An Overview of Market Abuse Regulation

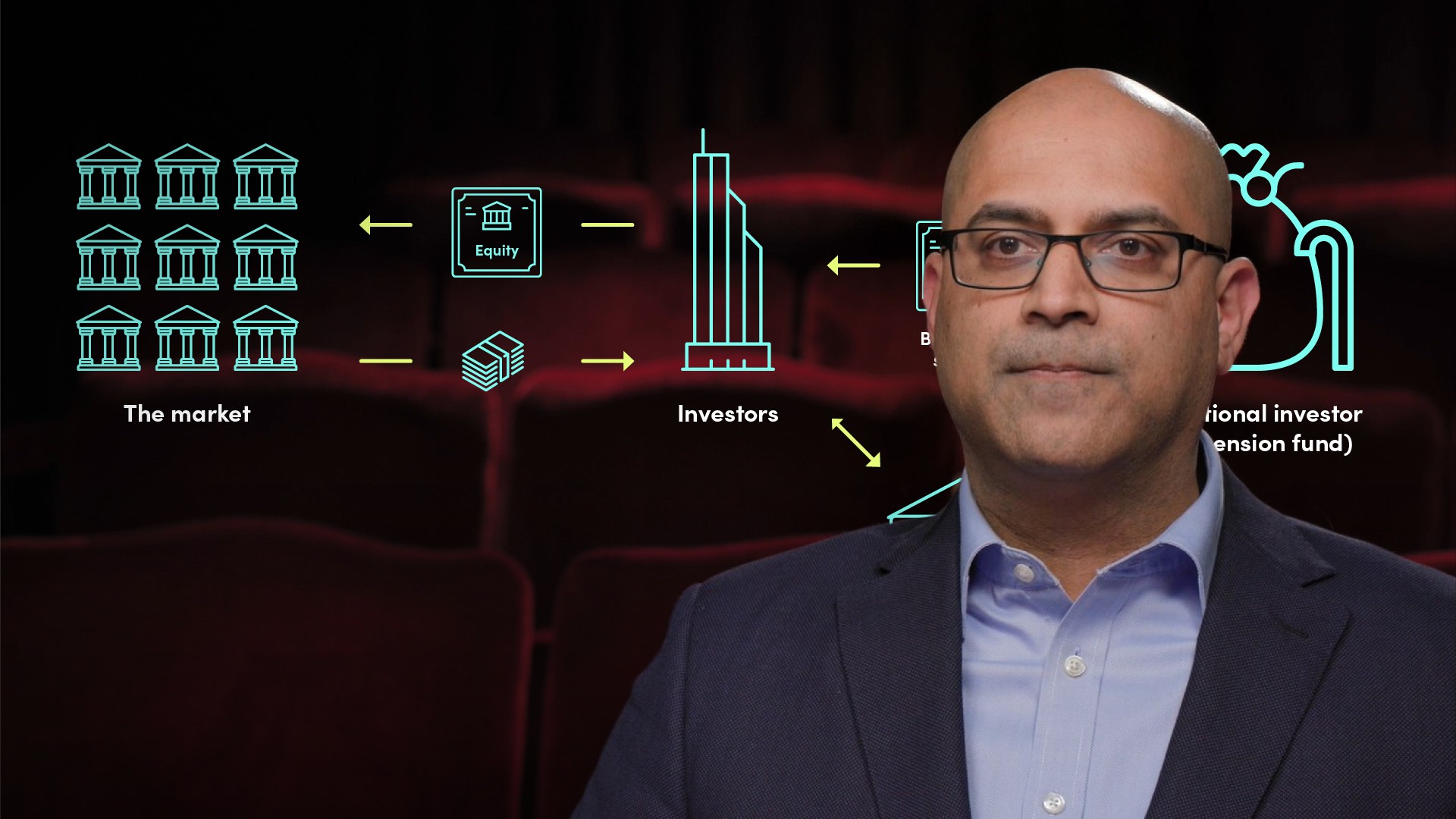

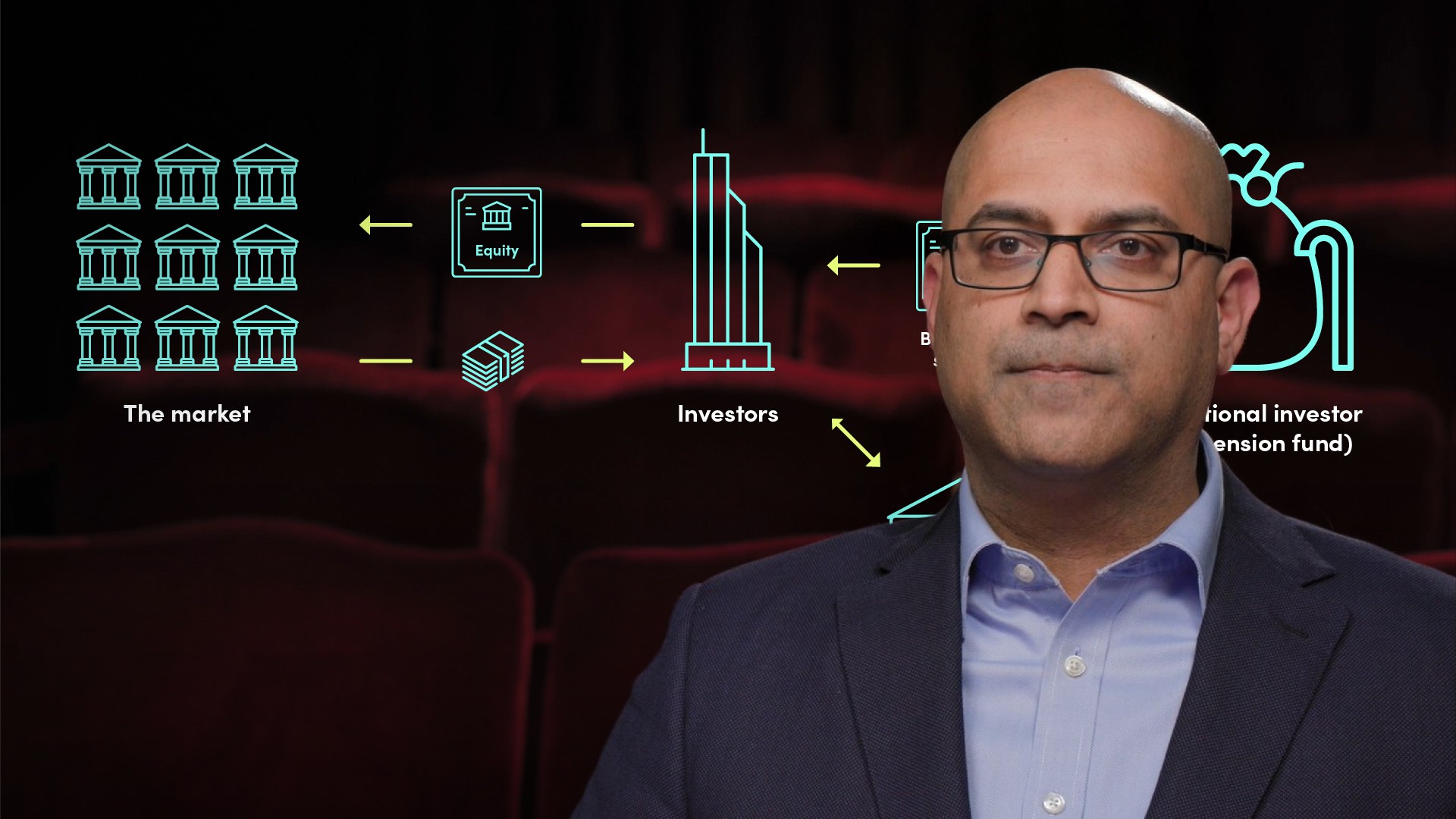

Carl Fernandes

20 years: Financial services law & regulation

Regulators and investors want public securities markets to be fair and effective in forming prices for the traded securities. In this video, Carl focuses on the key regulatory requirements and restrictions which influence how firms trade in public securities markets.

Regulators and investors want public securities markets to be fair and effective in forming prices for the traded securities. In this video, Carl focuses on the key regulatory requirements and restrictions which influence how firms trade in public securities markets.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

An Overview of Market Abuse Regulation

16 mins 51 secs

Key learning objectives:

Define short selling

Outline the requirements for fair and effective priced securities

Describe a Market Abuse Regulation

Define Market manipulation

Overview:

Regulators and investors demand fair and effective public securities markets in price formation of traded securities. In this video, Carl focuses on some of the main regulations dealing with these issues.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the requirements for fair and effective priced securities?

Regulators and investors want public securities markets to be fair and efficient in determining the prices of traded securities, this requires:

- Certain information to be made transparent for all market participants.

- The prohibition of practices which may distort the proper forces of supply and demand.

Understand the history of Market Abuse Regulation.

The Market Abuse Regulation, or "MAR," took effect on July 3, 2016, but it built on and refined pre-existing regulations. The UK onshored MAR on December 31, 2020, we will look at EU MAR.

MAR contains requirements and restrictions that apply to issuers who have requested or approved the trading of their securities on EU markets, as well as investors who trade those and other securities on EU markets.

What are the MAR requirements and restrictions that apply to issuers?

The most important requirement for issuers is to publicly disclose any information that a reasonable investor would expect to receive when deciding whether to buy or sell the securities of that issuer.

An issuer's responsibility might be triggered by a wide range of facts and circumstances, but a classic example is where the issuer intends to make an acquisition or disposal of assets which will materially impact the business and, hence, the value of the issuer’s securities. Investors should have access to that information as soon as possible so that they can make informed investment decisions.

What standards must be met in order to ensure the strict confidentiality of inside information?

- It is an offence for anyone to disclose inside information, except where the disclosure is made in the normal course of that person's employment, duties or profession.

- The issuer and its advisors must follow strict procedures when approaching and interacting with investors. These procedures are designed to ensure that confidentiality is preserved until information can be announced publicly.

- Issuers are required to keep lists of all persons who have access to inside information, which facilitates regulators identifying where leaks may arise.

What are the MAR requirements and restrictions that apply to investors?

Even if investors come into knowledge of inside information inadvertently, they are prohibited from disclosing it to anybody else. Equally as importantly, they are prohibited from trading in the securities of an issuer where they possess inside information relating to those securities.

What is Market manipulation?

Trading practices that often have a dishonest or improper intent, and seek to mislead innocent investors, such that they distort the proper forces of supply and demand.

What are some examples of Market manipulation?

- Disclosure of false and misleading information - Intentionally stating that you have discovered a huge accounting fraud at a firm and persuading unsuspecting investors to sell their stock, which you then purchase below their fair price.

- Abusive squeezes - When a trader gains considerable control over the supply and demand for a security and engages in market cornering behavior with the aim of driving the price of the security to a distorted level.

- Spoofing and layering - Where a trader uses visible non-bona fide orders to deceive other traders as to the true levels of supply and demand in the market.

What is Short Selling?

The practice of selling securities that are not legally owned by the seller, but the seller will simultaneously arrange to borrow the stock from a broker or another shareholder.

What does the Short Selling Regulation do?

- It restricts uncovered short sales of shares and EU sovereign debt instruments

- It prohibits the entry into of uncovered sovereign credit default swaps (CDS)

- Requires investors to notify the relevant competent authority of any net short positions

- Grants a number of powers to ESMA, the EU securities supervisor, and to national competent authorities (NCAs)

Who are the Market makers?

Firms that provide regular and ongoing market liquidity by posting simultaneous two-way quotes of comparable size and at competitive prices.

What are some mandatory market disclosures to allow investors to drive efficient price formation?

- The EU transparency Directive - Aims to ensure transparency of information for investors through a regular flow of disclosure of periodic and on-going regulated information.

- Takeovers - Where a formal takeover offer has been launched, there are often local requirements mandating public disclosure of trades in the target company by the offeror and its associates during the offer period.

- Pre- and post- trade price transparency - These rules have the aim of ensuring that investors are best able to determine fair pricing for their trades based on recently completed trades and currently available prices.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Carl Fernandes

There are no available Videos from "Carl Fernandes"