Post-COVID Exogenous and Endogenous ECB Monetary Policy II

Corrado Macchiarelli

15 years: Macroeconomist

In this video, Corrado discusses the level of spillovers depending on whether monetary policy is endogenous or exogenous and then finishes up by discussing the spillover effects of ECB and Fed monetary policy on emerging markets.

In this video, Corrado discusses the level of spillovers depending on whether monetary policy is endogenous or exogenous and then finishes up by discussing the spillover effects of ECB and Fed monetary policy on emerging markets.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Post-COVID Exogenous and Endogenous ECB Monetary Policy II

7 mins 29 secs

Key learning objectives:

Understand the level of these spillovers depending on whether monetary policy is endogenous or exogenous

Understand the spillover effects of ECB and Fed monetary policy on Emerging Markets

Overview:

We found that a Fed tightening leads to a reduction in the Euro Area's GDP and that the impact of ECB monetary policy on the US economy is close to zero after five years. And we also found that the Fed and ECB have a considerable cross-border influence on emerging market economies.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

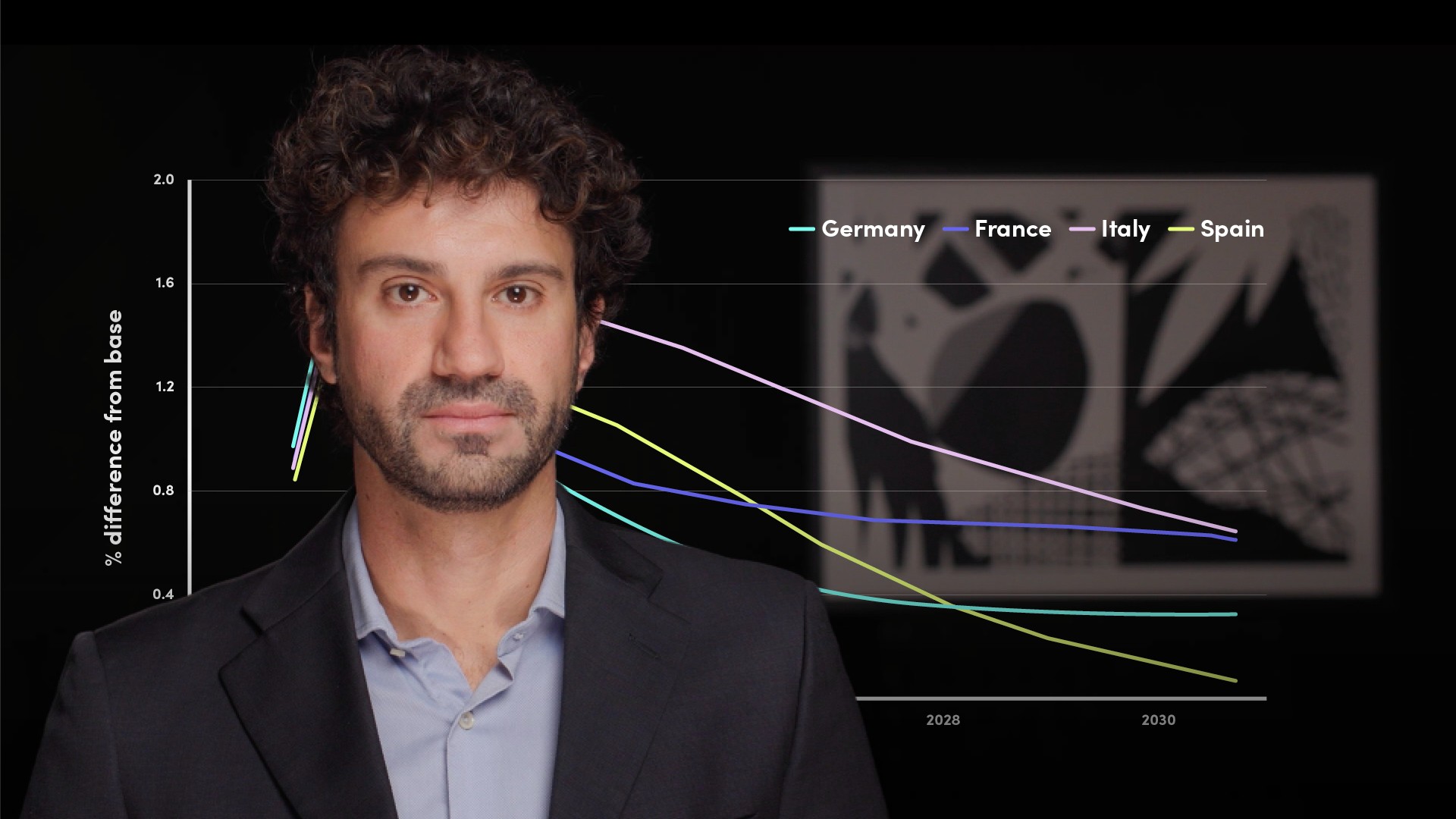

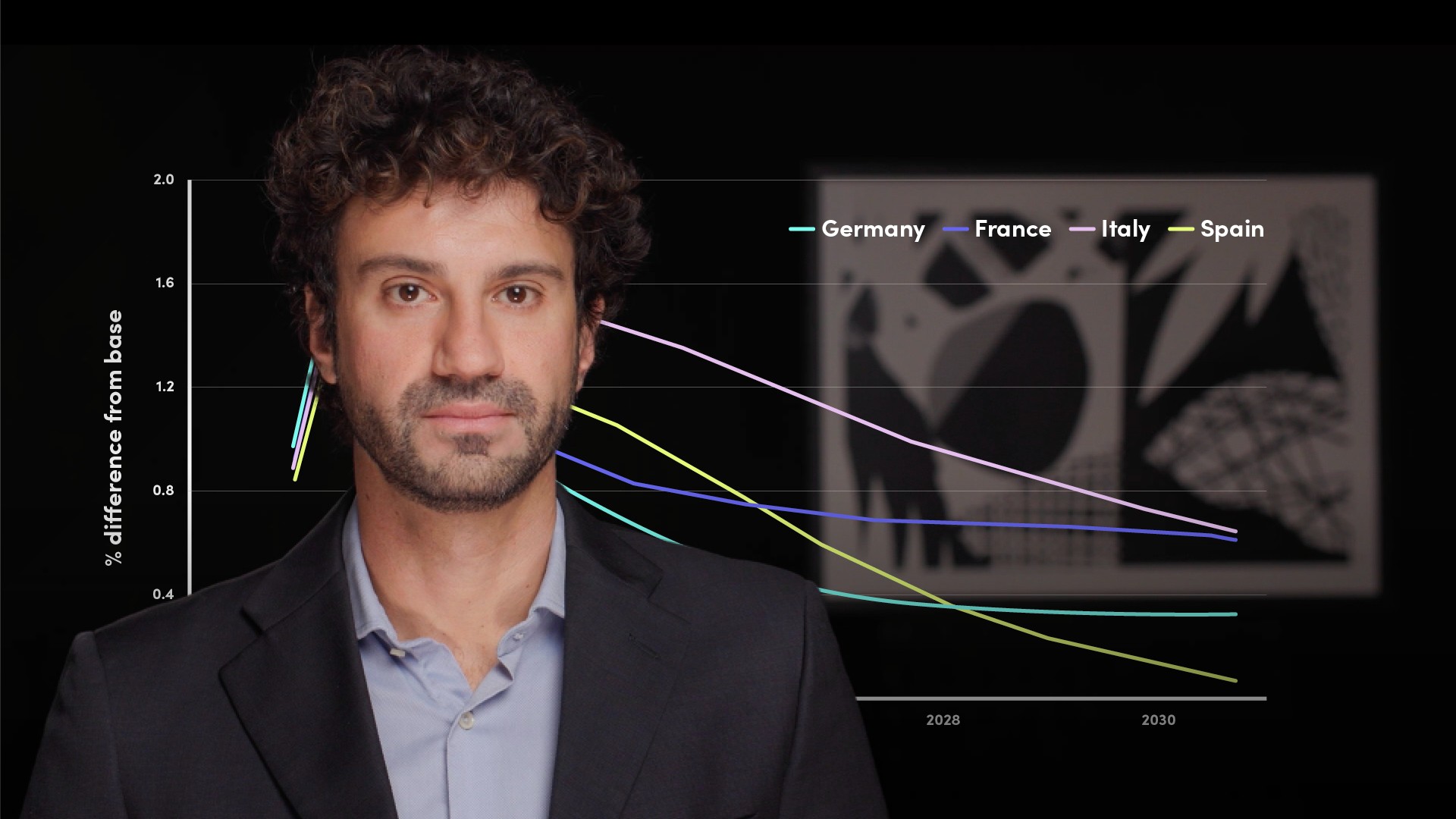

Endogenous vs exogenous ECB monetary policy

When the ECB's monetary policy endogenously reacts to the Fed tightening, the effect on real activity and inflation is smoothed out. In fact, a unilateral tightening in the US prompts a depreciation of the bilateral exchange rate of the Euro against the US dollar. The ECB would then potentially be tightening monetary policy in order to counter an increase in inflation in the Euro Area. Such a monetary policy reaction would partly offset the initial depreciation and cause an overreaction. As a result, the effective exchange rate would not fall as much as it would in a case where the ECB Monetary Policy is exogenous.

The Impact on Emerging Markets

The monetary policy divergence between the ECB and Fed does however extend beyond the bilateral spillovers between these two large economies. The two central banks have considerable cross-border influence on emerging market economies, or EMEs. This is demonstrated by events such as the 'taper tantrum' illustrating the importance of financial linkages and capital flows in the propagation of shocks across countries. Most EMEs go through a depreciation of about -0.8 to -2.5 percent, with the lowest values observed in Mexico and India following a Fed tightening. In the case of the ECB, monetary policy tightening is not shown to affect US, and as a result, Chinese monetary policy very much. Unlike bilateral spillovers between the Euro Area and the United States, our findings imply that if ECB and Fed monetary policy measures are not in sync, policy trade-offs may lead to unfavourable international spillovers.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Corrado Macchiarelli

There are no available Videos from "Corrado Macchiarelli"