What are Preference Shares?

Prasad Gollakota

20 years: Capital markets & banking

Preference shares were initially a form of ‘temporary rescue' capital used by companies in distress. Today, however, preference share capital is used far more broadly and represents a stable form and source of capital. Prasad explains how preference shares are issued, the different types that exist and how they are priced.

Preference shares were initially a form of ‘temporary rescue' capital used by companies in distress. Today, however, preference share capital is used far more broadly and represents a stable form and source of capital. Prasad explains how preference shares are issued, the different types that exist and how they are priced.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are Preference Shares?

18 mins 36 secs

Key learning objectives:

Define preference shares

Understand the typical rights that come with preference shares

Overview:

Preference shares make up a crucial portion of many companies’ capital structure. While the terms of each company’s preference shares may be different, they generally pay a fixed dividend and forego any voting rights. The specific pros, cons, pricing mechanisms and treatment for accounting are all discussed below.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a Preference Share?

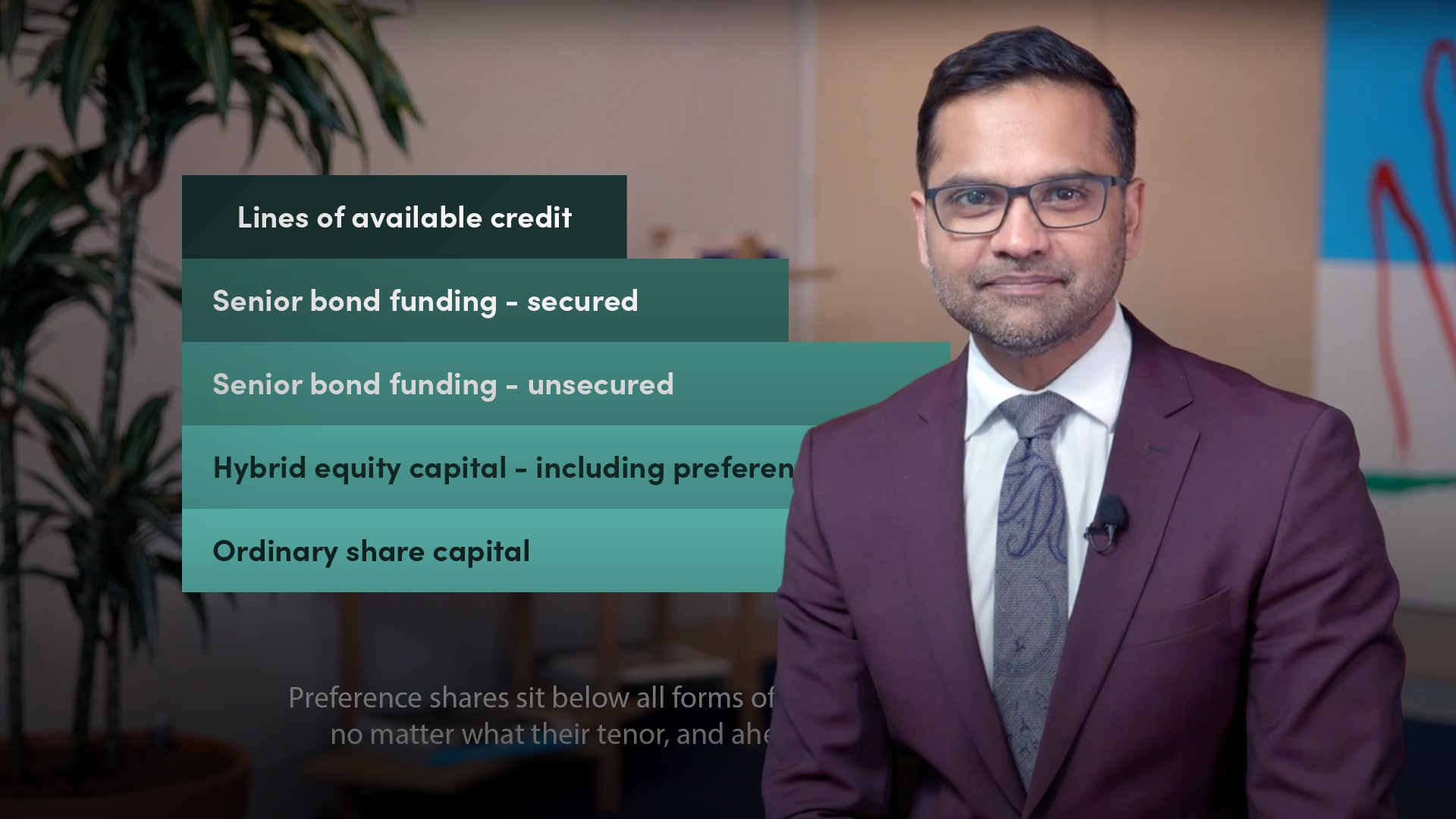

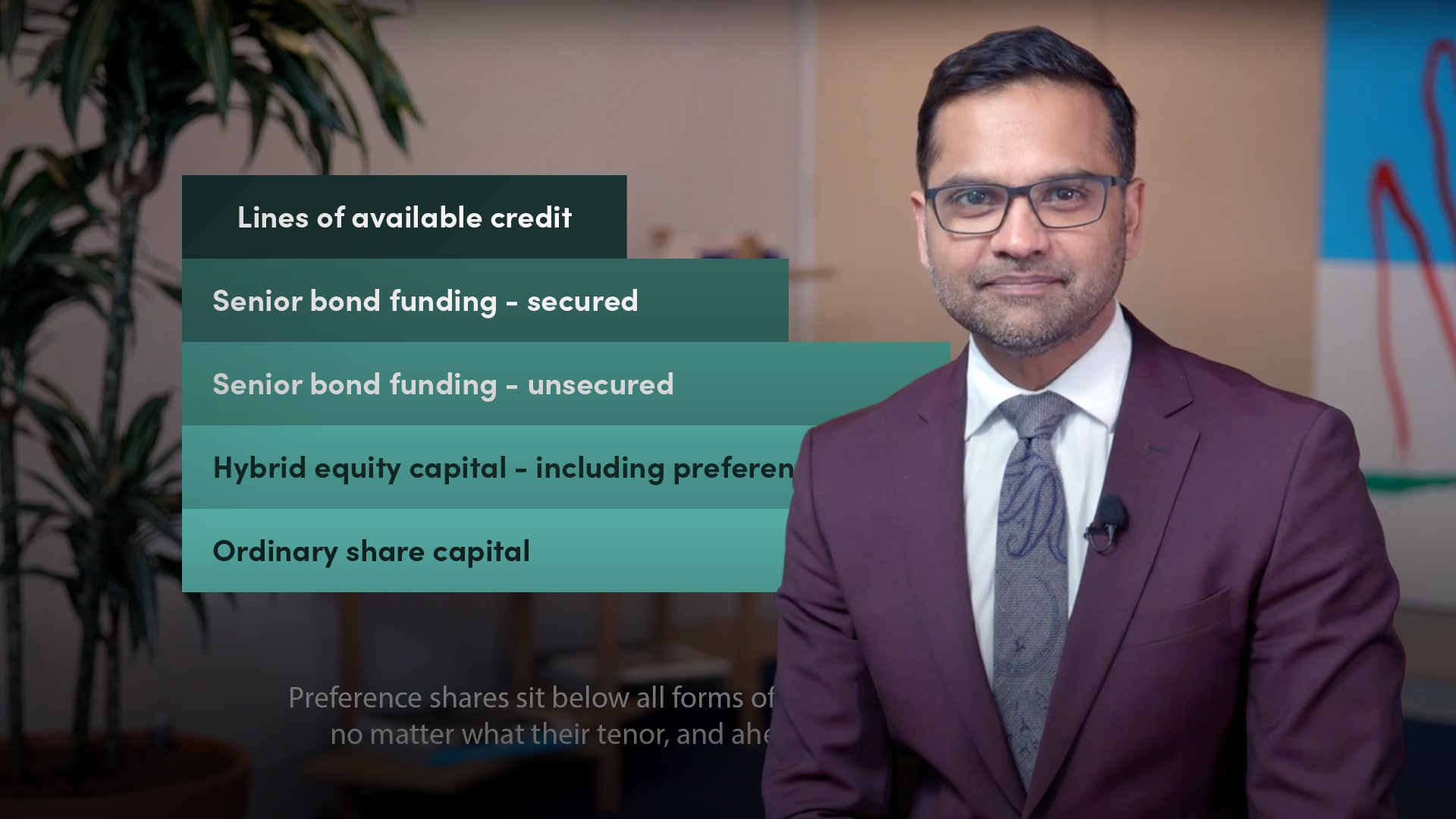

A company can raise money – also called funding or capital – in different formats and from different sources. One format a company may seek to use to raise money is by the issuance of preference shares. Preference shares broadly sit in the capital structure of a company, but below all forms of credit, secured and unsecured, no matter what their tenor, and ahead of ordinary share capital.

What are the origins of Preference Shares?

In the eighteenth and nineteenth centuries, preference shares were a form of ‘temporary rescue capital’ used by companies in distress, where traditional forms of capital were unavailable. Today however, preference share capital is used far more broadly, and especially by financially stable companies, and represents a staple form and source of capital.

What are Preference Shares as we understand them today?

- Preference shares “co-exist” with ordinary shares, and cannot exist on their own

- Preference shares will have different rights to ordinary shares, and they must have some rights which are “preferential” to ordinary shares. The most common among these differences are: dividend rights, capital rights, early redemption and voting rights

- The third basic principle about preference shares is that they can be issued to raise money from any investor, subject to the relevant laws and regulations and need not be issued to the ordinary shareholders

What is the Tax and Accounting treatment of Preference Shares?

Typically, preference shares are treated akin to equity on the balance sheet for financial statement purposes - namely, the balance sheet and income statement. There are certain instances however, where preference shares may be reclassified as a liability for financial statement purposes; this might occur where it is considered there is an unavoidable obligation to pay either a dividend or repay the share capital.

For tax purposes, preference shares are almost always treated akin to equity; meaning, dividends on such shares are not tax deductible.

What are some Different Types of Preference Shares?

A standard preference share may have the following rights:

- Non-cumulative such that any unpaid dividends are simply forgone

- Discretionary dividends, where the payment is at the option of the company

- Right for the issuer to redeem at its discretion, at certain points in time

- No rights for the investors to convert into ordinary shares, at any time

- No rights for investors to participate in the profits of the company over and above the stipulated dividend.

How are Preference Shares Priced?

There are three guiding comments to understand about pricing preference shares:

- As a preference share is a hybrid of a classic bond and an ordinary share, the theoretical price of a preference share is bound by these two extremes

- The typical approach to theoretically pricing a preference share (and the one most commonly applied in markets governed by English law) is by using traditional bond pricing techniques

- Using an ordinary share valuation approach will typically be more complex, and should be avoided unless there are good reasons for doing so

What are the Pros and Cons of Preference Shares?

Pros:

- Preference shares are flexible - they can be used as a long-term source of funding or transitional capital with a variety of features to suit the need

- Improves company's borrowing capacity, as now debtors have a bigger buffer below them

- Non dilutive - in so far as voting rights are concerned

- There is no charge on assets

Cons:

- Preference shares can be costly compared to traditional credit funding

- The flexibility of issuing preference shares might be purely theoretical

- There is not an unlimited market, and it is not available to every borrower without it being prohibitively expensive

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Prasad Gollakota

There are no available Videos from "Prasad Gollakota"