Measuring Social Impact and a Social Impact Fund Case Study

Stuart Sweeney

35 years: Risk management & social finance

In the second part of Stuart's introduction to social investment, he covers the different types of social investor and the approaches to measuring social impact.

In the second part of Stuart's introduction to social investment, he covers the different types of social investor and the approaches to measuring social impact.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Measuring Social Impact and a Social Impact Fund Case Study

14 mins 52 secs

Key learning objectives:

Identify the different types of social investors

Outline the approaches used in measuring the impact of social investment

Identify the key challenges to social investment

Overview:

Social investors cover a variety of funding bases and focus areas. Many have sought initial seeding through BSC. The impact of social investment can be measured through some of the following methods; theory of change and social accounting. However, there are challenges facing social investment, some of which include scalability and lack of equity.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the BSC, and what are its aims?

- BSC was founded in 2011 by David Cameron, with funding from dormant bank accounts. The big society was expected to nurture charities, mutuals, cooperatives and social enterprises. Some £600m of equity was invested in the BSC by 2018

- Now BSC acts partly as a ‘fund of funds’ to the social investment market. It invests in a number of funds that are expected to deliver returns. BSC has invested in funds ranging from the more commercial to the more philanthropic

What are the different types of social investors?

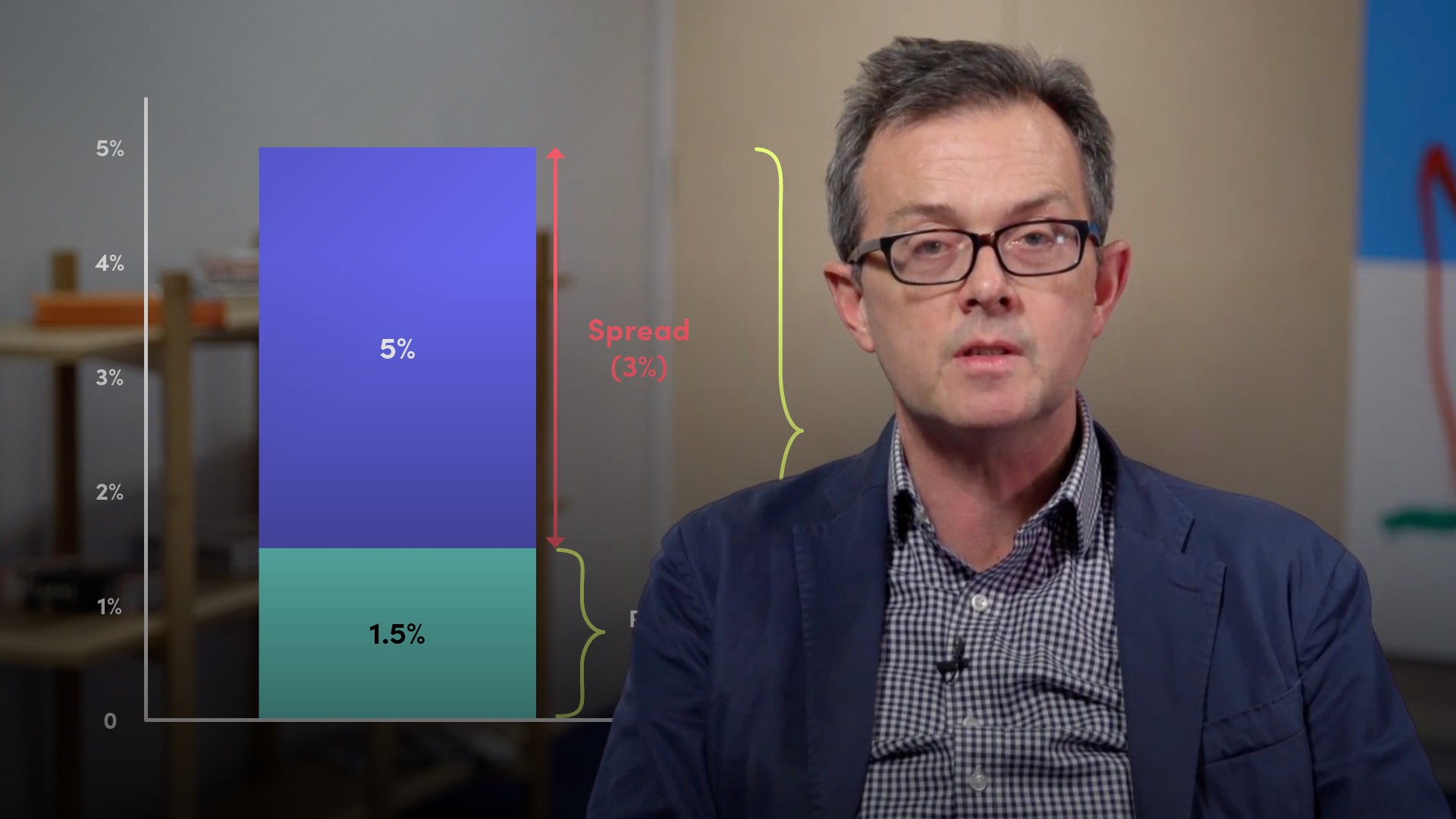

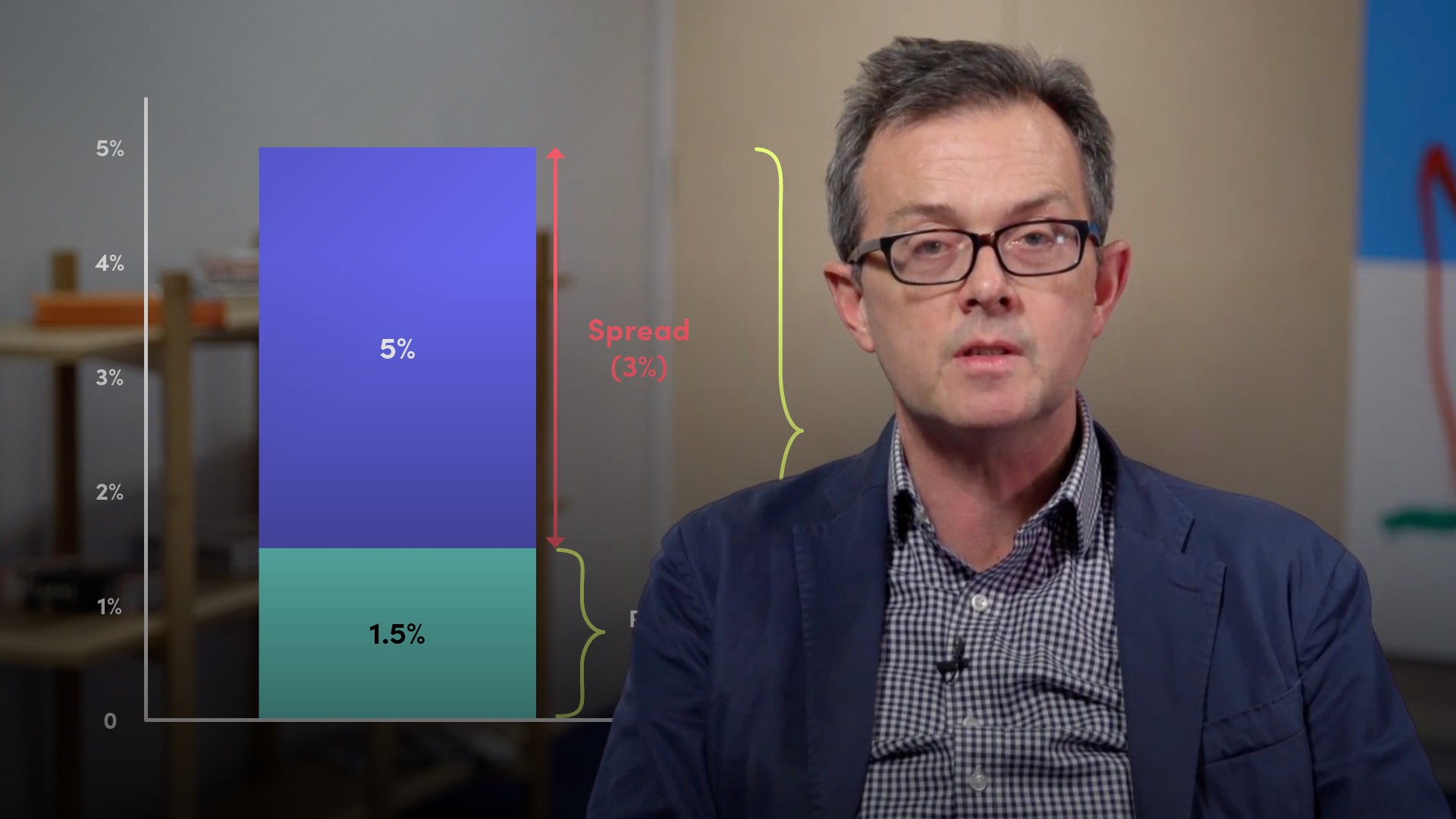

- At the lower end are commercial banks like Charity Bank that provide long-dated mortgages. These mortgages allow charities to buy property at 60-70% LTV. They require an investment of reserves/junior debt that comes from unsecured, more philanthropic investors

- In this latter unsecured cohort sit social investors like CAF, Venturesome, Big Issue Invest, and Social and Sustainable Capital (SASC)

- The combination of senior and junior debt has allowed the financing of several community housing businesses. For example,, in the Community Land Trust (CLT) and Cooperative Housing sectors

What different approaches are used in measuring the impact of social investment?

- Theory of Change - A map showing the short, medium and long-term outcomes that stem from the activities of the charity. This is highlighted for all stakeholders

- Social Accounting - Framework for monitoring and evaluating the benefits of activities for all stakeholders

- Social Return on Investment - Calculating monetary returns coupled with social and environmental benefits

- Social Enterprise Balanced Scorecard - Monitors the overall performance through quantitative and qualitative inputs

How may delivering social impact-ESG entice institutional investors into social investment?

Some are prepared to look at small investments where the social impact and ESG is distilled. For example, safe and affordable housing provided by charities, is viewed by philanthropists and investors as providing support to disparate vulnerable groups. There is an acceptance that a roof over the head of a, for example, ex-offender or recovering drug or alcohol abuser, can provide a platform for positive change in that person's life.

Using an example of a housing fund (SASC), how did they measure social impact?

(1). Business Model

- Purpose - does the business have a social mission?

- Power - Who has control and makes decisions?

- Profit - what happens to the profits?

(2). Employment

- Wages - does the business pay fair wages?

- Terms - what are the terms of employment for staff?

- Progression - what are the routes for employee progression?

(3). Equalities

- Labour - does the business increase employment for marginalised members of society?

- Product/Service - does the business provide products/services that mitigate the effects of inequality?

- Systemic - does the business address the causes of inequality?

(4). Market

- Market Gap - is the business meeting a market need?

- Market Failure - is the business responding to a market failure?

- Product/Service Quality - is the business providing a high quality product/service?

(5). Community

- Voice - is the community represented in the business?

- Supply Chains - does the business support community supply chains?

- Benefits - does the business trade for the benefit of the community?

(6.) Organisational Sustainability

- Investment Options - is the business able to draw on funding support?

- Repayable Finance - is the business leveraging additional repayable finance?

- Business Model - are the products profitable?

- Concentration - does the business have a good spread of contracts or relationships?

What are the challenges to social investment?

- Scalability - To bring traditional institutions into the sector and hence increase the size of funds, the institutions require size and liquidity in the first place

- Social Enterprise Cash Flows - This has involved setting up trade subsidiaries. With local authority funding under pressure, these cash flows, that support debt finance, remain vulnerable to set-backs

- Lack of Equity - Niche sources of equity type funding are unlikely to provide the volume and continuity of funding to temper the tendency of charities to become overleveraged.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Stuart Sweeney

There are no available Videos from "Stuart Sweeney"