EU Solvency II Capital Requirements

Sukhy Kaur

15 years: Debt capital markets

In her previous video on Global Insurance Regulation Sukhy briefly touched upon capital requirements for insurers under Solvency 2, namely the Minimum Capital Requirement and Solvency Capital Requirement. In this video Sukhy explains these ratios in detail along with how they are calculated and applied to the insurance industry.

In her previous video on Global Insurance Regulation Sukhy briefly touched upon capital requirements for insurers under Solvency 2, namely the Minimum Capital Requirement and Solvency Capital Requirement. In this video Sukhy explains these ratios in detail along with how they are calculated and applied to the insurance industry.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

EU Solvency II Capital Requirements

9 mins 56 secs

Key learning objectives:

Define a Solvency II balance sheet

What is the SCR and how is it measured?

What is the MCR and how is it measured?

Overview:

Solvency 2 was implemented in January 2016 and applies to all European insurance and reinsurance companies. It introduced a harmonised risk-based regime for the first time, which is formed under a three-pillar approach. The capital requirements sit under Pillar 1, which deals with the quantitative requirements for insurance companies. These capital requirements are known as the Minimum Capital Requirement and Solvency Capital Requirement, and most commonly referred to as the MCR and SCR.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a Solvency II balance sheet?

A Solvency 2 balance sheet takes an economic based view, rather than an accounting view, by better aligning an insurer’s business and risks. Therefore, assets and liabilities are recorded based on a market consistent valuation approach.

There are broadly three categories on the Liability side:

- Technical Provisions consists of two components: best estimate liabilities which is based on the present value of expected future cash flows and the risk margin which acts as an additional insurance buffer. Together, the Technical Provisions represents the current market value of the amount an insurer would have to pay in order to transfer its obligations to another company today

- Above the Technical Provisions, is the Own Funds component. This is comprised of capital (including equity) which is based on the Minimum Capital Requirement, as well as the Solvency Capital Requirement

- Any amount of Own Funds above this is equal to Surplus Liabilities

On the Asset side of the balance sheet:

All assets are based on the current market value. There should clearly be enough assets to cover the amount of Technical Provisions on the liability side. Assets will be equal to the sum of (i) Technical Provisions and (ii) Available capital or Own Funds.

What is SCR and how is it measured?

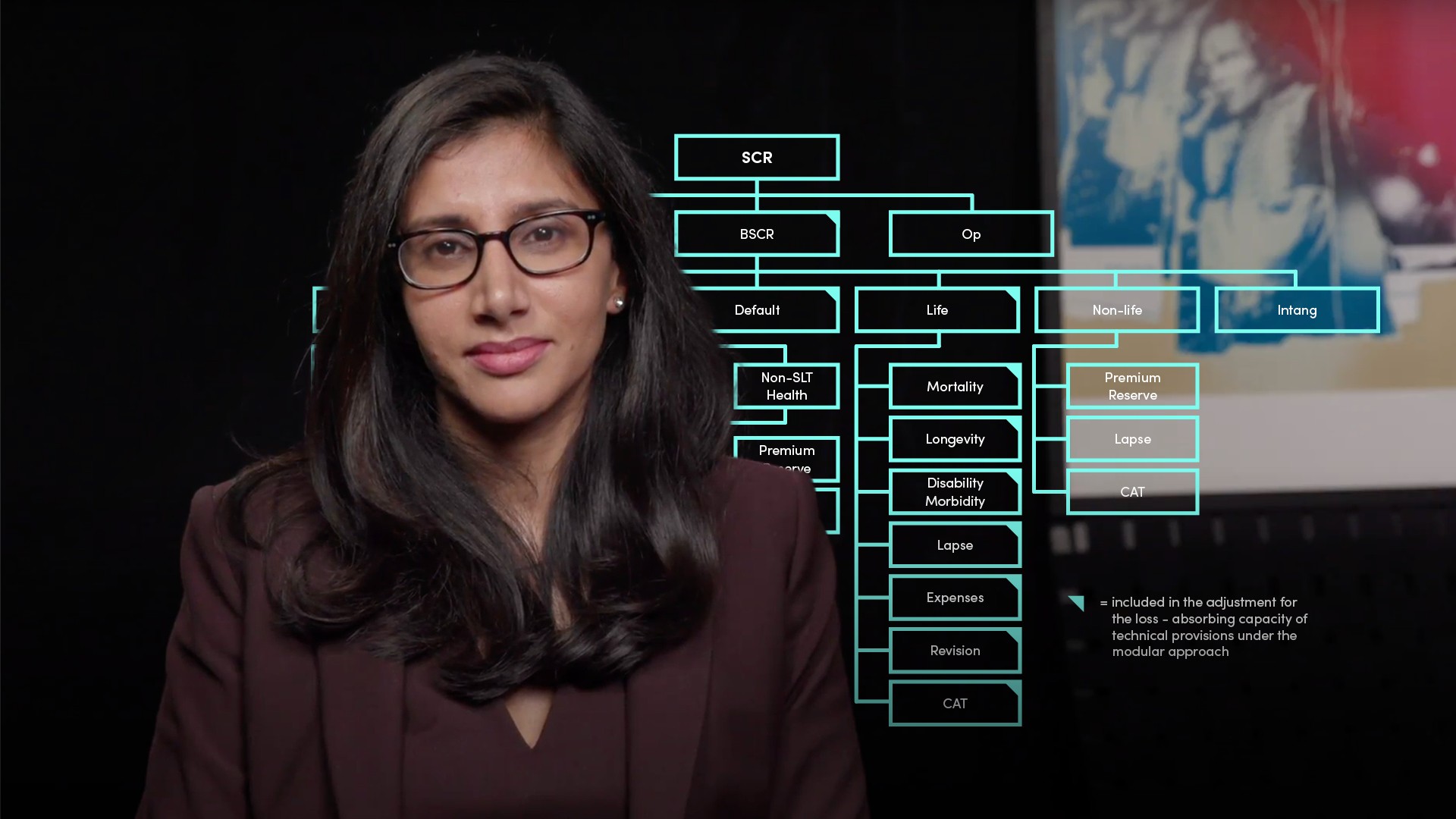

The Solvency Capital Requirement, also known as SCR, is the amount of capital an insurer is required to hold by the regulator and is prescribed specifically to each individual insurer. It is based on a 99.5% confidence interval over a one-year time horizon. In other words, an average 1 in 200-year event. The standard formula for the SCR involves combining the amount of capital required for a number of different risk groups, including Market, Health, Life and Non-Life Underwriting risks. These risks are then stressed using correlations and a complex matrix, which also considers the diversification of different business lines. National supervisors are permitted to intervene upon breach of 100% of the SCR. The SCR can also be calculated using an insurer’s internal model which needs to be signed off by the regulator. A mixture of both the standard and internal model can also be used. This is referred to as the partial internal model.

What is MCR and how is it measured?

The concept of the Minimum Capital Requirement, also known as MCR, is similar to that of the SCR, in that it is designed to capture and stress the risks on an insurer’s balance sheet, and represents the minimum measure for the quantum of capital an insurer is required to hold. The MCR is calculated as a simpler linear formula, based on the type of business. It is therefore calibrated on a confidence level of 85% over a one-year time horizon. The MCR is set at an absolute minimum level which the insurer cannot breach without losing its license to operate the business. This would occur upon breach of 100% of the Minimum Capital Requirement. The MCR is also subject to a floor of 25% and a cap of 45% of the SCR.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Sukhy Kaur

There are no available Videos from "Sukhy Kaur"