focus of the agencies

- Agency announcements for similar transactions in the sector will show how the agencies have reacted in these cases and their areas of focus and concern

- Recent agency reports on how they assess acquisitions in general should be obtained

What are the benefits of desktop modelling?

- Provides information to management on the feasibility of the transaction

- Provides information regarding which financing options are optimal, taking into account the ratings objective and other company objectives

- Valuable preparation for the meeting with the rating agency as the analysis may point out any potential weaknesses of the transaction and required mitigants

What is Step 3?

Initial Contact with the Rating Agency:

In step 3, the company’s management makes contact with the rating agency about the proposed acquisition in order to understand how the agency may react to the acquisition and also gather information for the ratings analysis. The best time to contact the agency is roughly 4 weeks before the acquisition is publicly announced.

What key information should management get from the rating agency analyst?

- How will the rating agency view the acquisition? - Initial feedback regarding how the agency will apply their rating criteria for their transaction and the potential areas of focus and concern

- The rating agency analyst should be asked about the agency process and the next steps - For example, the timing of the agency rating decision and the information required

- To confirm details about the agency’s product for providing a rating estimate

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Gurdip Dhami

There are no available Videos from "Gurdip Dhami"