Rights Issue Illustration

Rupert Walford

25 years: Capital markets

A rights issue is an offer of shares made via the issue of rights to subscribe for new shares to existing shareholders at a fixed subscription price. In this video Rupert gives us a closer look at what a rights issue can mean from the point of view of a shareholder.

A rights issue is an offer of shares made via the issue of rights to subscribe for new shares to existing shareholders at a fixed subscription price. In this video Rupert gives us a closer look at what a rights issue can mean from the point of view of a shareholder.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Rights Issue Illustration

15 mins 31 secs

Key learning objectives:

Identify what the rights issue looks like from the perspective of shareholders

Describe the Theoretical Ex-Rights (TERP) price

Understand how participating shareholders get enhanced returns and downside protection

Overview:

A rights issue is an offer of shares made via the issue of rights to subscribe for new shares to existing shareholders at a fixed subscription price. In this video, Rupert delves deeper into the granular details.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

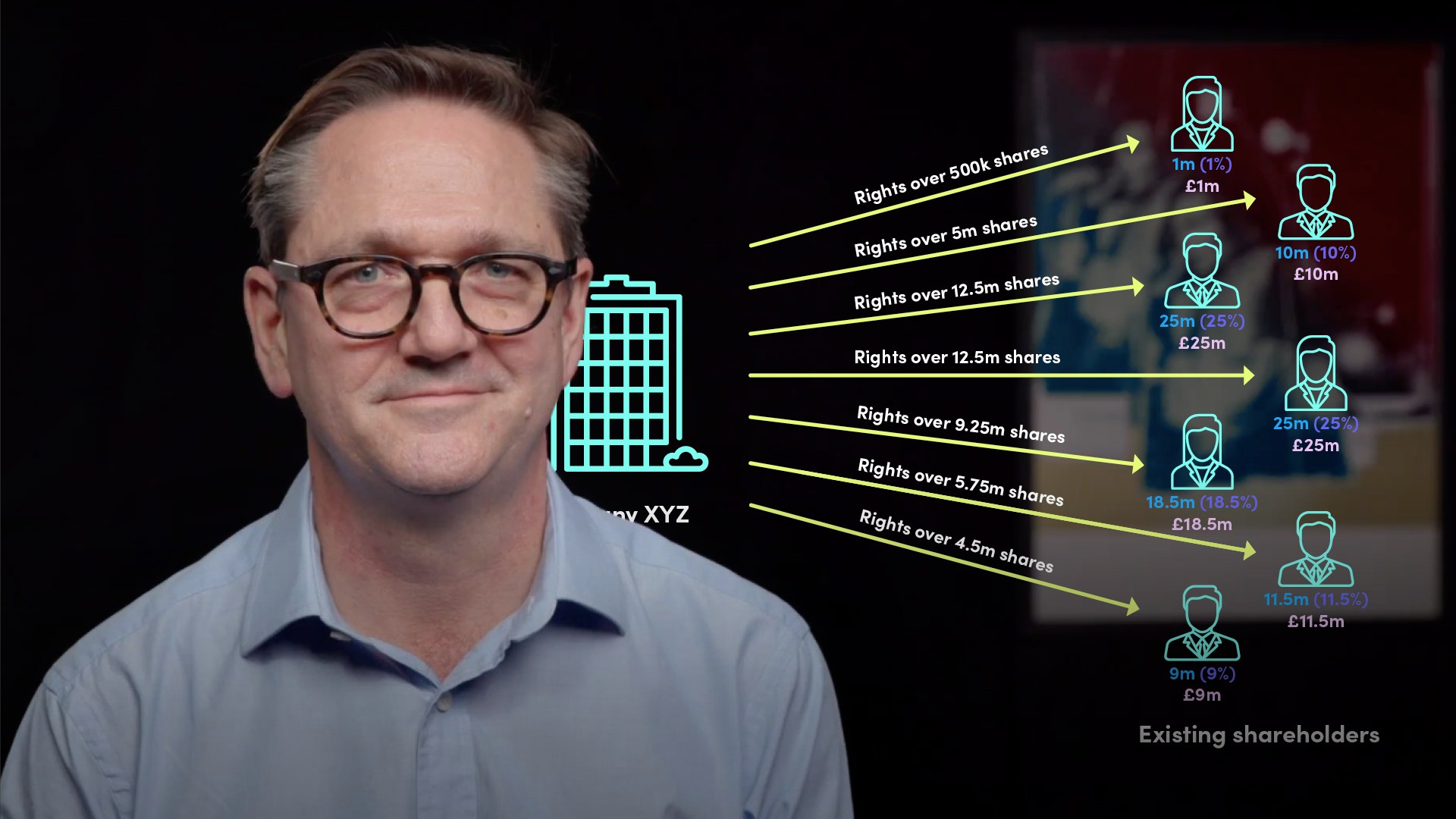

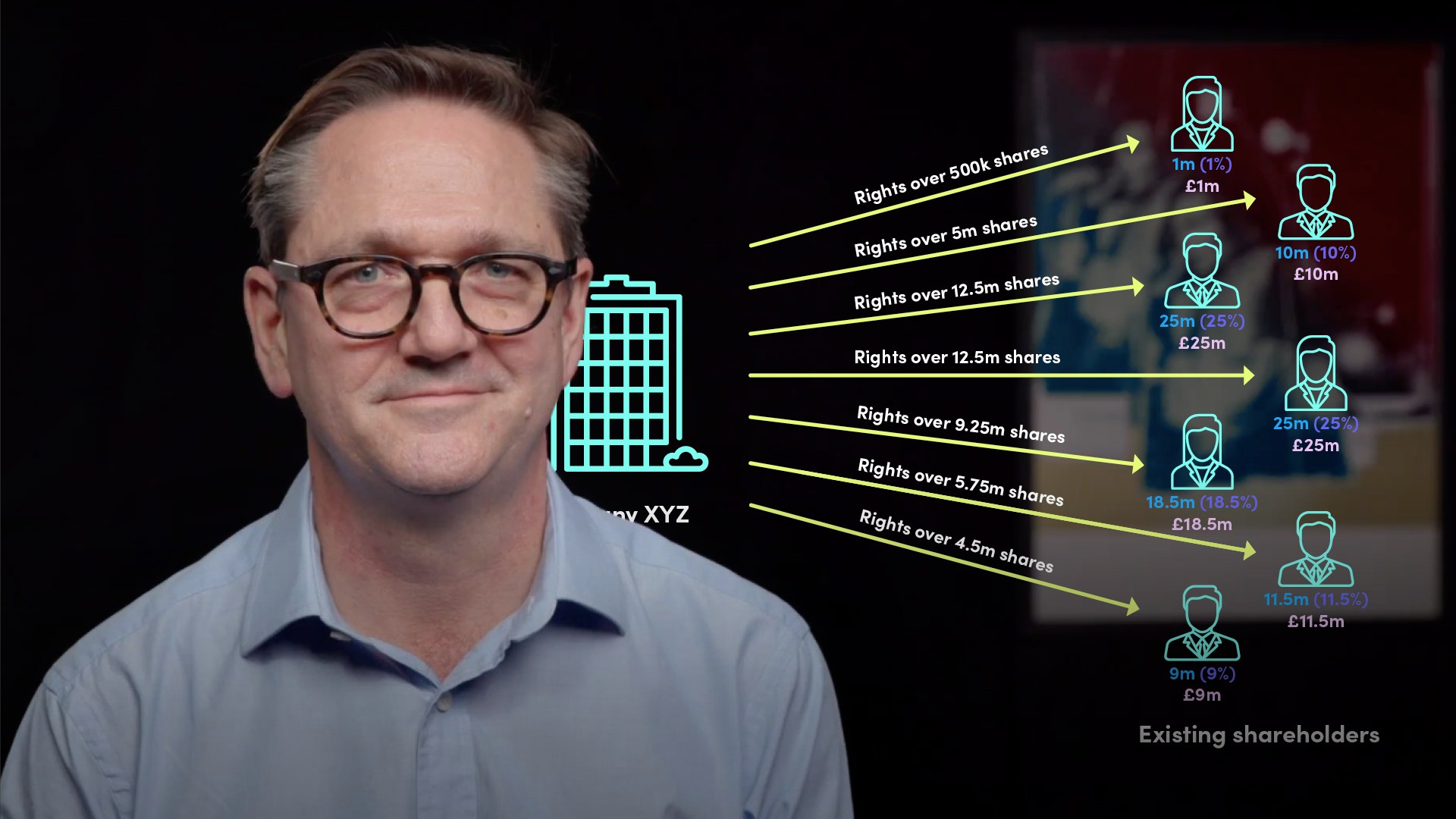

What does the rights issue look like from the perspective of shareholders?

The rights are issued to shareholders in proportion - or “pro-rata” - to their shareholdings, for example, one right for every two shares held - or “1 for 2” - and each right entitles the shareholder to subscribe for 1 share at the subscription price.

What is the Theoretical Ex-Rights (TERP) price?

The expected value of a share, all things being equal, after the rights issue has completed. This is calculated by adding the total value of all of the Company’s shares - the market capitalisation - before the rights issue to the total value of the shares being issued and dividing this sum by the total number of the Company’s shares that will be in existence after the rights issue has completed.

Using the following example, how do we calculate the TERP?

- A company has 100 million shares in issue and a share price of £1

- Its market capitalisation before the rights issue will therefore be £100 million

- If the rights issue is a 1 for 2 rights issue at 50 pence, 1 new share will be issued for every 2 existing shares - i.e. 50 million shares - at a subscription price of 50 pence

- The total value of the new shares being issued is 50 million multiplied by 50 pence - 25 million pounds - so the new theoretical market capitalisation after the rights issue will be 100 million pounds plus 25 million pounds - 125 million pounds

- The number of shares in issue following the rights issue will be the 100 million existing shares plus the 50 million new shares - so 150 million shares

- Therefore the TERP will be 125 million pounds divided by 150 million - 83.33 pence per share

Is there dilution?

There is often a perception that rights issues are dilutive to shareholders - but because they are fully preemptive, in any circumstances shareholders will not be diluted from a value perspective and shareholders taking up their rights in full are also not diluted from an ownership perspective. Shareholders who do not take up their rights in full however, will be diluted from an ownership perspective.

What are the three options that are available to a shareholder?

- Option 1 - exercise in full

- Option 2 - sell rights

- Option 3 - tail swallowing or cashless take-up

How do participating shareholders get enhanced returns and downside protection?

Using the example mentioned in the video, due to the discount - or locked in profit - that the shareholder who takes up rights gets, the losses suffered are smaller than for the shareholder who sells its rights. The discounted rights issue shares are providing downside protection. In fact, we can see that the share price would need to drop below the rights issue subscription price for all of the locked in profit to be eroded and the shareholder exercising rights to be worse off in absolute terms than the shareholder selling its rights.

What are the key takeaways?

- Rights issues are suitable for larger capital raises and where a Company wants the comfort that all shareholders are being given the opportunity to participate - and be compensated if they choose not to participate

- Because rights issues are fully preemptive, no size or discount restrictions will apply

- The discount the new shares are being offered at is usually significant to make the offer attractive

- A deep discount isn’t necessarily a bad thing - shareholders who take up in full will not suffer any value or ownership dilution - and shareholders who do not take up are compensated for their ownership dilution via the sale of their rights

- To work out the effect of a rights issue on a Company’s share capital it is necessary to calculate the Theoretical Ex-Rights Price - or TERP - and the discount on a rights issue is usually expressed as a discount to the TERP

- The discount - or locked in profit - has the effect of enhancing returns and providing downside protection for shareholders who take up their rights

- Rights issues should be assessed on what the proceeds are going to be used for - will they be put to good use - and improve the Company’s earnings per share?

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Rupert Walford

There are no available Videos from "Rupert Walford"