Private Equity Fundraising

Gavin Ryan

25 years: Private equity & banking

Fundraising is the key to becoming a private equity fund manager. Gavin emphasises its importance and discloses many misconceptions about fundraising and some key factors for success.

Fundraising is the key to becoming a private equity fund manager. Gavin emphasises its importance and discloses many misconceptions about fundraising and some key factors for success.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Private Equity Fundraising

10 mins 56 secs

Key learning objectives:

Identify the four main mistakes made in fundraising

Outline the key factors for a successful fundraising

Overview:

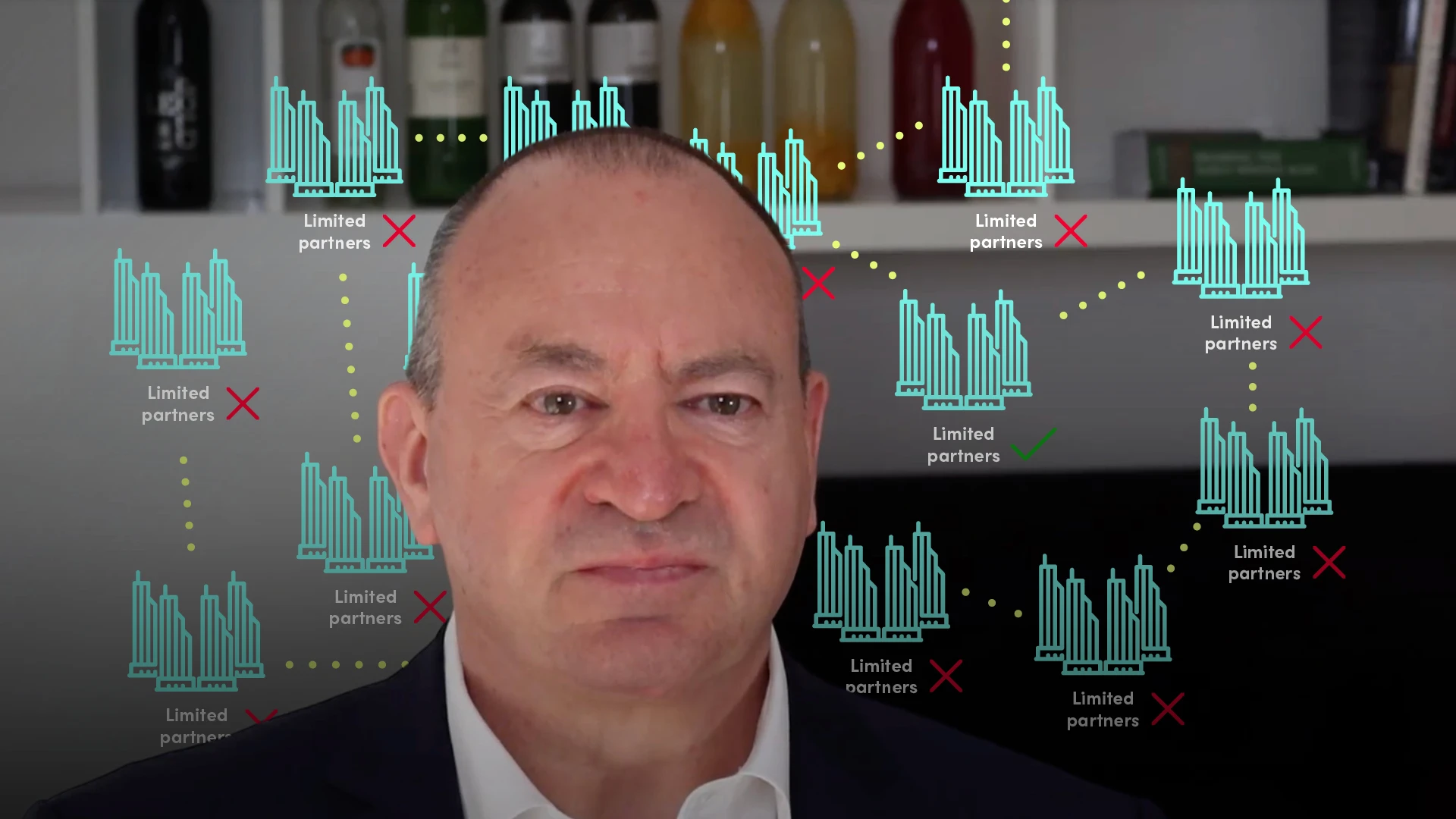

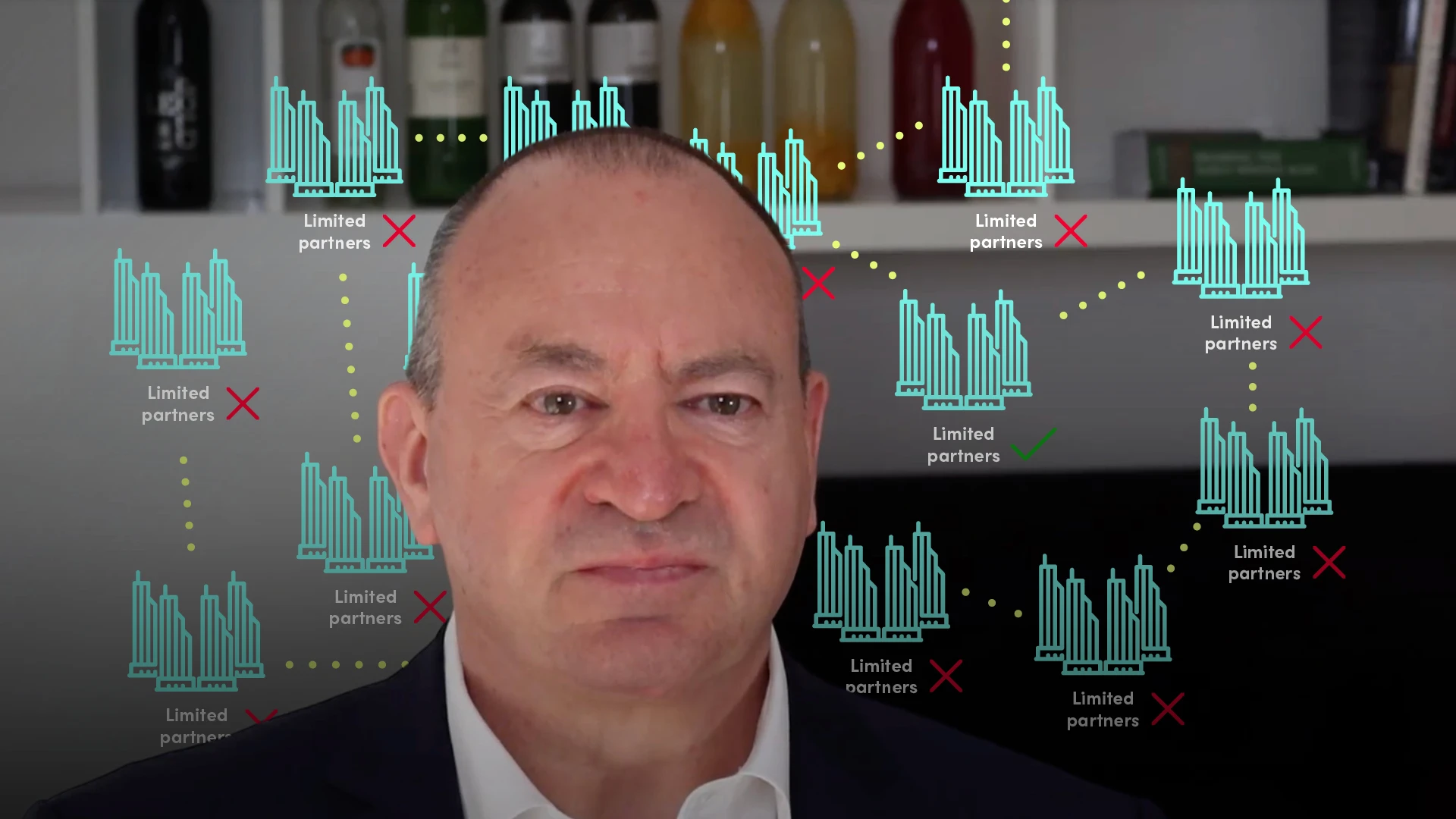

Many aspiring fund managers, who are otherwise valid investment professionals, have an unrealistic optimism bias when it comes to fundraising. The universe of LPs or their funds available will be more limited than with other asset classes. This is due to the huge risk factors specific to private equity, which are the lock up period and the “blind pool” nature of private equity investing. A first time fund manager may need eighteen to twenty four months to raise a fund; a follow on fund may be less. A major part of the fundraising process will be the pitch made by the aspiring fund manager to the LPs. Raising even a one hundred million euro fund can easily cost over quarter of a million euros.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

- The first mistake is underestimating the duration of the internal decision making processes of LPs.

- The second mistake is taking at face value the verbal expressions of interest by LPs.

- The third mistake is underestimating the costs of fundraising, which can escalate quickly.

- The fourth mistake is putting together a team which collapses half way through the process.

- It is important for aspiring fund managers to have a clear fundraising strategy. They should segment potential LPs like customers in marketing.

- Preliminary commitments should be secured form a first, closer and more friendly group of investors, before approaching a wider group of investors. A major part of the process will be the pitch made by the aspiring fund manager to the LPs, which takes the form of a group pitch of the team in an hour or so meeting with the LP.

- The odds of fundraising can be improved by finding an anchor investor and holding a first closing.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Gavin Ryan

There are no available Videos from "Gavin Ryan"