Pitfalls of EV and Equity Multiples

Sarah Martin

30 years: Corporate Valuations

In the previous videos, Sarah discussed enterprise and equity valuation multiples. In this video, Sarah concludes these topics by explaining the drawbacks of multiple valuations. She first explains the pitfalls common to both enterprise and equity multiples. Finally she touches upon some pitfalls specific to equity multiples.

In the previous videos, Sarah discussed enterprise and equity valuation multiples. In this video, Sarah concludes these topics by explaining the drawbacks of multiple valuations. She first explains the pitfalls common to both enterprise and equity multiples. Finally she touches upon some pitfalls specific to equity multiples.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Pitfalls of EV and Equity Multiples

8 mins 27 secs

Key learning objectives:

Understand the drawbacks common to enterprise value and equity value multiples

Understand the drawbacks specific to equity valuations (PE ratios)

Overview:

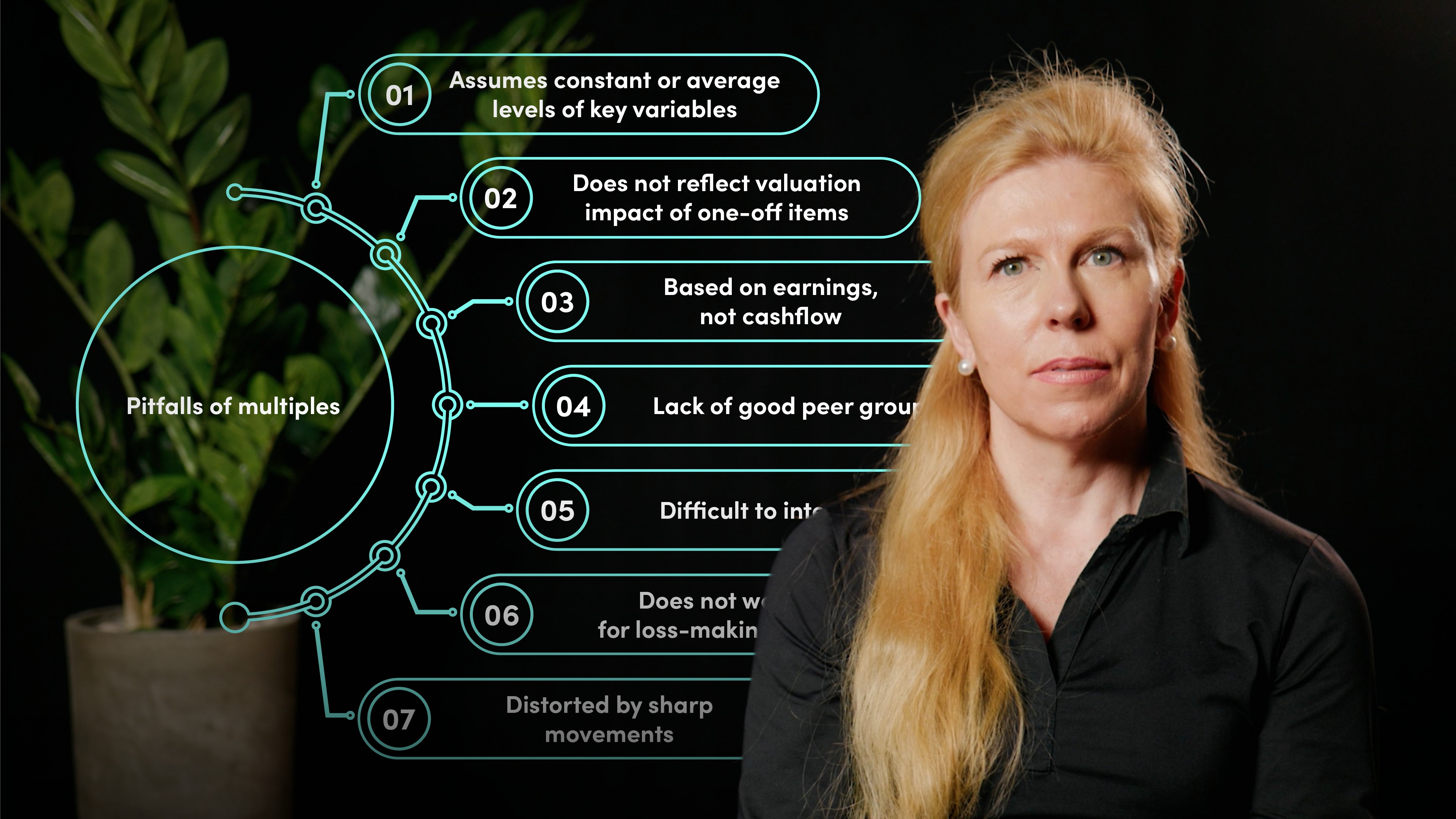

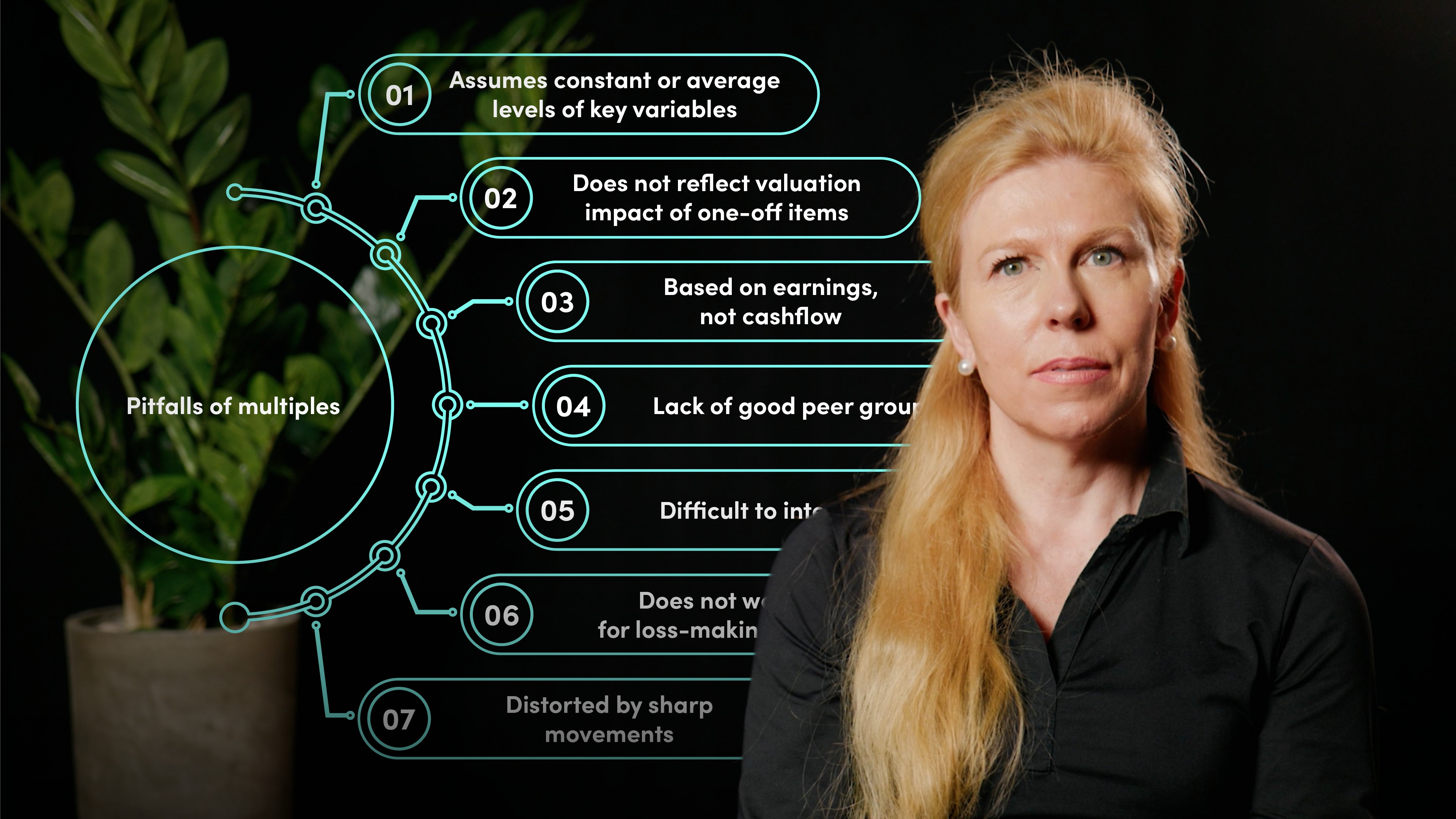

Multiples are used for deriving valuations for different purposes by different groups of users. Whilst their main advantage is that they provide relative valuations (compare one investment with another), multiples do have a number of pitfalls. They come with a host of drawbacks, some of which are common to both enterprise and equity multiples and some that are specific to one of the two. It is important to learn these drawbacks and understand why some investors prefer other valuation methods such as DCF.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

- Assume constant or average levels of our key value driver variables (growth, WACC and ROIC) - It is not possible to capture changes in key value drivers.

- Do not reflect valuation impact of one-off items such as a restructuring or major asset write-downs.

- As they are based on earnings, they can be manipulated so if we use and end up with erroneous valuations.

- If the firms in the peer group used to derive sector multiple are very different to the firm being valued, the valuation will be distorted and lessens the validity of their relative valuations.

- Multiple valuations can be difficult to interpret. For example, a high multiple does not necessarily mean that the firm’s equity is overpriced and a low multiple does not necessarily mean that the firm’s equity is cheap. A firm whose EBITDA multiple is high could be a better investment than a firm with a low EBITDA multiple if its growth outlook or WACC or ROIC are superior.

- They do not work for loss-making firms as multiples do not take account of the time value of money or the additional losses that may be incurred before the firm becomes profitable.

- They are not helpful when the firm’s or the sector’s earnings have fallen sharply and a recovery is expected. For example during financial crises or a pandemic, multiples became distorted and difficult to interpret

- PE ratio is based on net profit after tax and mixes up both the operating performance and capital structure.

- A high PE ratio could also be caused not by high ROIC, high growth and/or a low WACC but by a low level of net profit due in turn to a highly leveraged capital structure and high interest charges.

- A firm’s PE ratio will be biased upwards if it has high net cash balances on which it is earning a low rate of interest after tax.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Sarah Martin

There are no available Videos from "Sarah Martin"