Pre-contract Negotiations

Arun Singh

40 years - Corporate Lawyer

In this video, Arun explores pre-contract documents, such as letters of intent and the meaning of the words ‘subject to contract’ and 'without prejudice'. He also explores the ‘Duty of good faith’, what that means under English law and the questions that you should ask. Finally, he finishes by going through a checklist for analysing and drafting pre-contract documents.

In this video, Arun explores pre-contract documents, such as letters of intent and the meaning of the words ‘subject to contract’ and 'without prejudice'. He also explores the ‘Duty of good faith’, what that means under English law and the questions that you should ask. Finally, he finishes by going through a checklist for analysing and drafting pre-contract documents.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Pre-contract Negotiations

9 mins 21 secs

Key learning objectives:

Understand that pre-contract documents could be interpreted as a binding contract

Outline the concept of subject to contract, and that even when this terminology is used a binding contract can still be formed

Outline the concept of duty of good faith and how it varies between the different legal systems

Overview:

Letters of intent, memorandums of understanding, heads of terms and heads of agreement are known as pre-contract documents. They all pretty much do the same thing, so therefore the important thing is to be aware as to whether the documents are intended to be binding or not. Even if they are stated as ‘subject to contract’ some courts may take the documents as a binding contract if they find there was an intention to create legal relations.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What do pre-contract documents do?

They are a summary of the main points of the deal, a timetable for negotiation, including the date of the contract signature. They also outline any decisions that have to be obtained from within the organisation, and state the matters to be discussed and when they are to be done.

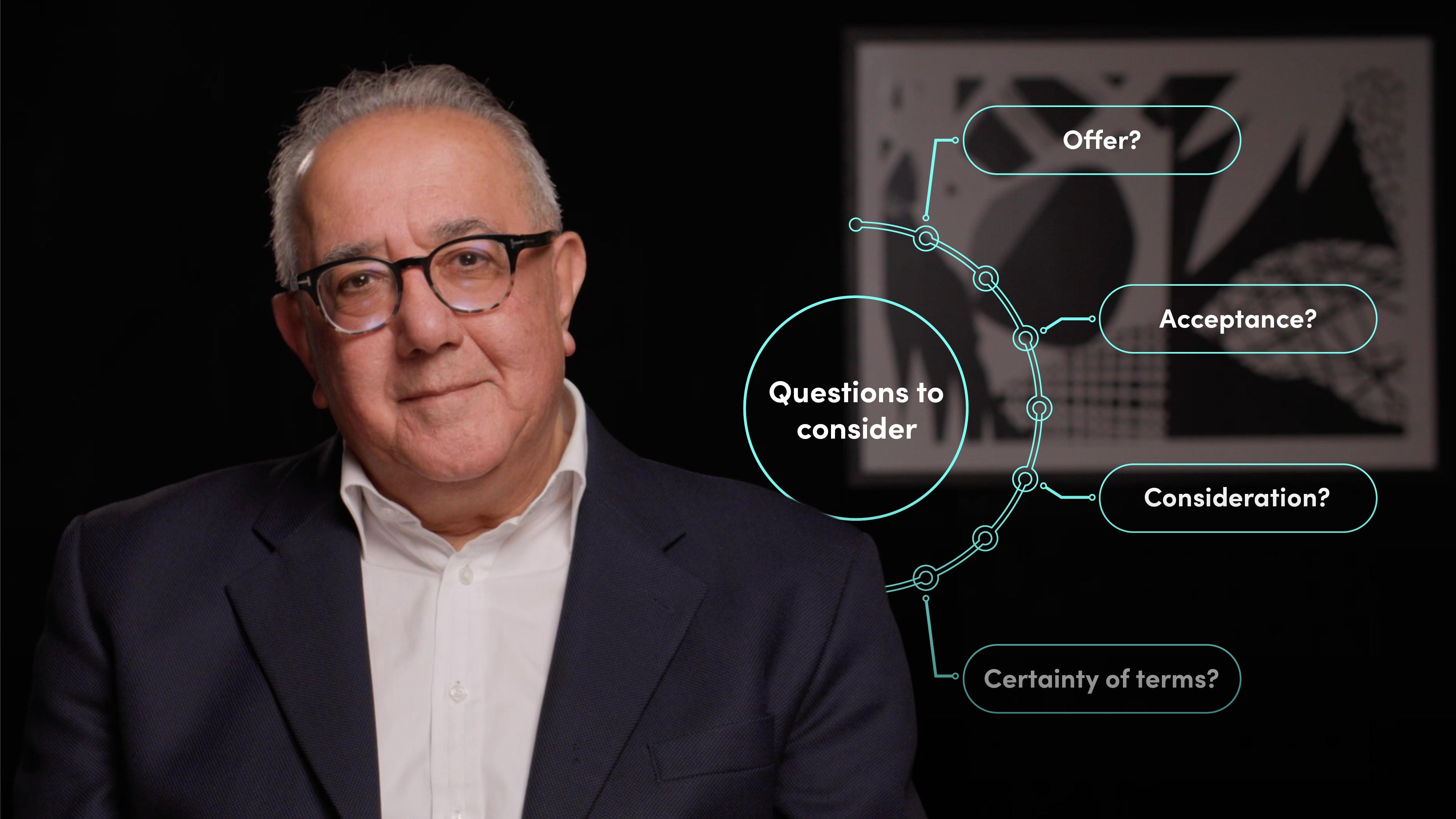

When drafting or analysing pre-contract documents, it is important to consider the following:

- Do you need a pre contract document?

- 2. Only write in definite terms if you are sure

- Concentrate on important and critical matters

- State any exceptions or qualifications

- Ensure behaviour accords with the document

- Consider liability

- Include the choice of law and jurisdiction

- State whether you intend it to be binding or not binding

If the pre-contract documents state subject to contract, the document isn’t binding right?

If the words ‘Subject to contract’ are used, the general rule is that the parties do not intend to form a binding contract. However, even if the term is used, but the parties then implement the terms of the agreement, they are taken to have entered into an implied binding contract.

In certain circumstances even when you have stated subject to contract, you may also have some liability in claims of ‘quantum meruit’ (or as much as a party has earned for their actions).

Is there always a duty of good faith in negotiations?

Generally, under English law there is no duty to negotiate in good faith. However, in Civil law systems, there generally is a duty to negotiate in good faith. Therefore in international negotiations it is important to be aware of duties and obligations of good faith. Ending negotiations badly in Civil law systems can leave the party having to pay damages to the other party.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Arun Singh

There are no available Videos from "Arun Singh"