The Discretionary Portfolio Management Framework I

Faisal Sheikh

25 years: Wealth and risk management specialist

In this video, Faisal discusses the role of a portfolio manager, outlining where they get their ideas from, the differences between certain types of portfolio managers, and the framework they use to manage the portfolio.

In this video, Faisal discusses the role of a portfolio manager, outlining where they get their ideas from, the differences between certain types of portfolio managers, and the framework they use to manage the portfolio.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

The Discretionary Portfolio Management Framework I

7 mins 3 secs

Key learning objectives:

Understand the benefits of discretionary management services for wealth management firm and its clients

Identify the role of the portfolio manager

Understand the need for and the 5 stages of the portfolio management framework

Comprehend the importance of Asset Allocation Plan stage in the framework

What is the role of the SAA and TAA?

Overview:

Discretionary portfolio management lies at the heart of the service wealth management firms offer their clients. This video explores the role of portfolio managers in constructing bespoke portfolios for individual clients and then provides an introduction to the 5 key components of the framework typically used by them to manage these portfolios.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the benefits of discretionary portfolio management?

Wealth management firms design, construct and manage personalised portfolios on behalf of clients, this is known as discretionary portfolio management. The advantage is that they don’t need to ask for client permission each time they want to make a change to the portfolio and they can avoid the need for a suitability assessment with every trade. This client has the benefit of not needing to spend time making investment decisions and can leave that to professional wealth managers.

What is the portfolio manager’s role in a wealth management firm?

Constructing portfolios meeting client risk profiles and designing bespoke portfolios for their unique needs and risk appetite is the foremost task for portfolio managers. A firm’s Chief Investment Office will produce market research and views, which is used by the portfolio management team to look for suitable investments and an important aspect here is diversification. Portfolio managers select different asset classes from individual stocks, bonds, mutual funds, ETFs and other alternative assets to balance the risk and return.

What is the portfolio management framework?

In order to construct portfolios that achieve a client’s long-term objectives, firms use a framework that effectively addresses each client’s needs. This framework is supported by policies and a portfolio management system to allow for efficient construction and ongoing management of the portfolio.

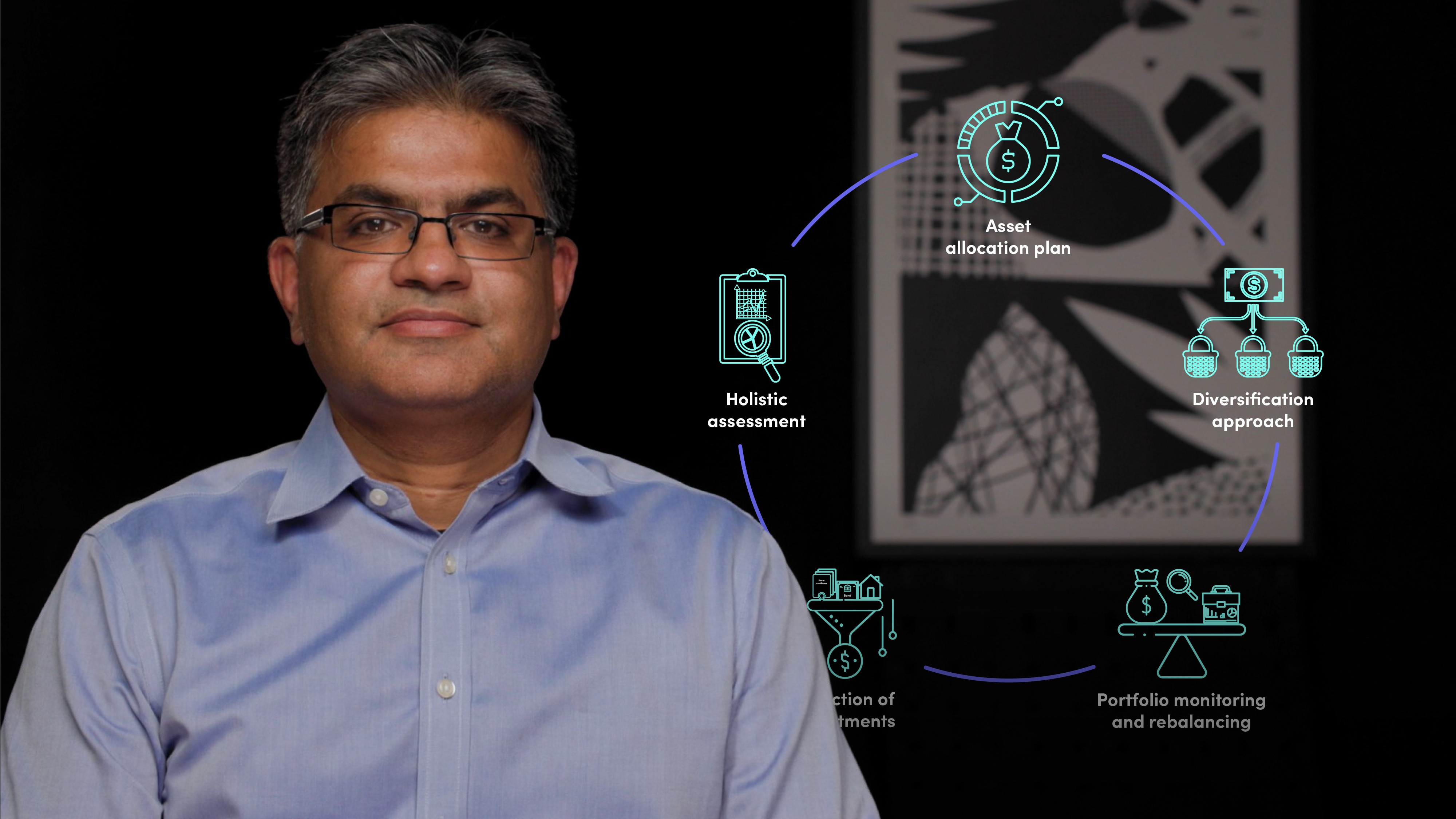

This framework has five key stages as follows:

- Asset Allocation Plan

- Diversification Approach

- Portfolio Monitoring and Rebalancing

- Selection of Investments

- Holistic Assessment of Portfolios

The Asset Allocation Plan

In this first stage of the framework, the manager first identifies the client’s end goals as these are unique to them. Asset Allocation has historically been the primary driver of a portfolio’s performance and risk management. Some key questions are asked at this stage to help in properly allocating assets. These questions include:

1. What is the client trying to accomplish? (Starting a business or save for retirement or to provide an inheritance)

2. What is their time horizon? (When will they actually need the money)

3. What is their risk appetite? (How much risk they are willing to take in order to achieve their objectives)

Strategic asset allocation and Tactical asset allocation

Portfolio managers refer to the views of the Chief Investment Office’s for the most appropriate Strategic Asset Allocation (SAA). The SAA is the CIO’s general view on the optimal asset allocation to achieve the best risk-adjusted returns, whilst also remaining flexible for each client. The Tactical Asset Allocation (TAA) is an active portfolio strategy that shifts the percentage of assets held in various categories (going overweight or underweight) to take advantage of market pricing anomalies or strong market sectors over the short to medium term. Managers will return to the portfolio's original asset mix once the desired short-term profits have been reached.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Faisal Sheikh

There are no available Videos from "Faisal Sheikh"